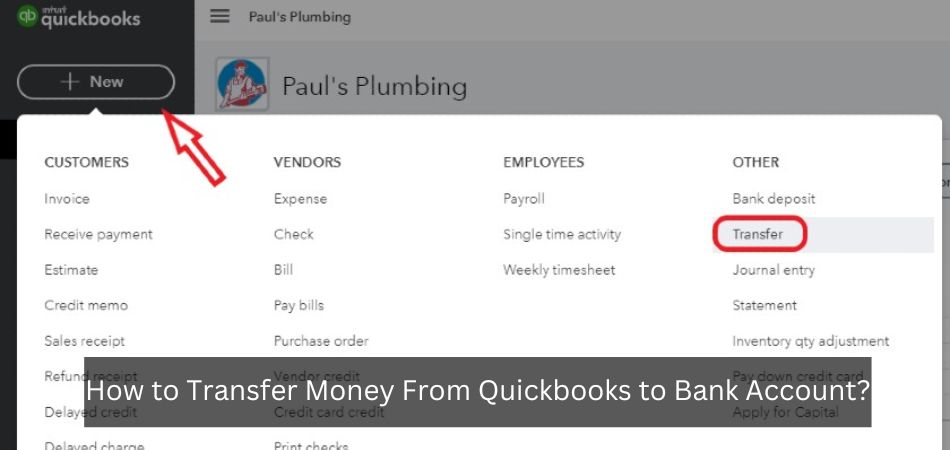

How to Transfer Money From Quickbooks to Bank Account?

QuickBooks is an accounting software that allows users to track their finances and manage their business accounts. One of the features of QuickBooks is the ability to transfer money from the software to a bank account. This can be helpful if you need to quickly move money between accounts or if you want to keep your QuickBooks account separate from your personal bank account.

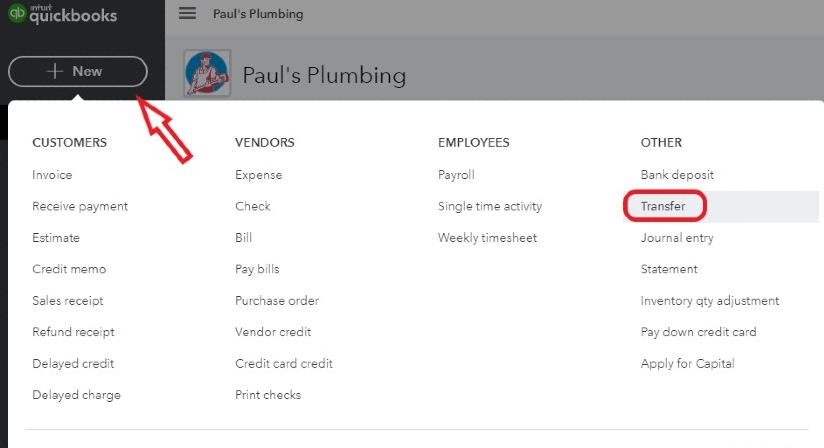

How To Transfer Funds Between Bank Accounts in QuickBooks Online

- Log into your QuickBooks account and click on the “Banking” tab

- Click on the account you want to transfer money from

- Click on the “Transfer Money” button

- Enter the amount of money you want to transfer and select the bank account you want to transfer it to from the drop-down menu

- Click “Submit

How to Transfer Money from One Account to Another in Quickbooks Desktop

Assuming you would like a blog post discussing how to transfer money from one account to another in QuickBooks Desktop:

QuickBooks is a popular accounting software that allows users to track their income and expenses, create invoices and reports, and manage their finances. One of the features of QuickBooks is the ability to transfer money between accounts.

This can be useful if you need to move money from one account to another for any reason.

There are a few different ways to transfer money between accounts in QuickBooks Desktop. The first way is to use the “Make Deposits” feature.

To do this, go to the “Banking” menu and select “Make Deposits”. Then, select the account that you want to transfer the money from and enter the amount of money that you want to transfer. Finally, select the account that you want to transfer the money to.

The second way to transfer money between accounts is by using journal entries. Journal entries are a bit more complicated than using the “Make Deposits” feature, but they offer more flexibility when it comes to transferring funds. To create a journal entry, go to the “Lists” menu and select “Chart of Accounts”.

Then, click on the “Accounts” menu and select “New Account”. Create an account for each side of the transaction (i.e., one for where the money is coming from and one for where it’s going). Once you’ve created both accounts, go back into the “Accounts” menu and select “Journal Entry”.

Enter all relevant information for both sides of the transaction and then click “Save & Close”.

Both methods will achievethe same result – moving funds from one accountto another – but each has its own advantagesand disadvantages. Using journal entries offersmore flexibility, but it’s also more time-consumingand requires a bit more knowledge aboutaccounting in general.

On the other hand,using the “Make Deposits” feature is muchsimpler and quicker, but it doesn’t offer asmuch flexibility. Ultimately, it’s up tousers which method they prefer or whichone makes more sense given their particularsituation.

Quickbooks Transfer Funds to Personal Account

Assuming you are referring to QuickBooks Online (QBO), there are only a couple ways to get funds from your business account into your personal account. You can either do an ACH bank transfer or write a check.

If you want to do an ACH bank transfer, you’ll need to set up your personal account as a vendor in QBO first.

Once that’s done, you can go to the Banking tab and select Transfer Money. From there, you’ll choose the accounts you want to transfer money between and enter the amount. Keep in mind that this method may take a few days for the funds to show up in your personal account.

Writing a check is probably the quickest way to get funds from your business into your personal account. To do this, go to the Banking tab and select Write Checks. Enter your personal account information as the payee and fill in the amount of the check.

