What is the Best Accounting Software for Rental Properties?

Are you a landlord looking for the best accounting software to manage your rental properties? If so, you’ve come to the right place. In this article, we’ll provide an overview of the best accounting software for rental properties, as well as some key features to look for in a good accounting program.

When it comes to choosing accounting software for rental properties, there are a few things to keep in mind. First and foremost, you’ll want to find a program that is easy to use and provides all of the features you need. Additionally, it’s important to find software that fits your budget and offers good customer support.

If you’re a landlord, then you know how important it is to keep track of your finances and stay organized. The best way to do this is by using accounting software designed specifically for rental properties.

There are a lot of different accounting software programs out there, so how do you know which one is right for you?

Here are a few things to consider when choosing the best accounting software for your rental property business:

1. Ease of use: You want something that’s easy to use and understand, especially if you’re not an accountant or don’t have much experience with bookkeeping. Look for software with a user-friendly interface and clear instructions.

2. Functionality: Make sure the software has all the features you need, such as the ability to track rent payments, expenses, and income. Many programs also offer additional features like unit management and online payment processing, which can be helpful if you manage multiple properties.

3. Price: Of course, you’ll want to find something that’s affordable – but don’t sacrifice quality for price.

There are plenty of high-quality accounting software programs available at reasonable prices. Just because something is free doesn’t mean it’s the best option; likewise, expensive doesn’t always equal quality either. Do your research and compare features before making your final decision.

Should You Use Quickbooks for Rental Properties?

Does Quickbooks Work for Property Management?

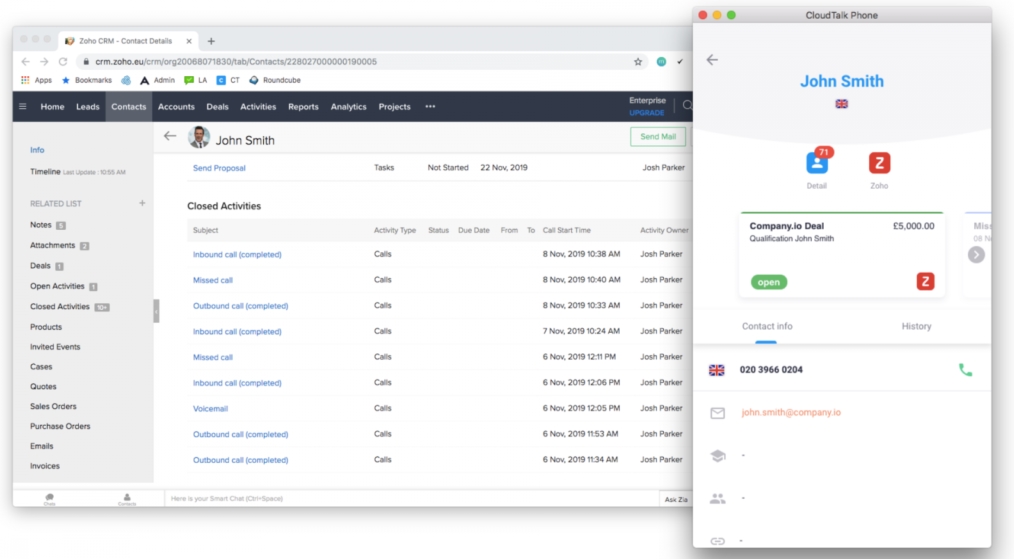

There is a lot of software out there that property managers can use to help run their business. QuickBooks is one option that some property managers choose. While it may work for some, it might not be the best fit for others.

Here are some things to consider if you’re thinking about using QuickBooks for your property management business:

1. Ease of Use – One thing to consider with any software is how easy it is to use. If you’re not familiar with accounting principles or bookkeeping, then QuickBooks might not be the best option for you.

There are other software options out there that might be more user-friendly and easier to learn.

2. Features – Another thing to think about is what features you need in a property management software system. QuickBooks offers basic accounting features like invoicing and tracking expenses.

But, it doesn’t have more robust features like lease management or work order tracking that some other systems offer.

3. Cost – QuickBooks can be a relatively affordable option when compared to other property management software systems on the market. However, keep in mind that you’ll need to purchase additional licenses if you have multiple properties or users who need access to the system.

