How Do I Set Up a Car Loan in Quickbooks?

If you’re like most people, the purchase of a new car is financed with a loan. You can easily set up and track your car loan in QuickBooks so that you always know where you stand financially. Here’s how to do it:

1. Go to the Company menu and select Chart of Accounts.

2. Click on the New button at the bottom of the screen.

3. Select Auto Loan from the Account Type drop-down list.

4. Enter a name for the account in the Name field (e.g., Car Loan).

5. Enter the beginning balance of the loan in the Opening Balance field (e.g., $15,000). This is the amount that you borrowed from your lender.

If you’re not sure what this number is, you can find it on your loan paperwork or contact your lender for assistance.

If you’re looking to set up a car loan in Quickbooks, there are a few things you’ll need to do. First, open up the Company menu and click on Preferences. From there, go to the Accounting tab and make sure that the Automatically use account numbers for new accounts checkbox is selected.

Now go to the Lists menu and click on Chart of Accounts. Click on the Account button at the bottom and select New from the drop-down menu. Enter all of the pertinent information for your car loan account, including the name, type (asset), number, and description.

Once you’re done, click Save & Close.

Next, go to your Customers menu and create a new customer entry for yourself. Include all relevant information such as your name, address, phone number, and email address.

Once you’re done, click Save & Close.

Now it’s time to set up your loan itself. Go to Banking from the top menu bar and select Make Deposits from the drop-down menu.

In the Customer:Job field at the top, select yourself from the list of customers (the one you just created). Then enter all of pertinent information about your loan into Quickbooks: The date of purchase/loan origination , The lender’s name , The amount financed , The interest rate , The term length in months . If there are any other miscellaneous charges associated with your loan (such as points or closing costs), be sure to include those as well before clicking Save & Close .

And that’s it!

How to Record a Vehicle Loan Purchase in Quickbooks

How Do I Record Car Finance in Quickbooks?

Assuming you would like a step-by-step guide on how to record car finance in QuickBooks:

1. Open QuickBooks and go to the Customers tab.

2. Select the customer you want to create the invoice for.

3. Go to New Transaction and select Invoice.

4. Fill in all of the required fields on the invoice screen. In the Description field, write something like “Vehicle down payment” or “Vehicle monthly payment.”

If this is a recurring transaction, check the box labeled “This is a repeating invoice.”

5. In the Items section, click Add Item. Choose Other Charge from the list that appears 6. Enter all relevant information about the charge in the fields that appear below (e.g., Vehicle Down Payment, $500).

Click OK when finished 7 .When you’re done adding all items, click Save & Close at the bottom of the screen 8 .

Anúncios

How Do I Set Up an Auto Loan in Quickbooks Online?

