How to Use Sage Accounting Software

If you’re just starting your business or are already using the Sage accounting software, it’s important to understand how the program works and how you can get the most out of it. It can help you with many different things, including inventory tracking, Payroll, Invoices, and Multicurrency. Using Sage is a great way to get started with accounting and is one of the easiest ways to get your company on track.

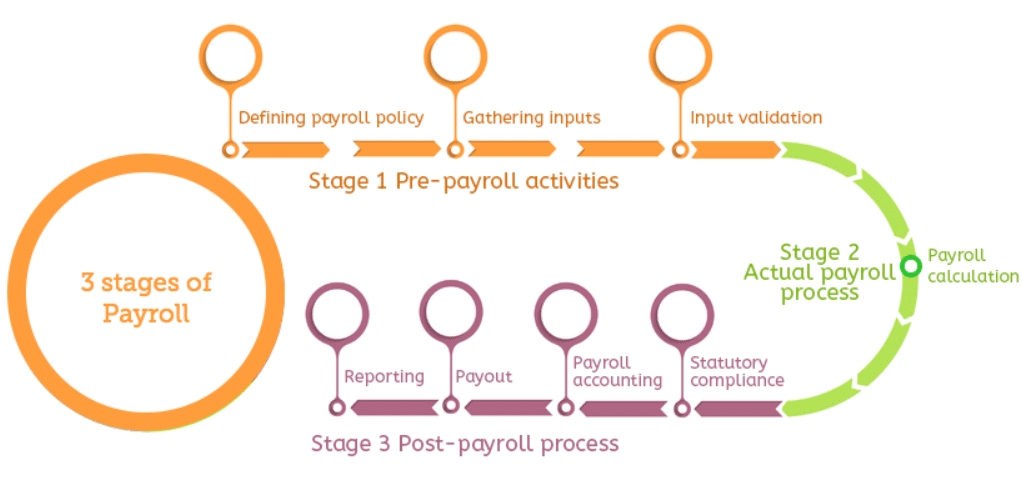

Payroll

If you’re looking for a payroll software solution that can handle your entire year’s payroll, Sage Payroll is a great choice. This cloud-based software helps you manage employees and prepare payslips and pensions. It also includes features to track expenses, reconcile transactions, and track inventory. In addition, it comes with a 40 percent discount on its first year.

This software also lets you manage supplier and customer relationships. You can even trade in multiple currencies and track exchange rate gains and losses. It also lets you log project income and expenses, as well as monitor progress, set up budgets, and track performance. This allows you to track and improve productivity. It’s also easy to manage multiple employees and clients.

Anúncios

Sage accounting software offers a free 30-day trial period. If you’re not sure whether it’s the right solution for your business, check out its features. If you have five or more employees, you can use it for free for three months. The software’s setup wizard will help you link your bank accounts. It also automatically downloads transactions. This streamlines the reconciliation process.

Sage Payroll is an excellent option for small and medium-sized businesses. Many users love the ease of use, and the reporting capabilities that it offers. Plus, it’s cloud-based, so you can access it from anywhere. It also integrates with other business systems and can be used in conjunction with them.

Anúncios

Invoices

Invoicing in Sage accounting software is made simple by enabling you to send PDF invoices. PDFs are widely accepted and can be viewed across many devices. Invoices can be easily exported to PDF from Sage 50 using the built-in feature. Simply double-click on an invoice to open it as a PDF file, and it will be automatically sent to your email account.

PDF invoices also eliminate the need to print invoices. You can send PDF invoices to your customers online instead of printing them, and you can even convert quotations into invoices with Sage accounting software. With Sage, you can also easily track invoice activity and customize your invoice with the colors, font, and logo you choose.

