How to Record Loan Forgiveness in Quickbooks?

Anúncios

If you’ve been forgiven a loan, you may be wondering how to record loan forgiveness in Quickbooks. The process is actually quite simple. First, you’ll need to create a new account in Quickbooks.

To do this, go to the “Company” menu and select “Create New Account.” In the window that appears, select “Other Account Types” and then choose “Loan Forgiveness.”

Once you’ve created the account, you’ll need to enter some basic information about the loan forgiveness.

This includes the date of the forgiveness, the amount forgiven, and any other relevant details. Once you have all of this information entered, you can save and close the account.

Now that you know how to record loan forgiveness in Quickbooks, it’s time to put it into practice.

If you have any questions about the process, be sure to consult with a certified public accountant or another financial expert.

- Assuming that the loan has already been set up in QuickBooks: 1

- Go to the Customers menu and select Customer Center

- Double-click on the customer name to open their account history

- Click the Transactions tab and then click Receive Payments

- Enter the date of the forgiveness in the Date field and enter the amount being forgiven in the Amount field under “Payments to Apply”

- If there are multiple loans, be sure to apply the payment to the correct loan by selecting it from the drop-down menu next to “Apply To”

- In Memo, write “Loan Forgiveness” or something similar so you’ll remember what this payment was for later on

- Click Save & Close when you’re finished

How to Record Partial PPP Loan Forgiveness in Quickbooks

How Do You Show Loan Forgiveness in Quickbooks?

Assuming you are referring to the QuickBooks Online version:

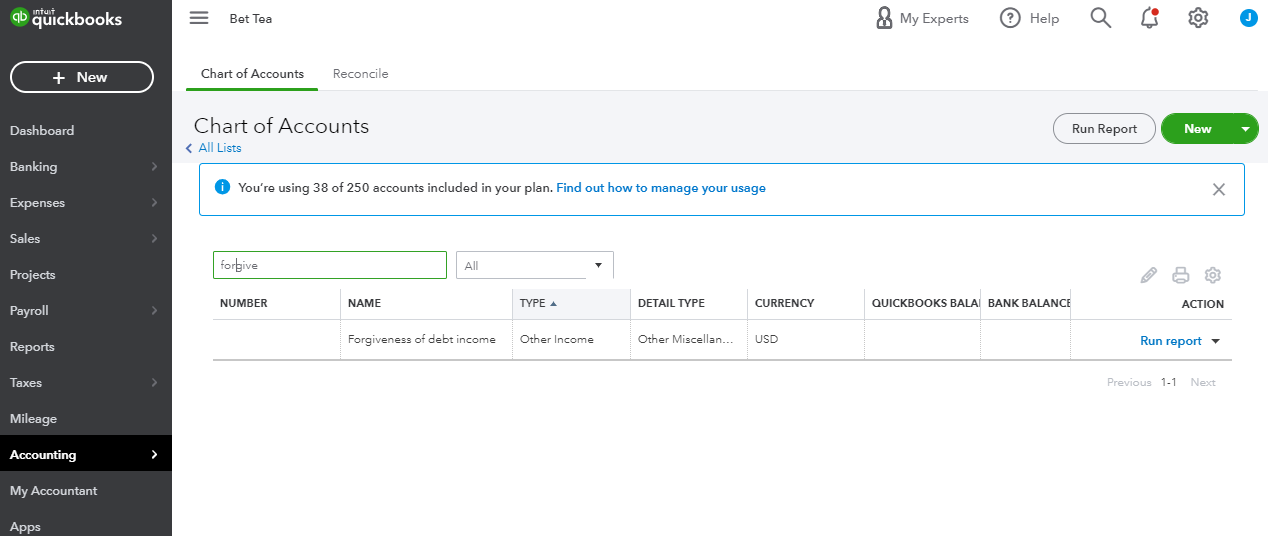

There are a few different ways that you can show loan forgiveness in QuickBooks. One way is to create a new line item under Other Income on your income statement.

You can label this line item something like “Loan Forgiveness.” Another way to track this is to create a new account in your chart of accounts specifically for loan forgiveness. You can then create a journal entry transferring the forgiven amount from the original loan account to the new Loan Forgiveness account.

Anúncios

What is the Journal Entry for a Forgiven Loan?

Assuming the loan was originally recorded as a liability, the journal entry to forgive the loan would be a debit to the allowance for doubtful accounts and a credit to the loan payable. This would reduce the amount of money that the company owes on its balance sheet. For example, if a company owed $1,000 on a loan and it was determined that there was no likelihood of ever collecting this money, the company could write off the debt by recording a $1,000 debit to the allowance for doubtful accounts and a $1,000 credit to loans payable.

How Do I Enter Ppp Loan Forgiveness in Quickbooks Online?

Assuming you are referring to the Paycheck Protection Program loan through the Small Business Administration (SBA), here is how you would record it in QuickBooks Online:

First, create an account for the loan. Go to Settings ⚙ and then Chart of Accounts.

Click New and select Loan from the Account Type drop-down menu. Give the account a name (e.g. “PPP Loan”) and click Save & Close.

Next, create a liability entry for the amount of the loan that was funded.

On the left side of your screen, under Your Company, select Accounting and then go to Transactions. Select + New and choose Vendor Credit from the list of transaction types. Enter the date that you received the funds, select PPP Loan from the Account drop-down menu, enter the amount of money received in total, checkbox Include this credit in Liability Payments if needed and click Save & Close.

Now you’re ready to start recording your PPP loan payments! To do this, go back to Transactions on the left side of your screen and select + New once again. This time choose Check from list of transactions types.

Enter today’s date or the date when you made your payment in Payment Date field, enter PPP Loan in Pay To The Order Of field, fill out appropriate amounts in Reference # Memo fields (e#g SBA Tracking Number) and click Save & Close when finished..

