Does Quickbooks Do Taxes?

Quickbooks is a bookkeeping software that allows users to track their finances and prepare for tax season. While Quickbooks does not do taxes itself, it can greatly simplify the tax preparation process for small businesses and individuals.

For many business owners, Quickbooks is an essential tool for managing their finances.

The software can track income and expenses, generate financial reports, and help with budgeting. Quickbooks also offers features specifically for tax preparation, such as the ability to import data from 1099 forms and create W-2 forms.

No, Quickbooks does not do taxes. Quickbooks is an accounting software that can be used to track your income and expenses, create invoices and reports, and manage your finances. While it can be a helpful tool in managing your taxes, Quickbooks does not actually file or prepare tax returns.

Accounting 101: Be Ready at Tax Time! | QuickBooks Training Webinars 2019

Can I File My Taxes on Quickbooks?

If you’re a small business owner, there’s a good chance you’re using QuickBooks to manage your finances. And if you’re using QuickBooks, you might be wondering if you can use it to file your taxes as well.

The answer is yes!

You can use QuickBooks to file your taxes. In fact, many small business owners find that QuickBooks makes tax time a lot easier.

Here’s how it works: when you enter information into QuickBooks, it automatically categorizes it for tax purposes.

That means when tax time comes around, all of the information you need is already organized and ready to go. All you have to do is export it to your tax software and file away!

Of course, every business is different and there may be some special circumstances that require additional work come tax time.

But if you’re using QuickBooks, chances are good that filing your taxes will be quick and easy.

Anúncios

What Reports from Quickbooks are Needed for Taxes?

As a business owner, you’re responsible for ensuring that your taxes are filed correctly and on time. To do this, you’ll need to gather all of the relevant information from QuickBooks. Here’s a rundown of the reports you’ll need:

1. The Profit & Loss Report will show you your total income and expenses for the year. This is helpful in determining how much tax you owe.

2. The Balance Sheet Report provides a snapshot of your assets and liabilities at a given point in time.

This is helpful in determining if you have the financial resources to pay any taxes owed.

3. The Accounts Receivable Summary shows how much money is owed to your business by customers. This is important information for tax purposes as it can affect the amount of tax you owe or are due back from the government.

4. The Accounts Payable Summary shows how much money your business owes to suppliers and others.

Do Tax Accountants Use Quickbooks?

There is no one-size-fits-all answer to this question, as the type of accounting software that tax accountants use can vary depending on the size and scope of their practice. However, many tax accountants do use QuickBooks for their accounting needs, as it is a powerful and user-friendly software program that can help them to manage their finances more effectively. QuickBooks can be used to track income and expenses, create invoices and estimates, manage payroll and customers, and much more.

If you are a tax accountant who is looking for an effective way to manage your finances, QuickBooks may be the right solution for you.

Anúncios

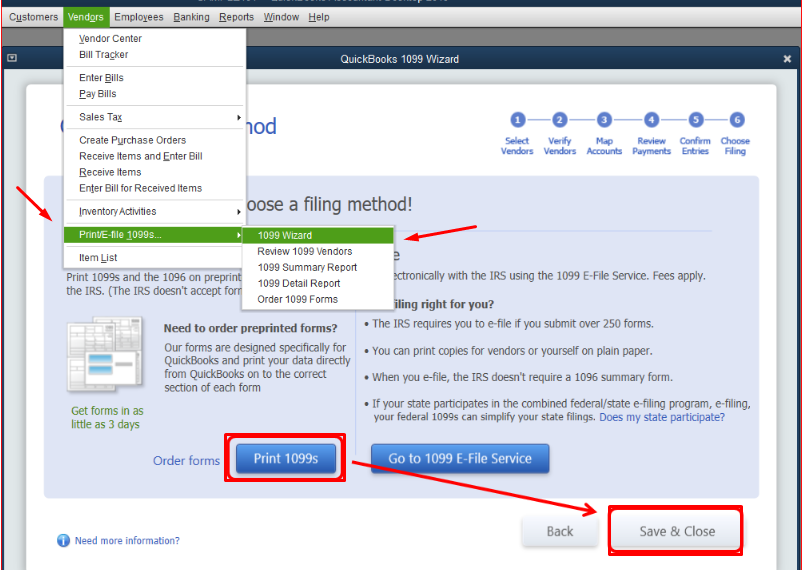

Credit: www.teachucomp.com

Does Quickbooks Do Payroll Taxes

When you use QuickBooks for your business finances, you can also use it to run your payroll. This includes calculating and paying your employees’ taxes. QuickBooks can handle all federal, state, and local taxes, as well as any other required deductions.

