Does Quickbooks Charge a Fee for Bank Transfers?

Quickbooks is a popular accounting software used by small businesses. One of its features is the ability to connect to your bank account and automatically download transactions. This can save you a lot of time if you’re manually entering transactions into Quickbooks.

However, some users have reported that their banks are charging a fee for this service.

There are a lot of people out there who are wondering if Quickbooks charges a fee for bank transfers. The answer is: it depends. If you’re using Quickbooks Online, there is no fee for transferring funds between your linked accounts.

However, if you’re using the desktop version of Quickbooks, there may be a small fee associated with the transfer. This is because the desktop version uses an third-party service to process the transfer, and that service may charge a small fee. Overall, though, Quickbooks is a very affordable way to manage your finances and there are no hidden fees or charges that you need to worry about.

How to record payment processing fees in QuickBooks Online

How Do I Avoid Transfer Fees in Quickbooks?

When you use QuickBooks to manage your finances, you may occasionally need to transfer funds between accounts. For example, you may need to move money from your business checking account to your business savings account. Or, you may need to contribute money to a personal savings account from your personal checking account.

While QuickBooks makes it easy to transfer funds between accounts, there is one potential downside: QuickBooks charges a fee for each fund transfer. The good news is that there are ways to avoid these fees. Here are four tips:

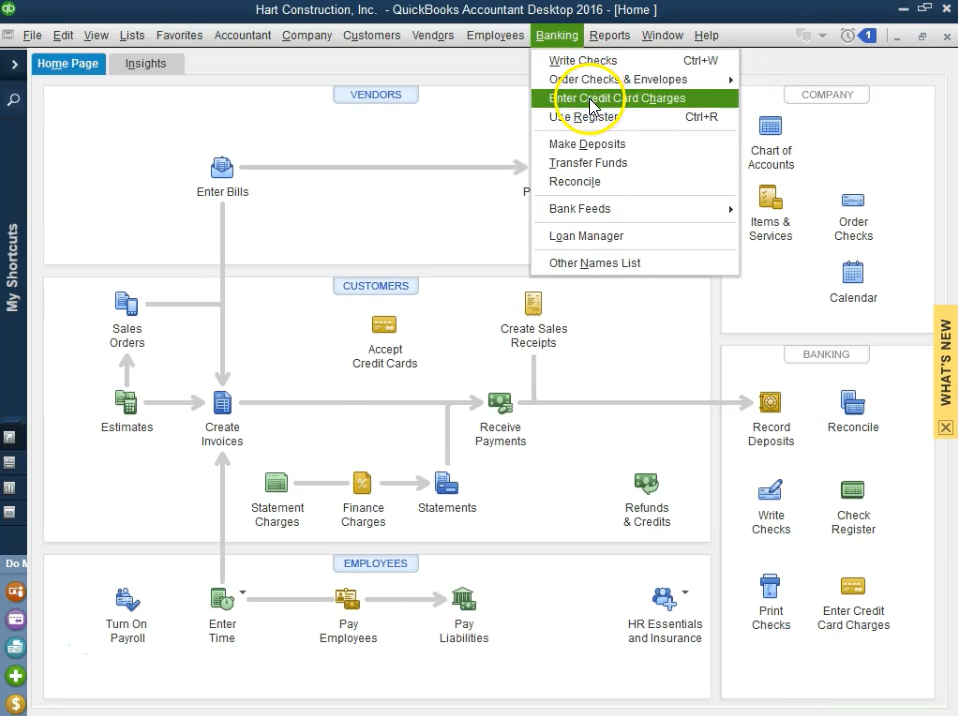

1. Use the “Make Deposits” Feature

If you need to move funds from one bank account to another, the quickest and easiest way is to use the “Make Deposits” feature in QuickBooks. To do this, simply go to the Banking menu and select “Make Deposits”.

Then, select the source account and the destination account. Enter the amount of money you want to transfer and click “Save & Close”.

2. Write a Check or Create an Invoice

Another way to avoid QuickBooks transfer fees is to write a check or create an invoice instead of transferring funds directly between accounts. For example, if you need to contribute $500 from your personal checking account into your business savings account, you can write a check for $500 from your personal checking account and deposit it into your business savings account. Or, if you need o move $1000 from your business checking into your personal savingsaccount , create an invoice for $1000 in QuickBooks and pay yourself with that invoice .