Anúncios

What is the Accounting Entry for Ppp Loan Forgiveness?

If your business received a Paycheck Protection Program (PPP) loan from the Small Business Administration (SBA), you may be eligible for loan forgiveness. Loan forgiveness is when the SBA forgives all or part of your PPP loan based on how you use the loan funds.

To be eligible for loan forgiveness, you must use the PPP loan funds for qualifying expenses within certain timeframes.

Qualifying expenses include payroll costs, mortgage interest, rent and utilities. At least 60% of your PPP loan must be used for payroll costs to qualify for maximum loan forgiveness.

The SBA will forgive the portion of your PPP loan equal to the amount you spend on qualifying expenses during the covered period.

The covered period is either 8 weeks or 24 weeks after you receive your PPP loan, depending on when you received your loan.

If you received your PPP loan before June 5, 2020, you have a covered period of 8 weeks. If you received your PPP loan after June 5, 2020, you have a covered period of 24 weeks.

You will not be required to make any payments on forgiven amounts until 10 months after the end of your covered period. For example, if your covered period ends on August 31st, 2020 then payment isn’t due until June 30th, 2021.

To apply for forgiveness:

• Submit a completed Loan Forgiveness Application and supporting documentation to your lender

• Your lender has 90 days to approve or deny your application

• The SBA has up to 150 days to approve or deny your lender’s decision

Credit: www.youtube.com

Journal Entry to Record Ppp Loan Forgiveness

As a small business owner, you may be eligible for partial or full forgiveness of your Paycheck Protection Program (PPP) loan. If you’re approved for forgiveness, you’ll need to make a journal entry to record the forgiven amount.

Here’s how to do it:

1. Check with your lender to see if your loan is eligible for forgiveness.

2. If it is, gather the required documentation and submit it to your lender. This may include payroll records, tax forms, and bank statements.

3. Once your lender approves the forgiveness request, they’ll send you a notice indicating the amount that’s been forgiven.

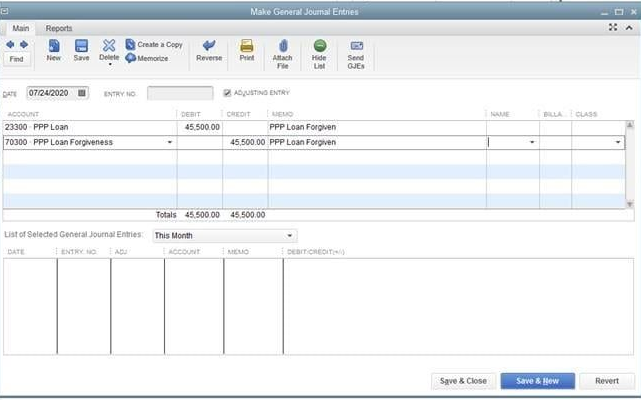

4. To record the forgiven amount in your accounting software, create a journal entry with the following information:

– Date: The date of the journal entry should be the date you received approval from your lender.

– Description: Include a brief description such as “PPP Loan Forgiveness.” – Debit: Enter the total amount of the loan that’s being forgiven as a negative number.

How to Record Ppp Loan Forgiveness on 1120S

If your business has received a Paycheck Protection Program (PPP) loan, you may be eligible for loan forgiveness. If you are approved for loan forgiveness, you will need to record the forgiven amount on your 1120S tax return.

Here’s how to do it:

1. First, calculate the amount of your PPP loan that is eligible for forgiveness. You can find more information about this process in the SBA’s PPP Loan Forgiveness Application Instructions.

2. Once you have calculated the eligible amount, enter that number on Line 9 of your 1120S tax return.

Include any supporting documentation with your tax return.

3. On Line 10 of your 1120S tax return, subtract the forgiven amount from the total PPP loan amount reported on Line 8a. This will give you the remaining balance of your PPP loan that is not yet forgiven.

4. Enter the remaining balance on Line 11 of Form 4562 (Depreciation and Amortization).

How to Record Ppp Loan Forgiveness on Tax Return

If your business has received a Paycheck Protection Program (PPP) loan through the Small Business Administration (SBA), you may be eligible for loan forgiveness. Loan forgiveness is when the SBA cancels all or part of your PPP loan and you are not responsible for paying it back.

To record PPP loan forgiveness on your tax return, you will need to file Form 1040-C with the IRS.

This form includes information about your PPP loan and how much of it was forgiven. You will also need to attach supporting documentation, such as your loan forgiveness application and any other required forms.

If you are approved for PPP loan forgiveness, the forgiven amount will not be considered taxable income by the IRS.

However, if you do not have enough documentation to support your claim of eligibility, the IRS may treat the forgiven amount as taxable income.

It’s important to note that even if you are approved for PPP loan forgiveness, you may still owe taxes on any forgiven portion of the loan that is classified as business income. Be sure to consult with a tax professional to determine how much, if any, taxes you may owe on your forgiven PPP loan.

Conclusion

If you’re like many business owners, you may be wondering how to properly record loan forgiveness in QuickBooks. The answer is actually quite simple: You’ll need to create a journal entry.

Here’s a step-by-step guide on how to do it:

1. First, you’ll need to determine the amount of the loan that was forgiven. This can typically be found in your loan agreement or documentation from the lender.

2. Next, you’ll need to create a journal entry in QuickBooks.

To do this, go to the Company menu and select Make General Journal Entries.

3. In the Date field, enter the date that the loan was forgiven.

4. In the first Account column, select Accounts Receivable (or whatever account is appropriate for your business).

Then enter the amount of the loan that was forgiven in the Debit column next to it. This will offset any outstanding balance you have with your lender.