How to Write Off Bad Debt in Quickbooks?

Assuming you’re referring to writing off a customer’s debt in QuickBooks:

The first thing you’ll need to do is create an account in your chart of accounts specifically for write-offs. This will help you track how much bad debt you have and make it easier to see the impact on your financial statements.

Once you’ve created the account, open up the customer’s record in Quickbooks and select the “Write Off” option from the menu. Enter the amount of the debt you’re writing off into the appropriate field and select the new account you created from the drop-down menu.

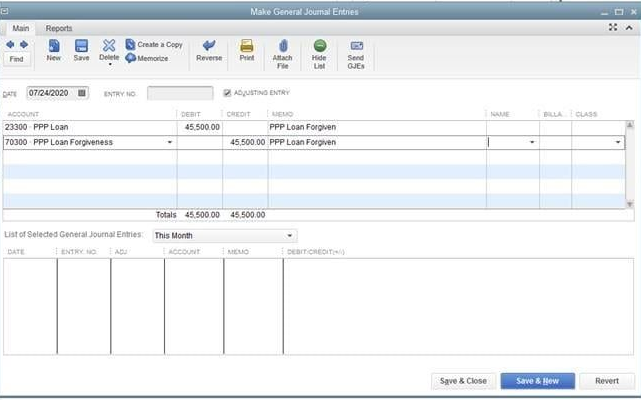

- To write off bad debt in QuickBooks, go to the Company menu and select Make General Journal Entries

- In the first line of the journal entry, select Accounts Receivable from the Account drop-down menu

- Enter the amount of the bad debt in the Debit column

- In the second line of the journal entry, select Bad Debt Expense from the Account drop-down menu

- Enter the same amount as in step 2 in the Credit column

- Click Save & Close to record your journal entry and write off your bad debt

Writing off an invoice to bad debt in Quickbooks Online

How Do You Record a Bad Debt Written Off?

Assuming you’re referring to how to record a write-off of an uncollectible debt in your accounting records:

If you have written off a debt as uncollectible, you need to remove the amount of the debt from your accounts receivable. To do this, debit your Allowance for Bad Debts account and credit your Accounts Receivable account.

The double entry is necessary because the amount of the write-off must be removed from both Accounts Receivable (an asset) and from revenue (since revenue was increased when the original sale was recorded).

For example, if Company XYZ had originally recorded a sale of $1,000 on credit to Customer ABC, then later determined that the debt was uncollectible and wrote it off, the journal entry would be as follows:

Debit Credit

Allowance for Bad Debts $1,000

How Do I Write off a Bad Debt Invoice?

If you’re a business owner, there’s a good chance you’ve had to deal with a delinquent customer at some point. While it’s never fun to chase down payments, sometimes you have to cut your losses and write off the debt as a bad invoice. Here’s how to do it:

First, check your records to make sure the debt is actually unpaid. Once you’re confident that the invoice is truly outstanding, reach out to the customer one more time in writing (email is fine) to give them a final notice and request payment. If they still don’t respond or pay up, then you can begin the process of writing off the debt.

To do this, create a new journal entry in your accounting software with two lines: one for the bad debt expense and one for accounts receivable. For the bad debt expense line, enter the full amount of the unpaid invoice as well as any associated fees (like late charges). On the accounts receivable line, enter 0 since we’re no longer expecting payment on this invoice.

Be sure to include both lines in your total so that your books stay balanced.

That’s it! You’ve now officially written off the bad debt and can move on from this delinquent customer.

Anúncios

How Do I Write off Customer Balance in Quickbooks?

There are a few different ways that you can write off customer balance in Quickbooks. The first way is to simply delete the outstanding invoices. This will remove the balance from your customer’s account and they will no longer owe you any money.

However, this option should only be used if the outstanding amount is very small and you are confident that the customer will not pay it back.

