Does Freshbooks Do Payroll?

In short, yes. Freshbooks can do payroll for your small business. Here’s how it works: you enter your employees’ hours into the Freshbooks system, and then at the end of each pay period, Freshbooks calculates each employee’s wages and prepares their paycheck accordingly.

You can then print out or electronically distribute the paychecks to your employees – all from within the Freshbooks interface.

How to Set Up Payroll: Everything You Need to Know

There are a lot of accounting software programs out there, and each one has its own strengths and weaknesses. So, does Freshbooks do payroll?

The answer is yes…and no.

Freshbooks can do some of the basics when it comes to payroll, but it’s not a dedicated payroll program like ADP or Paychex. If you’re looking for something that will handle all of your payroll needs, Freshbooks probably isn’t the right fit.

However, if you just need a program that can handle the basics (like calculating taxes and issuing paychecks), then Freshbooks might be worth considering.

It’s relatively inexpensive, easy to use, and integrates well with other popular business programs (like QuickBooks).

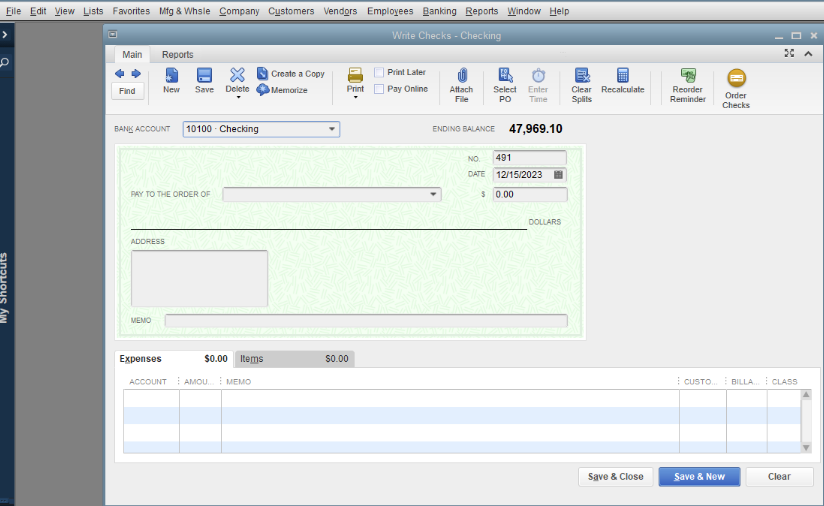

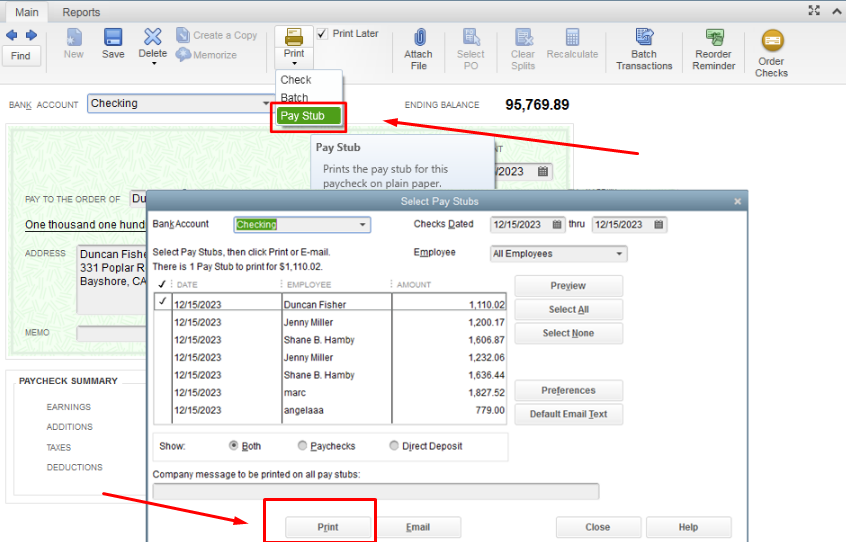

Does Quickbooks Do Payroll

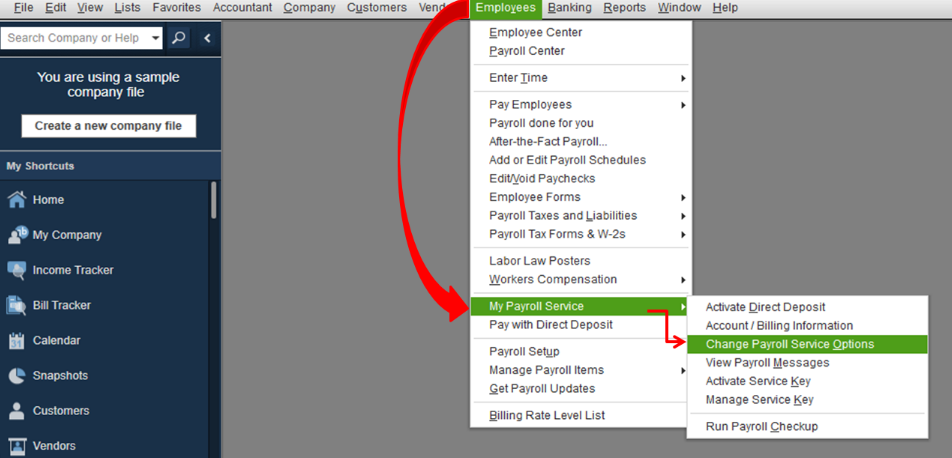

QuickBooks can do payroll, but there are some things to know before using the software for this purpose. First, QuickBooks is designed for small businesses and may not have all of the features that a larger business needs for payroll. Second, QuickBooks can be used for direct deposit, but there is a fee for this service.

Third, QuickBooks will calculate taxes automatically, but you will need to file and pay them yourself. Finally, QuickBooks offers a free trial period for payroll services, but you will need to sign up for a paid subscription after the trial period ends.

Anúncios

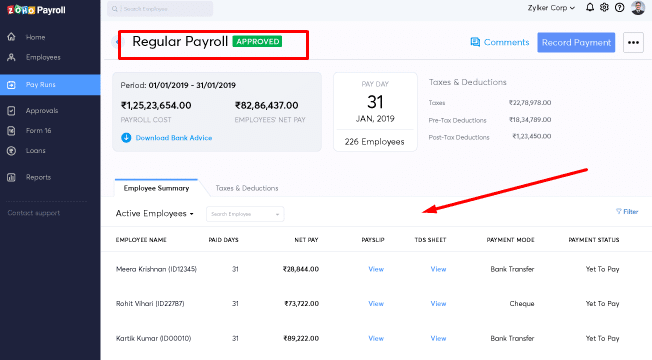

Gusto Payroll