4. Support – If you encounter any problems while using QuickBooks, make sure to check out their support options first before reaching out to customer service. They have an extensive online knowledge base where you can find answers to common issues and questions.

Anúncios

Can Tenants Pay Through Quickbooks?

There are many ways that landlords and tenants can manage their finances, but QuickBooks is not one of them. While there are some workarounds, it’s generally not recommended to use QuickBooks for rent payments.

The reason for this is that QuickBooks was designed for businesses, not individuals.

So while it has a lot of features that can be helpful for managing finances, it’s not set up in a way that makes it easy to track and manage rental payments.

Additionally, QuickBooks doesn’t have any built-in features for handling security deposits or other types of rental payments. This means that if you’re using QuickBooks to manage your rentals, you’ll need to find another way to track and manage those payments.

Overall, QuickBooks is a great tool for managing business finances, but it’s not the best choice for managing rental properties. There are other tools out there that are better suited for this purpose. If you’re looking for a tool to help you manage your rentals, we recommend checking out Rentec Direct or AppFolio Property Manager.

How Do I Keep Track of My Rental Income?

Assuming you are referring to keeping track of rental income for tax purposes, there are a few key ways to do this.

The first way is to keep good records throughout the year. This means tracking all income and expenses related to your rental property.

This can be done using a spreadsheet or software specifically designed for managing rental properties.

Another way to keep track of rental income is by using depreciation. Depreciation is an IRS-allowed expense that can be taken on your taxes each year regardless of actual repairs or improvements made to the property.

This can be a helpful tool in reducing your overall taxable income from your rentals.

Finally, it’s also important to keep in mind that there are different types of rental income, such as passive and active income. Passive income is generally money earned with little effort on your part, while active income requires more work from you.

Different types of rental incomes are taxed differently, so it’s important to understand which category your earnings fall into.

Overall, maintaining accurate records and understanding how different types of rental incomes are taxed will help you stay on top of your finances and ensure you’re prepared come tax time.

Anúncios

How Do I Record a Rental Property in Quickbooks?

Assuming you would like a step-by-step guide on how to record a rental property in QuickBooks:

1. Open QuickBooks and go to the “Lists” menu. Click “Chart of Accounts.”

2. In the Chart of Accounts window, click the “Account” drop-down menu and select “New.”

3. In the Account Type field, select “Other Asset.” Enter the name of your rental property in the Name field and click “OK.”

4. Go to the Company menu and select “Make General Journal Entries.”

5. In the first line of the journal entry, select your newly created asset account from the Account drop-down menu. Enter the purchase price of your rental property in the Debit column.

Leave the Credit column blank. Click OK when you’re done.

6. Now it’s time to record any improvements or repairs you make to your rental property as they occur.

To do this, go back to Company > Make General Journal Entries and create a new journal entry for each repair/improvement made using your asset account and entering repair/improvement costs in either the Debit or Credit column (depending on whether you paid for them with cash or credit).

7 Finally, every month when you receive rent payments from your tenants, go to Banking > Make Deposits and enter these payments into QuickBooks under your asset account. That’s it!

You’re now set up to track all income and expenses related to your rental property in QuickBooks!

Credit: www.stessa.com

Quicken Rental Property Manager

As a landlord, you’re responsible for a lot of different things. You have to find good tenants, keep up with repairs and maintenance, and make sure your property is compliant with all the relevant laws and regulations. It can be a full-time job, and then some.

That’s where Quicken Rental Property Manager comes in. This software makes it easy to keep track of everything related to your rental property, from tenant information to repair requests. And because it’s from Quicken, you know it’s reliable and easy to use.

