What Does Clear Payment Mean in Quickbooks?

In QuickBooks, “clear” payment means that the funds have been received and are no longer outstanding. This can happen in a couple different ways: either the customer has paid their invoice in full, or you’ve applied a credit to the invoice. Once an invoice is paid in full (or a credit is applied), the status of the invoice will change to “Paid” and the amount will be reflected as zero dollars owed.

How to Receive Payments for Invoices in QuickBooks Online

Are you using QuickBooks to manage your finances? If so, you may have come across the term “clear payment.” But what does this mean?

In short, a clear payment means that the money has been received and is available to be used. This is different from an uncleared payment, which means that the money has not yet been received.

There are a few different ways that you can receive payments in QuickBooks.

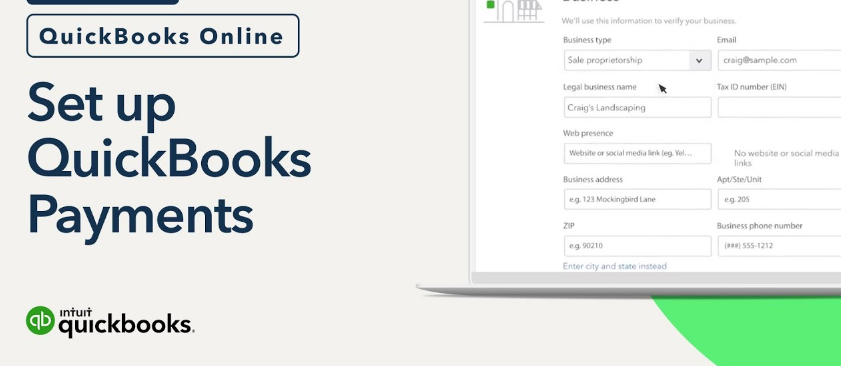

One way is to receive them electronically, such as through PayPal or credit card. Another way is to receive them through the mail. In either case, once the payment has been processed and appears in your bank account (or other designated account), it will be considered a clear payment.

If you’re not sure whether or not a payment is considered cleared, you can always check the status of the payments in QuickBooks. Just go to the “Banking” menu and then click on “Payment Status.” From there, you’ll see all of your payments and their current status.

If a payment shows up as “Uncleared,” that means it hasn’t been processed yet; if it says “Cleared,” then you know the money is available for use.

Clear payments are an important part of keeping track of your finances in QuickBooks. By understanding what they are and how they work, you can better manage your money and avoid any potential pitfalls down the road.

Clear Payment in Quickbooks

When you’re running a business, it’s important to keep track of your payments. QuickBooks can help you do this by providing clear payment information. Here’s how:

1. Go to the Customers menu and select Receive Payments.

2. Enter the date range for the payments you want to view.

3. Select the customer you want to view payments for from the Customer drop-down menu.

If you want to see all customers’ payments, leave this field blank.

4. Click OK.

The next screen will show all payments received within the specified date range, along with pertinent information such as the check number, amount, and payment method used.

You can also see whether a payment has been applied to an invoice or not by looking at the Applied To column.

Anúncios

What Does Receive Payment Mean in Quickbooks

When you receive a payment in QuickBooks, it means that the money has been deposited into your bank account. The payment may have come from a customer, or from another source, such as a loan.

In QuickBooks, you can track payments that you’ve received, and see when they were deposited into your account.

This information can be helpful in managing your finances and ensuring that you have enough money to cover expenses.

If you’re expecting a payment from a customer, you can create an invoice in QuickBooks and track the status of the payment. When the payment is received, QuickBooks will automatically update the invoice to show that it’s been paid.