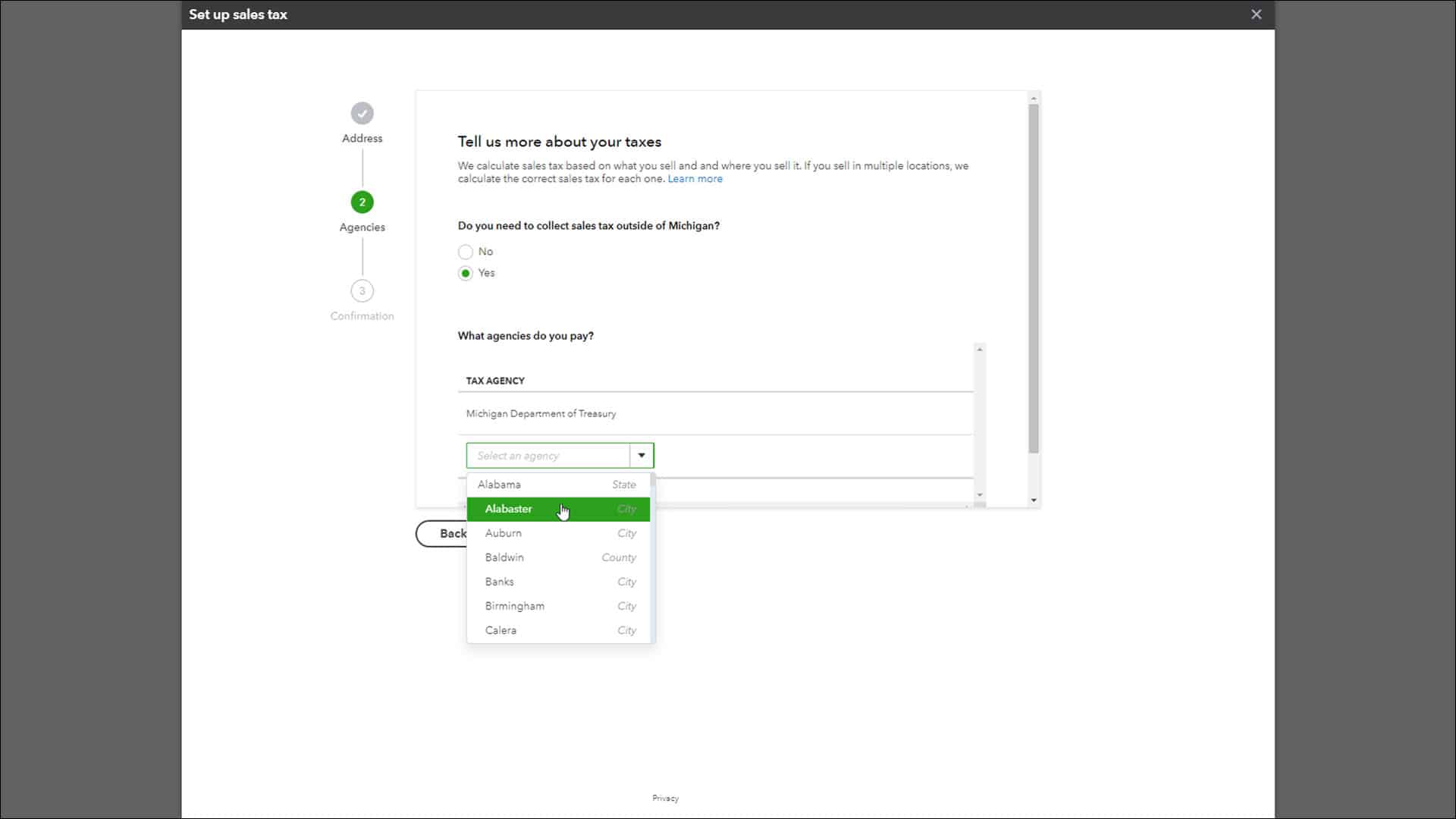

To set up QuickBooks for payroll taxes, you’ll first need to add all of the relevant tax agencies as payees in the software. You’ll then need to configure your tax settings, which will vary depending on the type of business you have and where you’re located. Once that’s done, you can run your payroll and QuickBooks will take care of the rest.

There are a few things to keep in mind when using QuickBooks for payroll taxes. First, make sure that you always enter the latest tax rates into the software. These rates change regularly, so it’s important to stay up-to-date.

Second, if you have employees in multiple states or jurisdictions, you’ll need to set up separate tax profiles for each one. Finally, remember that QuickBooks doesn’t file or pay your taxes for you – that’s still your responsibility. But using QuickBooks can help make the process a whole lot easier.

Quickbooks Online Tax Return Preparation

If you’re a small business owner, there’s a good chance you’re using QuickBooks Online (QBO) to keep track of your finances. And come tax time, you may be wondering if you can prepare and file your taxes using QBO.

The answer is yes!

You can use QuickBooks Online to prepare and file your federal and state income taxes. Here’s a step-by-step guide on how to do it:

1. Gather all the necessary documents.

This includes your W-2 forms from each employer, 1099 forms for any freelance work or other income sources, and records of any deductions or expenses.

2. Log in to QuickBooks Online and go to the Taxes tab. Click on File My Taxes.

3. Select the appropriate tax form – either 1040 for individual returns or 1120 for business returns – and then click Start Filing My Taxes.

4. Enter all the required information into the online form. This includes your personal information, income, deductions, etc.

When you’re finished, click Continue to Review & Pay Taxes Owed (if any).

5. Review your return for accuracy and then submit it electronically to the IRS by clicking File Now & Pay Taxes Owed (if any). That’s it!

Quickbooks Free Tax Filing

In the past, if you wanted to file your taxes using Quickbooks, you had to purchase the software. However, Quickbooks now offers a free tax filing service for federal and state taxes. This is a great option for small businesses and self-employed individuals who need to file their taxes but don’t want to spend the money on Quickbooks.

The process is simple and easy to follow, and you can even e-file your taxes directly from Quickbooks. If you’re looking for a free way to file your taxes, definitely check out Quickbooks Free Tax Filing!

Conclusion

Quickbooks is a software program that helps businesses manage their finances. It can track income and expenses, create invoices and reports, and even prepare tax returns. While Quickbooks is a great tool for managing finances, it is not a replacement for a qualified accountant or tax professional.