How to Code Ppp Loan in Quickbooks?

If you’re a Quickbooks user, you may be wondering how to code PPP loans in the software. The Paycheck Protection Program (PPP) is a loan designed to help small businesses keep their employees on the payroll during the COVID-19 pandemic. Here’s a step-by-step guide on how to code PPP loans in Quickbooks:

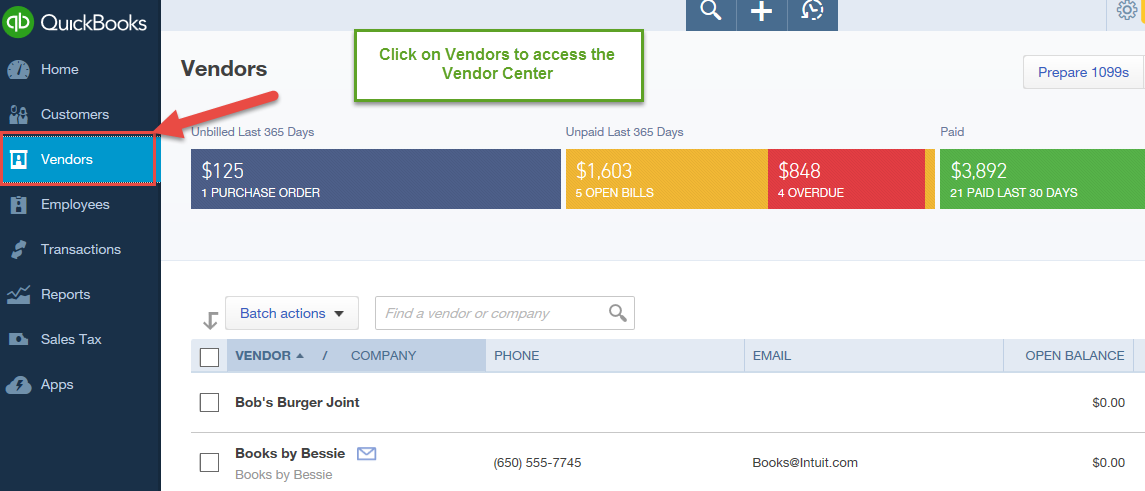

1. Go to the Vendors menu and select Enter Bills.

2. In the Vendor field, select the bank that issued your PPP loan.

3. In the Account field, select Accounts Receivable from the drop-down menu.

4. In the Terms field, select Non-Payment from the drop-down menu.

5. Enter the amount of your PPP loan in the Bill column and enter “PPP Loan” in the Memo column for reference purposes.

6 .

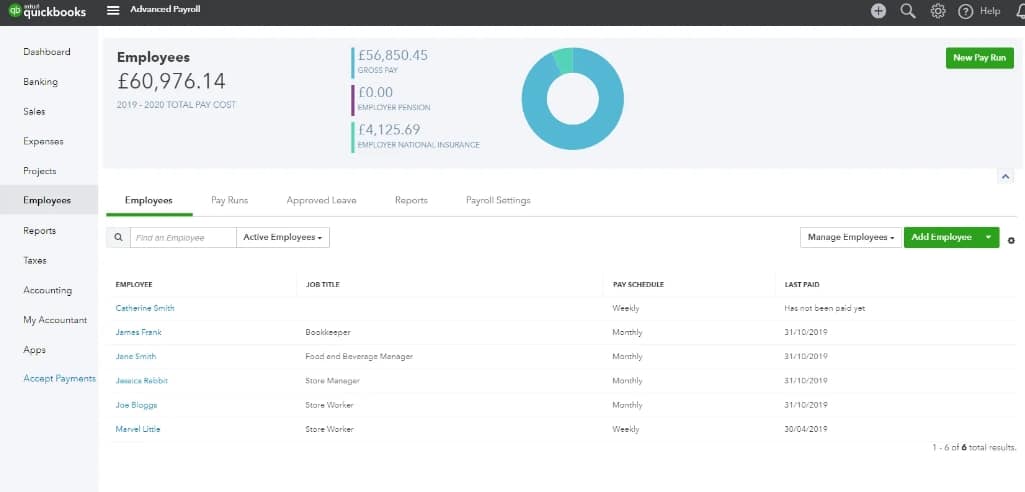

- Open QuickBooks and go to the Company menu

- Select Loans from the list of options

- Click on the Add Loan button

- Enter the relevant information about your loan, including the amount, interest rate, and term

- Click Save & Close when you’re finished

Quickbooks Tutorial – How to Record Proceeds from a PPP Loan

What Should I Put Ppp Loan under in Quickbooks?

