What is a Credit Memo in Quickbooks?

If you’ve ever had a customer return merchandise or if you need to issue a refund for any other reason, you’ll need to create a credit memo in Quickbooks. A credit memo is basically a negative invoice that gets applied to the customer’s account. This will reduce the amount that the customer owes you.

If you use QuickBooks to manage your finances, you may be wondering what a credit memo is. A credit memo is simply a document that shows how much money your customers owe you. This information can be useful when you’re trying to keep track of who owes you money and how much they owe.

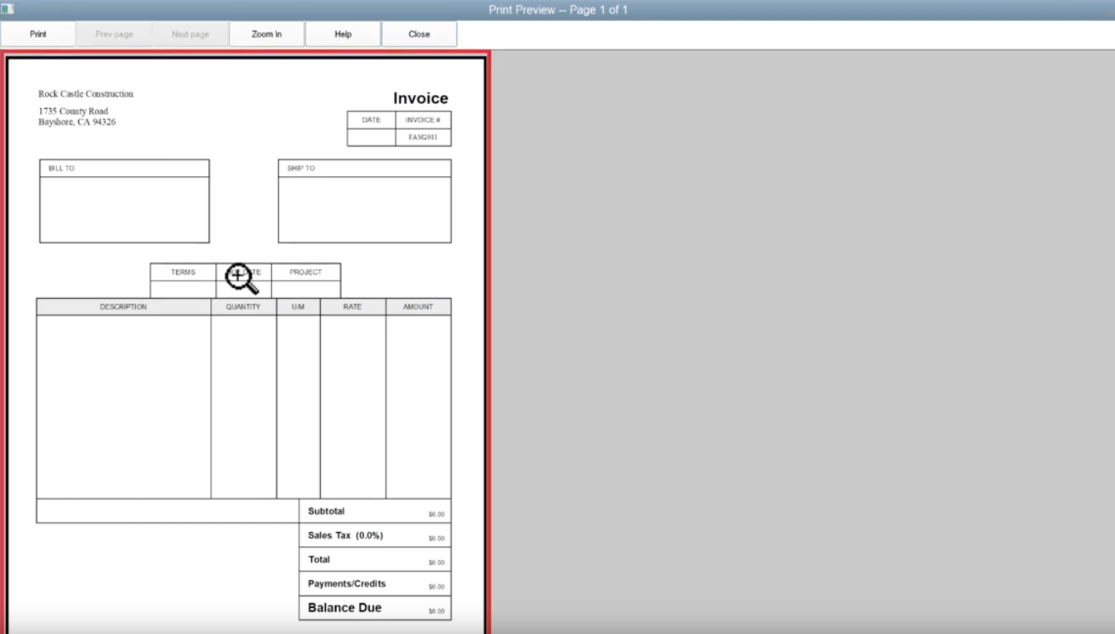

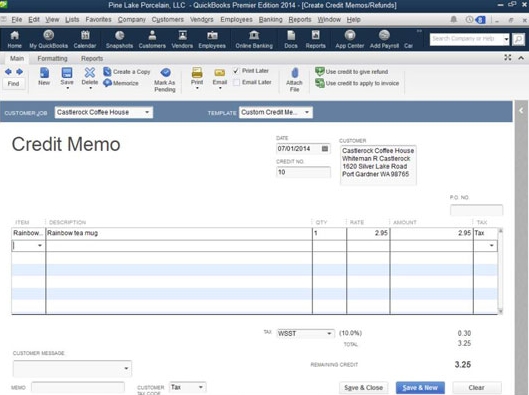

When you create a credit memo in QuickBooks, you’ll need to enter the customer’s name, the date of the sale, and the amount owed. You can also include any other relevant information, such as the reason for the credit or what product was purchased. Once you’ve created the credit memo, QuickBooks will automatically keep track of it for future reference.

If you ever need to know how much money a customer owes you, just pull up their credit memo in QuickBooks and all of the information will be right there at your fingertips. Credit memos can be a helpful tool in managing your finances and keeping track of who owes you money.

