Does Accounting Software Handle Payroll?

Anúncios

Yes, accounting software does handle payroll. This is one of the most important functions of accounting software. Payroll is the process by which employees are paid for their work.

It includes keeping track of hours worked, calculating wages, and withholding taxes and other deductions from employee paychecks. Accounting software makes it easy to manage payroll by automating many of the tasks involved.

Are you considering using accounting software to help manage your business finances, but wondering if it can also handle payroll? The short answer is: yes! Many leading accounting software programs offer robust payroll features that can save you time and money.

When it comes to managing payroll, accounting software can automate many of the tasks that are traditionally done manually. For example, most programs can calculate employee wages based on hours worked, overtime, deductions, and other factors. They can also generate pay stubs and track vacation and sick days.

And when it’s time to file taxes, the software can prepare and electronically file the necessary forms.

In addition to saving you time, using accounting software for payroll can also help you avoid mistakes that could cost you money. For example, if you miscalculate an employee’s pay or make an error on a tax form, the consequences could be significant.

But with accounting software handling the details for you, those risks are greatly reduced.

If you’re looking for a comprehensive solution for managing your business finances – including payroll – be sure to check out some of the leading accounting software programs on the market today. With their powerful automation capabilities, they can take care of all your financial needs in one place – freeing up your time to focus on growing your business.

Anúncios

What is Payroll? Introduction to Payroll in 2022 | QuickBooks Payroll

Does Accounting Deal With Payroll?

Yes, accounting deals with payroll. Payroll is the process of paying employees for their work. This includes calculating how much each employee should be paid, issuing payments, and keeping track of employee hours worked.

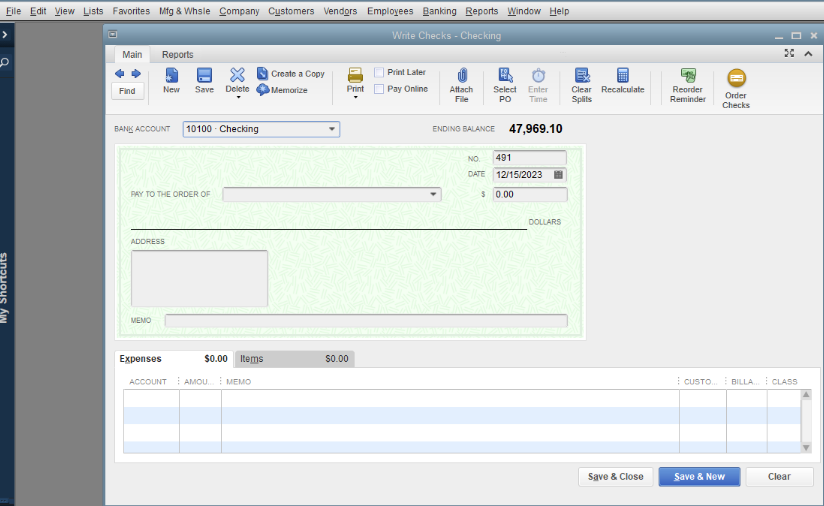

What Software Uses Payroll?

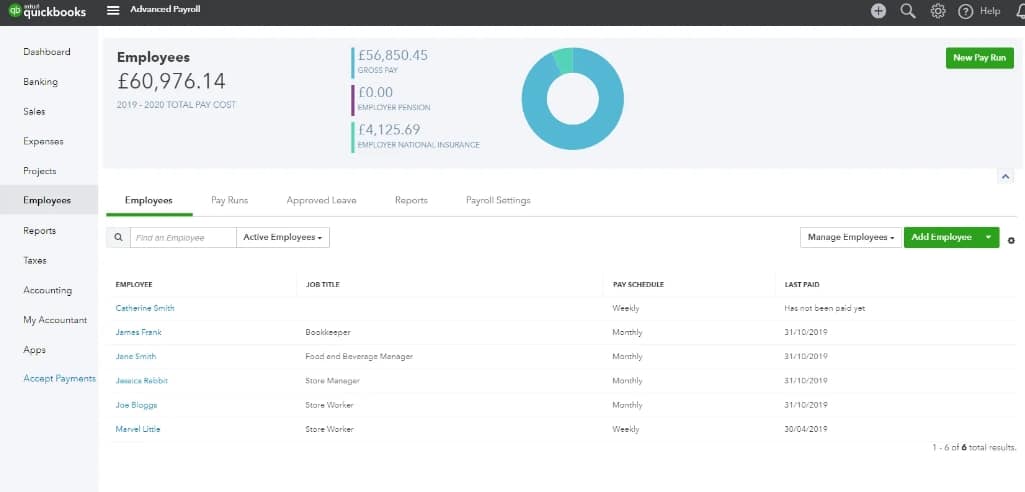

There are a variety of software programs that can be used for payroll. Some of the most popular include QuickBooks, ADP and Paychex. Each of these programs offers different features and benefits, so it’s important to choose one that will best meet your needs.