Gusto is a cloud-based payroll and benefits platform that offers a modern, intuitive interface for managing employee compensation. Gusto makes it easy to run payroll, calculate taxes, and process payments. The platform also provides tools for tracking time off and managing employee onboarding and performance.

Payroll Software for Small Business

If you own a small business, you know that keeping track of employee hours and managing payroll can be a daunting task. There are many payroll software options on the market, but which one is right for your business?

To make the decision easier, we’ve put together a list of the best payroll software for small businesses in 2020.

These programs are all user-friendly and offer a variety of features to help you manage your employees’ hours and pay.

1. Gusto

Gusto is one of the most popular payroll software options for small businesses.

It offers a simple interface that makes it easy to input employee data and run payroll calculations. Additionally, Gusto integrates with many popular accounting software programs, so you can keep all of your financial information in one place.

2. Patriot Software

Patriot Software is another great option for small businesses looking for payroll software. It offers both online and desktop versions, so you can use it regardless of where you do your work. Patriot Software also has robust reporting capabilities, so you can easily track your employees’ hours and pay information.

3. Paychex Flex

Paychex Flex is a cloud-based payroll solution that offers flexibility and scalability for small businesses. With Paychex Flex, you can run payroll from anywhere using any device with an internet connection.

Additionally, Paychex Flex offers built-in time tracking capabilities, so you can easily keep track of employee hours worked.

Anúncios

Payroll Software

When it comes to running a business, there are a lot of moving parts. And one of the most important pieces is payroll. Without accurate and timely payroll, your employees won’t be paid properly – which can lead to a whole host of problems.