Be sure to uncheck Print Later so that the check doesn’t actually print out – otherwise you’ll just have to void it later! You can then deposit the check into your personal account when it’s convenient for you.

Anúncios

Quickbooks Cash Account

If you’re a small business owner, chances are you’ve heard of Quickbooks. Quickbooks is a software program that helps businesses manage their finances. One of the features of Quickbooks is the cash account.

The cash account is a place where you can track all of your business’s incoming and outgoing cash flow. This information is important because it helps you see how much money your business has on hand at any given time. It also helps you keep tabs on where your money is going and how much profit your business is making.

Knowing where your business stands financially can help you make better decisions about spending, investing, and saving for the future. If you’re not already using Quickbooks, now might be a good time to give it a try!

Quickbooks Checking Account App

QuickBooks is a popular accounting software used by small businesses. The QuickBooks Checking Account App allows users to manage their checking account from their mobile device. This can be a convenient way to keep track of expenses and income, as well as reconcile your bank statements.

Using the QuickBooks Checking Account App, you can:

-Create and manage multiple checking accounts

-Deposit checks using your mobile device’s camera

-Send and receive money through ACH transfers

-Pay bills online

Anúncios

Quickbooks Checking Account

If you’re a small business owner, chances are you’ve heard of QuickBooks. QuickBooks is a popular accounting software that helps businesses keep track of their finances. One of the features of QuickBooks is the ability to link your checking account to the software.

This can be a great way to keep track of your expenses and income, but it’s important to understand how it works before you get started.

When you link your checking account to QuickBooks, the software will download your transactions from the bank and categorize them for you. This can be a great time-saver, but it’s important to note that QuickBooks can only categorize transactions that have already been processed by your bank.

So, if you make a purchase on your credit card and then pay off the balance with your checking account, QuickBooks won’t know that the transaction was for a purchase – it will just show up as a transfer from one account to another.

Another thing to keep in mind is that linking your checking account to QuickBooks doesn’t mean that all of your financial information will be automatically entered into the software. You’ll still need to manually enter some information, such as deposits or withdrawals that aren’t processed through your bank.

And, if you use multiple banks or financial institutions, you’ll need to link each one separately to Quickbooks.

Overall, linking your checking account to Quickbooks can be a helpful way to stay on top of your finances and save time by having transactions automatically downloaded and categorized. Just be sure to understand how it works before getting started so that you don’t run into any surprises down the road!

Credit: www.teachucomp.com

Can You Send Money from Quickbooks?

Yes, you can send money from QuickBooks. You can use QuickBooks to pay bills, make payments to vendors and suppliers, and even send money to yourself or others. To do this, you’ll need to set up a payment method in QuickBooks (such as a bank account or credit card) and then enter the recipient’s information.

Once that’s done, you can simply select the ‘Send Money’ option from the main menu and follow the prompts.

How Long Does It Take to Transfer Money from Quickbooks?

There are a few things to keep in mind when transferring money from QuickBooks. The first is thatQuickBooks can take up to three days to process the transfer. This means that if you initiate the transfer on a Monday, it may not show up in your account until Wednesday.

The second thing to keep in mind is that the amount of time it takes for the funds to actually hit your account can vary depending on your bank. Some banks may process the transfer immediately, while others may take a few days. If you need access to the funds right away, it’s best to initiate the transfer as early as possible.

How Do I Turn on Bank Transfers in Quickbooks?

Assuming you would like a step-by-step guide on how to turn on bank transfers in QuickBooks:

1. Log in to your QuickBooks account.

2. Click the “Settings” gear icon in the upper right corner of the screen.

3. Select “Account and Settings.”

4. Click the “Banking” tab from the left menu bar, then select “Bank Connections.”

5. Click “Add Bank Account.”

You will be prompted to enter your bank’s login information so that QuickBooks can connect to your bank account and automatically download transactions.

6. After entering your bank login information, click “Connect.” Your account should now be successfully connected and you can begin transferring funds between your bank account and QuickBooks!

How Do I Do a Bank Transfer in Quickbooks Desktop?

Assuming you would like a blog post discussing how to do a bank transfer in QuickBooks Desktop, here is some information that may be helpful.

QuickBooks Desktop has a few different ways that users can move money between accounts. One way is to use the Transfer Funds feature.

This tool allows you to move money between your accounts with just a few clicks.

To use the Transfer Funds feature, go to the Banking menu and select Transfer Funds. Then, select the account that you want to transfer money from and the account that you want to transfer money to.

Enter the amount of money that you want to transfer and then click Save & Close.

Another way to move money between accounts is to use Journal Entries. Journal Entries are transactions that allow you to move funds between your Accounts Receivable and Accounts Payable accounts.

To use Journal Entries, go to the Company menu and select Make General Journal Entries.

On the Make General Journal Entry screen, enter all of the relevant information for your transaction. Be sure to include the date, account names and amounts being transferred.

When you’re finished, click Save & Close.

You can also write checks as a way of transferring funds between your accounts. To write a check, go to the Banking menu and select Write Checks.

On the Write Checks screen, enter all of the relevant information for your transaction including which account you’re writing the check from, who you’re writing it out too and how much it’s for.

Conclusion

Assuming you would like a summary of the blog post titled “How to Transfer Money From Quickbooks to Bank Account?”:

The process for transferring money from Quickbooks to a bank account is relatively simple and only requires a few steps. First, open Quickbooks and go to the Banking menu.

Next, select the account you want to transfer money from and click on the Send/Receive Payments button. Then, enter the amount of money you want to transfer into the appropriate field and click Save & Close. Finally, go to your bank’s website and initiate a wire transfer using the information provided by Quickbooks.