How to Switch From Accrual to Cash Basis in Quickbooks?

The accrual basis of accounting recognizes revenue when it is earned and expenses when they are incurred. The cash basis of accounting recognizes revenue when cash is received and expenses when they are paid. If you use accrual basis accounting, you may want to switch to cash basis accounting, or vice versa.

Here’s how to switch from accrual to cash basis in Quickbooks.

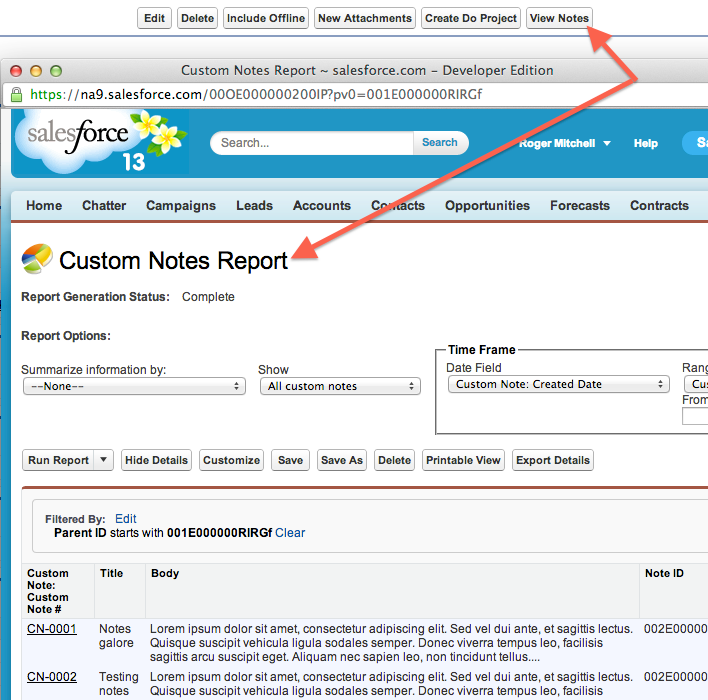

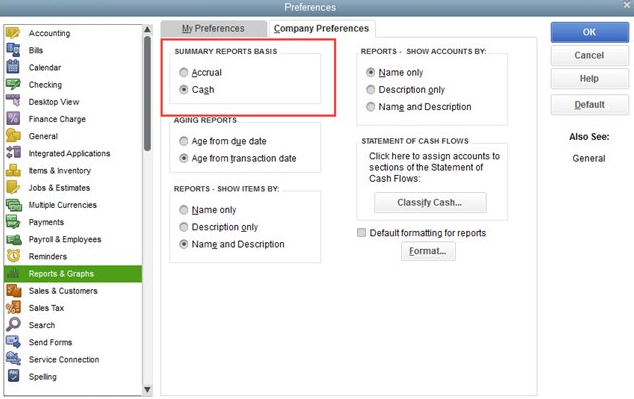

- Go to the Company menu and select Company Preferences

- In the Accounting Method section, select Cash Basis from the drop-down menu

- Click Save & Close

QuickBooks Now! Switch From Accrual to Cash Basis Report You Tube

How Do You Convert from Accrual to Cash Basis?

The accrual basis of accounting recognizes revenue when it is earned and records expenses when they are incurred, regardless of when cash is actually received or paid. The cash basis of accounting, on the other hand, only records transactions when cash changes hands. So, if you’re switching from accrual to cash basis accounting, you’ll need to make some adjustments to your books.

Here’s how to convert from accrual to cash basis:

1. Determine the point in time when you want to switch from accrual to cash basis. This could be at the beginning of your fiscal year, or it could be at some other point (e.g., when your business reaches a certain size).

Once you’ve decided on a date, make sure all future transactions are recorded on a cash basis.

2. Go through your past transactions and adjust them so that they comply with the new method. For example, if you had previously recognized revenue for a project that wasn’t completed until after the switch date, you would need to reverse that entry and wait until the project is finished before recording the revenue again (on a cash basis).

Similarly, if there were expenses incurred before the switch date but not paid until after, those would need to be adjusted as well.

3. Make sure your financial statements reflect the change in accounting method by clearly labeling them as “accrual” or “cash” for clarity purposes. Going forward, use whichever method is most appropriate for your business needs – there’s no requirement that businesses must use one over the other (although accrual is generally more common).

How Do I Change the Accounting Method in Quickbooks?

If you need to change your accounting method in QuickBooks, there are a few things you need to do. First, you need to make sure that all of your transactions are entered into QuickBooks using the new accounting method. This means going back and entering any transactions that have already been processed using the old accounting method.

Once all of your transactions are entered into QuickBooks using the new accounting method, you can then change the default accounting method in QuickBooks. To do this, go to Preferences > Accounting Method. From here, you can select the new accounting method you want to use.

Anúncios

Is Quickbooks a Cash Or Accrual Basis?

QuickBooks is an accrual basis accounting software. This means that transactions are recorded when they occur, regardless of when the money is actually exchanged. For example, if you sell a product on credit, you would record the sale as soon as the product is shipped, rather than when the customer pays you.

