How Long Does Quickbooks Take to Deposit?

Anúncios

QuickBooks is a software program that helps small businesses manage their finances. One of the features of QuickBooks is the ability to deposit funds into a business bank account. The process of making a deposit in QuickBooks is quick and easy, but it may take a few days for the funds to actually appear in the business bank account.

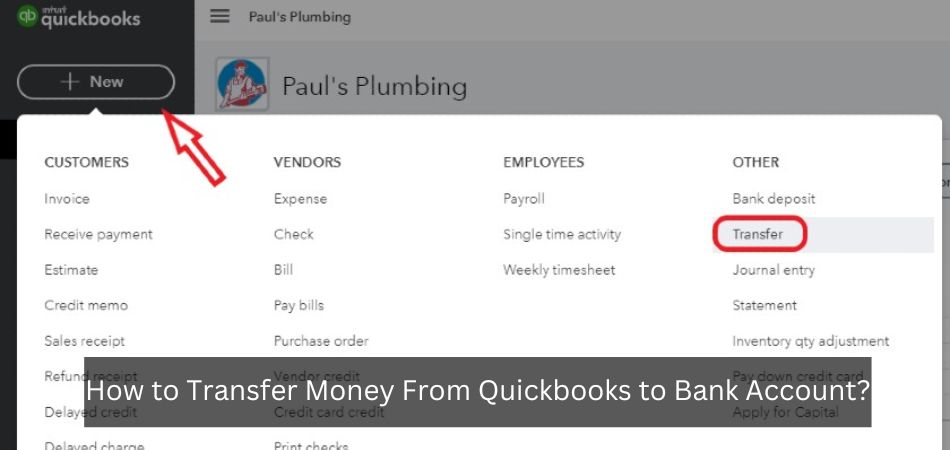

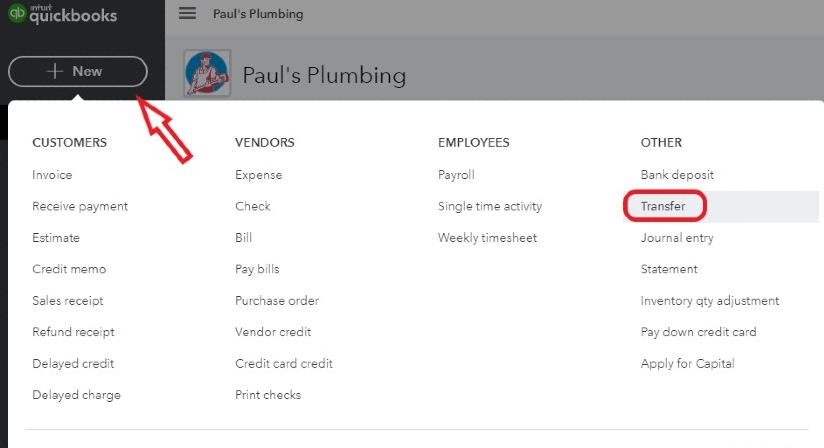

When a business owner wants to make a deposit into their QuickBooks account, they will first need to log into their software program. Once they are logged in, they will click on the “Banking” menu and then select “Make Deposits.” From there, the business owner will choose which invoices they would like to include in the deposit and then click “OK.”

Finally, the business owner will need to select which bank account they would like to make the deposit into and then click “Save & Close.”

The process of making a deposit in QuickBooks is quick and easy, but it may take a few days for the funds to actually appear in the business bank account. This is because banks typically take 1-2 days to process deposits.

So, while QuickBooks makes it easy to make deposits, business owners should still allow for some time before expecting those funds to be available in their bank accounts.

When it comes to QuickBooks, one of the most frequently asked questions is “How long does it take for QuickBooks to deposit?” The answer to this question can vary depending on a few factors, but in general, it shouldn’t take more than a few days for your deposit to show up in your account.

There are a few things that can affect how long it takes for your deposit to go through with QuickBooks.