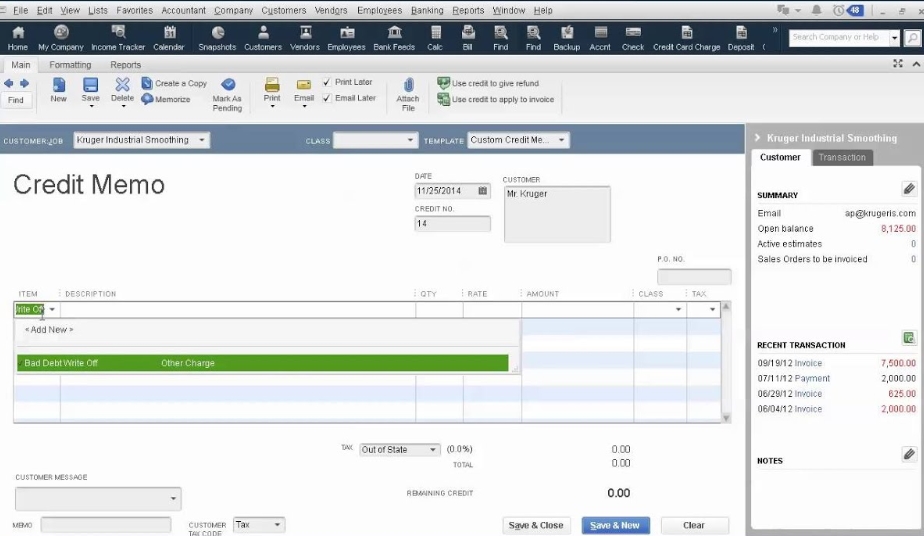

How to Create a Credit Memo in QuickBooks Pro

What Happens When You Create a Credit Memo in Quickbooks?

When you create a credit memo in QuickBooks, the following things happen:

1. A credit memo is created and appears in your customer’s list of transactions.

2. The amounts of the credit memo are applied to the customer’s account balance.

3. If you have invoices outstanding for the customer, the credit memo will be applied to those invoices (reducing the amount owed).

4. If you have payments outstanding for the customer, the credit memo will be applied to those payments (increasing the amount owed).

Anúncios

Where Does a Credit Memo Go in Quickbooks?

When you issue a credit memo in QuickBooks, the account it affects depends on what the credit memo is for. If the credit memo is for merchandise that was returned, then you would use an account called Sales Returns and Allowances. If the credit memo is given because of a mistake on your part, such as overcharging or sending the wrong product, then you would use an account called Sales Discounts.

To find out where your credit memos are going in QuickBooks, go to Accounts Receivable > Credit Memos. Here you will see all of the credit memos that have been issued in QuickBooks. If you click on a specific credit memo, it will show you which account it affects.

What Accounts Does a Credit Memo Affect in Quickbooks?

A credit memo in QuickBooks is used to give the customer a refund for overpayment, returned merchandise, or services not rendered. When you create a credit memo, it will automatically reduce the customer’s balance. You can apply a credit memo to an invoice or bill.

If you have already received payment from the customer, you can refund the customer by creating a draw check.

Anúncios

What is the Purpose of a Credit Memo?

A credit memo is a document that is issued by a seller to a buyer. The purpose of the credit memo is to notify the buyer that they have been credited for an amount of money. This can be due to various reasons, such as, returning merchandise, overpaying on an invoice, or receiving a discount.

The credit memo will contain information such as the date, the name and address of the buyer, the reason for the credit, and the amount of money that has been credited. The seller will then keep this document on file in case there are any questions from the buyer or discrepancies with their account.

