How to Fix Differences Between Quickbooks Balance And Bank Balance?

If you are having differences between your QuickBooks balance and bank balance, there are a few things that you can do in order to fix it. The first thing that you need to do is check for any outstanding transactions. This includes things like checks that have been written but not yet cashed, as well as deposits that have been made but not yet reflected in the QuickBooks account.

Next, you will want to reconcile your accounts. This process will help to ensure that all of the transactions are accounted for and correct. Finally, if there are still differences between the two balances, you may need to adjust your books accordingly.

Difference Between Bank Balance and In Quickbooks Balance

- First, open QuickBooks and go to the Banking menu

- Next, select the account that you want to reconcile and click on the Reconcile button

- Enter the ending balance from your bank statement and any other relevant information into the reconciliation window

- QuickBooks will now show you any discrepancies between your books and the bank’s records

- To fix these differences, simply make the necessary adjustments in QuickBooks and then click on the Reconcile Now button

How to Fix Bank Balance in Quickbooks

Assuming you are referring to an issue where the ending balance in QuickBooks does not match the statement balance from your bank, there are a few things that could be causing the discrepancy.

1. Check for any outstanding checks or deposits. If there are any checks that have not yet cleared or deposits that have not yet been processed by the bank, they will not be reflected in the QuickBooks balance.

2. Make sure all transactions have been entered into QuickBooks. Sometimes people will make manual payments or deposits outside of QuickBooks and forget to enter them into the software. This can cause a mismatch between the two balances.

3. Compare the date range of your QuickBooks report with your bank statement. If they don’t match up, it’s possible that there are transactions within that time frame that have not yet been entered into QuickBooks.

4. Reconcile your accounts regularly.

This process will help to ensure that all transactions are accounted for and will help prevent discrepancies between your QuickBooks balance and your bank statement balance going forward.

How to Fix a Negative Bank Balance in Quickbooks

If you have a negative bank balance in Quickbooks, don’t panic! There are a few things you can do to fix the problem.

First, check to see if there are any outstanding checks or deposits that have not yet cleared.

If so, those could be the cause of the negative balance.

Next, take a look at your transactions and see if there are any mistakes or errors. If you find any, correct them and see if that fixes the problem.

Finally, if all else fails, you can always contact Quickbooks support for help. They should be able to help you figure out what’s going on and how to fix it.

Anúncios

How to Balance Quickbooks With Bank Account

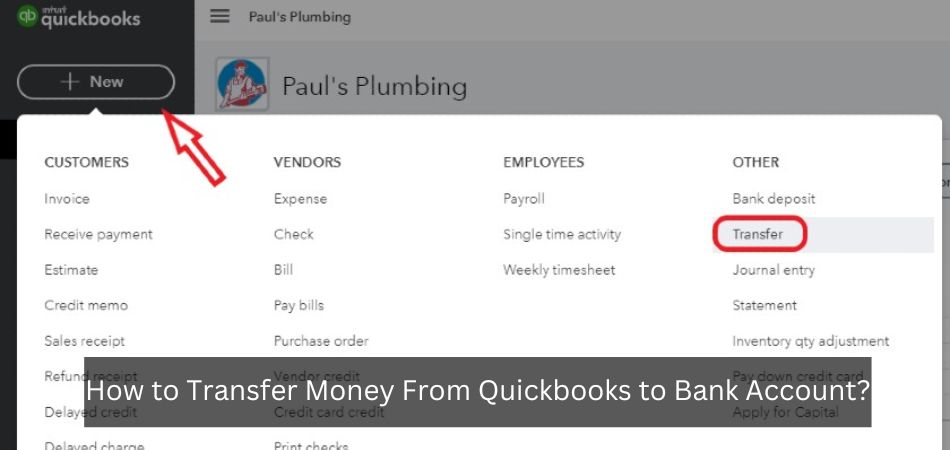

As a business owner, you’re responsible for keeping track of your company’s finances. This can be a daunting task, especially if you’re not using accounting software. One way to simplify the process is to connect your QuickBooks account to your bank account.

This will allow you to automatically import transactions and keep your records up-to-date.

The first step is to create a new bank connection in QuickBooks. To do this, go to the Banking menu and select Add Account.

Enter your bank’s name and website, then click Continue.

Next, you’ll need to enter your login information for the selected bank. Once you’ve done this, QuickBooks will download 90 days of transaction history.

You can also choose to sync your account on a daily basis going forward.

Once your accounts are connected, you can start categorizing transactions in QuickBooks. This will help you keep track of where your money is going and make it easier to prepare financial reports.