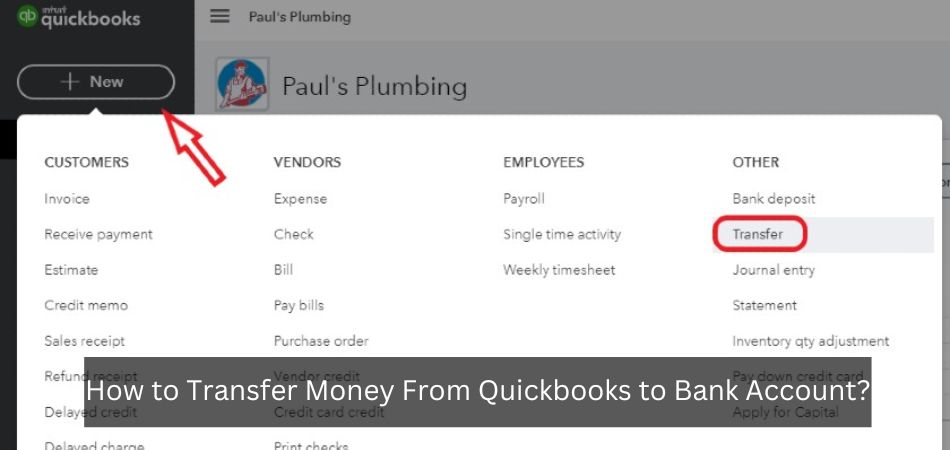

The second way to write off a customer balance is to create a journal entry. To do this, you will need to go to the “Accounting” tab and then click on “Journal Entries.”

From here, you will want to select the customers account and enter the amount that they owe you in the debit column. Then, in the credit column, you will want to choose an offsetting account such as Accounts Receivable or Bad Debt Expense. This method is a bit more complicated than simply deleting the invoices but it does provide a better record of what happened with the outstanding balance.

The third and final way to write off a customer balance is through using a bad debt expense account. To set this up, you first need to create an expense account called Bad Debt Expense (or something similar). Then, when an invoice becomes overdue, you can simply add a line item to that invoice for the bad debt expense account.

This method is best used for larger balances since it allows you to track how much money you are writing off each month due to bad debts.

How Do I Write off Unpaid Invoices in Quickbooks?

When you’re running a business, it’s important to keep track of the money that you’re owed-this is known as Accounts Receivable. If you use QuickBooks, there’s an easy way to keep track of which invoices are unpaid, and to write them off if need be. Here’s how:

First, open up QuickBooks and go to the Customer Center. From here, you can see a list of all your customers and their contact information. To the right of each customer’s name, you’ll see their current balance.

Any unpaid invoices will be listed here in red.

If you need to write off an invoice, simply click on it and then select “Write Off Unpaid Invoice” from the menu that appears. You’ll be prompted to enter a reason for writing off the invoice-be sure to choose something that makes sense for your business so that you can easily remember it later on.

Once you’ve written off the invoice, it will no longer show up in your Accounts Receivable list.

Keep in mind that when you write off an invoice, this doesn’t mean that the customer doesn’t owe you money anymore-it just means that QuickBooks is no longer tracking this particular debt. You may still want to follow up with the customer about paying what they owe; if not, at least now you won’t have any outstanding invoices cluttering up your records!

