How to Adjust Inventory in Quickbooks Pos?

If you’ve been using Quickbooks Pos for a while, you may have noticed that your inventory levels aren’t always accurate. This is because the program doesn’t automatically adjust for items that are returned or damaged. You can manually adjust your inventory levels in Quickbooks Pos, but it’s important to do this carefully so that your books remain accurate.

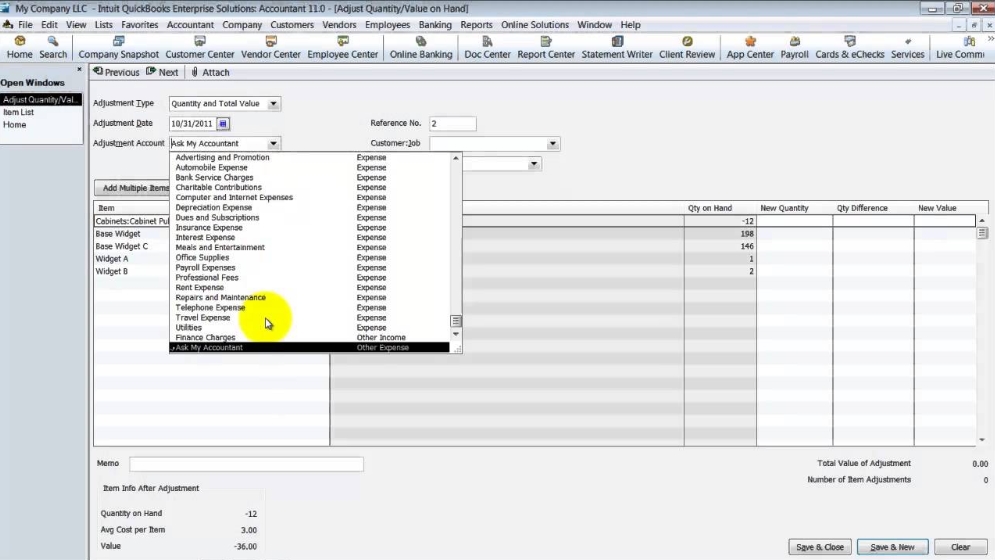

How To Adjust Inventory Value And Inventory Quantity In QuickBooks Desktop

- To adjust inventory in Quickbooks POS, first open the software and log in with your username and password

- Click on the “Inventory” tab at the top of the screen, then click on “Adjust Inventory

- Select the items that you want to adjust, then enter the new quantities in the appropriate fields

- Click on the “Save” button to save your changes

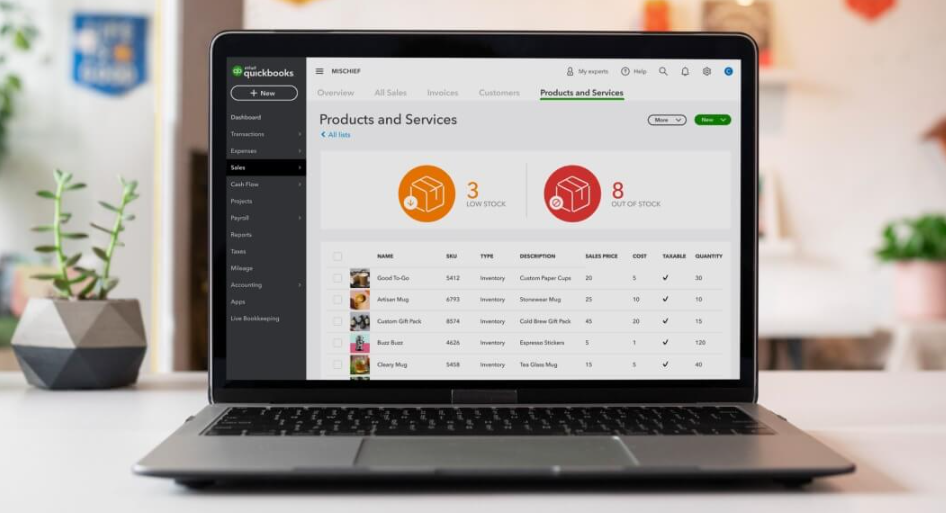

How to Adjust Quantity on Hand in Quickbooks Online

It’s a common scenario: you’re keeping track of your inventory in Quickbooks Online, but realize that the quantity on hand (QOH) is off. Maybe you forgot to account for a recent shipment, or perhaps there was some damage to stock that you didn’t realize at the time. Whatever the reason, it’s important to keep your QOH accurate in QuickBooks so that your financial records are up-to-date.