If you have any questions about how to properly categorize transactions, consult with an accountant or bookkeeper.

Maintaining accurate financial records is essential for any business owner.

How to Balance Quickbooks Accounts

Are you a small business owner who uses QuickBooks? If so, you know how important it is to keep your QuickBooks accounts balanced. But what happens when things get out of balance?

If your QuickBooks accounts are out of balance, don’t panic! There are a few things you can do to fix the problem.

First, check to see if there are any errors in your data entry.

Sometimes, a simple mistake can cause your accounts to become unbalanced. If you find an error, correct it and then recheck your balances.

If everything looks good but your accounts are still out of balance, it’s time to take a closer look at each account.

Make sure all of the transactions in each account are entered correctly. Sometimes an incorrect transaction can throw off the entire balance.

Once you’re sure all of the transactions are entered correctly, it’s time to look for any discrepancies between your records and those of your bank or other financial institution.

If you find any discrepancies, make the necessary adjustments in QuickBooks so that your records match those of the financial institution. This may require some trial and error, but eventually you should be able to get everything squared away and have accurate records once again.

Anúncios

How to Balance Quickbooks Online

If you are a small business owner, then you know how important it is to have a good accounting system in place. QuickBooks Online is a great option for small businesses, but it can be tricky to learn how to use it effectively. In this blog post, we will give you some tips on how to balance Quickbooks Online so that you can keep your finances in order.

First of all, make sure that you track all of your income and expenses in QuickBooks Online. This will allow you to see where your money is coming in and going out, and it will also help you identify any areas where you may need to cut back or save more money.

Next, take some time each month to reconcile your bank statements with the transactions that are recorded in QuickBooks Online.

This will ensure that everything matches up and that there are no discrepancies. If you find any errors, make sure to correct them right away so that they don’t cause problems down the road.

Finally, remember to run reports periodically so that you can see how your business is performing financially.

This information can be very helpful when making decisions about where to allocate your resources. By taking these steps, you can ensure that QuickBooks Online stays balanced and provides accurate financial information for your small business needs.

Credit: tworoadsco.com

How Do I Get My Quickbooks Balance to Match My Bank Balance?

If you’re using QuickBooks Online, there are a few different ways to reconcile your accounts. The first step is to make sure that all of your transactions are entered into QuickBooks. Once you’ve done that, you can use the Reconcile feature to match up your QuickBooks balance with your bank statement.

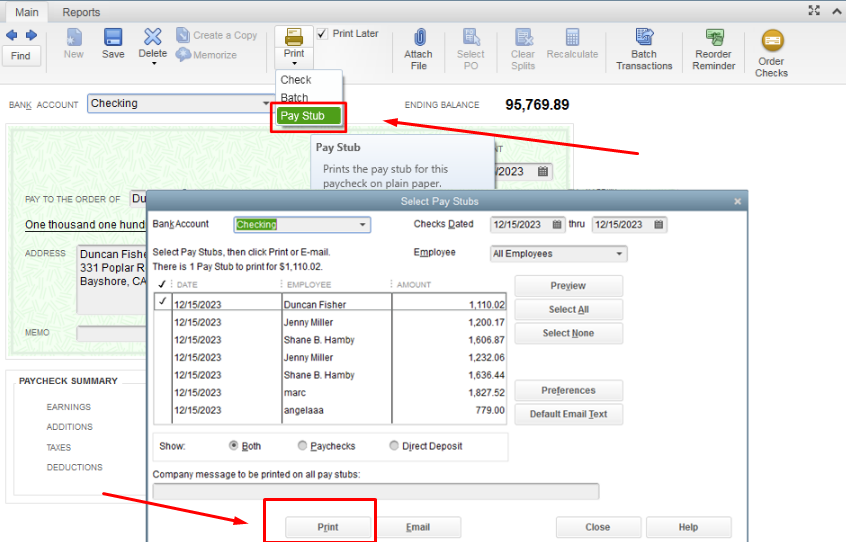

To do this, go to the Banking menu and select Reconcile. From there, you’ll enter in the ending balance and date from your bank statement. QuickBooks will then show you all of the transactions that have cleared since your last reconciliation.

If everything looks good, simply click “Reconcile Now” and your accounts will be balanced.

