Can Freshbooks Process Credit Cards?

In short, yes! You can use Freshbooks to process credit cards. In order to do so, you’ll need to sign up for a third-party payment processor like Stripe or PayPal.

Once you’ve done that, you can add your credit card information to Freshbooks and start processing payments.

9. Freshbooks – How to Accept Credit Cards

If you’re like most small business owners, you probably have a love-hate relationship with credit cards. On the one hand, they’re extremely convenient for both you and your customers. On the other hand, processing credit card payments can be a real pain.

Fortunately, there’s FreshBooks.

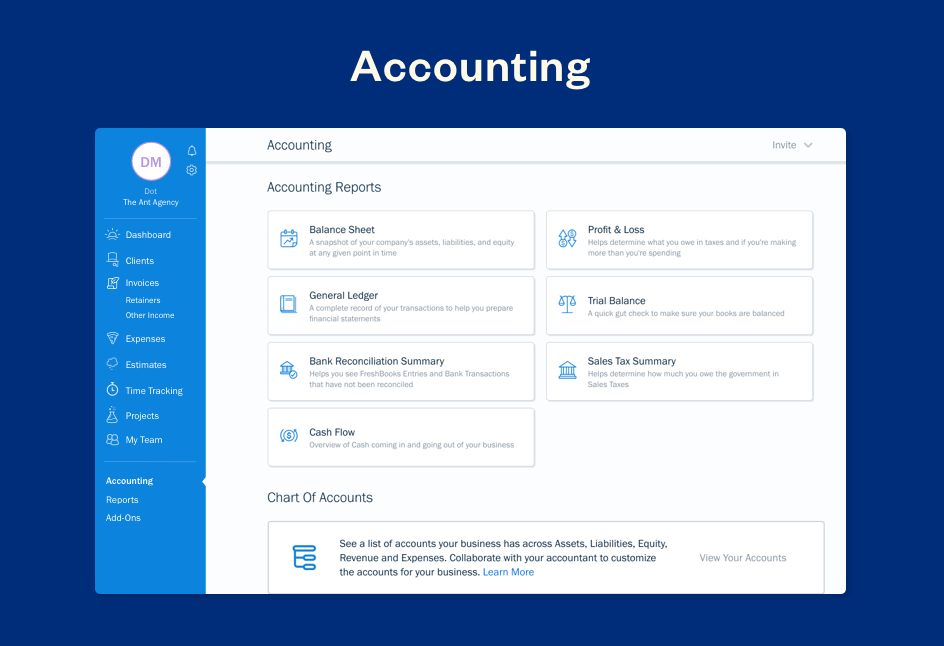

FreshBooks is a cloud-based accounting software that makes billing and invoicing easy and painless. And yes, it can process credit card payments too!

Here’s how it works: when you create an invoice in FreshBooks, you’ll have the option to include a “Pay Now” button. Your customer can then click on this button to pay their invoice via credit card. The best part?

All of the payment processing is done automatically by FreshBooks – no need for you to lift a finger!

Not only does this save you time, but it also gives your customers another payment option that they may prefer over writing a check or sending money via PayPal. So if you’re looking for an easy way to take credit card payments, look no further than FreshBooks!

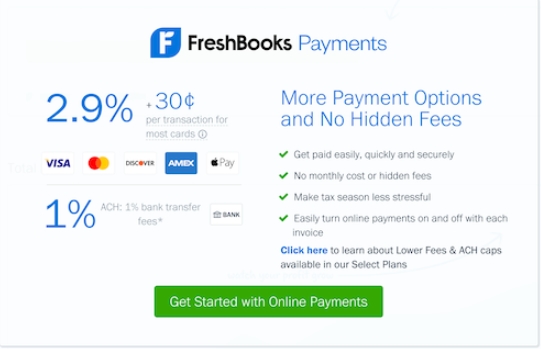

Freshbooks Credit Card Processing Fee

If you’re a small business owner who uses Freshbooks to manage your finances, you may be wondering about the credit card processing fee. Here’s what you need to know.

First, it’s important to understand that there is no such thing as a “Freshbooks processing fee.”

Rather, this is simply the standard 2.9% + $0.30 per transaction fee that all credit card processors charge. So when you see this fee on your statement, it’s not an additional charge from Freshbooks – it’s just the normal rate for processing credit card payments.

Now that we’ve got that out of the way, let’s talk about how this fee can impact your business.

Obviously, the more transactions you process, the higher this fee will be. And if you’re selling products or services online, chances are good that a good portion of your sales will come via credit card. That means this fee can add up quickly!

