Does Quickbooks Charge for Ach Payments?

No, QuickBooks does not charge for ACH payments. This is a free service that we offer to our customers. ACH (Automated Clearing House) is an electronic network that handles the transfer of funds between banks.

This type of payment is typically used for payroll and can be set up to automatically withdraw funds from your account on a regular basis.

How to Receive ACH Payments in QuickBooks Online

If you’re a small business owner, you’re probably always looking for ways to save money. One way you might be able to do that is by using ACH payments through Quickbooks. However, you may be wondering if there are any fees associated with this service.

The good news is that Quickbooks does not charge any fees for ACH payments. This means that you can save money on transaction fees when compared to other payment methods like credit cards or PayPal.

Of course, it’s important to note that your bank may still charge a fee for processing ACH payments.

So, be sure to check with them before using this service. But overall, Quickbooks ACH payments can help you save money on your transactions.

Quickbooks Ach Payments from Customers

What are ACH Payments?

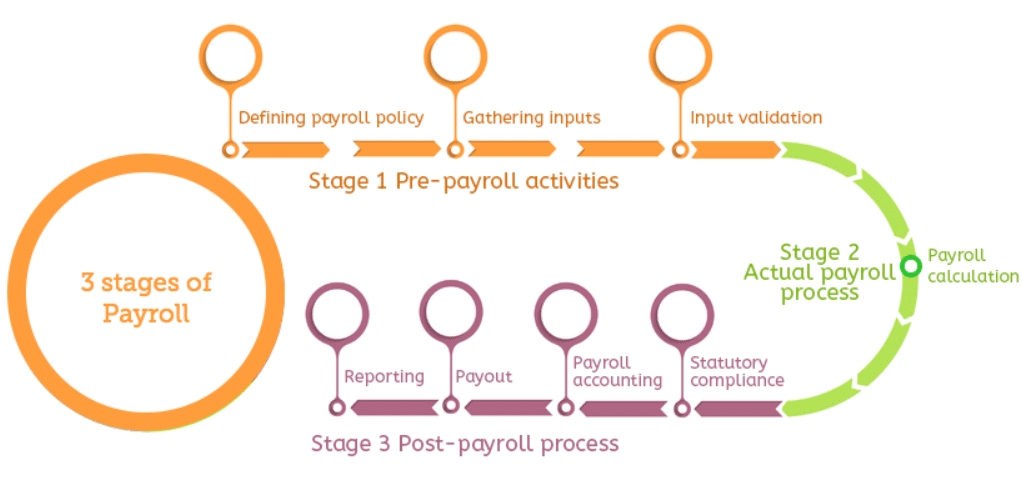

ACH payments are electronic payments that are processed through the Automated Clearing House network. This type of payment is often used for direct deposit of payroll, social security benefits, and tax refunds.

ACH payments can also be used to make payments on loans, mortgages, and other bills.

How do QuickBooks Ach Payments work?

When you set up an ACH payment in QuickBooks, you will need to provide your bank account information as well as the routing number for the ACH network.

You will also need to specify the amount of the payment and the date that it should be processed. Once you have entered all of this information, QuickBooks will generate a unique transaction code that will be used to process the payment.

Can Customers Make QuickBooks Ach Payments?

Yes! In fact, many customers prefer to make their payments via ACH because it is a more efficient way to handle their finances. If you would like to offer this option to your customers, you can set up an ACH payment form in QuickBooks that they can use to make their payments.

All you need is their bank account information and routing number, and they can make their payment with just a few clicks.

Anúncios

Does Quickbooks Charge for Credit Card Payments

No, QuickBooks does not charge for credit card payments. You can either pay your bill directly through your bank account or by using a debit or credit card. If you use a debit or credit card, there may be a processing fee charged by the financial institution that issued the card.

However, this fee is not charged by Quickbooks.

How to Avoid Quickbooks Ach Fees

QuickBooks ACH fees can be expensive, but there are ways to avoid them. One way is to use a different payment method, such as a credit card or check. Another way is to set up your QuickBooks account so that it does not charge ACH fees.

This can be done by going into the preferences and selecting the option to not charge ACH fees.

Anúncios

Quickbooks Ach Payments Time

If you’re using QuickBooks to manage your finances, you may be wondering about ACH payments and how they work. QuickBooks can handle ACH payments just like any other type of payment, but there are a few things you should know before getting started.

ACH stands for Automated Clearing House.

It’s an electronic network that handles financial transactions between banks and businesses. When you make an ACH payment, the money is transferred from your bank account to the recipient’s bank account automatically.

One advantage of using ACH payments is that they’re usually cheaper than other types of payments, such as wire transfers.

They can also be processed more quickly, which can be helpful if you need to make a payment urgently.