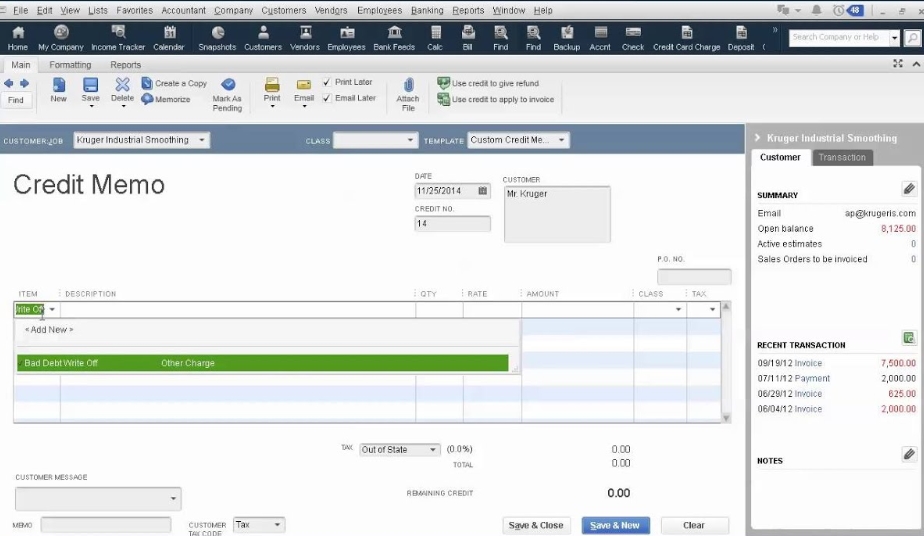

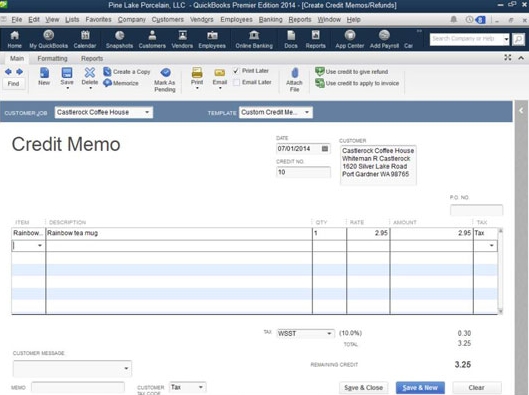

QuickBooks can also help you keep track of refunds and other payments that you need to make to customers. By tracking these payments, you can ensure that your financial records are accurate and up-to-date.

How to Receive Payment in Quickbooks Online

Receiving payments in Quickbooks Online is a very simple process. To receive a payment, just follow these steps:

1. Go to the “Banking” menu and select “Receive Money”.

2. Enter the amount of money you are receiving and select the account you want to deposit it into.

3. If you are receiving the payment from a customer, be sure to select their name from the drop-down menu so that it will appear on their invoice correctly.

4. Click “Save & Close” when you’re finished and your payment will be recorded!

Anúncios

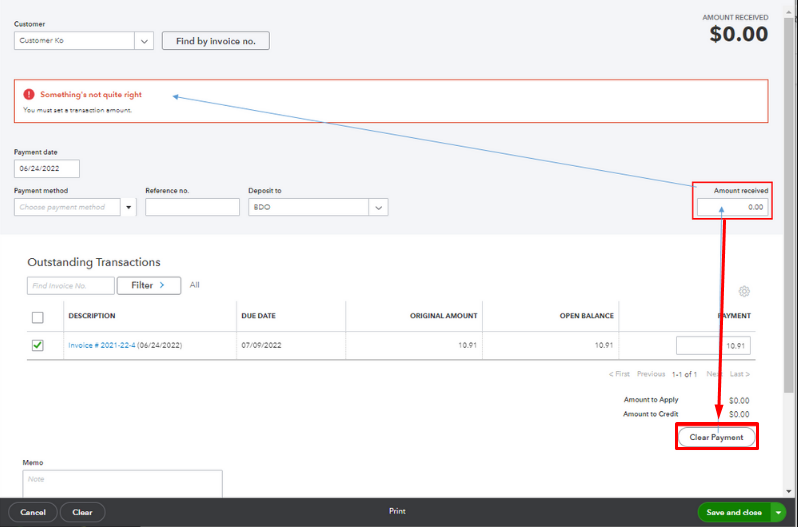

How to Clear a Payment in Quickbooks Online

Quickbooks Online is a great tool for managing your finances. One of the features that makes it so useful is the ability to clear payments. This means that you can keep track of what you’ve paid and what you still need to pay, without having to remember all the details yourself.

Here’s how to clear a payment in Quickbooks Online:

1. Go to the “Banking” menu and select “Clear & Close.”

2. Select the account that you want to clear the payment from.

3. Enter the date of the payment, the amount, and any relevant information in the memo field.

4. Click “OK.”

That’s all there is to it!

Clearing payments in Quickbooks Online is quick and easy, and it can help you stay organized and on top of your finances.