There is no one-size-fits-all answer to this question, as the best way to categorize your PPP loan in QuickBooks will vary depending on your unique situation. However, we can provide some general guidelines to help you make the best decision for your business.

If you received a PPP loan for your business, you will need to track it separately from other loans in QuickBooks.

To do this, we recommend creating a new account specifically for your PPP loan. You can then label this account accordingly (e.g., “Paycheck Protection Program Loan”).

Once you have created this new account, you will need to enter all of the relevant information about your PPP loan into QuickBooks.

This includes the amount of the loan, the interest rate, and the repayment terms. You will also need to indicate whether or not the loan has been forgiven by the SBA.

tracking your PPP loan in QuickBooks will help you stay organized and ensure that you are making timely payments on your loan.

It will also help you keep track of how much of the loan has been forgiven (if applicable).

How Do I Code a Ppp Loan Forgiveness in Quickbooks?

Assuming you’re referring to the Paycheck Protection Program loan through the SBA…

The PPP loan forgiveness process is as follows:

1. You (the borrower) submit a request for forgiveness to your lender

2. Your lender reviews your request and supporting documentation

3. Your lender submits a decision to the SBA

Anúncios

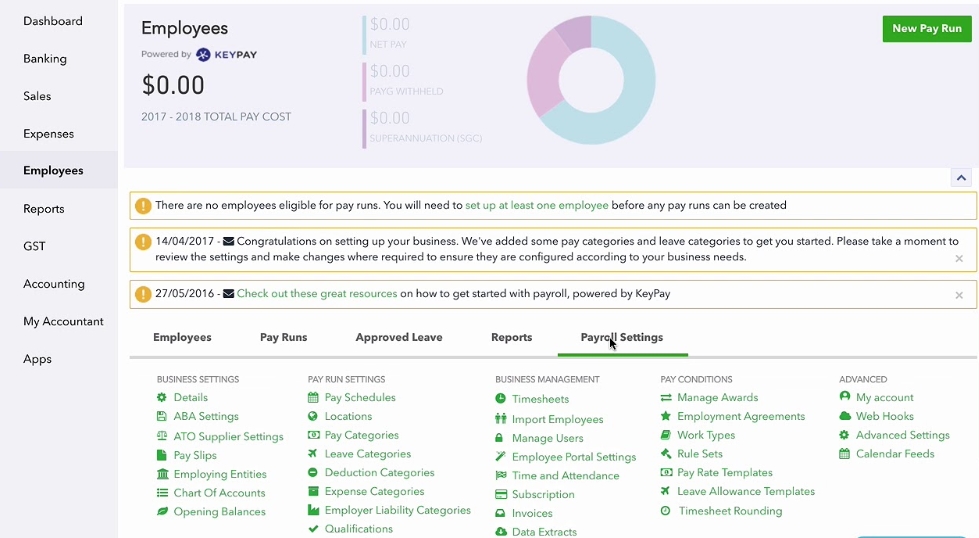

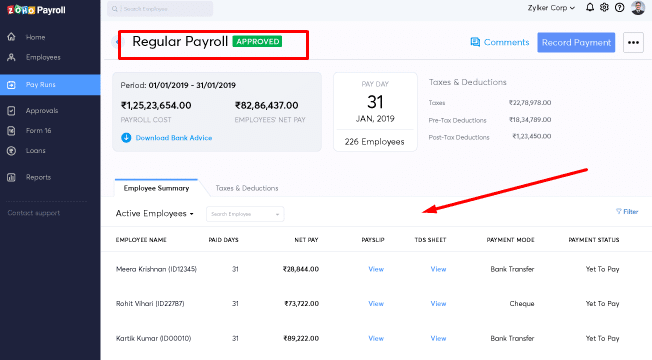

How Do I Record Ppp Expenses in Quickbooks?

