Does Freshbooks Accept Paypal?

There are a lot of people out there who are looking for a good accounting software that they can use, and one of the most popular options out there is Freshbooks. Many people wonder if Freshbooks accepts Paypal as a payment method, and the answer is yes! You can easily add your Paypal account to Freshbooks in order to make payments for your invoices.

This is a great way to pay for your invoices, and it can also help you keep track of your finances.

PayPal Invoicing vs FreshBooks: Why I switched from FreshBooks to PayPal Invoicing

If you’re looking for an online invoicing and accounting software that accepts Paypal, then you’ll be happy to know that Freshbooks does indeed accept this form of payment. This means that you can easily and quickly send invoices and get paid by your clients without having to worry about setting up a separate merchant account or anything like that. Plus, with Paypal’s built-in fraud protection, you can rest assured that your payments are safe and secure.

How to Manually Accept Paypal Payment

Assuming you would like a blog post discussing how to manually accept PayPal payments:

“How to Manually Accept Paypal Payment”

Have you ever had someone tell you they sent you money through PayPal, but when you login to your account, the payment is nowhere to be found?

There are a few reasons this could happen. The first thing you should do is check the email address linked to your PayPal account to see if you received an email notification about the payment. If not, there are a few other things you can try.

This guide will show you how to manually accept PayPal payments.

If the person who sent you money has a verified PayPal account, their name will appear in the Transaction Details section of your account overview page. To find this page, log into your PayPal account and click on ‘Activity.’

From here, find the transaction in question and click on it. This will take you to the Transaction Details page where you can view information about the payment, including whether or not it has been completed successfully. If the payment shows as ‘Completed,’ then it has gone through and all you need to do is accept it.

If the payment status is ‘Pending’ or ‘Unclaimed,’ then there may be an issue with the funding source linked to that particular transaction. For example, if someone tries to send money from their bank account but doesn’t have enough funds available, the transaction will remain in Pending status until those funds become available (which could take a few days). If this happens, there’s nothing really for either party to do except wait until funds clear – once they do, the transaction will automatically go through and no further action will be required from either party.

In some cases, people have reported trying unsuccessfully to send payments through PayPal using credit cards that don’t have enough funds available – even if there’s no problem with using that credit card for regular purchases outside of PayPal. If this happens and a payment remains unclaimed after 7 days, it will automatically be canceled and refunded back to sender by PayPal; at which point hopefully they’ll try again with a different funding source!

There are also some instances in which someone may have tried sending money without having a verified PayPal account themselves – in these cases neither party will see any details about each other besides their email addresses (as opposed being able t view each other’s full name and/or profile picture).

Anúncios

Accept Paypal Payment Without Account

If you’re like most people, you probably use PayPal to send and receive money online. But did you know that you don’t need a PayPal account to accept payments? In fact, all you need is a valid email address.

Here’s how it works:

1. When someone sends you a payment via PayPal, they’ll enter your email address into the recipient field.

2. PayPal will then send you an email notification about the payment.

3. To claim the payment, simply click on the link in the email and follow the instructions. You’ll have the option to create a PayPal account at this point, but it’s not required.

4. Once you’ve claimed the payment, it will be deposited into your chosen bank account or added to your PayPal balance (if you do have an account).

That’s all there is to it! Now you can accept payments from anyone without having a PayPal account of your own.

How Much Can You Receive on Paypal

If you’re like most people, you probably use PayPal to receive money from friends and family or for online shopping. But did you know that there are limits on how much money you can receive through PayPal?

Here’s what you need to know about the PayPal receiving limit:

What is the PayPal receiving limit?

The PayPal receiving limit is the maximum amount of money that you can receive in a single transaction. This limit applies to all transactions, whether they are made through your personal account or your business account.

How much is the PayPal receiving limit?

The exact amount of the PayPal receiving limit varies depending on your account type and verification status. For example, if you have a verified Premier or Business account, your receiving limit will be $10,000.

However, if you have an unverified Personal account, your receiving limit will be only $2,500. To find out what your specific limits are, log into your PayPal account and click on “View Limits” under “Account Settings.”

What happens if I try to receive more money than my limit allows?

If you attempt to receive more money than your account limits allow, PayPal will notify you that there is a problem with the transaction and refund the money back to the sender.

Anúncios

How to Accept Money on Paypal App

If you’re running a business, there’s a good chance you’re using PayPal to accept payments. And if you’re using the PayPal app, there’s an even better chance that you want to know how to accept money on the PayPal app.

Luckily, it’s a pretty simple process.

Here’s how to do it:

1. Open up the PayPal app on your phone or tablet.

2. Tap on the “Send & Request” tab at the bottom of the screen (it looks like a paper airplane).

3. On the next screen, tap on “Request.”

4. Enter the amount of money you want to request and tap on “Next.”

5. On the next screen, select whether you want to request money from someone specific or from anyone who uses PayPal.

If you choose “From anyone who uses PayPal,” they’ll be able to send you money by entering your email address or phone number associated with your PayPal account.

How to Accept Pending Money on Paypal

If you have pending money in your PayPal account, it means that someone has sent you a payment, but the funds are not yet available to spend. When you receive a payment, PayPal will hold the funds for a period of time (usually around 21 days) before releasing them to you. This is to protect both buyers and sellers in case there are any disputes about the transaction.

If you want to access your pending funds sooner, you can do so by completing certain tasks or providing additional information to PayPal. For example, if you link your PayPal account to a bank account or credit card, PayPal will typically release your funds within a few minutes.

To accept pending money on PayPal:

1. Log into your PayPal account and go to the ‘Summary’ page.

2. Under ‘Pending’, find the payment that is being held and click ‘Accept’.

3. You may be asked to provide additional information or confirm your identity in order to complete the acceptance process.

