Does Xero Have Payroll?

Yes, Xero has a payroll feature that businesses can use to manage employee compensation. This includes calculating and issuing payments, as well as tracking employee hours worked and vacation time. The payroll feature is integrated with other aspects of the Xero software, such as accounting and human resources, to make managing employee compensation a streamlined process.

If you’re thinking about using Xero for your business’ payroll, you may be wondering if the software has this capability. The answer is yes! Xero offers a comprehensive payroll solution that can save you time and money.

With Xero, you can manage all of your employee’s information in one place. This includes their contact details, tax information, leave balances, and more. You can also set up automatic payments so that your employees are paid on time, every time.

Plus, Xero integrates with many popular accounting software programs, making it easy to keep track of your finances.

If you’re looking for a complete payroll solution that is easy to use and saves you time and money, then Xero is the right choice for you!

Credit: www.youtube.com

Anúncios

Does Xero Have a Payroll Function?

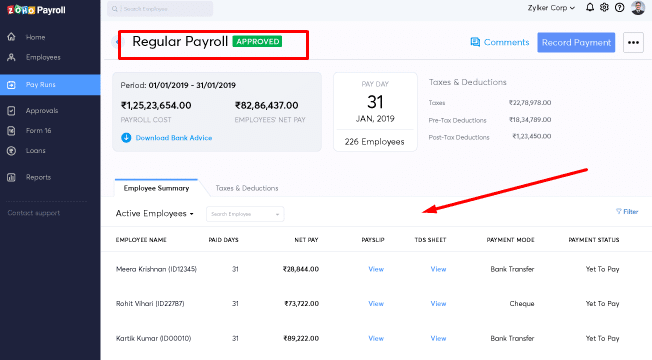

Yes, Xero has a payroll function. This allows you to manage your employee’s pay and deductions, as well as generate payslips and reports.

How Do I Set Up Xero Payroll?

If you’re looking to set up Xero payroll, there are a few things you’ll need to do. First, create an account and sign in to Xero. Then, click the “Add-ons” tab and select “Payroll.”

Follow the prompts to complete the setup process. Once you’re finished, you’ll be able to use Xero payroll to manage your employees’ pay and benefits.

Anúncios

How Does Xero Integrate Payroll?

