Does Quickbooks Charge for Bank Transfers?

Quickbooks is a powerful accounting software that helps small businesses keep track of their finances. One of the features of Quickbooks is the ability to connect to your bank account and download transactions. This can be a great time saver, but it does come with a price.

Quickbooks charges a fee for each bank transfer that you make. The fee is typically around $0.50 per transaction, but it can vary depending on the bank and the amount of money being transferred.

There are a lot of different accounting software programs out there, and QuickBooks is one of the most popular. But does QuickBooks charge for bank transfers?

The answer is yes and no.

If you are using QuickBooks Online, there is no fee for bank transfers. However, if you are using QuickBooks Desktop, there is a $0.50 fee per transfer.

This fee can add up if you are making a lot of transfers, but it is still relatively inexpensive compared to other accounting software programs.

And if you need to make a lot of transfers, QuickBooks Desktop may be the better option anyway since it can handle more transactions than QuickBooks Online.

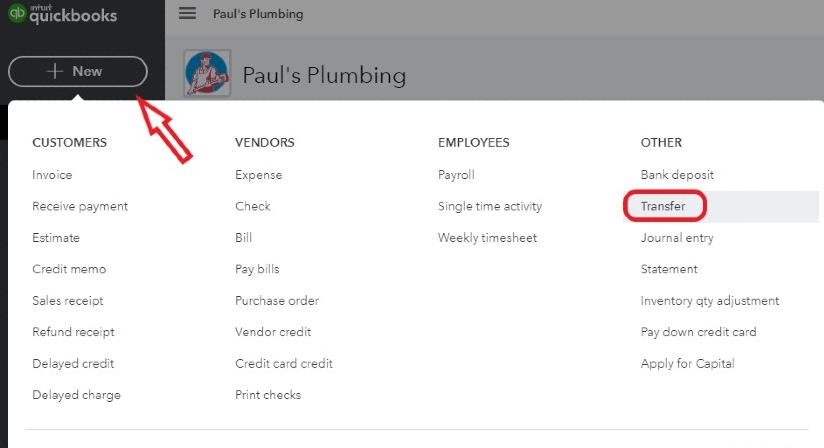

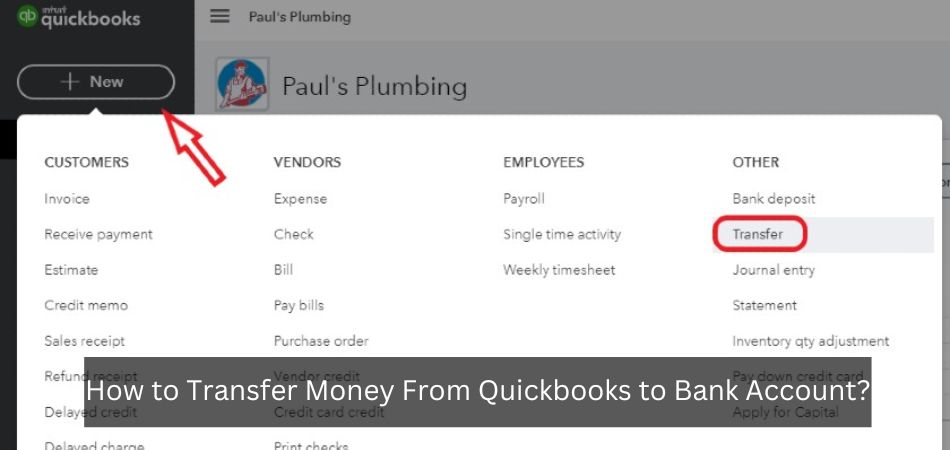

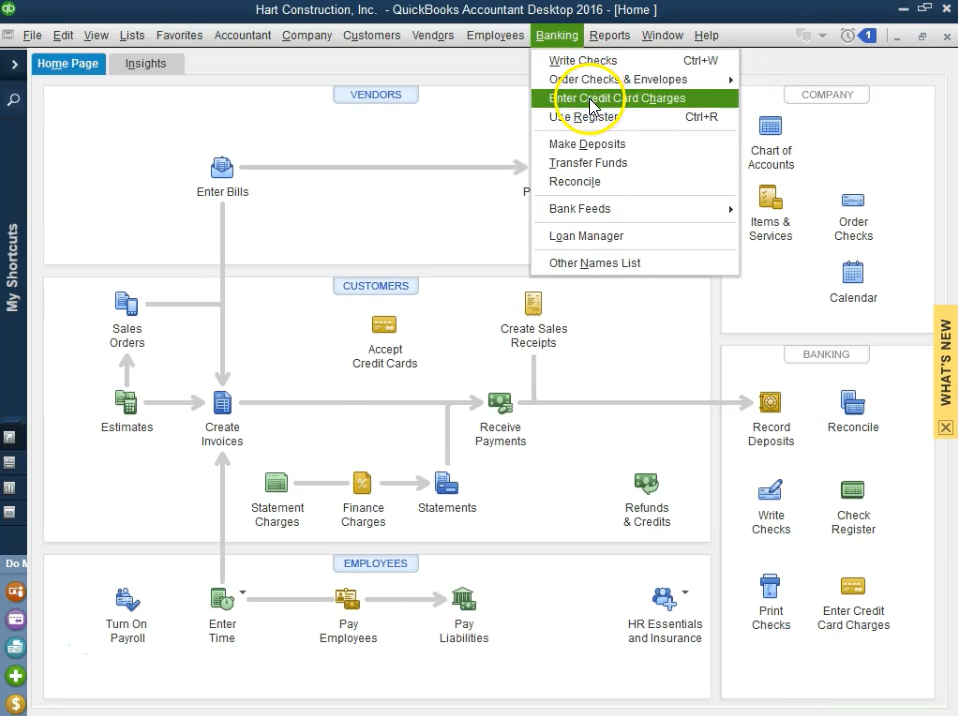

How To Transfer Funds Between Bank Accounts in QuickBooks Online

How Do I Avoid Transfer Fees in Quickbooks?