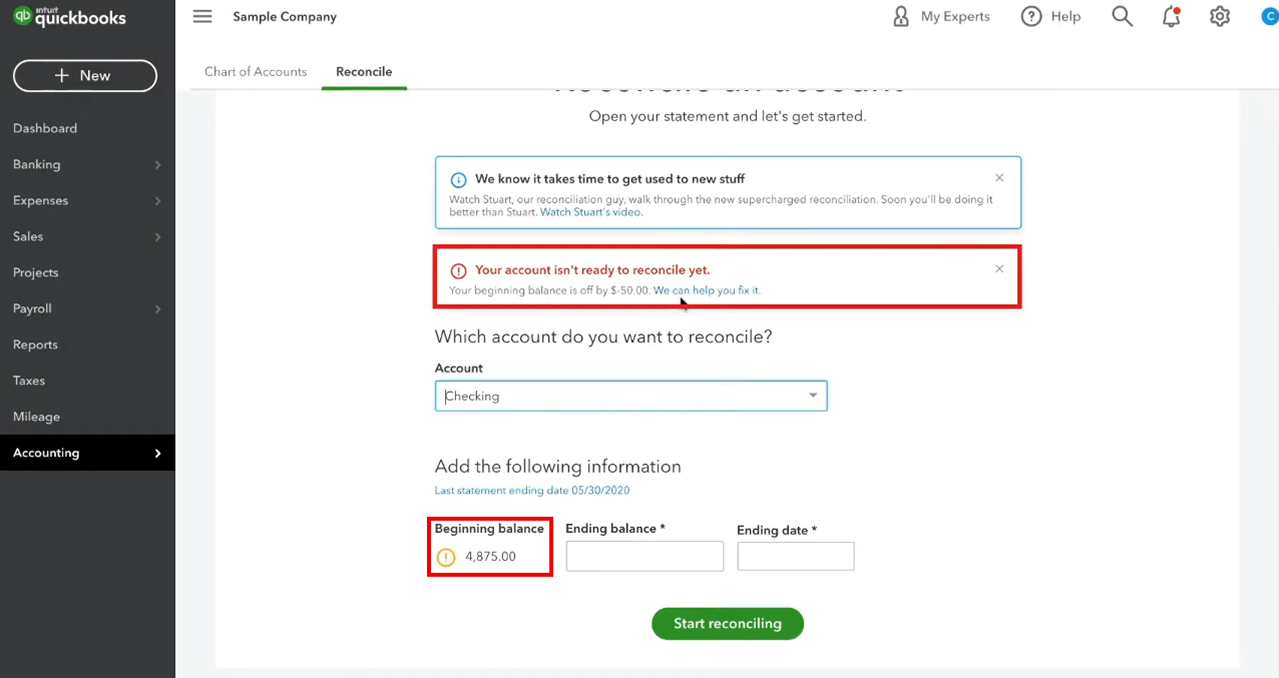

If you’re looking to set up an auto loan in QuickBooks Online, there are a few things you’ll need to do. First, you’ll need to create a liability account for the loan. To do this, go to the Accounts tab and click on “Create New.”

From there, select “Liability” as the account type and give it a name (e.g., Auto Loan).

Once the liability account is created, you’ll need to add the loan information. To do this, go to the Banking tab and click on “Add Loan.”

Enter in the relevant information, such as the amount of the loan, interest rate, etc. Once everything is entered, click “Save & Close.”

Now that your loan is set up in QuickBooks Online, you can begin tracking payments.

To do this, go to the Banking tab and click on “Make A Payment.” Enter in the payment amount and date, then click “Save & Close.” Repeat this process each time you make a payment on your loan.

By following these steps, you can easily set up an auto loan in QuickBooks Online!

How Do I Add a Car Loan to Quickbooks Desktop?

Assuming you would like a step-by-step guide on how to add a car loan to QuickBooks Desktop:

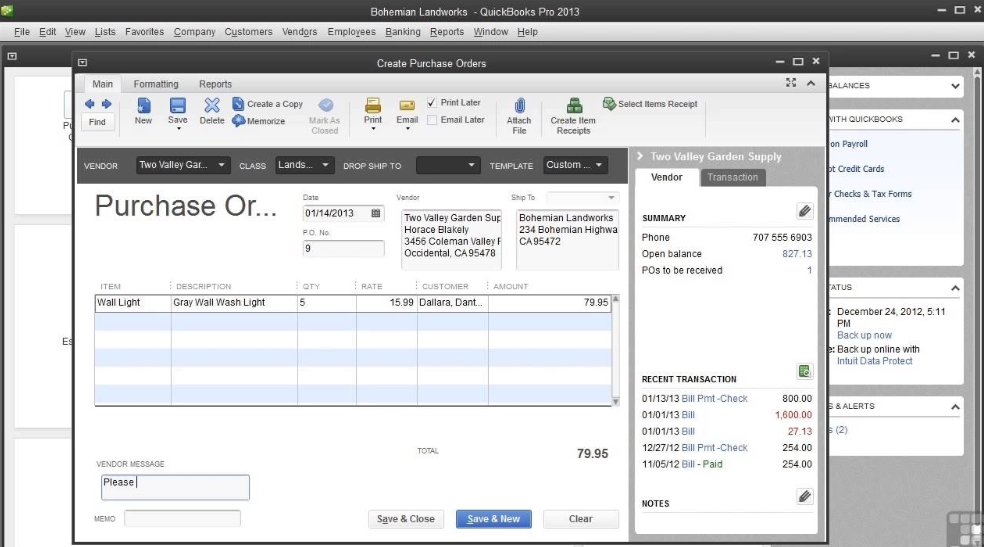

1. Open QuickBooks and go to the Lists menu. Select Item List.

2. In the Item list window, click the New button and select Other Charge from the drop-down menu.

3. Enter the name of your charge in the Name field (e.g., Car Loan). Then, enter an account number in the Account # field if you want to track this information in a specific financial account within QuickBooks (optional).