One of the biggest factors is whether or not you have all of the necessary information entered correctly. If any of the information is incorrect, it can delay the process.

Another factor that can affect the timing of your deposit is the bank that you’re using.

Some banks are faster than others when it comes to processing deposits. If you’re using a smaller or regional bank, it’s likely that your deposit will take a little longer to go through.

In general, though, you should expect your QuickBooks deposit to show up within a few days.

If it takes longer than that, there may be an issue with the information that you entered or with the bank that you’re using. In either case, you should contact QuickBooks support for assistance.

Anúncios

Handling Upfront Deposits in QuickBooks Online

Does Quickbooks Do Instant Deposits?

Yes, QuickBooks does offer an instant deposit feature. This feature allows you to make a deposit into your account instantly, without having to wait for the funds to clear. The instant deposit feature is available for both personal and business accounts.

How Long Do Quickbooks Bank Transfers Take?

Bank transfers in QuickBooks usually take 3-5 business days. However, there are a few factors that can affect the timing of your transfer.

The first thing to consider is the type of bank account you’re using.

If you’re using a checking or savings account, the funds will likely be available much sooner than if you’re using a credit card or line of credit.

Another thing to consider is the time of day that you initiate the transfer. If you make the transfer during banking hours, it will go through much faster than if you make the transfer after hours or on a weekend.

Finally, keep in mind that some banks process transfers more quickly than others. If your bank is known for processing transfers quickly, you can expect your funds to be available sooner than if your bank is known for taking its time with transfers.

Overall, QuickBooks bank transfers usually take 3-5 business days.

However, there are a few factors that can affect how long it takes for your particular transfer to go through.

Anúncios

How Do I Speed Up a Deposit in Quickbooks?

Assuming you are referring to QuickBooks Online (QBO), there are a few things you can do to help ensure your deposits post as quickly as possible.

First, be sure that you have updated to the latest version of QBO. Newer versions generally include performance improvements that can help speed up various processes, including bank feeds.

Next, check your internet connection. A strong and stable connection is important for successful bank feed updates. If you are on a shared network or public Wi-Fi, try connecting to a different network if possible.

If your company file is particularly large or complex, it may take longer for QBO to process deposits (or other transactions). In this case, consider breaking up your deposit into smaller batches. This will help QBO process the information more quickly and efficiently.

Finally, if none of the above suggestions seem to be helping, reach out to QuickBooks support for assistance. They may be able to offer additional advice or troubleshoot any issues that may be causing delays in your bank feed updates.

How Fast Do You Get Paid by Quickbooks?

When you use QuickBooks for your business finances, you can get paid faster in a number of ways. First, QuickBooks can help you send invoices quickly and easily. You can also set up payment reminders to help ensure that your customers pay on time.

Finally, QuickBooks offers a number of payment options that can help you get paid even faster.

One way to get paid faster with QuickBooks is to send invoices quickly and easily. QuickBooks makes it simple to create and send invoices, so you can get paid sooner rather than later.

You can also set up payment reminders for customers who haven’t yet paid their invoice. This way, you can stay on top of payments and ensure that you’re getting paid in a timely manner.

Another way to get paid faster with QuickBooks is to take advantage of the various payment options that are available.

For example, QuickBooks Online allows you to accept credit card payments directly through the software. This means that customers can pay their invoices immediately, so you don’t have to wait for a check to come in the mail. There are also a number of other online payment options available through QuickBooks, such as PayPal and Google Checkout.

All of these options allow you to receive payments quickly and easily, so you can keep your business running smoothly.

Credit: quickbooks.intuit.com

Why Does Quickbooks Take So Long to Deposit Money

Has QuickBooks been taking longer than usual to deposit your money? If so, you’re not alone. Many QuickBooks users have reported that their deposits are taking much longer than they used to – sometimes up to several days.

