How to Reconcile in Quickbooks?

Anúncios

If you have ever found yourself in the position of having to reconcile your Quickbooks, you know it can be a daunting task. Whether you are reconciling for the first time or the hundredth time, there are some basic steps that you need to follow in order to ensure a successful reconciliation.

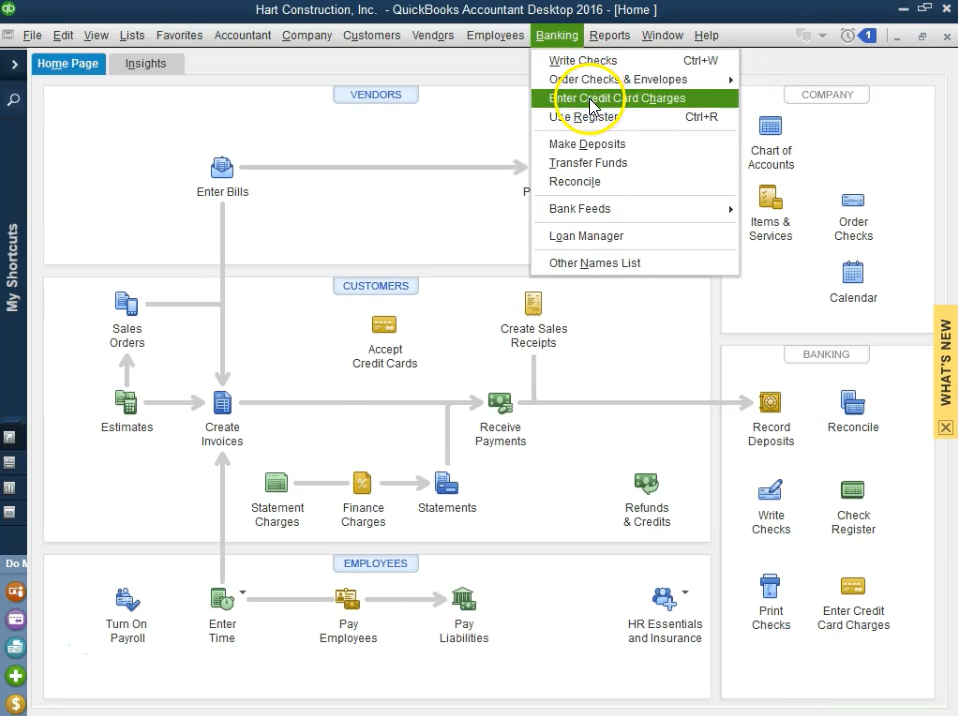

- From the Quickbooks home page, click on the “Banking” tab

- On the Banking page, find the account you want to reconcile and click on its name

- On the Account History page, click on the “Reconcile” button

- Enter in the ending balance and statement date from your bank statement, then click “Continue

- Review all of the transactions that are flagged as uncleared, then check off each one that appears on your bank statement

- When you’re finished, click “Reconcile Now

How to reconcile your accounts in QuickBooks Online

How Do You Reconcile in Quickbooks Step by Step?

Assuming you would like a step-by-step guide on how to reconcile in QuickBooks:

1. Go to the Company menu and select Make General Journal Entries

2. In the first field, select the date that you want to reconcile.

This is typically the last day of the month being reconciled.

3. In the next field, enter “Reconciliation” for the name/description of this entry.

4. Enter your Beginning Balance in the next field.

You can find this number on your bank statement under “Beginning Balance.” If you have never reconciled before in QuickBooks, your beginning balance will be $0.00.

5. Enter any service charges or interest earned that is not yet reflected in QuickBooks in the next two fields respectively labeled Debit and Credit 6. Next, add all deposits that have been made since your last reconciliation but are not yet reflected in QuickBooks under Deposits column 7..

Finally, list any checks written, automatic payments made, or withdrawals since your last reconciliation under Checks column 8..

Anúncios

How Do I Do a Bank Reconciliation in Quickbooks?