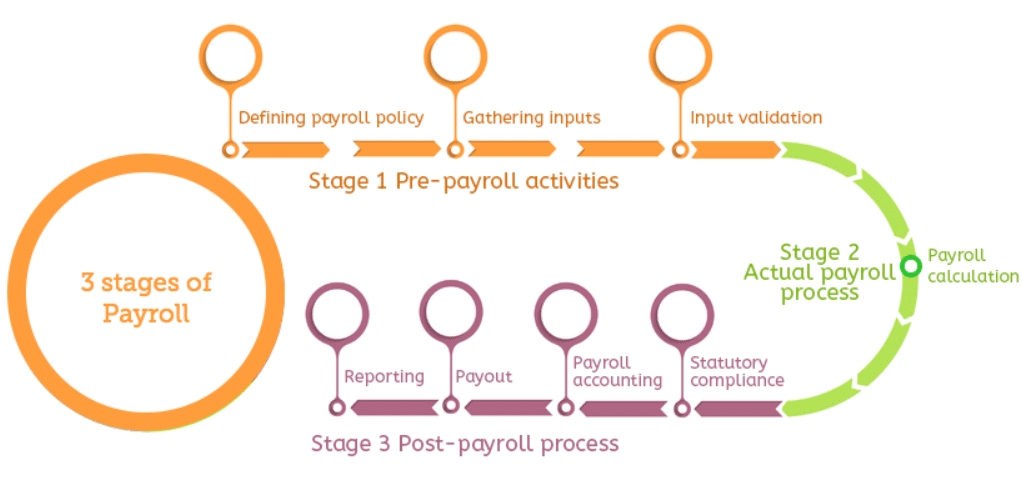

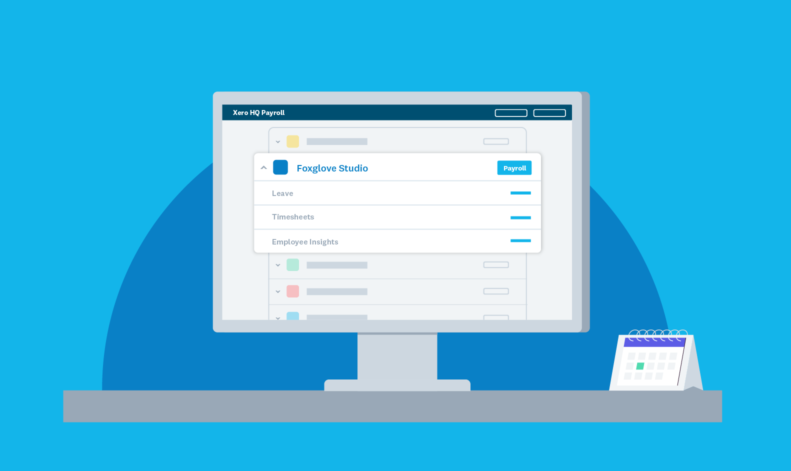

Xero’s payroll integration is one of the most popular features of the accounting software. The integration allows businesses to manage their payroll processes and employee data within Xero, making it a convenient and efficient way to run their business.

With Xero’s payroll integration, businesses can:

– Track employee hours and earnings

– Generate payslips for employees

– Calculate employee tax deductions

Is Myob Better Than Xero?

There is no simple answer to the question of whether MYOB or Xero is better. The two accounting software programs offer different features and benefits, so it really depends on the specific needs of your business as to which one would be a better fit. That being said, let’s take a closer look at each program to see how they compare.

MYOB was founded in 1991 in Australia and provides accounting software for small businesses. It offers a range of features including invoicing, inventory management, payroll, and tax preparation. MYOB also integrates with other business applications such as POS systems and ecommerce platforms.

Xero was founded in 2006 in New Zealand and provides online accounting software for small businesses. Its key features include invoicing, bank reconciliation, expense tracking, and reporting. Xero also offers a mobile app so that you can access your account anywhere, anytime.

So which program is better? Again, it really depends on your specific needs as a business owner. If you’re looking for comprehensive accounting software with lots of bells and whistles, then MYOB might be a good choice for you.

However, if you’re simply looking for an easy-to-use program that allows you to manage your finances on the go, then Xero might be a better option.

Xero and Single Touch Payroll | Xero

Xero Payroll

If you’re running a small business, you know how important it is to stay on top of your finances. And when it comes to payroll, Xero has you covered.

Xero’s online payroll software makes it easy to manage your employee’s pay and leave, with all the information you need in one place.

You can run payroll yourself or outsource it to a certified advisor, and either way you’ll get access to handy features like:

– Automatic tax calculations

– payslip generation

– Reporting and compliance tools.

Plus, Xero integrates with a range of other popular business software, so you can keep all your financial information in one place.

Xero Login

If you’re a small business owner or entrepreneur, chances are you’ve heard of Xero. Xero is a cloud-based accounting software that allows users to manage their finances and bookkeeping online. While there are many different accounting software options out there, Xero has become one of the most popular choices for small businesses in recent years.

One big reason for this is that it’s very user-friendly and easy to get started with. In this blog post, we’ll give you a detailed overview of the Xero login process so that you can get started using this powerful software.

When you first create your Xero account, you’ll be asked to choose a unique URL for your login page.

This will be the page where you (and your employees or team members) will go to log in to your account each time. Once you have chosen your URL, simply go to that page and enter your email address and password to log in. If you forget your password, no worries – just click the “Forgot Password?” link on the login page and follow the instructions to reset it.