Assuming you are referring to the Paycheck Protection Program:

The Paycheck Protection Program (PPP) is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll.

If your business takes out a PPP loan and spends the money as intended (on payroll, mortgage interest, rent, and/or utilities), then the entire loan may be forgiven by the SBA.

That means you would not have to repay any of the money borrowed.

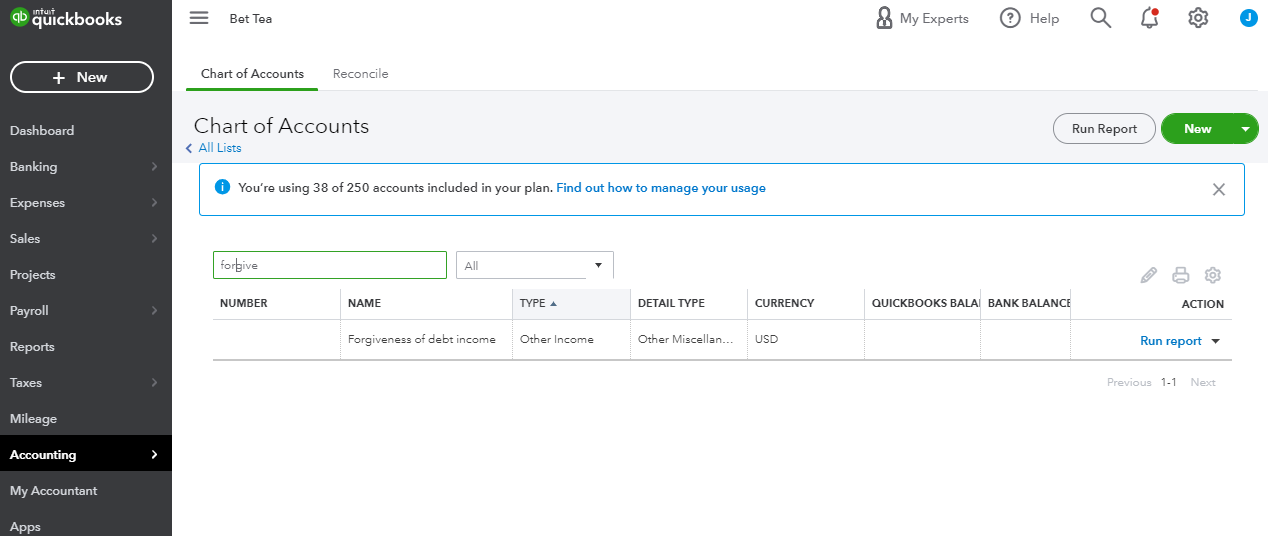

To record PPP expenses in QuickBooks, first create an account specifically for the PPP loan. To do this, go to Settings ⚙️ and then Accounts and Settings.

Under Company Settings, select Chart of Accounts. On the Account page that opens, select New.

In the Add New Account dialog box that appears:

Select Other Current Liability from the Account Type drop-down menu. This will ensure that your PPP liability shows up correctly on your balance sheet.

Enter “Paycheck Protection Loan” in the Name field.

Choose whether you want this account to be trackable by class or not using the Track Classes checkbox below (it’s up to you). Then click Save and Close.

What is the Accounting Entry for the Ppp Loan?

The Payment Protection Program (PPP) loan is a low-interest, government-backed loan that helps small businesses keep their workers employed during the COVID-19 pandemic. The PPP loan is part of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which was passed by Congress in March 2020.

Under the CARES Act, eligible small businesses can receive a PPP loan of up to 2.5 times their average monthly payroll costs.

The maximum loan amount is $10 million. Loans are available through June 30, 2020.

Small businesses can use PPP loans for payroll and other expenses, such as rent, utilities, and mortgage interest.

Loan payments will be deferred for six months. There are no fees or collateral required for the loan.