Credit: www.fourlane.com

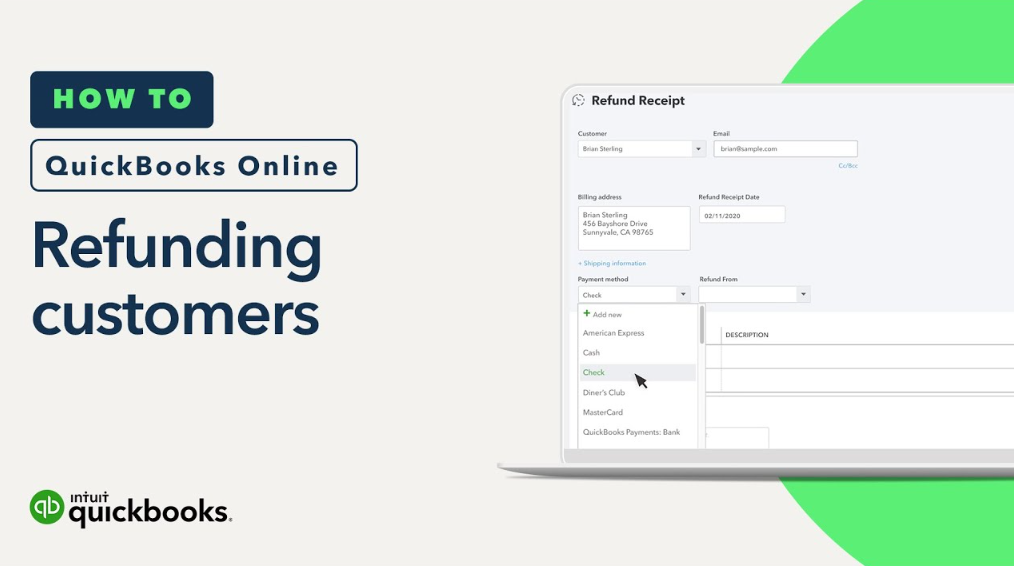

What is a Credit Memo in Quickbooks Online

In QuickBooks Online, a credit memo is an invoice that represents a credit balance on an account. This can happen when you return merchandise to a vendor, or if you receive a refund from a vendor for overpayment.

A credit memo in QuickBooks Online has the following fields:

Account: The name of the customer or vendor associated with the credit memo. If this is a customer, the account will be found under Customers in your chart of accounts. If this is a vendor, the account will be found under Vendors in your chart of accounts.

Class: You can categorize transactions by class in QuickBooks Online. This field will be blank if you have not set up any classes in your company file.

Credit To Account: This defaults to Accounts Receivable (A/R), which is where QuickBooks tracks money that customers owe you.

Customer Message: This message prints on customer statements next to the credit memo details.

Delivery Method: How did you deliver the product or service? Choose from Email, Fax, Print, or Postal Mail.

Due Date: When does the customer need to pay? You can leave this field blank if there is no specific due date.

Employee: Which employee did this work?

Start typing an employee’s name and then choose from the drop-down list that appears below it. Only active employees appear in this list; inactive employees do not appear here at all .

Expiration Date: When does this credit expire?

For example, if you give customers 60 days to use their credits, enter 60 days from today’s date here . Credits that have expired do not print on customer statements .

Location : If you track inventory quantities by location , choose the location where these items were returned . Locations are set up under Company Settings .

How to Apply Credit Memo in Quickbooks Desktop

When you receive a credit memo from a vendor, you can apply it to an outstanding invoice in QuickBooks Desktop. This will reduce the amount you owe the vendor. To apply a credit memo in Quickbooks Desktop, follow these steps:

1. Go to the Vendors menu and select Apply Credits/Refunds.

2. Select the vendor whose credit memo you want to apply and click Next.

3. Choose whether to apply the credit memo to one specific invoice or multiple invoices.

If you choose to apply it to multiple invoices, select the invoices that you want to apply the credit memo towards and click Next.

4. Enter the amount of the credit memo that you want to apply and click Finish.

What are 2 Ways to Create a Credit Memo in Quickbooks Online?

A credit memo in Quickbooks Online can be created in 2 ways: through an invoice, or directly through the Create Credit Memo feature.

If you’re creating a credit memo through an invoice, first go to the Customers tab and select the customer you want to create the credit memo for. Then click on the New button and select Invoice.

Enter in the relevant information for the invoice, such as date, terms, products or services being invoiced, etc. Under the Addresses section, make sure to check the box next to “Credit Memo” so that Quickbooks knows this is a credit memo instead of a regular invoice. Once you’re done entering all the necessary information, click Save & Close.

You can also create a credit memo directly through Quickbooks Online by going to Customers > Create Credit Memo. Again, enter in all the relevant information for the credit memo including date, customer name, products or services being credited, etc. When you’re finished click Save & Close.

Conclusion

A credit memo in Quickbooks is a document that is used to request a refund for goods or services. This can be done for products that were damaged or returned, or for services that were not rendered as agreed. The credit memo should include the date, the customer’s name and contact information, a description of the problem, and the amount owed.