For example, QuickBooks is a popular accounting software program that also offers payroll features. ADP is a leading provider of payroll and human resources services. And Paychex is a leading provider of payroll and human resources solutions.

Anúncios

Does Payroll Fall under Bookkeeping?

Payroll definitely falls under bookkeeping! When you do your payroll, you’re essentially keeping track of how much money your employees are owed for the work they’ve done. This information is then used to prepare paychecks and/or direct deposit payments.

Payroll can be a complex task, but it’s definitely something that bookkeepers can handle.

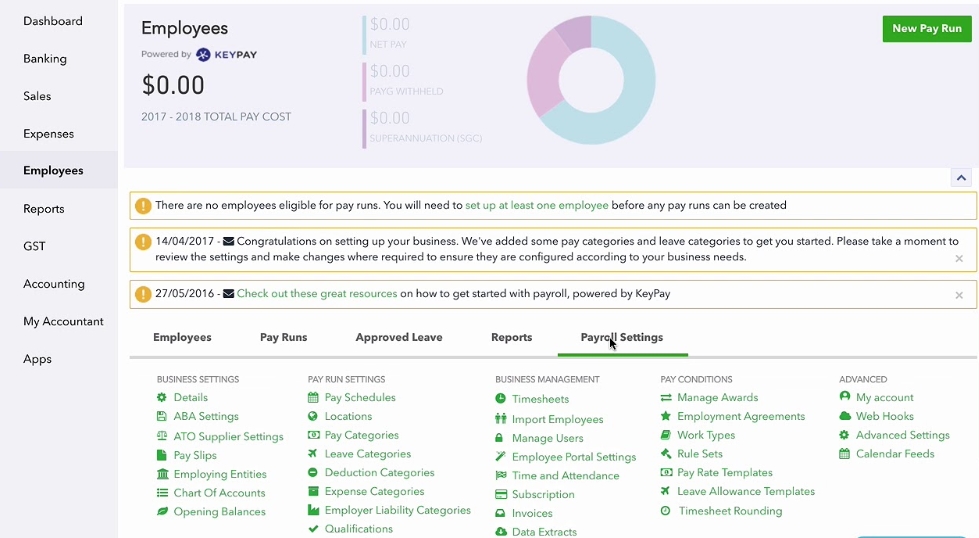

Can Xero Handle Payroll?

Yes, XERO can handle payroll. Here’s how:

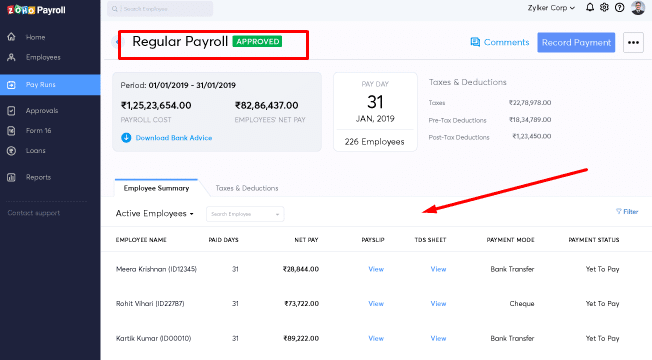

When you’re ready to pay your employees, simply create a pay run in Xero.

This will calculate each employee’s net pay based on the hours they’ve worked and any deductions or allowances that are applicable.

Once the pay run is complete, you can then use Xero to generate payslips for each employee. These can be emailed directly to employees or printed out for distribution.

Finally, once everything is approved, you can use Xero to process payments to your employees via direct deposit or cheque.

Credit: www.patriotsoftware.com

Does Xero Have Payroll

If you’re a small business owner, you’re probably always on the lookout for ways to streamline your operations and save time and money. One area that can be a real challenge is payroll. Fortunately, there are now online payroll solutions like Xero that make it easy to manage your payroll from start to finish.

Xero is a cloud-based accounting software platform that offers a complete payroll solution. With Xero, you can easily process paychecks for your employees, calculate taxes, and track employee hours and vacation time. You can also use Xero to create custom reports and run analytics on your payroll data.