Anúncios

Credit: www.wizxpert.com

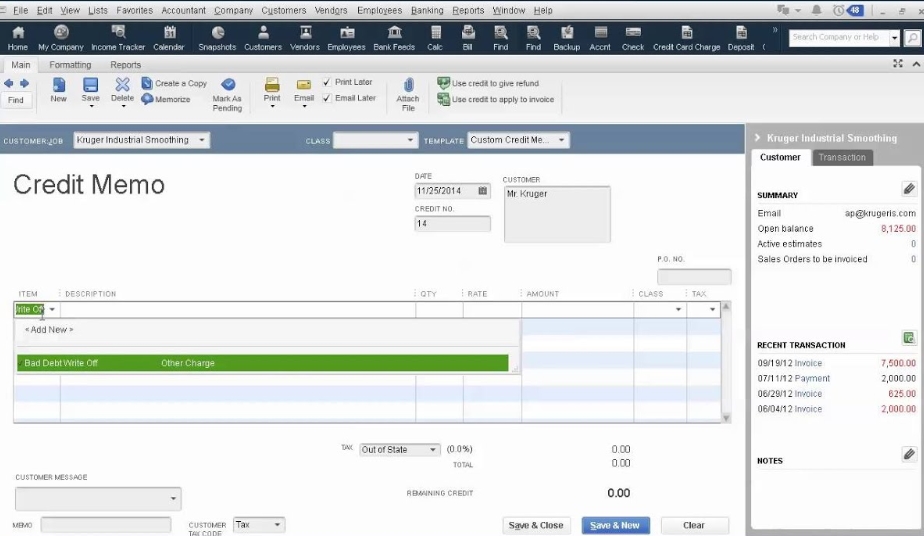

How to Write off Bad Debt in Quickbooks Desktop 2021

If you’re a small business owner, chances are you’ve had to deal with bad debt at some point. Maybe a customer didn’t pay their invoice, or a client never returned goods they borrowed from your store. Whatever the case may be, QuickBooks Desktop can help you write off that bad debt so it doesn’t impact your bottom line.

Here’s how:

First, open QuickBooks and go to the Customers menu. Then, select Write Off Bad Debt.

On the next screen, you’ll need to choose which customer’s debt you want to write off. QuickBooks will show you a list of customers who have outstanding balances. Select the one you want to write off and click OK.

Now, enter the amount of money you want to write off in the Amount field. If there’s interest on the debt, you can enter that amount as well (but it’s not required). When you’re finished, click Save & Close.

That’s it! The bad debt will now be written off in QuickBooks and won’t impact your financial reports going forward.

Write off Bad Debt in Quickbooks Desktop

If you’re like most business owners, you want to do everything you can to minimize your losses. That’s why it’s important to know how to write off bad debt in QuickBooks Desktop.

Bad debt is money that is owed to you but that you are unlikely to ever collect.

This can happen for a variety of reasons, such as when a customer doesn’t have the funds to pay their bill or if they simply refuse to pay.

Whatever the reason, if you find yourself in this situation, it’s important to take action so that you can get rid of the debt and move on. Here’s what you need to do:

1. Create a Bad Debt Expense account in QuickBooks Desktop. To do this, go to Lists > Chart of Accounts and click the “New” button at the bottom of the window. Select “Expense” from the Account Type drop-down menu and enter “Bad Debt Expense” in the Name field.

Click “OK” when you’re done.

2. Write off the bad debt using an accounts receivable journal entry . To do this, go to Company > Make General Journal Entries .

In the first line of the journal entry , select your Bad Debt Expense account from the Account drop-down menu . Then , enter the amount of bad debt that you want write -off in either t he Debit or Credit column (it doesn’t matter which one). In t he second line of t he journal entry , select your Accounts Receivable account from t he Account drop- down menu and enter t he same amount of bad debt in ei ther t he Debit or Credit column (again, it doesn’t matter which one).

How to Write off Bad Debt in Quickbooks Online

If you’re a business owner, chances are you’ve had to deal with bad debt at some point. Whether it’s a customer who doesn’t pay their invoices or a loan that goes into default, bad debt can have a major impact on your bottom line.

The good news is that you can write off bad debt in QuickBooks Online.

This process is known as “charge-offs” and it’s a way to remove the outstanding balance from your books. Charge-offs are reported on your income statement as an expenses, which reduces your overall profit for the period.

Here’s how to write off bad debt in QuickBooks Online:

1. Go to the Gear icon > Company Settings.

2. Select Accounting from the left menu.

3. Under Advanced Accounting, select Write Off Bad Debt.

Conclusion

Assuming you’re asking for a summary of the blog post:

The blog post explains how to write off bad debt in Quickbooks. First, the user must create an account called Bad Debt.

Second, the user should go to Customers > Enter Bills. Third, select the customer that owes you money from the drop-down menu and enter the amount they owe in the Outstanding Charges field. Fourth, click Save & Close.

Finally, go to Reports > Accounting > A/R Aging Summary and look for any customers with a balance in the Bad Debt column. If you find any, contact them to arrange payment.