There are a few ways that you can avoid transfer fees in QuickBooks. One way is to use the Find/Select feature and choose “Not Eligible for Payment”. This will bring up all of the transactions that are not eligible for payment, which you can then exclude from your payment batch.

Another way to avoid transfer fees is to choose the “net” option when making a payment. This means that any fees associated with the transaction will be deducted from the amount being paid out, rather than being charged as a separate fee.

Finally, you can always contact your bank or financial institution to see if they offer any programs or services that would allow you to avoid paying transfer fees on your QuickBooks transactions.

Anúncios

How Much Does Quickbooks Charge for Wire Transfers?

QuickBooks Online Advanced offers two types of payment services: QuickBooks Payments and Bill.com. With QuickBooks Payments, you can pay by credit card, debit card, or bank transfer (wire transfer). There is no fee to set up QuickBooks Payments, but there are fees for each type of payment.

For example, when you pay by credit card, there is a 2.4% + $0.25 fee per transaction. If you pay by bank transfer (wire transfer), there is a $5 flat fee per transaction. You can also choose to use Bill.com to pay your bills.

With Bill.com, you can pay by check, ACH (bank transfer), or wire transfer.

Does Quickbooks Charge a Fee for Debit Card Payments?

No, QuickBooks does not charge a fee for debit card payments. In fact, you can even set up QuickBooks to automatically deduct your monthly debit card payment from your checking account.

Anúncios

Are Quickbooks Bank Transfers Safe?

When it comes to your finances, you want to be sure that your money is safe. QuickBooks is a popular accounting software that many businesses use to manage their finances. But is QuickBooks bank transfers safe?

Here’s what you need to know about QuickBooks bank transfers and whether or not they are safe.

What Is QuickBooks?

QuickBooks is an accounting software that helps businesses manage their finances.

It can track income and expenses, create invoices and reports, and more. QuickBooks also offers a feature called “QuickBooks Bank Transfer” which allows users to transfer money between their bank account and their QuickBooks account.

Is QuickBooks Bank Transfer Safe?

Yes, QuickBooks bank transfer is a safe way to move money between your bank account and your Quickbooks account. When you set up the transfer, you will be prompted to enter your banking login information. This information is encrypted and stored securely by Quickbooks.

Only you will have access to this information.

Credit: www.mobiletransaction.org

How Much Does Quickbooks Charge for Credit Card Payments

Intuit, the company that owns Quickbooks, charges different rates for credit card payments processed through Quickbooks depending on which plan you have- either Quickbooks Online or Quickbooks Self-Employed.

For Quickbooks Online plans, there is a 1.75% charge per transaction if you use an Intuit Payment Network account and a 2.9% + $0.30 charge per transaction for all other major credit cards. If you have the Plus plan, there is an additional $0.25 fee per payment.

For those using the Quickbooks Self-Employed plan, the rate is 3.4% + $0.25 per transaction regardless of which type of credit card is used.

There are also some merchant services fees that may apply depending on your bank or payment processor, so be sure to check with them as well before signing up for any service!

Make Ach Payments in Quickbooks Online

Making ACH payments in QuickBooks Online is simple and easy to do. Here’s how:

1. Go to the Vendors tab and select the vendor you want to pay.

2. Click Pay Bill under the Action column on the right side of the screen.

3. Select ACH from the Payment Method drop-down menu. You can also add a new payment method by clicking Add New and selecting ACH from the list of options.

4. Enter the amount you want to pay in the Payment Amount field and click Save & Close.

Quickbooks Bank Transfer

QuickBooks offers a convenient way to transfer money between your business bank account and your QuickBooks Online account. QuickBooks Bank Transfer is a free service that allows you to securely connect your bank account to QuickBooks Online. Once connected, you can easily transfer money between your accounts with a few clicks.

There are many benefits of using QuickBooks Bank Transfer to manage your finances. First, it saves you time by eliminating the need to log in to multiple accounts and manually transferring funds between them. Second, it helps you avoid mistakes by automatically recording all transactions in QuickBooks Online.

Third, it provides peace of mind by keeping your financial information safe and secure.

If you’re looking for a quick and easy way to manage your finances, QuickBooks Bank Transfer is the perfect solution!

Conclusion

Quickbooks is a popular accounting software used by small businesses and individuals. While it offers many features, one common question is whether Quickbooks charges for bank transfers.

The answer is that Quickbooks does not charge for bank transfers.

You may be charged a fee by your bank, but Quickbooks itself does not have any fees associated with transferring funds between accounts. This makes it a good option for those who need to move money around frequently.

While there are no fees from Quickbooks, you should still be aware of the other costs associated with using the software.

For example, if you use Quickbooks Online, you will be charged a monthly subscription fee. There may also be transaction fees depending on the payment processor you use. Overall, though, Quickbooks is an affordable option for managing your finances.