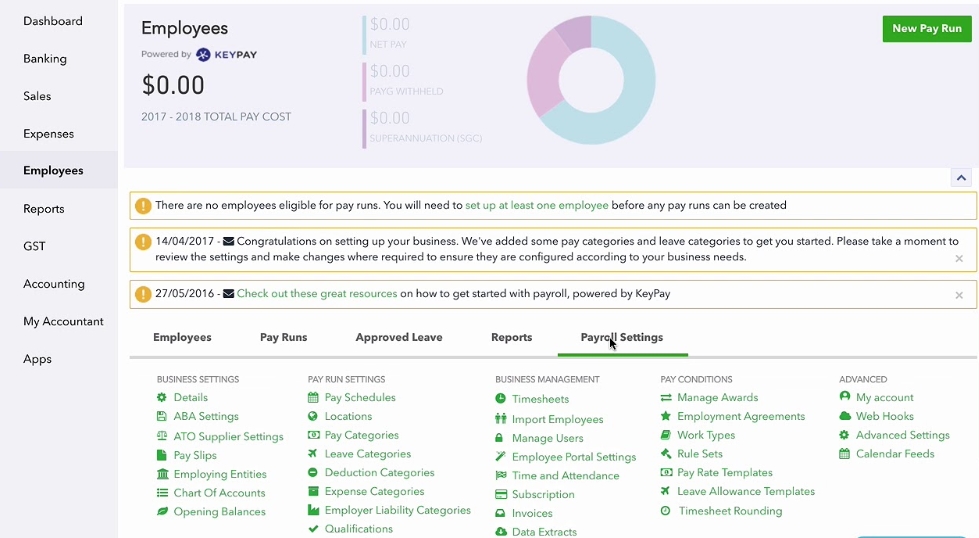

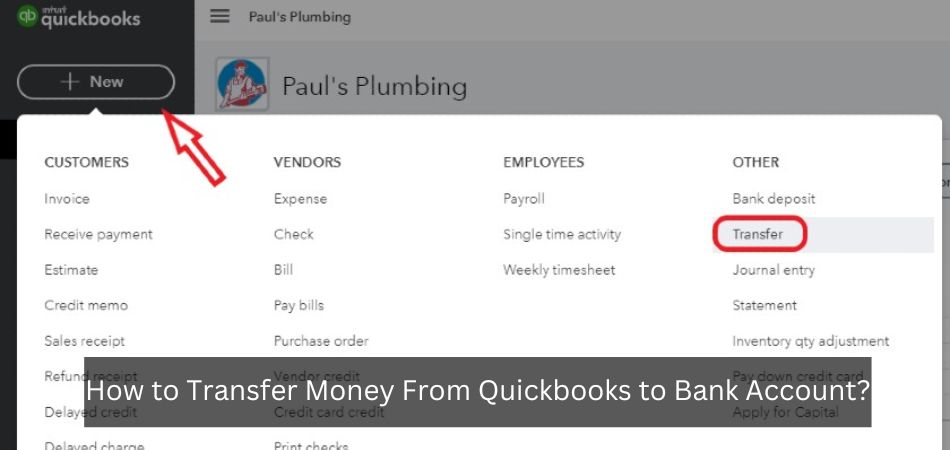

To set up ACH payments in QuickBooks, go to the Banking menu and select Add/Edit Bank Accounts. Then click on the Payments tab and choose Add New Payment Method.

Select ACH from the drop-down list and fill in the relevant information. Once everything is set up, making an ACH payment is quick and easy – just select the recipient from your list of vendors and enter the amount you want to pay. The money will be transferred automatically!

Quickbooks Ach Fee Increase

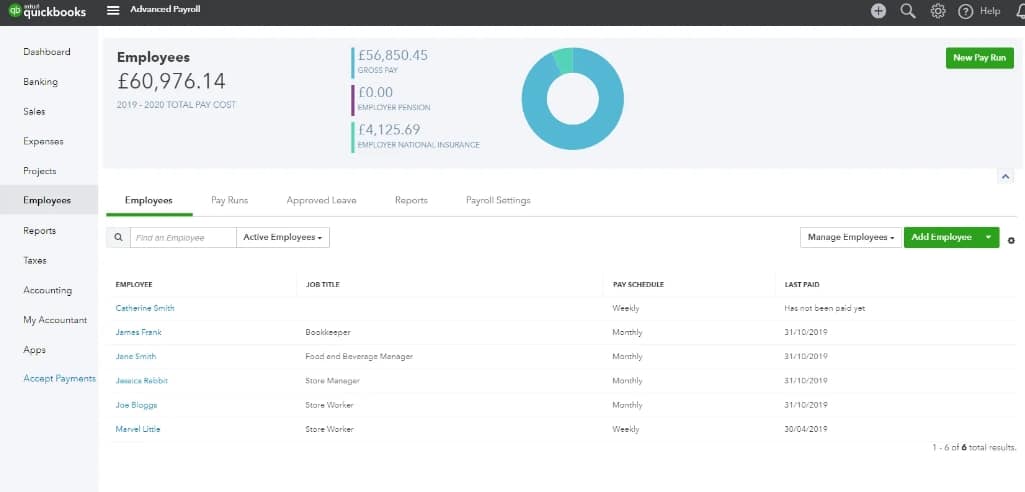

Over the past few years, there has been an increase in the number of businesses using QuickBooks for their accounting needs. QuickBooks is a software program that offers many features and benefits to businesses, including the ability to track sales and expenses, create invoices and reports, and manage payroll. One of the most popular features of QuickBooks is its ACH payment processing capabilities.