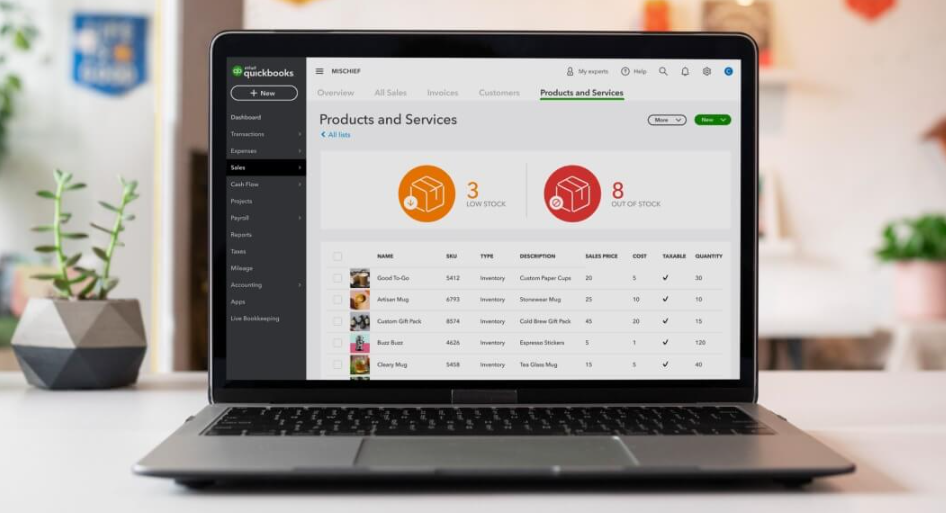

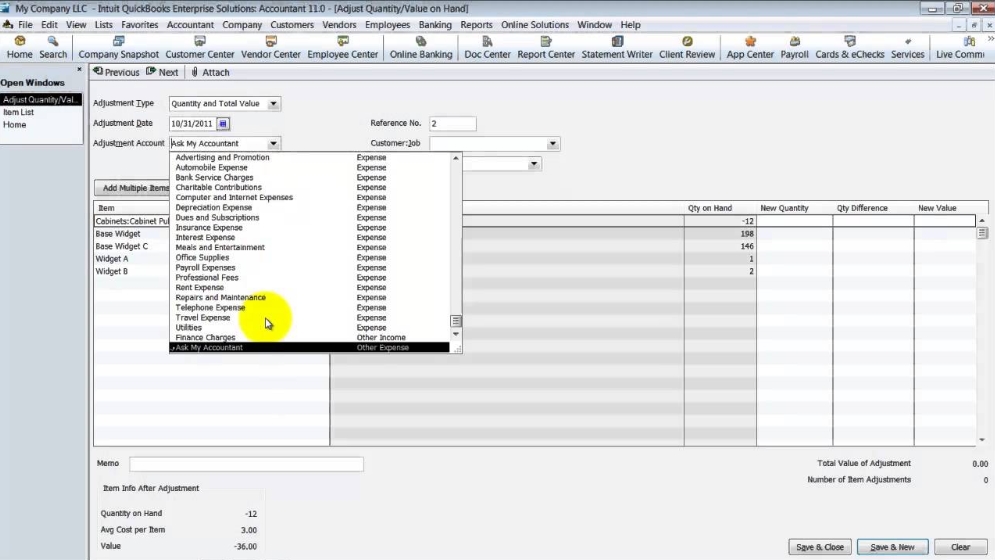

Another benefit of using Sage accounting software is its ability to manage your inventory. It recognizes two types of inventory: product and service. It allows you to input an item’s unique number, name, category, and price. You can also set minimum reorder levels and get alerts when a product is out of stock.

Sage accounting software has a long history and is continually improving its features. The software offers a range of cloud-based features and is ideal for small businesses. You can access all of your financial information at any time, anywhere you have an internet connection. The software also helps you track payments and send follow-up messages to get paid faster.

Inventory tracking

Sage accounting software includes inventory tracking features that allow you to manage your business’s inventory. You can enter products into the software, organize them into categories, and customize prices. It can also track the quantities of each item, automatically reorder them when they run out, and generate reports on your best selling products.

The main difference between Sage and QuickBooks is that Sage offers a free 30-day trial, and the software requires no credit card information to download. QuickBooks, on the other hand, requires a credit card for the free trial, and will start charging after 30 days. However, there are some alternatives to QuickBooks that will fit your budget.

Sage One Inventory lets you keep track of stocks and make easy inventory adjustments. You can also make inventory adjustments for lost, damaged, or stolen items. In addition, you can record the date that the adjustment was made. Sage One inventory software includes inventory tracking that keeps track of stock levels in real-time.

Another feature of Sage accounting software is its ability to import data from spreadsheets. You can also link bank accounts to the software and download transactions automatically. This eliminates the need to print invoices. It also offers customization options for invoices. You can customize fonts, colors, and even a logo.

Multicurrency

Multicurrency accounting is essential for any business with an international presence. Sage accounting software lets you set up and manage multiple currencies at the same time. It enables you to monitor cash flow and exchange rates. It can also help you reconcile foreign currency transactions. This feature is a great option for businesses that deal with multiple currencies and frequently transact with foreign suppliers.

