Does Quickbooks Do Payroll?

Yes, QuickBooks can do payroll. In fact, it’s one of the most popular payroll software options available. QuickBooks offers a full suite of payroll features, including the ability to pay employees via direct deposit, calculate and file taxes, and generate detailed reports.

Plus, with QuickBooks Online Payroll, you can access your payroll data from anywhere using any device.

QuickBooks is a widely used accounting software that offers a payroll service. Payroll in QuickBooks is simple to set up and use. You can enter employee information, pay rates, and hours worked.

The software will then generate paychecks for your employees and calculate taxes owed. You can also use QuickBooks to run reports on your payroll data.

QuickBooks Online PAYROLL – Full Tutorial

Does Quickbooks Do Payroll Taxes

QuickBooks is a popular accounting software that can be used for various purposes, including payroll. In this blog post, we’ll discuss whether QuickBooks can help you with your payroll taxes.

When it comes to paying employees, QuickBooks can definitely help.

The software can calculate paychecks based on hours worked and hourly rates. It can also withhold taxes from those paychecks, as well as any other deductions you may have. So, if you’re using QuickBooks to pay your employees, it will also handle the payroll taxes for you.

However, there are some things to keep in mind when using QuickBooks for payroll taxes. First of all, make sure that the software is set up correctly for your business. This includes ensuring that the correct tax rates are being applied to the right people.

If you’re not sure how to do this, it’s best to consult with an accountant or another financial professional who can help you get everything set up correctly.

Another thing to keep in mind is that QuickBooks may not always be 100% accurate when it comes to calculating payroll taxes. So, if you’re ever in doubt about whether or not the software is calculating something correctly, it’s always best to check with an expert before moving forward.

Overall, QuickBooks can definitely help with your payroll taxes – but there are a few things to keep in mind before using it for this purpose.

Anúncios

Quickbooks Payroll

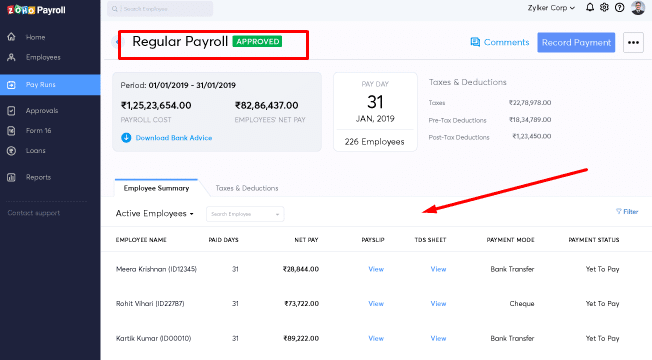

QuickBooks Payroll is a cloud-based payroll service that helps small businesses manage their employee compensation. The service offers features like direct deposit, tax filing, and employee self-service. QuickBooks Payroll integrates with QuickBooks Online, making it easy to manage your finances in one place.

If you’re running a small business, chances are you don’t have the time or resources to keep up with all the latest changes in payroll tax law. That’s where QuickBooks Payroll comes in. This cloud-based payroll service takes care of all the heavy lifting for you, so you can focus on running your business.

QuickBooks Payroll offers a number of features that can save you time and money. With direct deposit, your employees can get paid faster and there’s no need to print and distribute paychecks. And when it comes time to file taxes, QuickBooks Payroll can do that for you too.

Plus, with employee self-service, your team can view their pay stubs and W-2 forms online anytime, from anywhere.

The best part is that QuickBooks Payroll integrates seamlessly with QuickBooks Online. So if you’re already using QuickBooks Online to manage your finances, adding payroll will be a breeze.

You’ll be able to see all your financial data in one place, which will make managing your business finances easier than ever before.

If you’re looking for a payroll solution that can save you time and help you better manage your small business finances, then look no further than QuickBooks Payroll.

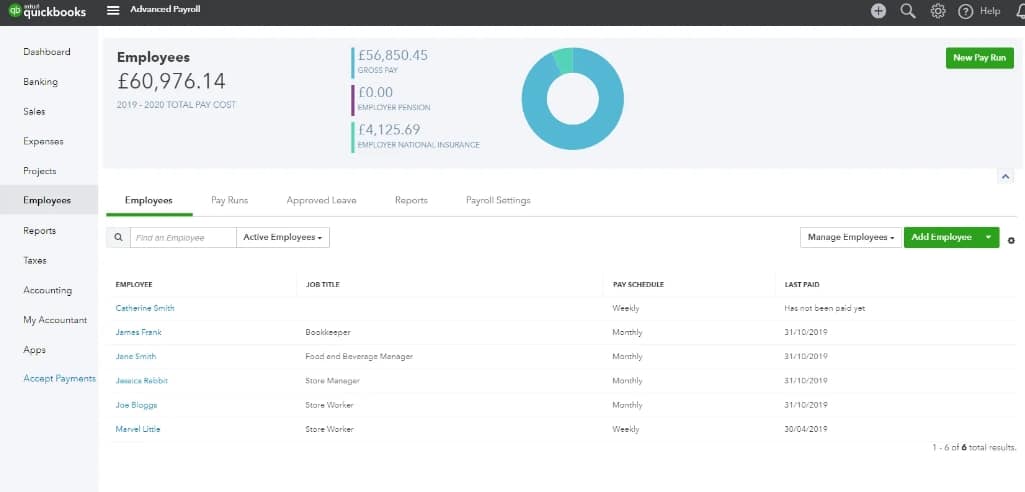

How to Do Payroll in Quickbooks Desktop

If you’re like most business owners, you want to do your own payroll but aren’t sure where to start. QuickBooks Desktop is a popular accounting software that can help you with all your payroll needs. Here’s a step-by-step guide on how to do payroll in QuickBooks Desktop:

1. Set up your company file in QuickBooks Desktop. Be sure to include all relevant information about your employees, such as their Social Security numbers, addresses, and compensation rates.