That’s why it’s so important to have good payroll software in place. But with so many options on the market, how do you choose the right one for your business?

Here are some things to look for in a good payroll software:

1. Ease of use: You don’t want something that’s going to be complicated and difficult to use. Look for something that’s user-friendly and easy to navigate.

2. Accuracy: This is obviously extremely important.

You need to be able to trust that your payroll software will calculate everything correctly. Otherwise, you could end up overpaying or underpaying your employees – which could get you into hot water.

3. Timeliness: Payroll needs to be processed on time, every time.

Look for a system that can handle your pay frequency (weekly, bi-weekly, etc.) and will always generate payments on time.

4. Customer support: When something goes wrong with your payroll (and it will at some point), you need to be able to reach someone who can help you fix the problem quickly. Make sure the software company you choose offers excellent customer support .

Quickbooks Payroll

QuickBooks Payroll is a cloud-based payroll service that helps businesses manage their payroll processes. It offers a variety of features, including the ability to create and manage employee profiles, calculate payroll taxes, and generate pay stubs and W-2 forms. QuickBooks Payroll also offers direct deposit capabilities and integrates with other QuickBooks products, making it a convenient solution for businesses that use QuickBooks for accounting purposes.

Credit: ffnews.com

Does Quickbooks Have Payroll?

Yes, QuickBooks has payroll. You can use it to pay your employees and contractors, as well as to file and pay your taxes. QuickBooks will also help you keep track of your employees’ hours and vacation time.

What is the Best Program to Use for Payroll?

There are a number of payroll software programs available on the market, each with its own strengths and weaknesses. In order to choose the best payroll program for your business, you’ll need to consider your specific needs and budget.

One popular payroll program is ADP Payroll.

This program offers a variety of features, including online access for employees, direct deposit, and tax filing. It’s also relatively affordable, with pricing starting at $10 per month for up to 10 employees.

Another option is QuickBooks Payroll.

This program is designed specifically for businesses that use QuickBooks accounting software. It integrates seamlessly with QuickBooks and offers many of the same features as ADP Payroll. Pricing starts at $25 per month for up to 10 employees.

If you’re looking for a free payroll solution, Gusto may be a good option. This program includes most of the basic features you’ll need, such as direct deposit and tax filing. However, it doesn’t offer some of the more advanced features found in other programs (such as online employee access).

What is the Cheapest Way to Run Payroll?

If you’re a small business owner, you may be wondering what the cheapest way to run payroll is. After all, payroll can be one of the most expensive aspects of running a business.

The good news is that there are a number of ways to cut down on the costs of payroll.

Let’s take a look at some of the best options:

1. Outsource Your Payroll

One of the best ways to save money on payroll is to outsource it to a third-party provider.

There are a number of companies that specialize in providing affordable payroll services to small businesses. By outsourcing your payroll, you can avoid having to hire in-house staff or purchase expensive software.

2. Use an Online Payroll Service

Another great option for saving money on payroll is to use an online payroll service. These services are typically much cheaper than traditional methods, and they offer a range of features and benefits that can help you save time and money. Many online payroll services also offer free trial periods, so you can try them out before committing to anything long-term.

3. Do It Yourself with Software

If you’re comfortable with technology, another option is to do your own payroll using software such as QuickBooks or FreshBooks . This can be a great way to save money, but it’s important to make sure that you have the time and knowledge necessary to set up and maintain your system correctly.

Otherwise, you could end up spending more time and money fixing mistakes than if you had outsourced your payroll in the first place!