Here’s how to adjust the QOH for an item in QuickBooks Online:

1. Go to the Gear icon > Products and Services.

2. Find the item whose QOH needs to be updated and click Edit.

3. In the Inventory section, change the QOH field to reflect the correct amount.

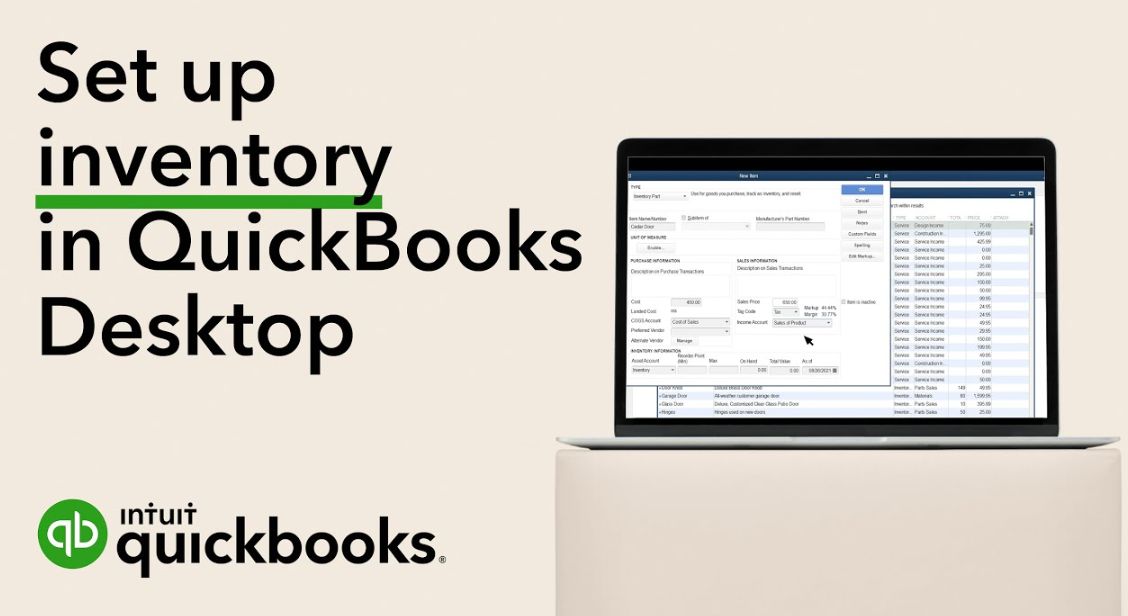

How to Adjust Inventory in Quickbooks Desktop

If you’re a small business owner, chances are you’ve had to deal with inventory at some point. And if you use QuickBooks Desktop, you know that there’s a special feature for tracking your inventory levels. But what happens when your inventory changes?

How do you adjust it in Quickbooks?

Here’s a step-by-step guide on how to adjust inventory in Quickbooks Desktop:

1. Go to the “Lists” menu and click on “Item List”.

2. Find the item whose inventory level you need to adjust and double-click on it.

3. In the “Quantity on Hand” field, enter the new quantity.

4. Click “OK” to save your changes.

Anúncios

Inventory Adjustment Journal Entry

An inventory adjustment journal entry is a type of accounting journal entry that is used to correct errors in a company’s inventory records. This type of journal entry is typically used when there is a discrepancy between the physical count of inventory and the recorded amount in the company’s books.

Inventory adjustments can be caused by many different factors, such as theft, damage, spoilage, or simply inaccurate counting.

Whatever the cause, it is important to make sure that your company’s inventory records are accurate so that you can make sound business decisions.

When making an inventory adjustment journal entry, you will need to debit the account that contains the overstated value and credit the account that contains the understated value. For example, if your physical count showed that you had 10 widgets in stock but your records showed that you had 12 widgets in stock, you would need to debit Inventory and credit Accounts Receivable for two widgets.

The amount of each inventory item may need to be adjusted up or down depending on the results of the physical count. If multiple items need to be adjusted, it is best to create a separate journal entry for each item so that your records remain organized and easy to understand.

Inventory Adjustment Example

An inventory adjustment is a physical count of your inventory that is conducted to reconcile the quantities on hand with what’s actually in stock. This can be done for a number of reasons, such as to correct errors, update records after items have been added or removed from inventory, or to account for spoilage.

Inventory adjustments are an important part of maintaining accurate records and keeping your business running smoothly.

By conducting periodic counts, you can catch errors early and prevent them from snowballing into bigger problems down the road.

There are a few different methods that can be used to adjust inventory. The most common method is simply counting all of the items in stock and comparing this number to the quantity on hand in your records.

If there is a discrepancy, you will need to investigate where the error occurred and make corrections accordingly.

Another method is known as sampling. With this approach, you would select a certain percentage of items at random and count those.

This can be especially helpful if you have a large inventory and counting everything would be too time-consuming. You can then extrapolate from the sample data to arrive at an estimate for the total number of units in stock.

No matter which method you use, it’s important to document everything carefully so that you can reference it later if needed.

Make sure to note the date of the count, who conducted it, how many items were counted, and any other relevant details. This will help ensure that your inventory adjustments are reliable and accurate.

Anúncios

What Adjustment Account for Inventory Adjustments

If you are a business owner, it is important to be aware of the different types of inventory adjustments that can occur. These adjustments can have a significant impact on your business, so it is important to understand what they are and how to account for them.