This method may take a bit more time than using the “Make Deposits” feature , but it will save you money in fees .

3 . Use Online Banking Transfers

If both of your bank accounts are connectedtoQuickBooks ,youcanavoidtheQuickBookstransferfeebyusingtheonlinetransferfeatureinyourbank’swebsite .For example , most banks allow y ou t o s chedulerecurringtransfersorone-time transfersbetweentheiraccounts . T hese trans f erswill not show upin Quic k Books becausetheyarehandledexternally ;however , theywill still be reflected inthe appropriateaccountswithinthe software .

4 . Use Journal Entries

Anúncios

Does Quickbooks Charge a Transaction Fee?

There are a few different ways to answer this question, as QuickBooks Online (QBO) charges differently for transactions than QuickBooks Desktop (QBDT). In short, QBO charges a subscription fee that includes unlimited transactions, while QBDT requires a la carte purchase of each transaction.

QuickBooks Online:

With a QuickBooks Online subscription, users have access to an unlimited number of transactions. There are four different pricing tiers available, ranging from $25 to $150 per month. The costs will vary depending on the features and functionality required.

However, all plans include free 24/7 customer support and automatic backups.

QuickBooks Desktop:

QuickBooks Desktop is licensed software that must be purchased upfront.

There is no monthly subscription fee associated with this version of QuickBooks. Instead, users pay for each individual transaction they make. These costs can quickly add up, especially for businesses that process a lot of transactions on a daily basis.

How Do I Avoid One Fee in Quickbooks?

There are a few fees that you may be charged when using QuickBooks, but there is only one that is avoidable. This fee is the monthly service fee for your QuickBooks subscription. This can be avoided by paying for your subscription upfront for 12 or 24 months.

If you choose to do this, you will not be charged the monthly service fee until your prepaid period expires.

Anúncios

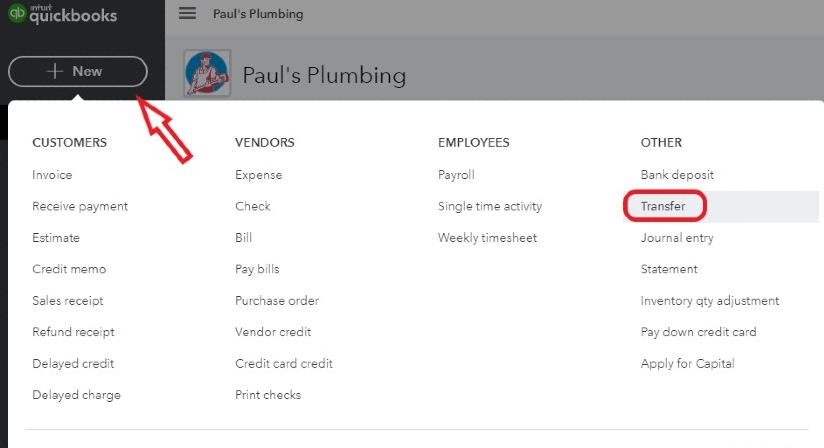

What is Bank Transfer on Quickbooks?

Assuming you are referring to QuickBooks Online (QBO)

A bank transfer is when you move money from one bank account to another. This can be done within the same bank or between different banks.

In QBO, you can set up bank transfers in the Banking menu. To do this, you’ll need to have both accounts added to QBO first.

Once both accounts are added and displayed in the Banking menu, click on the Transfers tab.

From there, you can select which accounts you’d like to transfer money between, enter the amount of money to transfer, and schedule thetransfer for a future date or make it happen immediately. You also have the option to add a note for your own reference before confirmingthe transaction.

Bank transfers are a handy way to keep your finances organized if you have multiple accounts.

They’re also useful for paying yourself back after using business funds for personal expenses (like if you’ve used a business credit card for personal purchases).

Credit: www.mobiletransaction.org

How Much Does Quickbooks Charge for Credit Card Payments

If you’re like most business owners, you want to find the cheapest and most efficient way to process credit card payments. After all, every little bit saved on processing fees can add up over time. So what does QuickBooks charge for credit card payments?

The short answer is: it depends. QuickBooks offers a few different options for processing credit card payments, and each option comes with its own set of fees. The good news is that QuickBooks is generally cheaper than other popular payment processors like PayPal or Square.