2. Go to the Employees menu and select Payroll Center.

3. Enter the date range for the pay period you wish to process.

4. Select the employees you wish to run payroll for and click Run Payroll.

5. Enter each employee’s hours worked during the pay period and any other relevant information, such as vacation or sick time used.

6. When you’re finished, click Calculate Payroll at the bottom of the screen. QuickBooks will calculate each employee’s gross pay, deductions, and net pay based on the information you entered.

7 .

To print paycheck stubs or direct deposit forms, go to the File menu and select Print Forms > Paychecks/Pay Stubs or Direct Deposit Forms respectively . You can also choose to have QuickBooks email or fax these forms directly to your employees . Click here for instructions on how to set up emailing or faxing in QuickBooks Desktop .

That’s it!

Anúncios

Can I Do Payroll With Quickbooks Online

As a business owner, you have a lot of responsibilities. One of those is making sure your employees are paid on time and accurately. QuickBooks Online can help you with that by running your payroll for you.

Here’s how it works:

First, you’ll need to set up your account and add your employees. You’ll need their basic information like name, address, Social Security number, and date of birth.

Once that’s done, you’ll need to set up their compensation. This includes their hourly rate or salary, as well as any bonuses or commissions they may earn.

You also have the option to offer them health insurance or other benefits, which QuickBooks can deduct from their paychecks automatically.

Now it’s time to run the payroll! You can do this manually or set it up to run automatically on a schedule that works for you. QuickBooks will calculate everything for you – all you need to do is enter the hours worked and approve the payments.

Credit: fitsmallbusiness.com

Does Quickbooks Include Payroll?

Yes, QuickBooks includes payroll. You can use QuickBooks to run your payroll and pay your employees. QuickBooks will calculate payroll taxes and deductions for you, and you can print checks or direct deposit funds to your employees’ accounts.

Is Payroll Free in Quickbooks?

No, payroll is not free in QuickBooks. There is a monthly subscription fee for the QuickBooks Payroll service. This fee includes access to support and updates.

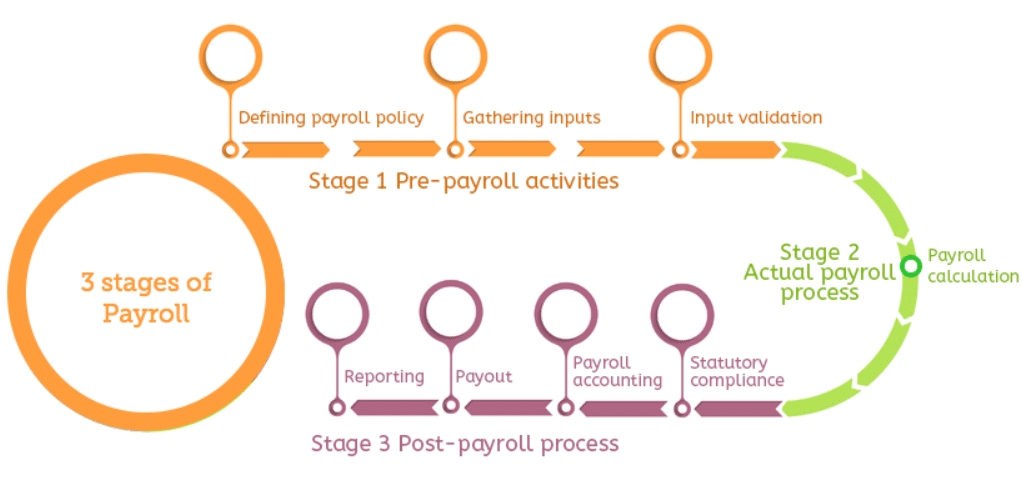

How Does Quickbooks Work for Payroll?

QuickBooks is an accounting software program that offers a number of features for businesses, including the ability to process payroll. QuickBooks can be used to manage both hourly and salaried employees, and it can calculate payroll taxes and other deductions automatically. Payroll can be processed manually or through an integrated service such as Intuit Payroll.

When processing payroll manually, employers will need to enter employee hours into QuickBooks and then calculate paychecks based on hourly rates or salaries. Deductions and taxes will need to be calculated separately, and then checks can be printed or direct deposited into employee bank accounts.

If using the integrated payroll service, employers will still need to enter employee hours into QuickBooks but the rest of the process is automated.

Taxes and deductions are calculated automatically, and employees can be paid through direct deposit or paper check. The integrated payroll service also offers additional features such as the ability to create electronic W-2 forms and file state and federal tax forms electronically.

Conclusion

QuickBooks is a popular accounting software that helps small businesses manage their finances. It can track income and expenses, create invoices and financial reports, and more. QuickBooks also offers a payroll service that can help businesses pay their employees on time and calculate taxes.