If you’re looking to automate the process of entering multiple currencies into your accounting software, you may want to consider Sage Pastel Partner’s Multi-Currency add-on module. It can support up to 30 different currencies. It also lets you define the currency of each customer, supplier, and bank account. It also supports European Union-compliant processing.

Multi-currency accounting software also includes built-in exchange rate calculators that remove the need to manually input values. This helps maintain consistency of bookkeeping across multiple ledgers and reduces human errors. Many multi-currency accounting software packages also allow you to select from a number of automated exchange rate tools to make the process even easier.

The multi-currency option in Sage Intacct enables you to manage multiple entities from one login. You can view the financial performance of different entities by selecting the currency and language of reporting. You can also customize account titles to conform to local regulations. Furthermore, you can easily toggle between regional and consolidated views. You can access data from wherever you are with the help of your internet connection.

Integration with third-party apps

The accounts receivable and payable functions of Sage accounting software make it easy to manage your company’s cash flow and keep your books organized. This program automatically generates reports that detail the amounts you owe suppliers and customers, as well as sales invoices and pending payments. It also allows you to set up and manage the credit limits for each supplier.

Sage can import data from other applications. It supports data from local files, web URLs, cloud drives, and databases. You can also share workspaces, reports, dashboards, and tables. You can also share reports and tables with filters. Those integrations can be set up by an administrator, so only authorized users can access them.

Sage accounting software also lets you enter invoices, purchase orders, and vendor credits. It also allows you to generate sales tax reports, profit and loss reports, and cash flow projections. Inventory management is also an integral part of Sage. It helps you organize your inventory and categorize products, as well as customize pricing for regular and recurring orders.

Using Sage 50cloud Accounting is a great choice for companies that need inventory tracking, advanced accounting features, and data capacity. This software can also allow you to integrate third-party apps with ease. It also supports online payments and a robust inventory module.

Pricing

Sage accounting software pricing depends on a number of factors. While the software is designed to be user-friendly, it’s also very customizable. You can change prices globally or round up or down to a specific amount. It also lets you track your business expenses and track credit card transactions. Moreover, you can create recurring invoices and void charges. You can also customize your invoices using one of the four pre-built invoice templates.

The cost of Sage 50cloud depends on the number of users and the number of modules that you need. However, it ranges from $15,000 to $35,000 per year. You can also ask for a trial version before purchasing the software to get an idea of the software’s features. In addition, you can choose a monthly or yearly payment plan.

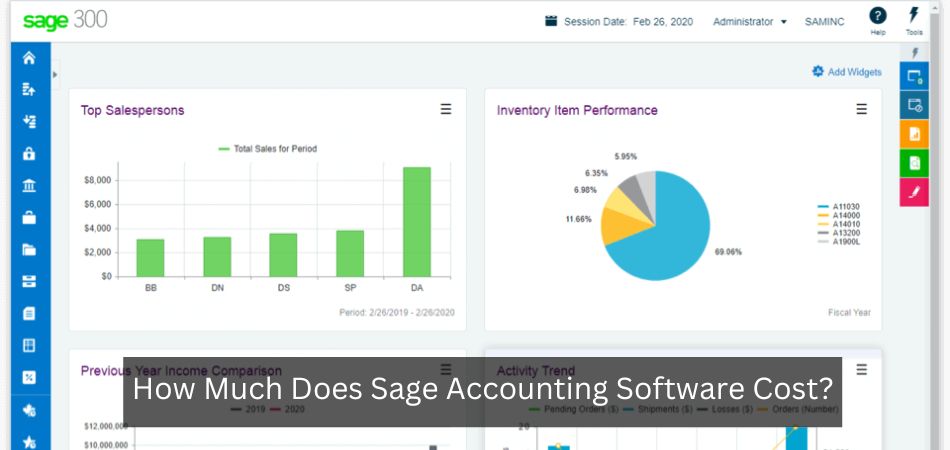

Sage divides its products into Finance, People Management, and Business Management. The Finance segment includes the Intacct program, which automates core financial functions. It also helps businesses create dashboards and reports. The software also offers a variety of add-on modules that help businesses with specific aspects of their businesses. However, the website doesn’t list all available features. If you want unlimited users, you should go for the Business Cloud plan.

In terms of cost, Sage Business Cloud is the mid-tier accounting software and is easy to use for non-professionals. Its pricing plan costs $25 per user per month, which is lower than many other accounting software programs. In addition, you can try Sage Business Cloud for free for 30 days. There are similar free alternatives, such as Wave, but if you want a more advanced tool, you should choose QuickBooks or Xero.