ACH stands for Automated Clearing House, and it is an electronic network that processes financial transactions. ACH payments are typically used for things like direct deposit of payroll or Social Security benefits, bill payments, or tax refunds. QuickBooks allows businesses to process ACH payments directly through the software, which is a convenient way to make bulk payments without having to write out individual checks.

The downside to using QuickBooks for ACH payments is that there is a fee associated with each transaction. These fees can add up quickly, especially for businesses that make a lot of payments each month. In response to this issue, QuickBooks recently announced an increase in their ACH processing fees.

The new fee structure went into effect on January 1st, 2020, and it affects all businesses that use QuickBooks for ACH payment processing. The new fees range from $0.30-$0.60 per transaction, depending on the amount being paid (the higher the amount, the higher the fee). For example, if you are making a $1,000 payment through Quickbooks Ach , your fee would be $0 .60 .

This may not seem like a lot of money , but it can add up quickly if you are making multiple payments each month .

If you are a business owner who usesQuickbooks Achfor your accounting needs , we encourage you to take some time to review these new fees and decide if they are worth paying . You may also want to consider alternative methods of payment processing , such as writing out individual checks or using another software program .

Credit: www.stampli.com

Is There a Processing Fee for Ach?

Yes, there can be a processing fee for ACH transactions. This fee is typically around $0.50-$1.00 per transaction, but may be more depending on the bank or credit union. The fee is often charged by the receiving bank or credit union, but sometimes it is split between the two financial institutions.

Are Bank Transfers Free in Quickbooks?

Bank transfers in QuickBooks are free for users with a QuickBooks Online Essentials or Plus subscription. For other users, there is a fee of $0.50 per bank transfer.

How Do I Do Ach Payments in Quickbooks?

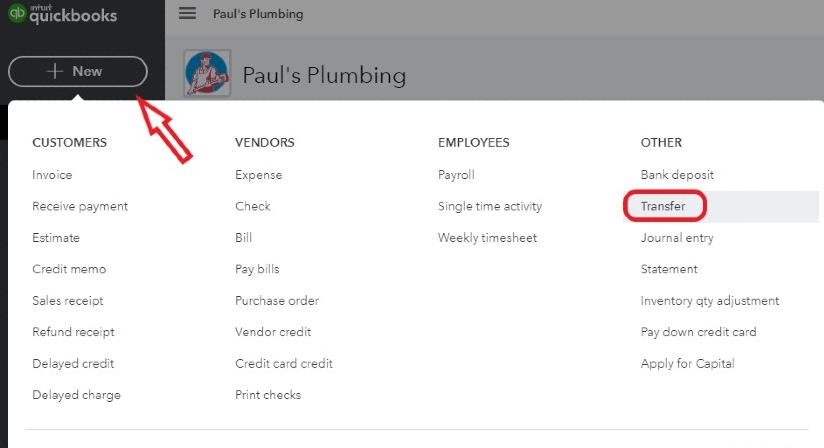

In order to set up ACH payments in QuickBooks, you’ll need to first set up a payment method and then create a batch of payments.

To set up the payment method, go to Edit > Preferences > Payments. Under Company Preferences, select the Payment Methods tab.

Click Add Method and choose ACH from the drop-down menu. Enter a name for the payment method, such as “ACH Payment.”

Next, you’ll need to create a batch of payments.

To do this, go to Customers > Create Batch of Payments. Select the customers you want to include in the batch, then click Next. Choose ACH from the Payment Method drop-down menu and enter the relevant banking information.

Finally, review the batch of payments and click Send when you’re ready to process them.

How Do I Avoid Transaction Fees in Quickbooks?

In QuickBooks, transaction fees can be a pain – especially if you’re not aware of them. Here are a few tips on how to avoid them:

1. Use an accounting software that integrates with your bank.

This way, you can automatically import transactions and avoid any fees associated with manual entry.

2. Keep track of your expenses manually or through another system such as Mint.com. This way, you’ll know exactly what you’re spending and won’t be surprised by any unexpected fees.

3. When entering transactions into QuickBooks, make sure to categorize them correctly. This will help ensure that the right amount is being charged to the right account, and reduce the chances of errors and fees.

4. Finally, always remember to review your transactions before finalizing them in QuickBooks.

This last step will help catch any mistakes so you can avoid paying unnecessary fees!

Conclusion

No, Quickbooks does not charge for ACH payments.