How Do I Change to Accrual in Quickbooks?

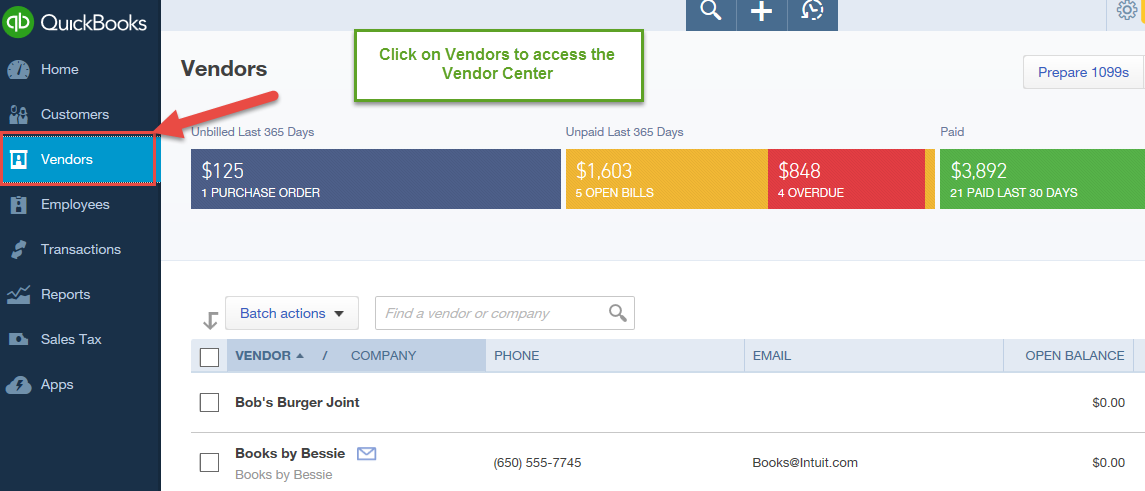

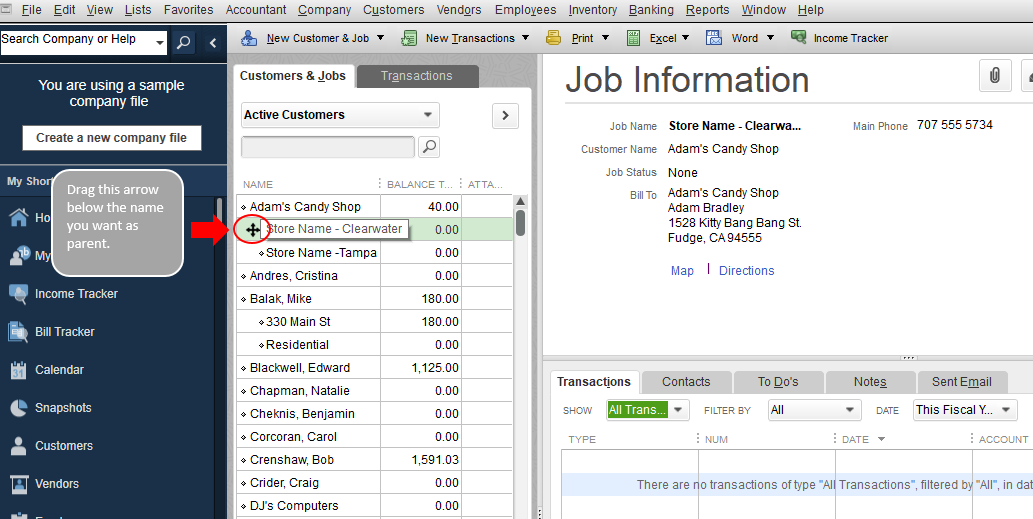

If you’re using the QuickBooks desktop software, there are a few steps you’ll need to follow in order to change your accounting method from cash basis to accrual. First, you’ll need to create an account for each inventory item that you carry in your QuickBooks file. To do this, go to the Lists menu and click on Item List.

Then, click the Item button at the bottom of the screen and choose New from the drop-down menu. In the Type field, select Inventory Part and fill out the rest of the information for your item. Once you’ve created an account for each inventory item, you can begin changing your sales transactions from cash basis to accrual.

To do this, go to the Customers menu and click on Create Invoices. Enter all of the information for your invoice as usual, but be sure to include any inventory items that were sold on the invoice. When you’re finished entering all of the information for your invoice, click Save & Close.

This will save your invoice as a draft so that you can come back and make changes if necessary.