One type of inventory adjustment is known as an allowance for damaged goods.

This occurs when some of your merchandise is damaged or destroyed and you need to write it off as a loss. In order to account for this, you will need to create an allowance account on your books. This account will track the value of the damaged goods and help you determine how much you need to write off each month.

Another type of inventory adjustment is known as an obsolescence reserve. This occurs when some of your products become obsolete and are no longer sellable. In order to account for this, you will need to create an obsolescence reserve on your books.

This account will track the value of the obsolete products and help you determine how much you need to write off each month.

Both allowance for damaged goods and obsolescence reserve are important accounts to have on your books. They can help you keep track of losses due to damage or obsolescence and make sure that these losses are accounted for properly.

Credit: www.usingpos.com

What is Pos Inventory Adjustment?

POS inventory adjustment is the process of making changes to the inventory records in a POS system to ensure that they accurately reflect the current state of affairs. This can involve adding or removing items, changing prices, and so on. It is important to keep POS inventory records up-to-date, as they are used to track sales and stock levels.

How Do You Do an Inventory Adjustment?

Inventory adjustments are a necessary part of managing inventory levels. They allow businesses to account for discrepancies between the physical count and the book count of inventory items. Adjustments can be made for a variety of reasons, including damaged or lost items, theft, inaccurate counts, and price changes.

The first step in doing an inventory adjustment is to identify the reason for the discrepancy. Once the reason is known, the appropriate action can be taken to correct the problem. If items are damaged or lost, they should be removed from the inventory records.

If theft is suspected, an investigation should be conducted and proper documentation filed. Inaccurate counts can often be corrected by simply taking a new count of the affected items. Price changes should also be documented and reflected in the updated records.

Once all of the relevant information has been gathered, it is time to make the actual adjustment to the inventory records. This is typically done by entering a negative quantity for items that have been removed from stock (damaged, lost, stolen) and/or entering a positive quantity for items that have been added to stock (new arrivals, price changes). The final step is to update any reports or systems that useinventory data so that they reflectthe accurate quantities on hand.

Why Would You Adjust Inventory in Quickbooks?

If you’re a business owner, then you know that one of the most important aspects of running your business is keeping track of your inventory. After all, if you don’t have enough inventory on hand, then you can’t sell your products and make a profit. And if you have too much inventory, then you’re tying up valuable resources that could be used elsewhere in your business.

That’s why it’s so important to keep an accurate count of your inventory levels at all times.

There are a number of different ways to do this, but one of the most popular methods is to use QuickBooks. QuickBooks is accounting software that helps businesses keep track of their finances, and it also has a handy feature for tracking inventory levels.

In this blog post, we’ll show you how to adjust inventory in QuickBooks so that you can always be sure that your numbers are accurate.

One reason why you might need to adjust your inventory in QuickBooks is if you receive a shipment of goods that is different from what was expected. Perhaps you ordered 100 widgets but only received 50.

Or maybe you ordered 10 cases of beer but received 12 instead. Whatever the case may be, if the quantity or quality of goods received does not match what was expected, then you will need to update your records accordingly.

Another reason why you might need to adjust your inventory in QuickBooks is if some of your products go bad before they can be sold.

This happens occasionally with perishable items like food or flowers. If you find that some of your merchandise has gone bad and needs to be thrown out, then again, you will need to update your records accordingly so that your books remain accurate.

Making adjustments to yourinventory in QuickBooks is actually quite simple onceyou know whereto look .

First , log intoyour Quickbooks accountand click on the “Inventory” tab at the topof the screen . Then , findthe item oritemsin question and click on themto open up their information page . Onthis page , locate the “Qtyon Hand ” field and enterthenew numberthat reflectsthe current quantityof goods on hand .

Be sureto hit save whenyou ‘ re finishedsoyour changeswill take effect!

How Do I Fix Inventory Problems in Quickbooks?

If you’re having problems with your inventory in QuickBooks, there are a few things you can do to try and fix the issue. First, make sure that all of your inventory items are set up correctly. This includes making sure that each item has the correct name, description, price, and account assignment.

You can also check to see if any of your inventory items have been damaged or destroyed, and if so, update the information in QuickBooks accordingly.

Next, take a look at your inventory reports to see if there are any discrepancies. If you find any errors, make the necessary corrections in QuickBooks.

You should also run a physical count of your inventory to compare against what’s on hand in QuickBooks. If there are differences between the two counts, adjust your records accordingly.

Finally, keep an eye on your inventory levels going forward and track any changes carefully.

By staying on top of your inventory situation, you can avoid future problems and keep your business running smoothly.

Conclusion

If you use Quickbooks for your POS system, you may need to adjust your inventory from time to time. Here’s how to do it:

1. Go to the “Lists” menu and select “Item List.”

2. Find the item you want to adjust and double-click it.

3. Click the “Inventory” tab at the top of the window.

4. Enter the new quantity in the “Quantity on Hand” field.

5. If you want, you can also enter a reason for the adjustment in the “Reason for Adjustment” field.