Here’s a breakdown of the different fee structures for QuickBooks’ credit card processing options:

1. Intuit Merchant Services: 2.4% + $0.25 per transaction

2. Paymentech Orbital Gateway: 2.3% + $0.30 per transaction

3. Authorize.Net: 2.9% + $0.30 per transaction

As you can see, the fees vary depending on which gateway you use to process your payments. In general, though, QuickBooks is one of the more affordable options out there – especially if you process a lot of transactions (since the flat rate per-transaction fee becomes less significant as volume increases).

One final note:QuickBooks also offers discounts on processing fees for certain types of businesses (like nonprofits or restaurants). So if you think your business might qualify, be sure to ask about any available discounts before choosing a payment processor!

How to Avoid Quickbooks Fees

QuickBooks is a powerful accounting software that can save small businesses time and money. However, QuickBooks also has some fees associated with it. Here are some tips on how to avoid QuickBooks fees:

1. Get the right version of QuickBooks. There are three versions of QuickBooks: Basic, Pro, and Premier. Each version has different features and costs different amounts.

Make sure you choose the right version for your business needs so that you don’t overspend on features you don’t need.

2. Use coupons and discounts. When purchasing QuickBooks, be on the lookout for coupons or discounts that can lower the price.

Many times, these are available through online retailers or directly from Intuit (the company that makes QuickBooks).

3.. Consider alternatives to QuickBooks.

. If you’re not sold on Quickbooks or if its fees are too high for your budget, there are other accounting software options available such as Wave Accounting or Freshbooks. Do your research to find the best fit for your business needs.

.

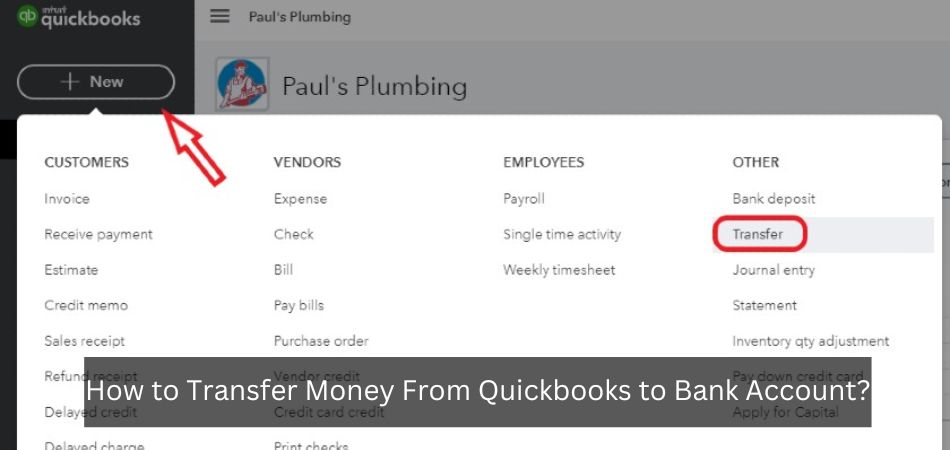

Quickbooks Bank Transfer

It’s no secret that Quickbooks is one of the most popular accounting software programs on the market. And for good reason! Quickbooks can make your life as a small business owner or entrepreneur much easier by helping you track your finances and manage your bookkeeping.

But did you know that Quickbooks can also help you transfer funds between banks? This can be a huge time-saver if you have multiple bank accounts that you need to keep track of.

Here’s how it works:

1. Open up Quickbooks and go to the Banking menu.

2. Select Transfer Funds from the list of options.

3. Choose the account that you want to transfer funds from, as well as the account that you want to transfer funds to.

Enter the amount of money that you want to transfer, and then hit Submit.

4. That’s it! Your funds will be transferred between the two banks in just a few minutes (depending on your bank’s processing times).

Conclusion

Quickbooks is a popular accounting software that many small businesses use to manage their finances. One of the features of Quickbooks is the ability to transfer funds between bank accounts. However, some users have reported being charged a fee for this service.

According to Intuit, the company that makes Quickbooks, there is no fee for transferring funds between bank accounts. However, your bank may charge a fee for this service. We recommend checking with your bank to see if they charge a fee for bank transfers before using this feature in Quickbooks.