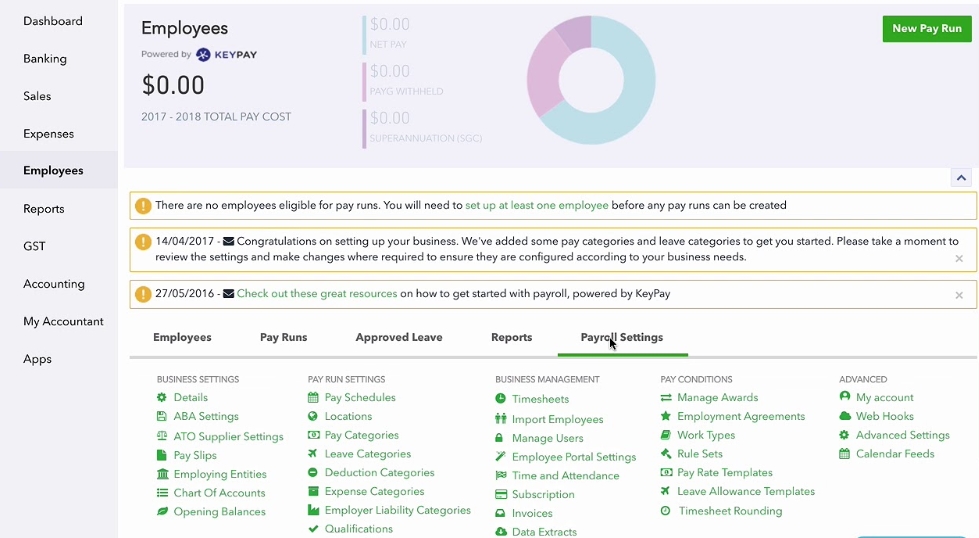

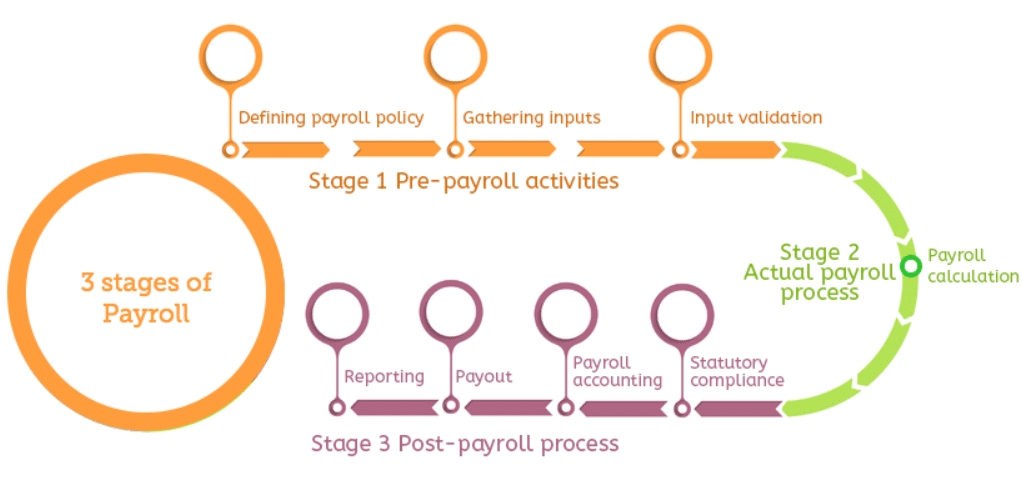

How Do I Set Up Payroll for My Small Business?

If you have a small business, you may be wondering how to set up payroll. Payroll can be a complex and confusing process, but it doesn’t have to be. With a little research and planning, you can set up payroll for your small business quickly and easily.

The first step is to choose a payroll service. There are many different payroll services available, so it’s important to do some research to find the one that’s right for your business. Once you’ve selected a payroll service, you’ll need to provide them with some basic information about your employees, such as their names, addresses, Social Security numbers, and dates of birth.

You’ll also need to let the payroll service know how often you want to run payroll (weekly, bi-weekly, etc.) and how much you want to pay your employees (hourly rate or salary).

Once you’ve provided the necessary information to the payroll service, they will take care of the rest. They will withhold taxes from each employee’s paycheck and send the money to the appropriate government agencies.

They will also prepare and file any required tax forms on your behalf. All you need to do is deposit each employee’s paycheck into their bank account or give them cash if they prefer.

Conclusion

Freshbooks is an online accounting software that small businesses and freelancers can use to invoice clients, track expenses, and manage their finances. The software includes a payroll feature that allows users to pay their employees and contractors electronically. Freshbooks offers a free trial of their payroll service so users can try it out before committing to a paid subscription.