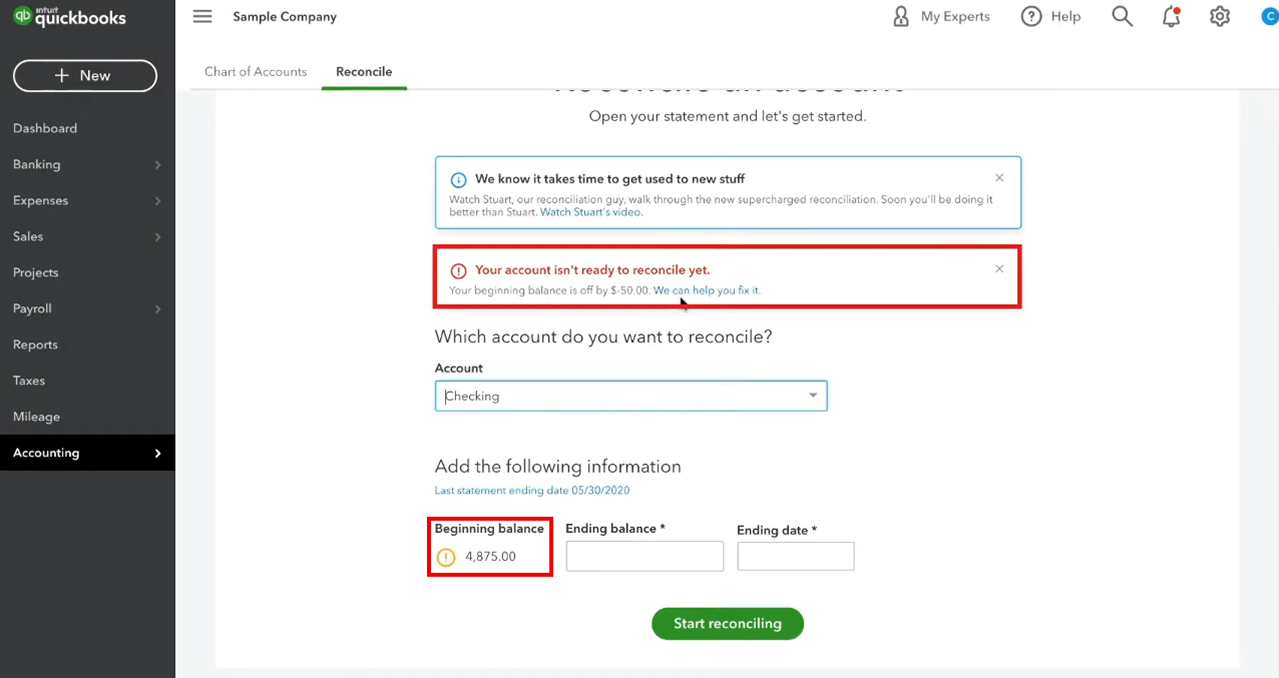

Assuming you’re asking how to reconcile a bank statement in QuickBooks Online:

To reconcile a bank statement in QuickBooks Online, go to the Gear icon > Tools > Reconcile.

From the Account drop-down, select the account you want to reconcile.

The Ending Balance and Statement Date fields will populate based on your selection. If the ending balance and statement date are correct, select Continue. If not, update the information and select Continue.

On the next screen, enter your Opening Balance. This is typically the beginning balance from your bank statement. Then, begin matching each transaction on your bank statement with a corresponding transaction in QuickBooks Online.

For each row on your bank statement:

Enter the Check Number (if there is one). If there isn’t a check number on your bank statement (for example, if it’s an ATM withdrawal), leave this field blank.

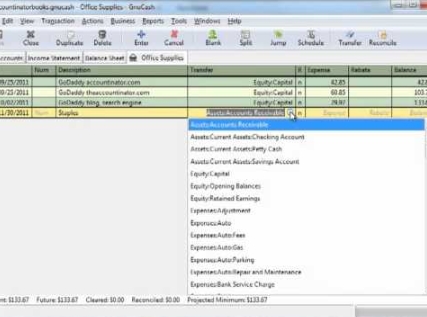

In the first column labeled “This Transaction Appears On My Statement,” use the drop-down menu to choose how this row should be categorized in QuickBooks Online: Add new, Match existing or Skip this line item entirely

Add new: Choose this option when there’s no corresponding transaction in QuickBooks Online for this row on your bank statement

Match existing: Choose this option when there’s already a transaction in QuickBooks that matches what appears on your bank statement for this row

Skip line item entirely: You might choose to skip an entire line item if it’s something that shouldn’t be included in reconciliation like interest earned or a service fee charged by your financial institution

In some cases (like ATM withdrawals), you’ll see two transactions for one line item on your bank statements because both debits and credits are represented. In these cases match each side of the ATM withdrawal separately by selecting “Add New” twice – once for the Debit side and once for Credit side of that particular ATM Withdrawal

How Does Reconcile Work in Quickbooks?