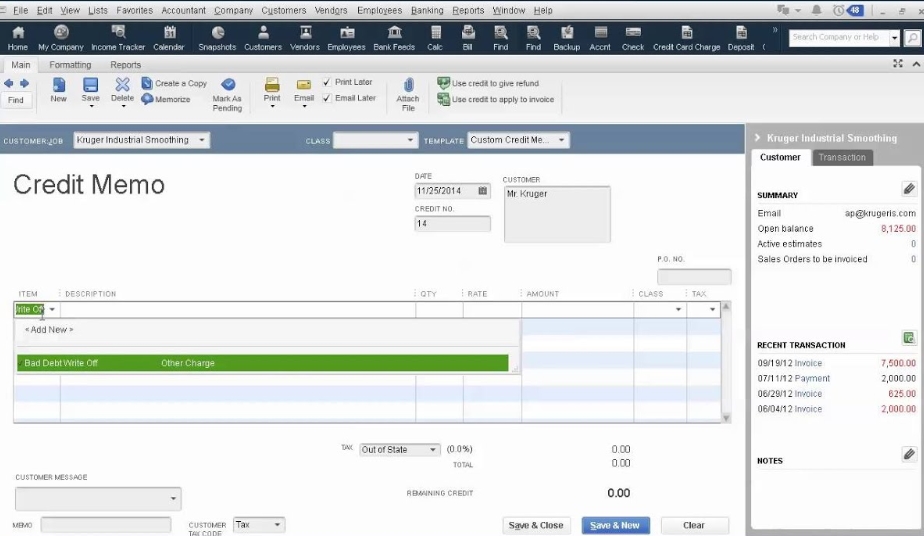

If you’re using the desktop version of QuickBooks, the process is similar. Go to the Banking menu and select Reconcile Accounts.

Enter in your ending balance and date from your bank statement, and then review the transactions that have cleared since your last reconciliation. If everything looks good, click “OK” to reconcile your accounts.

Why is My Quickbooks Balance So Different Than My Bank Balance?

If you’re noticing a discrepancy between your QuickBooks balance and your bank balance, there are a few possible explanations. First, it’s important to make sure that all of your transactions have been properly entered into QuickBooks. If you’re missing any transactions or have entered them incorrectly, that could account for the difference.

Another possibility is that you have outstanding checks or bills that haven’t cleared yet. These items will show up as deductions in your QuickBooks balance even though they haven’t hit your bank account yet. Similarly, if you’ve made any deposits that haven’t cleared yet, those will be reflected in your bank balance but not in QuickBooks until they go through.

Finally, there could be differences in the way that your bank and QuickBooks handle things like interest and fees. If you’re not sure what might be causing the discrepancy, it’s best to reach out to an accountant or other financial expert who can take a closer look at your records and help you find the cause of the problem.

Why Does My in Quickbooks Amount Not Match My Bank Balance?

When you reconcile your bank account in QuickBooks, the goal is to have your ending balance in QuickBooks match your bank statement. However, there are a number of reasons why these two balances might not match.

One reason could be that there are outstanding transactions in QuickBooks that have not yet cleared your bank.

This can happen if you’ve made a check or ATM withdrawal that hasn’t shown up on your bank statement yet, or if you’ve entered a transaction but haven’t recorded the payment yet.

Another possibility is that there are unrecorded transactions in your bank account. This could be an old check that finally cleared, or interest earned on the account that you haven’t recorded in QuickBooks yet.

If you’re reconciling for the first time, it’s also possible that there are simply discrepancies between what’s been entered into QuickBooks and what’s actually happened in reality. This isn’t necessarily a problem, but it’s something to keep an eye on going forward.

If you’re having trouble reconciling your accounts, the best thing to do is to go through each transaction one by one and compare it to your bank statement.

That way, you can identify any errors or omissions and get your reconciliations back on track.

How Do I Fix an Incorrect Balance in Quickbooks?

If you discover that your QuickBooks balance is incorrect, don’t panic! There are a few things you can do to fix the issue.

First, take a look at your chart of accounts.

Make sure that all of your account balances are up-to-date and accurate. If any of the numbers are off, adjust them accordingly.

Next, check your bank statements.

Compare the transactions in QuickBooks with what’s actually on your statement. If there are any discrepancies, make the necessary changes in QuickBooks.

Finally, reconcile your Accounts Receivable and Accounts Payable accounts.

This will help to ensure that all money owed to you (or by you) is accounted for in QuickBooks.

By following these steps, you should be able to get your QuickBooks balance back on track!

Conclusion

If you’re discrepancies between your QuickBooks balance and your bank balance, there are a few things you can do to fix them. First, make sure that all transactions are entered into QuickBooks correctly. This includes payments, deposits, fees, and interest.

Next, reconcile your accounts regularly to ensure that all transactions are accounted for. Finally, if you have any outstanding checks or loans, be sure to enter them into QuickBooks so they’re reflected in your balance. By following these tips, you can keep your QuickBooks and bank balances in sync.