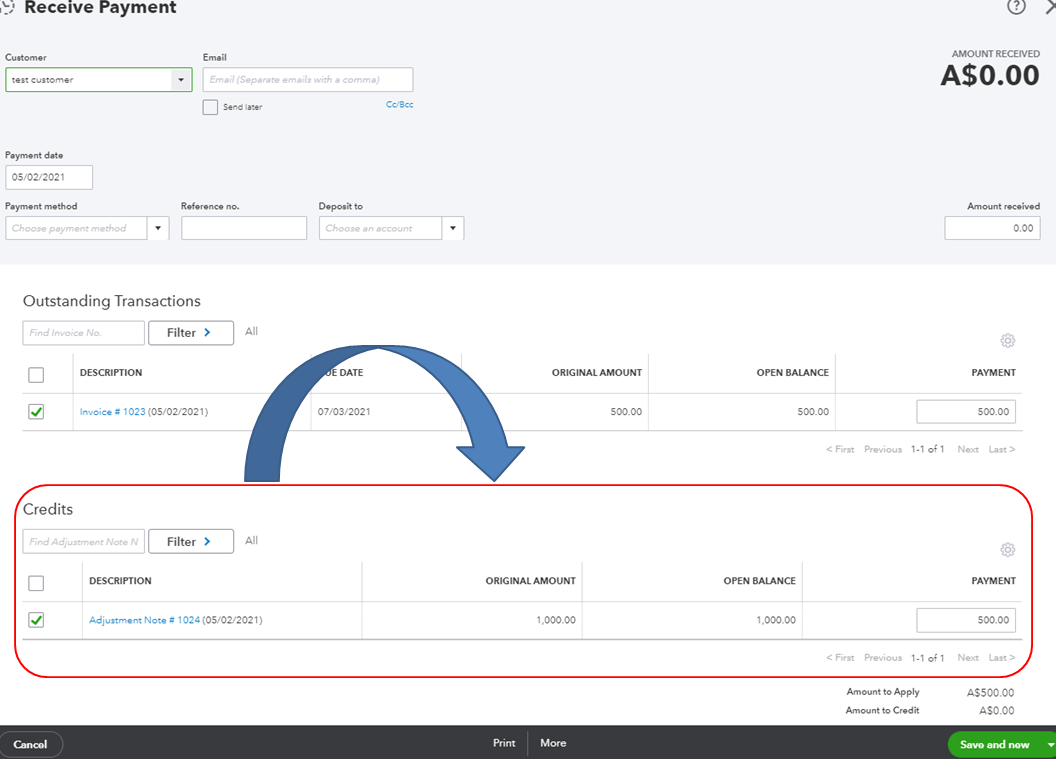

How to Apply a Payment to an Invoice in Quickbooks Online

If you’re like most business owners, you want to get paid as quickly as possible. To do that, you need to learn how to apply a payment to an invoice in QuickBooks Online.

The first step is to log into your QuickBooks Online account and go to the “Invoices” page.

On this page, you will see a list of all the invoices that are outstanding. Find the invoice that you want to apply a payment to and click on it.

On the next page, you will see a button that says “Apply Payment.”

Click on this button.

A pop-up window will appear asking you how much of the payment you want to apply to the invoice. Enter the amount and then click on the “Apply” button.

That’s it! You’ve now applied a payment to an invoice in QuickBooks Online.

Credit: quickbooks.intuit.com

What Does Clear Payment Mean?

When you make a payment, whether it’s with cash, a check, or a credit card, you expect the money to go through. But what does that mean, exactly? Here’s a look at what clearing a payment means and how it works.

When you make a payment, the first thing that happens is that the money is transferred from your account to the recipient’s account. This is called the “settlement process.” The settlement process can take anywhere from a few seconds to a few days, depending on the type of payment you made and the financial institution involved.

Once the money has been transferred, it goes through a clearinghouse. A clearinghouse is like an air traffic control tower for payments. It makes sure that all of the paperwork associated with the payment is in order and then sends out confirmation to both parties that the transaction has been completed successfully.

After the clearinghouse gives its approval, the money is finally deposited into the recipient’s account. At this point, the payment is considered “cleared” and both parties can be confident that everything went through as planned.

There are some payments which may not need to go through a clearinghouse in order to be considered cleared.

For example, if you make apayment using Zelle®, Venmo®, or PayPal®, these services typically clear payments immediately so that you don’t have to wait for anything to go through an intermediary step first.

In general, though, most payments will need to go through some form of settlement and clearance before they are considered complete. So next time you make a payment, keep in mind all of the steps involved in getting your money from Point A (your account) to Point B (the recipient’s account).

What Does It Mean to Clear an Invoice?

In business, the term “clear” can have many meanings. When applied to invoices, clearing an invoice usually means that the funds have been received and processed by the company. This can happen in a number of ways, such as when a customer pays their bill online or through automatic withdrawal from a bank account.

However, simply because an invoice is cleared doesn’t necessarily mean that the customer has paid in full. In some cases, businesses may offer partial payment plans or allow customers to make payments over time. As long as the minimum amount due is paid and processed, the invoice will be considered cleared.

Once an invoice is cleared, it’s typically removed from the accounts receivable system and recorded as income on the company’s financial statements. This allows businesses to keep track of which invoices have been paid and helps them budget accordingly for future expenses.

How Long Does a Quickbooks Payment Take to Clear?

When you make a payment using QuickBooks, the funds are typically transferred within two to three business days. However, it can take longer for the funds to clear if you’re using a bank that’s located in a different country. If you need to know exactly when the funds will be available, you can contact your bank to get more information.

How Do I Clear a Bill in Quickbooks?

Assuming you are referring to a vendor bill in QuickBooks:

To clear a vendor bill in QuickBooks, first make sure that the bill has been paid in full. Once the payment has been processed, open up the bill and click “Edit.”

From there, select “Clear” from the drop-down menu next to the Status field. This will remove the bill from your list of outstanding bills and indicate that it has been paid in full.

Conclusion

In Quickbooks, “clear payment” refers to the process of transferring money from one account to another. This can be done either manually or automatically. When you clear a payment, the money is moved immediately and the transaction is recorded in your books.

This can be helpful if you need to keep track of where your money is going, or if you’re trying to reconcile your accounts.