Fortunately, there are a few ways to lessen the impact of these fees. First, if you have customers who frequently use their credit cards on file with Freshbooks (for example, if they pay their invoices automatically each month), you can offer them a discount for doing so. This can help offset the processing fees somewhat.

Second, many payment processors offer discounts for businesses that process a high volume of transactions each month. If your business falls into this category, it’s worth shopping around for a processor that offers lower rates.

Finally, keep in mind that these fees are tax-deductible!

So even though they may seem like a pain now, remember that they’ll eventually help reduce your tax bill at the end of the year.

Anúncios

Freshbooks Pricing

If you’re looking for an invoicing and accounting solution for your small business, you may be considering Freshbooks. In this article, we’ll take a closer look at the Freshbooks pricing plans and features to help you decide if it’s the right fit for your business.

Freshbooks has three main pricing plans: Lite, Plus, and Premium.

The Lite plan is $15 per month and includes up to 5 clients, unlimited invoices, and basic accounting features. The Plus plan is $25 per month and includes up to 50 clients, advanced invoicing features, time tracking, and project management tools. The Premium plan is $50 per month and includes everything in the Plus plan plus additional features like client portals and proposals.

One of the great things about Freshbooks is that they offer a free 30-day trial so you can try out all of the features before committing to a paid plan. And if you need more than 50 clients or want to add on optional extras like priority support or custom branding, they have enterprise plans starting at $100 per month.

Overall, Freshbooks is a great option for small businesses looking for an easy-to-use invoicing and accounting solution.

And with its free trial and flexible pricing plans, it’s definitely worth checking out!

Invoice Accept Credit Cards

If you’re a small business owner, chances are you’ve had to deal with the hassle of invoicing. You know the drill: send out an invoice, wait for a check to come in the mail, and then deposit it into your bank account. But what if there was an easier way?

Nowadays, there are plenty of options for businesses to accept credit cards. And while this may seem like a daunting task, it’s actually pretty simple! There are plenty of services out there that will allow you to take credit cards without having to set up a merchant account.

The benefits of accepting credit cards are numerous. For one, it’s much faster than waiting for a check to come in the mail. This means that you can get paid sooner and have access to your funds more quickly.

Additionally, taking credit cards can help you expand your customer base – after all, not everyone carries cash or checks these days. Finally, it’s just plain convenient! No more chasing down payments or worrying about lost checks; simply process the card and move on.

Of course, there are some things to keep in mind when accepting credit cards. First and foremost, you’ll need to make sure that you’re using a secure system; this means ensuring that your customers’ data is safe and encrypted. Additionally, you’ll want to be aware of any fees associated with processing credit cards; typically, these run around 2-3% per transaction.

Lastly, be sure that you clearly state that you accept credit cards on your invoices – this will avoid any confusion down the line.

Overall, accepting credit cards can be a great way to streamline your billing process and make life easier for both you and your customers!

Anúncios

Freshbooks Vs Quickbooks

If you’re a small business owner, then you know how important it is to have a good accounting software. After all, this is what will help you keep track of your finances and make sure that everything is in order. But with so many different options on the market, it can be tough to decide which one is right for you.

That’s why we’ve decided to compare two of the most popular accounting software programs out there: Freshbooks and Quickbooks.

When it comes to features, both Freshbooks and Quickbooks offer a lot of great options for small businesses. However, Quickbooks does have a few more bells and whistles than Freshbooks.

For example, Quickbooks allows you to track inventory levels and create estimates and invoices from within the program. Freshbooks also has some great features, like the ability to track billable hours worked by employees and send automatic payment reminders to clients.

In terms of pricing, both programs are very affordable for small businesses.

However, Quickbooks does have a monthly subscription fee while Freshbooks charges per month based on how many clients you have (with discounts available for annual billing).

So which program should you choose? Ultimately, it comes down to personal preference and what features are most important to you and your business.

If you need robust accounting features and don’t mind paying a monthly subscription fee, then QuickBooks might be the better option for you. However, if you’re looking for an affordable way to invoice clients and track employee hours worked, then FreshBooks could be a better fit.

Freshbooks Ach Fee

If you’re like most small business owners, you want to find ways to save money wherever possible. After all, every penny counts when you’re trying to run a successful operation. One area where many businesses can save is on credit card processing fees.

And if you use FreshBooks, there’s a good chance you can eliminate those fees entirely by using ACH payments.

What are ACH Payments?