One of the best things about using Xero for payroll is that it integrates with other popular business tools like QuickBooks Online and FreshBooks. This makes it easy to keep all of your business finances in one place. And if you ever need help with anything, Xero’s award-winning support team is always just a click or call away.

So if you’re looking for an easier way to manage your small business payroll, be sure to check out Xero!

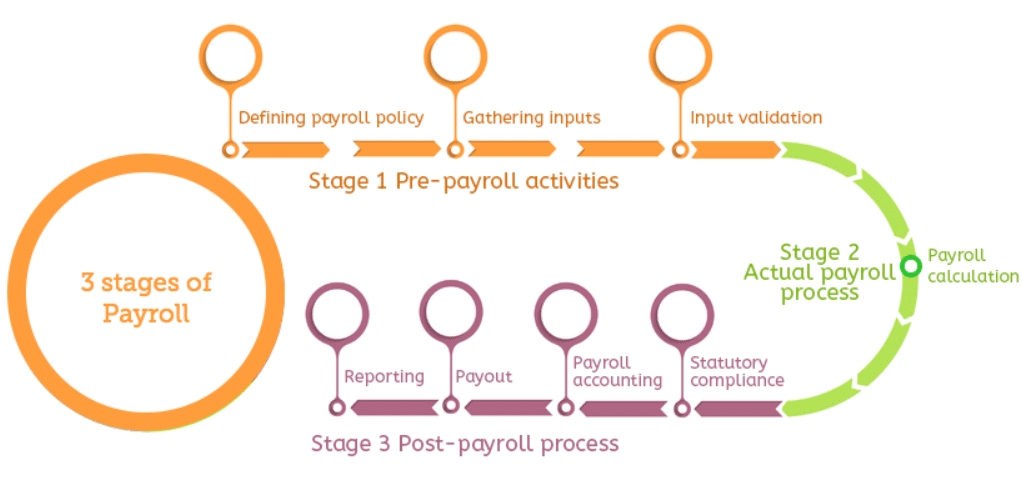

Payroll Accounting Entries

Payroll accounting is the process of tracking and managing employee compensation. This includes keeping track of hours worked, calculating wages, withholding taxes and other deductions, and issuing payments.

Payroll accounting is a critical part of running a business.

It helps ensure that employees are paid accurately and on time, and that all required taxes are withheld correctly. Payroll accounting can be complex, so it’s important to have a good understanding of the basics before getting started.

Here are the key components of payroll accounting:

Tracking employee hours: This is typically done using time tracking software or punch cards. Employees must clock in and out for their shifts, and their total hours worked per week are tracked.

Calculating wages: Wages are typically calculated by multiplying the number of hours worked by an hourly rate.

Overtime rates may also apply for employees who work more than 40 hours in a week. Salary employees may have their pay calculated differently.

Withholding taxes: Federal, state, and local taxes must be withheld from employee paychecks based on their income tax bracket.

Social security and Medicare taxes must also be withheld. Employers are responsible for paying these withholdings to the government agencies involved.

How to Calculate Payroll in Accounting

Assuming you would like a blog post discussing how to calculate payroll in accounting:

Calculating payroll can be a daunting task for those unfamiliar with the process. However, by following a few simple steps and keeping some key information in mind, anyone can quickly and easily calculate payroll.

The first step is to gather all of the necessary information. This includes each employee’s gross pay, any deductions that need to be taken out, and the employer’s tax liability. Once you have all of this information, you can begin calculating payroll.

To calculate an employee’s gross pay, simply multiply their hourly wage by the number of hours they worked. For example, if an employee makes $15 per hour and worked 40 hours during the week, their gross pay would be $600. If there are any deductions that need to be taken out of an employee’s paycheck, such as taxes or insurance premiums, simply subtract those amounts from the gross pay.

For example, if an employee owes $100 in taxes and has $50 in insurance premiums deducted from their paycheck, their net pay would be $450 ($600 – $100 – $50). Finally, once you have calculated each individual employee’s net pay, you can add up all of the totals to get your company’s total payroll for the period.

Calculating payroll may seem like a complicated task at first glance, but it is actually quite simple when broken down into its component parts.

By gathering all of the necessary information and following these simple steps, anyone can quickly and easily calculate their company’s payroll.

Conclusion

Yes, accounting software can handle payroll. This is because payroll is a financial transaction that needs to be recorded in the books of accounts. The software can generate the necessary reports for this purpose.