There are a few possible reasons for this:

1. Your bank may have changed its policy on how quickly it processes deposits. If this is the case, there’s not much you can do except wait patiently for your deposit to go through.

2. You may be using an older version of QuickBooks that isn’t compatible with the latest banking standards. In this case, upgrading to a newer version of QuickBooks should solve the problem.

3. There could be an issue with the way your bank account is set up in QuickBooks.

This is something you’ll need to talk to a QuickBooks expert about in order to fix it.

Does Quickbooks Deposit on Saturday

It’s a common question we get here at QuickBooks: “Does QuickBooks deposit on Saturday?” The answer is yes! You can schedule deposits in QuickBooks Online to process on any day of the week, including Saturdays.

This can be helpful if you have employees who are paid on the weekends and need their paychecks deposited into their bank accounts ASAP.

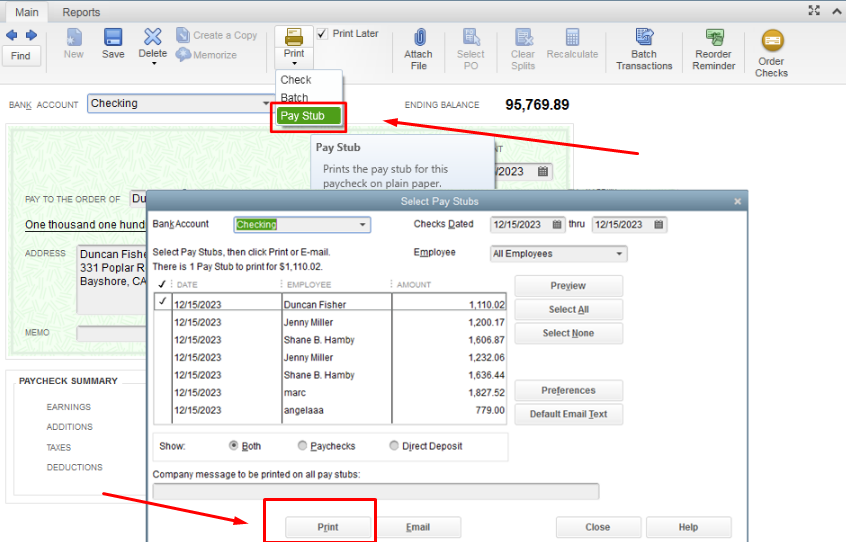

To schedule a deposit for Saturday, simply create a new deposit in QuickBooks Online and select Saturday as the Deposit Date. Then, add the checks or other payments you want to include in the deposit and hit Save & Close.

That’s it! Your deposit will process on Saturday and your employees will receive their funds accordingly.

If you have any questions about scheduling deposits in QuickBooks Online, feel free to reach out to our support team for assistance.

Quickbooks Instant Deposit Limit

As a business owner, you know that every dollar counts. That’s why QuickBooks Instant Deposit1 is such a helpful tool. With Instant Deposit, you can deposit funds into your account quickly and easily, without having to wait for a check to clear.

However, there is one thing to be aware of with Instant Deposit: the deposit limit. This limit is currently $10,000 per day (or $20,000 per rolling 7 days). So if you need to deposit more than that amount in a single day, you’ll need to use another method (such as ACH or wire transfer).

Of course, this limit may change in the future – so it’s always best to check with QuickBooks before making any large deposits. But for now, $10,000/day is the maximum you can deposit using Instant Deposit.

1https://quickbooks.intuit.com/r/banking/what-is-instant-deposit/?

Conclusion

Intuit QuickBooks is a software that helps small businesses manage their finances. One of the features of QuickBooks is the ability to deposit funds into a business bank account. The process is simple and can be completed in just a few minutes.

To deposit funds into your QuickBooks account, you will need to log into your account and go to the “Banking” tab. From there, you will select the account that you want to deposit the funds into and enter the amount of money that you want to deposit. Once you have entered all of the required information, you will click on the “Deposit” button and your funds will be deposited into your account immediately.