Assuming you are referring to the reconcile feature in QuickBooks Online (QBO), reconciliation is the process of matching transactions in your QBO account with those on your bank or credit card statement. This is done by comparing the ending balance on your statement with the ending balance in QBO.

The goal of reconciling is to have these two balances match.

This means that all transactions entered into QBO (including any fees or interest charged by your financial institution) have been accounted for. Reconciling also allows you to catch and fix any errors, such as duplicate entries or payments that have not cleared the bank yet.

To reconcile an account in QBO, go to the Banking menu and select Reconcile.

Then, follow these steps:

1. Select the account you want to reconcile from the Account drop-down menu. This will bring up all un-reconciled transactions for that account.

2. Enter the Ending Balance and Statement Date from your bank statement. These can be found at the top of most statements next to where it says “Balance Forward”.

3. If there are any service charges or interest fees listed on your statement, enter them in the Service Charges and Interest fields respectively.

Anúncios

How Often Should I Reconcile Quickbooks?

There’s no set answer to how often you should reconcile your QuickBooks, but we recommend doing it at least once a month. This will help ensure that your books are accurate and up-to-date, and will also help you catch any errors or discrepancies early on.

If you have a lot of transactions going through your account each month, you may want to reconcile more frequently.

And if your business is seasonal or has irregular income, you may want to reconcile more often in busier periods and less often during slower times.

The most important thing is to stay on top of your reconciliation and to do it regularly. This will help keep your books in good order and will save you time and headache down the road.

Credit: www.smbaccountants.com

How to Reconcile in Quickbooks Desktop

If you’re like most business owners, you probably use Quickbooks to keep track of your finances. And if you’re like most business owners, you’ve probably had to deal with the occasional discrepancy between what Quickbooks says you have and what your bank account says you have. When this happens, it’s important to reconcile your accounts so that everything is accurate.

Here’s how to do it:

1. Go to the Banking menu and select Reconcile.

2. Enter the date range for the reconciliation.

This should be the period of time since your last reconciliation.

3. Enter your ending balance and click OK.

4. Quickbooks will now show you all of the transactions that occurred during that time period.

Compare these transactions to your bank statement and make sure they match up. If there are any discrepancies, make note of them so you can investigate further later on.

How to Reconcile in Quickbooks Desktop 2022

Welcome to our How to Reconcile in Quickbooks Desktop 2022 tutorial. This guide will teach you everything you need to know about reconciling your accounts in Quickbooks Desktop 2022. We’ll cover topics like how to launch the reconcile feature, how to add and remove transactions, how to match up your bank statement withQuickbooks, and more.

By the end of this tutorial, you’ll be an expert at reconciling your accounts in Quickbooks Desktop 2022!

How to Reconcile in Quickbooks Online

In order to reconcile in Quickbooks Online, you will need to follow these steps:

1. Go to the Company menu and select Reconcile.

2. Select the account you want to reconcile from the Account drop-down.

3. Enter the statement ending date and balance. The beginning date will default to the last reconciliation date. If this is your first time reconciling this account, enter the open period beginning date for your company file.

Learn more about entering opening balances for new accounts.

4. Check or uncheck transactions as necessary so that they match what’s on your bank statement. To learn more about how to add, edit, or delete transactions during reconciliation, see Add, change, or delete a transaction during reconciliation .

When you’re finished making changes to transactions, click Save & Close .

5. Click Reconcile Now . Review any discrepancies and make any necessary changes before clicking Finish Now .

Conclusion

If you’re using Quickbooks to manage your finances, you may occasionally need to reconcile your accounts. This process ensures that the balances in Quickbooks match the actual balances in your bank or credit card accounts. To reconcile in Quickbooks, follow these steps:

1. Go to the Banking menu and select Reconcile.

2. Select the account you want to reconcile from the drop-down menu.

3. Enter the ending balance and statement date from your bank or credit card statement.

4. Click Start reconciling. Quickbooks will now compare your transactions to those on your statement and flag any discrepancies.

5. Review each discrepancy and make any necessary changes.