What is the Best Accounting Software for Real Estate Agents?

There are many different types of accounting software on the market, so it can be difficult to know which one is best for your business. Real estate agents have specific needs when it comes to accounting software. They need something that can track income and expenses, create invoices, and manage properties.

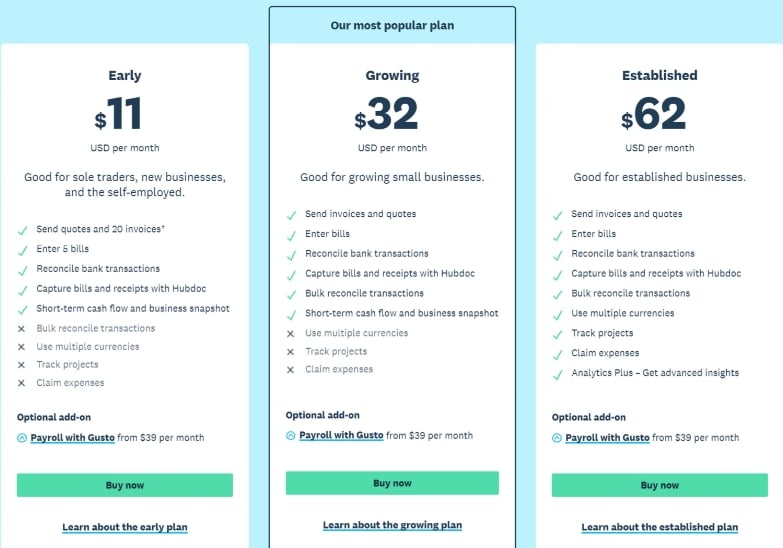

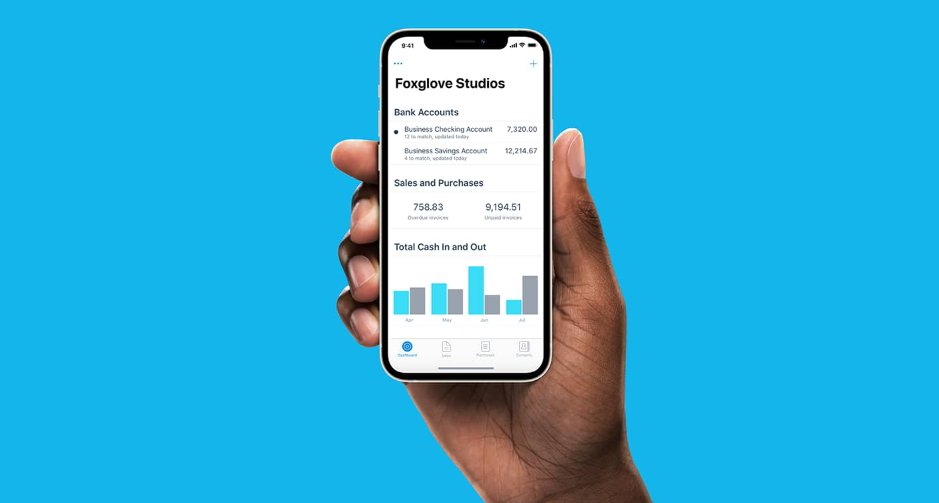

QuickBooks is a popular accounting software that offers all of these features. It’s easy to use and has a variety of plans to choose from, so you can find one that fits your budget. Xero is another option that offers similar features.

It’s slightly more expensive than QuickBooks but has a more user-friendly interface.

If you’re a real estate agent, then you know that having the right accounting software is crucial to your business. There are a lot of different options out there, so how do you know which one is the best for you?

Well, the answer depends on a few things.

First, what features do you need? Second, how much are you willing to spend? And third, what’s your level of comfort with technology?

Once you’ve answered those questions, it should be easier to narrow down your choices. For example, if you need robust features and aren’t afraid of learning new software, then QuickBooks would be a good option. On the other hand, if you want something simpler and cheaper, then FreshBooks might be a better choice.

Ultimately, the best accounting software for real estate agents is the one that meets their specific needs at a price they’re comfortable with. So take some time to figure out what Those needs are before making your final decision.

Best Accounting Software for Real Estate Agents in 2021

Which Accounting Software is Best for a Real Estate?

There are many accounting software programs on the market, but not all of them are well suited for the real estate industry. When choosing an accounting program for your real estate business, there are a few key features to look for.

First, the program should have good property management tools.

This includes the ability to track rental income and expenses, as well as create lease agreements and manage tenants.

Second, it should have robust financial reporting capabilities. This way you can track your income and expenses easily, and see how your business is performing over time.

Third, it should be easy to use. You don’t want to spend hours trying to figure out how to input data or generate reports. The best accounting software will be intuitive and user-friendly.

Finally, it should come at a reasonable price. There’s no need to break the bank when choosing an accounting program – there are plenty of great options available at affordable prices.

Some of the best accounting software programs for real estate businesses include Propertyware, AppFolio Property Manager, QuickBooks Enterprise Real Estate Edition, and Yardi Voyager.

All of these programs offer excellent property management tools and financial reporting features that will help you run your business effectively.