With Quicken Rental Property Manager, you can:

• Keep track of important tenant information like contact info, lease terms, and payment history

• Schedule and track repairs and maintenance tasks

Property Management Accounting Software

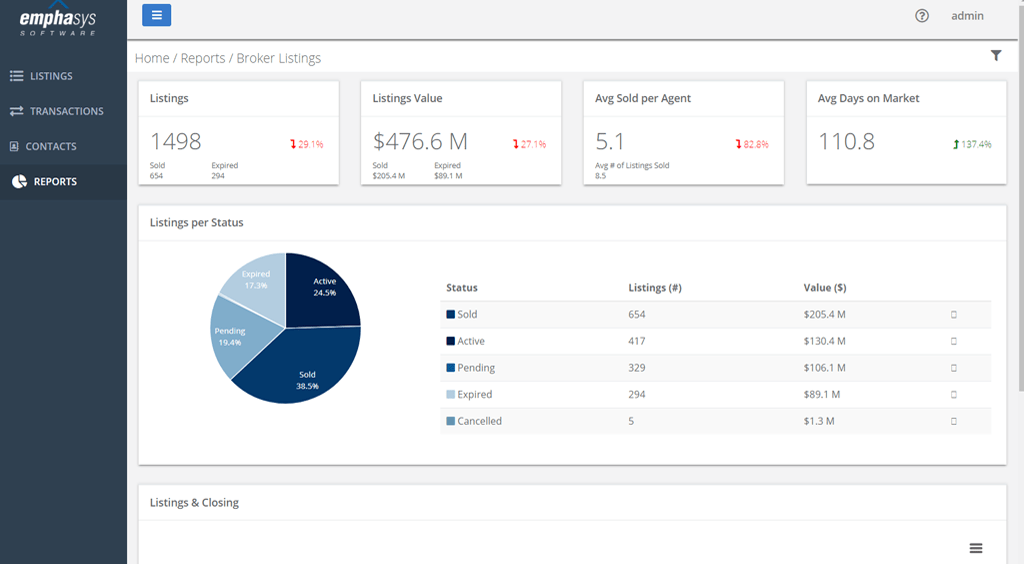

Are you a property manager looking for accounting software to help streamline your workflow? If so, you’ve come to the right place! In this blog post, we’ll provide an overview of some of the best accounting software solutions for property managers.

First up is Propertyware. This cloud-based software is designed specifically for property managers and offers a variety of features to help you stay organized and efficient. With Propertyware, you can track rent payments, expenses, maintenance requests, and more.

You can also generate detailed reports on your properties and finances. Pricing starts at $49/month for up to 10 units.

Next is AppFolio Property Manager.

This software is also geared towards property managers and offers many of the same features as Propertyware. With AppFolio, you can track rent payments, expenses, work orders, and more. You can also create custom reports and export data into Excel or PDF format.

Pricing starts at $65/month for up to 10 units.

Finally, there’s BuildiumProperty Management Software . Buildium offers a comprehensive solution for property managers with features like online rent collection, tenant screening, maintenance tracking, and more.

You can also create custom reports and export data into Excel or PDF format. Pricing starts at $50/month for up to 10 units managed.

Bookkeeping for Rental Properties

If you’re a landlord, bookkeeping is an essential part of your job. Keeping accurate records of your rental income and expenses will help you stay organized and on top of your finances.

There are a few different ways to approach bookkeeping for your rental property.

You can use traditional paper-and-pencil methods, or opt for digital record-keeping using software like Quicken or Mint. Whichever method you choose, be sure to keep track of the following items:

Rental income: This includes rent payments from tenants, as well as any other money that comes in from the property (such as coin laundry revenue).

Rental expenses: Keep track of all the money you spend on maintaining and operating the property, including things like repairs, insurance, advertising, and property taxes.

Depreciation: This is an important expense to track for tax purposes. You’ll need to depreciate the value of your property over time, which can be deducted from your taxable income.

Conclusion

If you manage rental properties, you know how important it is to keep track of your finances. The right accounting software can make a big difference in your business. But with so many options on the market, how do you choose the best one for your needs?

To help you out, we’ve put together a list of the best accounting software for rental properties. We’ve considered features like property management, invoicing, and reporting. And we’ve also taken into account customer reviews and ratings.

QuickBooks is our top pick for rental property accounting software. It offers everything you need to manage your finances, including property management, invoicing, and reporting tools. Plus, it’s easy to use and has great customer support.

FreshBooks is another excellent option for rental property accounting software. It has all the same features as QuickBooks but is slightly easier to use. However, FreshBooks doesn’t offer as much support as QuickBooks does.

Xero is another good choice for rental property accounting software. It has most of the same features as QuickBooks but doesn’t have built-in property management tools. That said, Xero integrates with many popular property management apps so you can still get the functionality you need.