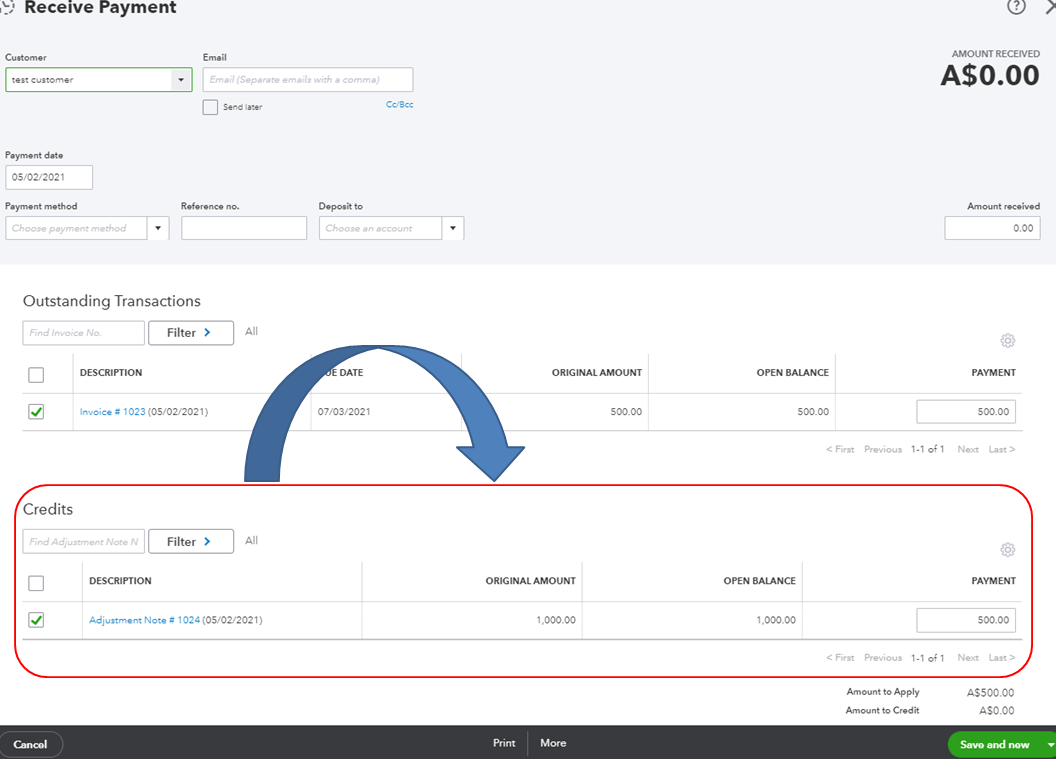

Once you’re ready to finalize your invoice, go back to the Customers menu and click on Receive Payments. Enter all of payments received against outstanding invoices – including any payments received for invoices that were created using accrual basis accounting.

Be sure to apply each payment correctly so that QuickBooks can keep track of which invoices have been paid in full and which ones are still outstanding.

Anúncios

Credit: www.wizxpert.com

How to Change from Accrual to Cash Basis in Quickbooks Online

If you’re using QuickBooks Online, you can easily change from accrual to cash basis accounting. Here’s how:

1. Go to the Settings menu and select Accounts and Settings.

2. Under the Company tab, select Advanced.

3. Scroll down to the Accounting section and click on the pencil icon next to Accounting Method.

4. Select Cash Basis from the drop-down menu and click Save.

How to Do Accrual Accounting in Quickbooks

If you’re a small business owner, then you know that QuickBooks is one of the most popular accounting software programs available. And while QuickBooks is fairly easy to use, there are still some concepts that can be confusing – like accrual accounting.

So what is accrual accounting?

In short, it’s an accounting method that recognizes revenue and expenses when they occur, regardless of when the actual cash is exchanged.

This may sound complicated, but it’s actually not too difficult to do in QuickBooks. Here’s a step-by-step guide:

1) Set up your chart of accounts. When you first set up QuickBooks, you’ll need to create a chart of accounts. This will include all of the different types of income and expenses that your business has.

Make sure to include separate accounts for each type of revenue and expense.

2) Track your invoices and bills. Whenever you create an invoice or bill customers/clients, make sure to track them in QuickBooks.

You can either do this manually or set up automatic tracking so that all invoices and bills are automatically entered into QuickBooks as they’re created.

3) Enter your transactions into the correct account categories. When you record transactions in QuickBooks (either manually or automatically), make sure to categorize them correctly according to your chart of accounts.

This will ensure that your financial reports are accurate.

4) Generate financial reports periodically. Accrual accounting requires that you generate periodic financial reports (usually monthly or quarterly).

These reports will show you how much revenue and profit your business has generated during the period, as well as any expenses incurred during the period.

How Do I Default to Cash Basis in Quickbooks Desktop?

The cash basis is the most commonly used accounting method for small businesses. Under this method, revenue and expenses are recognized when cash is received or paid out. This makes it easy to track your income and expenses, and helps to keep your books simple.

If you’re using Quickbooks Desktop, you can easily switch to the cash basis by following these steps:

1. Go to the Company menu and select Company Settings.

2. Click on the Accounting tab.

3. In the Accounting Method section, select Cash Basis from the drop-down menu.

4. Click Save & Close.

Conclusion

If you’re using the accrual basis of accounting, you can switch to the cash basis in Quickbooks. Here’s how:

1. Go to Company Settings and select Accounting.

2. Under How do you want to track payments?, select Cash Basis from the drop-down menu.

3. Click Save and then Done.

That’s it! You’ve now switched from accrual to cash basis accounting in Quickbooks.