Is it worth having a Discover it Balance Transfer? Find out everything!

If you want a secure card that can bring advantages when making your purchases, the Discover it Balance Transfer Credit Card is a card that can help you. It is different from other cards by providing customers with unique conveniences and benefits.

You will use it with the money you have in your account, ensuring lower fees and better payment terms.

Check out more information about the Discover it Balance Transfer in our article and learn how to request yours.

Anúncios

Understanding how a Balance Transfer card works

A Balance Transfer credit card is a credit card that offers a low-interest rate for transferring a balance from another credit card. The balance transfer fee is usually 3% to 5% of the transferred amount.

Anúncios

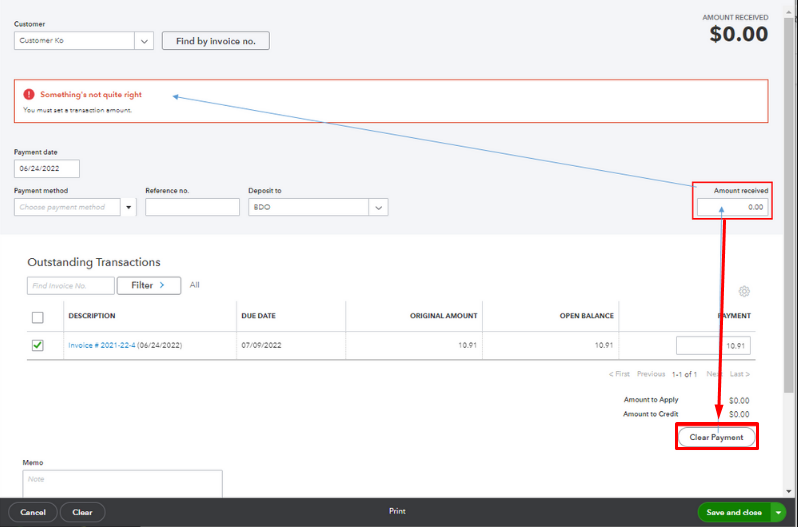

To use a Balance Transfer credit card, you’ll first need to open an account with the card. Once approved, you can transfer the balance from your existing credit card to the new card.

The transfer is usually done through an online or phone process. You will need to provide information from your existing credit card, including the card number, cardholder’s name, and expiration date.

After the transfer is complete, you will need to start paying off the balance on your Balance Transfer credit card. You can either pay the entire balance immediately or make monthly payments.

If you choose to make monthly payments, you will need to pay interest on the remaining balance. The interest rate for monthly payments is usually higher than the balance transfer rate.

So, by using your Discover it Balance Transfer Credit Card, you are sure to have better payment terms and much lower fees.

Advantages of Discover it Balance Transfer

The Discover it Balance Transfer offers many advantages to bank customers. Therefore, it is important that you keep in mind the benefits you will receive when applying for this credit card.

Here’s why this is one of the best Balance Transfer cards on the market:

Low fees

The Discover it Balance Transfer offers a balance transfer fee of 3% of the transferred amount, but only for transactions made until April 10, 2024. After that date, the balance transfer fee will be up to 5%.

This fee is competitive compared to other Balance Transfer credit cards. If you are paying high interest rates on an existing credit card, transferring the balance to the Discover it Balance Transfer can help you save money.

For example, if you have a balance of $10,000 on a credit card with a 20% interest rate, you will pay $2,000 in interest per year.

If you transfer the balance to the Discover it Balance Transfer with a 3% balance transfer fee, you will pay $300 in balance transfer fees.

However, you will save $1,700 in interest per year, which means you will save $1,400 in total.

Low introductory APR

The Discover it Balance Transfer offers a 0% introductory APR for balance transfers for 18 months. This means you will not pay interest on the transferred balance during this period.

This introductory APR is a great opportunity to pay off the transferred balance quickly and save money on interest.

Good rewards

The Discover it Balance Transfer offers rewards such as 5% cashback on purchases at select merchants and 1% on all other purchases.

These rewards can help you save money on future purchases and make the card an excellent option for those looking to have more credit in the market.

Other benefits

In addition to low fees, the introductory APR, and rewards, the Discover it Balance Transfer offers other benefits, such as:

- No annual fee: You do not need to pay an annual fee to have the Discover it Balance Transfer.

- Approval guarantee: If you are approved for the Discover it Balance Transfer, you will receive a $200 credit.

- Purchase protection: The Discover it Balance Transfer offers purchase protection of up to $1,000 per item purchased.

How to apply for the Discover it Balance Transfer?

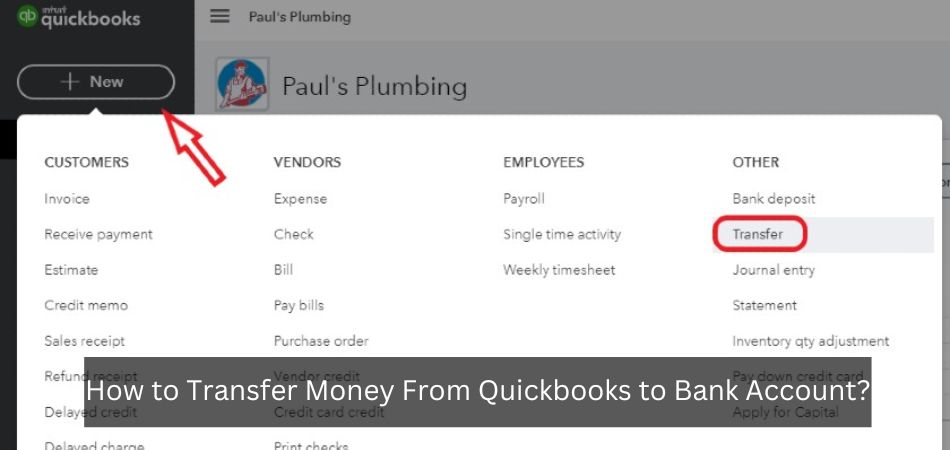

To apply for the Discover it Balance Transfer online, follow these steps:

- Access the Discover website.

- Click on “Credit Cards.”

- Click on “Discover it Balance Transfer.”

- Fill out the application form with all the information requested by the bank.

- Submit the application form and await approval.

To be eligible for the Discover it Balance Transfer, you must meet the following requirements:

- Be at least 18 years old.

- Have a good credit history.

- Have a residential address in the United States.

Discover generally takes 7 to 10 business days to process your credit card application.

If you are approved for the Discover it Balance Transfer, you will receive an email or letter with your card information. You will also receive an email or letter with instructions on how to transfer your balance.

The transfer is usually completed within 2 to 3 business days.

Simple and practical, the Discover it Balance Transfer will be the right card for you.

Liked learning about it? Go to the website and request yours.

How about exploring other cards for your profile? Browse the website for more information.

Useful information

This content was produced in January 2024. In case of updates or changes to services and conditions, please contact the responsible bank.

Contact methods:

Call Discover at 1-800-347-2683 (English/Español)