ACH payments are electronic transfers that are processed through the Automated Clearing House network.

This network is used by banks and financial institutions to move money between accounts. When you make an ACH payment, the funds are transferred from your bank account to the recipient’s account without any involvement from a third-party processor.

Why Use ACH Payments?

There are several reasons why you might want to use ACH payments for your business:

They’re cheaper than credit card payments: Credit card processing fees can eat into your profits, but with ACH payments, those fees are waived.

They’re more secure than checks: Checks can be lost or stolen, but with ACH payments, the funds are transferred directly into the recipient’s account so there’s no risk of them being misused.

They’re faster than checks: Checks have to be mailed and then deposited, which can take days or even weeks. With ACH payments, the funds are transferred almost immediately so the recipient has access to them right away.

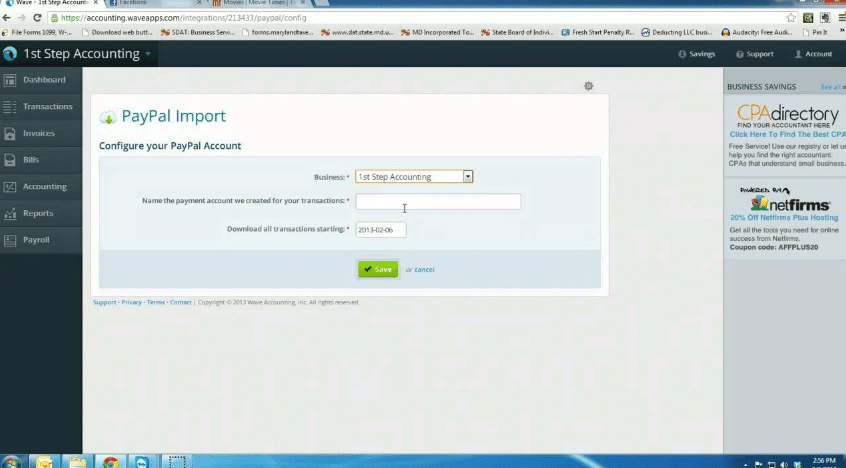

How to Set Up FreshBooks for ACH Payments If you’re already using FreshBooks , setting up Ach Payment s is easy .

Just follow these steps : Log in to your FreshBooks account and go to Settings > Payment Types . Click “Add Payment Type” and select “ACH/EFT/Wire Transfer.” Enter the required information and click “Create Payment Type.”

That’s it! You’ve now set up Ach Payments inFreshBooks . To learn more about how this feature works , check out this support article from FreshBooks .

Credit: www.merchantmaverick.com

Does Freshbooks Accept Amex?

Yes, FreshBooks accepts American Express (Amex) as a form of payment. You can use your Amex card to pay for your FreshBooks subscription, and you can also use it to pay invoices that you send to your clients through FreshBooks. To do so, simply enter your Amex card number and expiration date when prompted during checkout or invoice payment.

Can You Pay Through Freshbooks?

Yes, FreshBooks offers a number of different payment options to suit your needs. You can pay by credit card, PayPal, or bank transfer. If you have any questions about which payment option is best for you, our support team would be happy to help.

How Do I Add a Credit Card to Freshbooks?

Assuming you would like a step-by-step guide on how to add a credit card to your FreshBooks account:

1) Log in to your FreshBooks account and click on the ‘Settings’ gear icon in the upper right-hand corner.

2) From the drop-down menu, select ‘Billing.’

3) On the left side of the screen, select ‘Credit Cards.’

4) In the middle of the screen, click on the green ‘+Add Credit Card’ button.

5) A pop-up box will appear.

Enter in all of your credit card information and then click on the blue ‘Save Credit Card’ button.

6) Your credit card should now be successfully added to your FreshBooks account!

Does Freshbooks Have a Card Reader?

No, FreshBooks does not have a card reader. However, there are many other options available for businesses to accept credit and debit card payments. One option is to use a third-party processor like Square or PayPal.

These processors typically offer card readers that can be used with a smartphone or tablet. Another option is to use a point-of-sale (POS) system that includes a built-in card reader. POS systems are typically more expensive than third-party processors, but they offer additional features such as inventory management and customer tracking.

Conclusion

Can Freshbooks Process Credit Cards?

Yes, Freshbooks can process credit cards. You can add your credit card information to your account and then use that card to pay for invoices.

When you add a credit card to your account, you will be asked to enter the billing address, expiration date, and security code for the card. You can also set up auto-pay so that your invoices are automatically paid each month.