Anúncios

Is There a Quickbooks for Real Estate?

There is no QuickBooks for real estate. However, there are many accounting software programs that can be used for tracking rental property expenses and income. When choosing an accounting program, it is important to find one that can track both income and expenses, as well as generate reports.

What Technologies Do Real Estate Agents Use?

The technologies that real estate agents use vary depending on their broker, but most use some form of multiple listing service (MLS) to list properties and track leads. Some brokers also offer customer relationship management (CRM) software to help agents keep track of their clients. Other popular technologies include lead generation software, which helps agents find new leads, and transaction management software, which helps them manage the paperwork involved in a sale.

Anúncios

How is Accounting Used in Real Estate?

Real estate accounting is the process of tracking, recording, and managing all financial aspects of a real estate business. This includes everything from income and expenses to asset and liability management. An effective real estate accounting system can help a business keep track of its finances, make informed decisions about investments, and manage risk.

There are several key financial metrics that real estate businesses should track. These include gross income, operating expenses, net operating income (NOI), capital expenditures (CAPEX), cash flow, and return on investment (ROI). Tracking these metrics can help a business understand its financial performance, identify trends, and make better decisions about where to allocate resources.

Real estate businesses generate revenue from two main sources: rental income and sales income. Rental income is typically recurring revenue that comes in on a monthly or quarterly basis. Sales income is generated when properties are bought or sold.

Both types of income need to be tracked carefully in order to maintain accurate financial records.

Expenses related to running a real estate business can be divided into two categories: operating expenses and capital expenditures. Operating expenses are ongoing costs associated with running the day-to-day operations of a business, such as staffing, marketing, repairs & maintenance, etc.

Capital expenditures are one-time costs associated with acquiring or improving properties, such as purchasing land or making major renovations.

Net operating Income (NOI) is a key metric for evaluating the profitability of a real estate business. It is calculated by subtracting operating expenses from gross income .

A property’s NOI can be further divided into two categories: cash NOI and GAAP NOI . Cash NOI only includes those items that impact cash flow , while GAAP NOI also includes non-cash items like depreciation .

Credit: www.freshbooks.com

Quickbooks for Real Estate Agents

As a real estate agent, you are always looking for new ways to streamline your business and make things run more smoothly. One way to do this is by using QuickBooks, which is accounting software specifically designed for small businesses.

While QuickBooks can be used for any type of business, it offers some features that are especially beneficial for real estate agents.

For example, you can create custom invoices with your company logo, track payments from clients, and manage expenses easily.

If you are not already using QuickBooks in your business, now is the time to give it a try! It can save you time and money, and help you run your real estate business more efficiently.

Real Estate Agent Accounting Software

As a real estate agent, you have a lot of different financial responsibilities. You need to track your income and expenses, manage properties and client funds, and stay on top of your commission payments. The right accounting software can make all of these tasks easier and help you run your business more efficiently.

There are a few different things to consider when choosing accounting software for your real estate business. First, you need to decide if you want a desktop or cloud-based solution. Desktop software is installed directly on your computer, while cloud-based solutions are accessed online.

Cloud-based solutions offer the benefit of being accessible from anywhere with an internet connection, but they typically cost more than desktop software.

Next, you need to choose which features are most important to you. Some accounting software programs offer basic features like income and expense tracking, while others include more advanced features like property management tools and commission tracking.

Decide which features you need and then compare prices before making a final decision.

Once you’ve chosen the right accounting software for your business, be sure to use it regularly. Keep track of all of your income and expenses so that you can stay organized and on top of your finances.

With the right accounting software in place, running your real estate business will be a breeze!

Bookkeeping for Real Estate Agents

As a real estate agent, it’s important to keep accurate records of your business expenses. This will not only help you stay organized, but it will also ensure that you maximize your tax deductions come tax time.

There are a few key things to keep in mind when bookkeeping for your real estate business.

First, make sure to track all income and expenses related to your business. This includes everything from advertising and marketing costs to office supplies and travel expenses.

Secondly, be sure to keep receipts for all of your business-related purchases.

These can be stored electronically or in a physical file. Having receipts on hand will make it easier to track expenses and verify them come tax time.

Lastly, consider hiring a professional bookkeeper or accountant to help manage your finances.

This is especially helpful if you have a complex business structure or multiple properties. A professional can help you stay organized and compliant with tax laws.

Overall, keeping accurate records is essential for any real estate agent.

By tracking income and expenses, storing receipts, and working with professionals, you can ensure that your finances are in order come tax time!

Conclusion

There are many accounting software programs on the market, but which one is the best for real estate agents? The answer may surprise you.

While there are many accounting software programs out there that can do a great job for businesses in general, when it comes to real estate agents, there is one program that stands out above the rest.

That program is QuickBooks.

QuickBooks was designed specifically with small businesses in mind, and it has all the features that a real estate agent needs to stay organized and on top of their finances. QuickBooks can track income and expenses, create invoices and receipts, manage customers and vendors, and so much more.

Plus, it integrates seamlessly with other popular business applications like Microsoft Office.

If you’re looking for the best accounting software for real estate agents, look no further than QuickBooks.