To qualify for a PPP loan:

Your business must have fewer than 500 employees

You must have experienced a decrease in revenue of at least 25% in any quarter of 2020 compared to the same quarter in 2019

You must be able to demonstrate that you cannot meet your financial obligations without additional funding

Anúncios

Credit: www.firmofthefuture.com

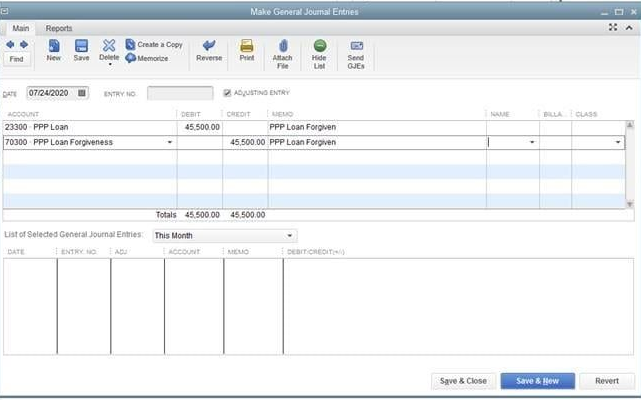

Journal Entry to Record Ppp Loan Forgiveness

The Paycheck Protection Program (PPP) loan forgiveness process is a bit different than other types of loan forgiveness. Here are the basics of how to record PPP loan forgiveness on your books:

First, you’ll need to make sure that you’ve spent the PPP loan funds in accordance with the program guidelines.

The expenses eligible for forgiveness include payroll costs, mortgage interest, rent, and utility payments.

Once you’ve determined that your expenses meet the criteria for forgiveness, you’ll need to submit a request for forgiveness to your lender. You’ll also need to provide documentation supporting your expenses.

Your lender will review your request and documentation and make a decision on whether or not to forgive the loan. If they decide to forgive part or all of the loan, they will notify you and send you instructions on how to record the forgiven amount on your books.

If you have any questions about journaling your PPP loan forgiveness, be sure to talk to your accountant or bookkeeper.

They can help ensure that everything is properly recorded on your books.

How to Record Ppp Loan in Quickbooks Self-Employed

If you’re a small business owner who has taken out a Paycheck Protection Program (PPP) loan, you may be wondering how to record it in QuickBooks Self-Employed. Here’s a step-by-step guide to help you get it done:

1. Go to the Banking tab and click on the PPP Loan account.

2. Click on the pencil icon next to the account name and select Edit from the drop-down menu.

3. In the Account Details section, change the Type of account from Cash/Checking to Other Liability. Then enter the Loan Amount and click Save & Close.

4. Now that your PPP loan is recorded as an Other Liability account, you can add transactions related to it just like any other liability account in QuickBooks Self-Employed. For example, if you made a payment on the loan, you would add that as a Payment transaction under the Banking tab.

Ppp Loan Accounting Entries

The Paycheck Protection Program (PPP) loan is a lifeline for small businesses across the country that have been impacted by the COVID-19 pandemic. The PPP loan program provides low-interest loans to small businesses that can be used to cover payroll and other expenses.

As a small business owner, you may be wondering what the accounting entries are for a PPP loan.

Here is some information to help you understand the accounting entries for a PPP loan.

When you receive a PPP loan, the first thing you need to do is record it in your books as a liability. The amount of the loan should be recorded as a liability on your balance sheet.

You will also want to create an accrual for interest expense on the loan.

Once you have received the funds from the PPP loan, you will want to use them to pay eligible expenses such as payroll, rent, and utilities. As you incur these expenses, you will want to record them in your books as usual.

Conclusion

If you’re a small business owner who has been affected by the coronavirus pandemic, you may be able to get a Paycheck Protection Program (PPP) loan from the Small Business Administration (SBA). If you’re using QuickBooks, there are a few different ways that you can code your PPP loan.

One way to code your PPP loan in QuickBooks is to create a new income account for the loan proceeds.

You can then record each expenditure that is eligible for forgiveness as it occurs. When it comes time to apply for forgiveness, you’ll just need to submit your documentation to the SBA.

Another way to code your PPP loan in QuickBooks is to create a new liability account for the loan amount.

You can then make payments on the loan as they’re due and track the balance of the loan in QuickBooks. When it comes time to apply for forgiveness, you’ll need to provide documentation showing how you used the funds from the loan.

No matter which method you choose, coding your PPP loan in QuickBooks will help you keep track of your expenses and ensure that you have all of the documentation that you need when it’s time to apply for forgiveness.