You can also add a description of this charge in the Description field (optional).

Anúncios

How Do You Record Car Loans in Accounting?

Assuming you would like a blog post discussing how to record a car loan in accounting:

When an individual takes out a loan to buy a car, the amount they borrowed creates a liability on their balance sheet. The monthly payments they make toward the loan principal and interest reduces the size of that liability over time.

The first step is to record the loan as a long-term liability. This can be done by creating a journal entry that includes the amount borrowed, the name of the lender and the interest rate of the loan. For example, if you borrow $10,000 from ABC Bank at an annual interest rate of 5%, your journal entry would look like this:

Long-Term Liabilities

ABC Bank Loan 10,000

Interest Rate 5%

Each month when you make a payment on your car loan, you’ll need to make two entries in your accounting records. The first will reduce your cash balance by the amount of money you paid toward the principal and interest. The second will decrease your long-term liabilities by that same amount.

So, if your monthly payment is $250 and $200 of that goes toward principal and $50 goes toward interest, your journal entries would look like this:

Cash 250

Credit: www.smbaccountants.com

How to Set Up a Loan in Quickbooks Desktop

If you’re like most business owners, you probably don’t love dealing with numbers and financial reports. QuickBooks can help make things a bit easier by allowing you to track your loans and other debts in one place. Here’s a step-by-step guide on how to set up a loan in QuickBooks Desktop.

1. Open QuickBooks and go to the Company menu at the top of the screen. Select Company Info from the drop-down menu.

2. In the Company Information window, go to the Accounting tab and select Loans from the list on the left side of the screen.

3. Click on Add Loan in the middle of the screen.

4. Enter all of the relevant information about your loan, including account number, balance, interest rate, etc. Be sure to click Save when you’re finished so that your changes are recorded in QuickBooks.

How to Record a Financed Vehicle

Assuming you would like a blog post discussing how to record a financed vehicle:

“How to Record a Financed Vehicle”

If you have recently financed a vehicle, you may be wondering how to properly record it.

Here is a quick guide on how to do so.

First, you will need the following information:

-The name of your lender

-Your loan account number

-The date of your loan

-The amount of your loan

-The term of your loan

-The interest rate of your loan

armed with this information, you can begin recording your financed vehicle.

To do so, simply create a new asset account in your accounting software and label it accordingly (e.g., “Vehicle Loan”). Then, input the relevant information from above into the software. Doing so will help ensure that all aspects of your finances are accounted for and up-to-date.

How to Set Up a Loan in Quickbooks Online

If you’re like most business owners, chances are you’re always looking for ways to save time and streamline your accounting processes. QuickBooks Online is a great tool that can help you do just that. And one of the coolest things about QuickBooks Online is its loan feature.

With QuickBooks Online, you can easily set up loans and track payments. This can be a huge time-saver, especially if you have multiple loans or lines of credit. In this blog post, we’ll show you how to set up a loan in Quickbooks Online so you can start tracking payments and saving time!

Here’s what you’ll need to do:

1. Log into your QuickBooks Online account and click on the “Banking” tab at the top of the page.

2. Click on the “Loan Accounts” link on the left side of the page.

3. Click on the “Add Loan Account” button near the top of the page.

Conclusion

If you’re looking to set up a car loan in Quickbooks, there are a few things you’ll need to do. First, create an account for the car loan under the assets section. Then, add the lender as a customer under the customers and vendors tab.

Once that’s done, you can create an invoice for the loan amount and send it to the lender. They should then make payments on the loan which you can track under the transactions tab. By following these steps, you can easily keep track of your car loan in Quickbooks!