Once you’re logged in, you’ll see your Dashboard – this is where all of your financial information will be displayed. From here, you can view things like recent transactions, upcoming bills, invoices, reports, etc. You can also access all of the other features and tools that Xero offers from here.

So take some time to explore around and familiarize yourself with everything that Xero has to offer!

We hope this overview of the Xero login process was helpful – if you have any questions or need help getting started with anything else related to Xero, feel free to reach out to us anytime!

Xero Payslips

If you’re a small business owner, then you know how important it is to keep track of your finances. One way to do this is by using Xero, an online accounting software that allows you to track your income and expenses. Another way to keep track of your finances is by using payslips.

Payslips are like mini-statements that show how much money you’ve earned and how much tax has been deducted from your pay.

Using Xero, you can generate payslips for your employees which can be emailed or printed out. This article will show you how to generate payslips in Xero.

To generate payslips in Xero, first go to the “Payroll” tab and click on the “Payslips” sub-tab. Then, select the employee whose payslip you want to generate and click on the “Generate Payslip” button. A new window will pop up where you can enter the relevant information such as the pay period and payment date.

Once everything is filled out, click on the “Generate Payslip” button again and Xero will create a PDF of the payslip which you can then email or print out for your employee.

That’s all there is to it! Generating payslips in Xero is quick and easy, and it will help you keep track of your employees’ earnings and deductions.

Xero Pricing

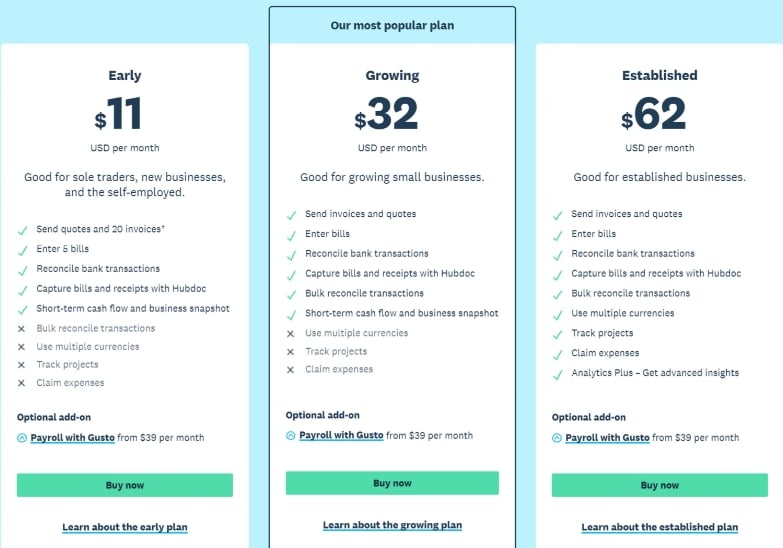

Xero is a cloud-based accounting software with plans for small businesses, growing businesses, and accountants or bookkeepers. The pricing for each plan is based on the number of monthly transactions.

The Small Business plan starts at $9 per month (if paid annually) and allows up to 50 invoices, bills, and quotes per month.

The Growing Business plan starts at $30 per month (if paid annually) and allows up to 500 invoices, bills, and quotes per month. The Accountant or Bookkeeper plan starts at $60 per month (if paid annually) and allows an unlimited number of invoices, bills, and quotes per month.

There are also add-ons that can be added to any plan for an additional cost.

These include Xero Projects ($5/month), Xero Payroll ($1/employee/month), Xero Expenses ($4/month), and more.

Whether you’re just starting out or have been in business for years, Xero has a pricing plan that will fit your needs. And if you need help getting started or have any questions along the way, their support team is always available to help.

Conclusion

If you’re looking for a comprehensive accounting software solution that includes payroll, Xero is a great option. Xero offers a complete payroll solution that includes everything from employee onboarding and tracking to tax filing and compliance. And because it’s all integrated with the rest of Xero’s accounting features, you can manage your finances in one place.