Once you have done so, your pending funds will be released and added to your balance.

Credit: www.youtube.com

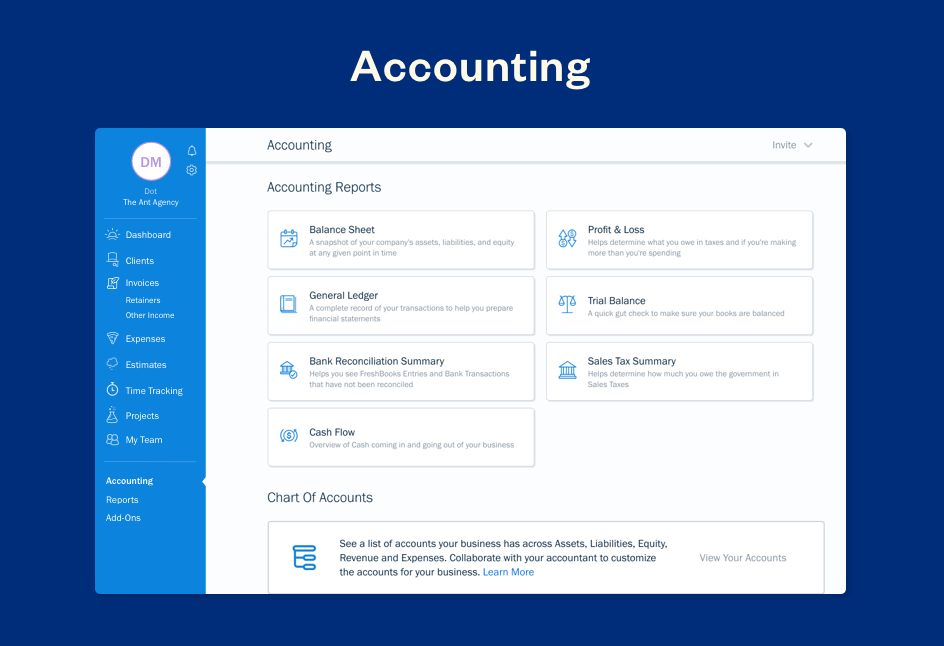

How Do You Pay for Freshbooks?

There are a few different ways that you can pay for FreshBooks. The first way is to pay for your subscription with a credit or debit card. You can also choose to pay for your subscription with PayPal.

If you have an outstanding balance with FreshBooks, you can also choose to pay that off with a credit or debit card, or with PayPal.

Can You Pay People Through Freshbooks?

Yes, you can pay people through FreshBooks. You can either issue a payment directly to your contractor or vendor, or you can set up automatic payments. To issue a payment, go to the ‘Contacts’ tab and select the contractor or vendor you’d like to pay.

Then, click ‘Issue Payment.’ You’ll be able to enter the amount you’re paying and select how you’d like to pay them (e.g., by check, ACH transfer, or PayPal). Once you’ve entered all the relevant information, click ‘Issue Payment’ again to finalize the transaction.

If you’d like to set up automatic payments, go to the ‘Settings’ tab and click on ‘Manage Automatic Payments.’ From there, you can add contractors or vendors who should receive automatic payments and specify how often they should be paid (e.g., weekly or monthly). You can also specify what method of payment should be used (e.g., check, ACH transfer, or PayPal).

How Do I Pay an Invoice Through Paypal?

Assuming you have a PayPal account and the person you are paying has given you their PayPal information (email address or phone number linked to their PayPal account), there are several ways to pay them:

1. If you’re both using the PayPal app, tap “Send & Request” at the bottom of the screen, then tap “Pay.” Enter the amount you want to send, tap “Continue,” review and confirm your payment, then tap “Send Now.”

The funds will be drawn from your linked bank account or credit/debit card.

2. If you’re on a computer, log in to your PayPal account, click “Send & Request” at the top of the page, then click “Pay or complete an invoice.” Enter the email address or phone number of the person you’re paying, enter the amount, then click “Continue.”

Review and confirm your payment, then click “Send Now.” As with sending money through the app, the funds will be drawn from your linked bank account or credit/debit card.

3. If you receive an invoice from someone via email who uses PayPal for invoicing (you’ll know because it says so on the invoice), simply open that email and click onthe “Pay Now” button.

You’ll be taken to a web page where you can review the invoice details and enter your payment information; once everything is correct, click “Submit Payment.” As with other payments made through PayPal, this will come from your linked bank account or credit/debit card.

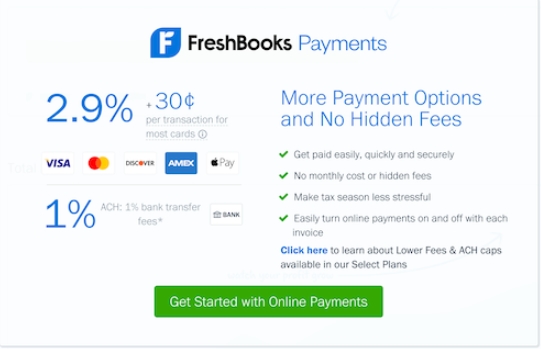

Does Freshbooks Charge Transaction Fees?

If you’re looking for an invoicing and accounting solution that won’t hit you with transaction fees, FreshBooks is a great option. While most online payment processors will charge you a fee for each transaction, FreshBooks doesn’t have any hidden fees like that. You’ll just pay the standard 2.9% + $0.30 per credit card transaction fee when your client pays by card.

Conclusion

If you’re looking for an invoicing and accounting software that integrates with Paypal, you’re in luck. Freshbooks accepts Paypal as a payment method for your clients. This means that you can send invoices and receive payments through Paypal without having to leave the Freshbooks interface.