What Are the 5 Profit First Accounts?

The Profit Account is the place where you can keep a small amount of cash. It can be used for debt reduction, emergencies, or bonus money. In fact, this is a key aspect of the Profit First formula. The Owner’s Pay account is a separate account that you use for your after-tax salary and wage. While you should not use this money to invest, you can use it to pay your salary or meet your tax obligations.

Income account

In accounting, an income account is related to the money earned by a business. The income account is divided into different categories according to the sources of income. These categories include commission accounts, purchase accounts, capital accounts, un-distributed profit accounts, and asset accounts. The purpose of these accounts is to classify transactions related to income.

Anúncios

Another important type of income account is the revenue account. This account is used to track profit for the specific accounting period. It is used by governments, corporations, and individuals to track the income they earn. Some companies also have income accounts to keep track of investment returns. There are many different types of income accounts available, so it is important to understand all of them.

Non-operating revenue is the income a business generates outside of its core activities. It is also referred to as non-recurring revenue because the source of the income is not consistent. This type of revenue can come in the form of interest on business capital, investments, and royalty payments. Some of these income sources may occur only a few times a year, depending on the circumstances of the company. However, they can still be accounted for in the income account statement.

Anúncios

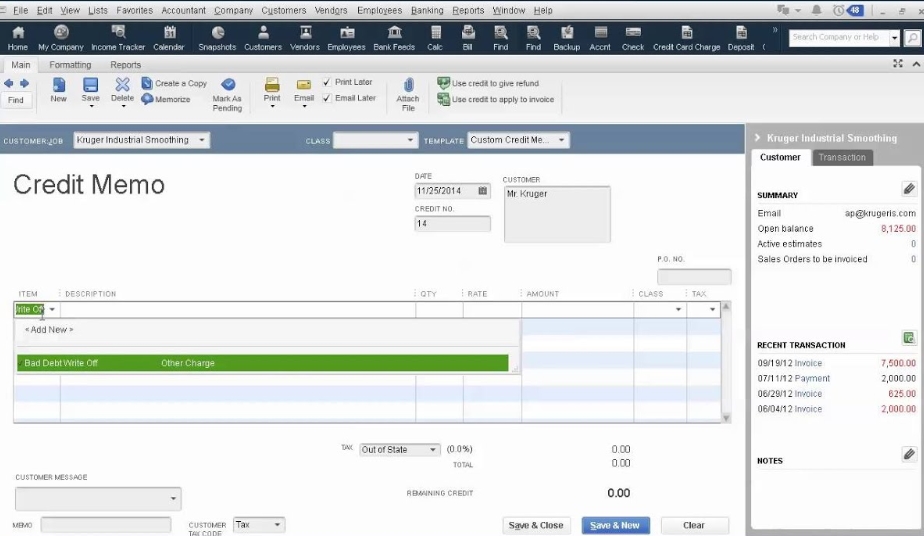

Income can be generated from an invoice if you have income from a sales transaction. Invoices can include the products and services that you sell. Once you have an income from the sale, assign the income to an income account. The default income account is Sales. You can change the income account or assign a different one if you need to.

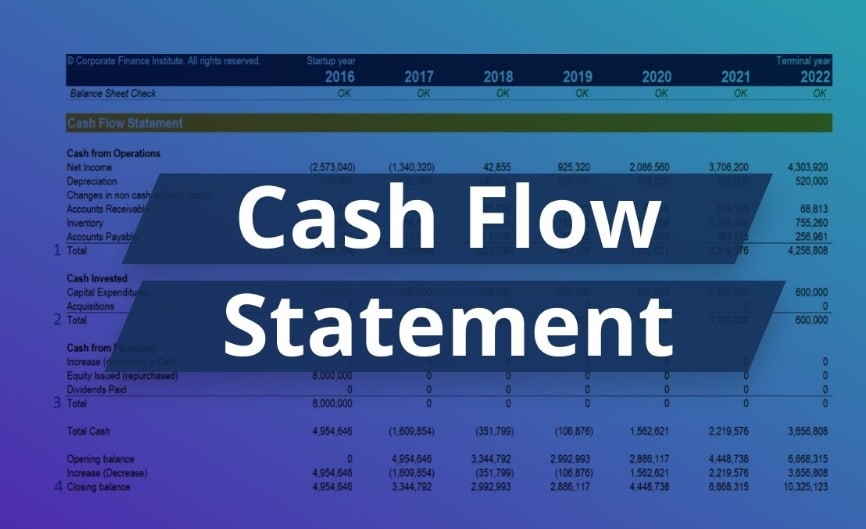

Income can be categorized in many ways, but most commonly, it refers to the net profit of a company. It can be earned by selling products, labor, and investing. Businesses report their income on their income statements and individuals report their earnings on their tax forms. The income statement lists all of the income a company receives.

A company’s income account statements are important to the company and to shareholders. Every year, a company is required to file an income account statement with the Securities and Exchange Commission (SEC). It tells the SEC how much money the company makes and where it gets its revenue. It also provides the figures necessary to calculate the company’s total tax liability. An income account statement is also important for investors and shareholders as it provides a clear view of the business’s operations.

Income account data is essential for economic policy development. It helps the government and the public understand a country’s economic activity. Various measures of income are included, including the total revenues of domestic corporations, wages paid to foreign workers, and sales and income taxes paid by individuals. However, the accuracy of these measures depends on the amount of data available.

Owner’s compensation

The five profit first accounts are a key to achieving a healthy balance sheet. These accounts include the profit that is in the bank and the dividends paid out. Other accounts include operating expenses, owner’s compensation, and tax. Operating expenses refer to the costs of running a business.

Keeping track of your expenses is essential to business success. Operating expenses should be accounted for in a separate account from the profit. The owner’s compensation account should hold the salary of the business owner. Bluevine’s flexible account management features allow business owners to add sub-accounts to the main account. Moreover, business owners do not need to open all five profit first accounts right away. They can start with the profit and tax account and add the other accounts as their business grows.

Operating Expenses

Operating expenses are the costs of running your business. While it might seem obvious, it is important to remember that these expenses are not always accounted for in your profits. For example, you might have a separate account for business owners compensation. Having five different business accounts is important to keep track of all your expenses and ownership of decisions. In addition, it is important to choose the right bank for your business. It can be confusing to have multiple bank accounts, so make sure you choose the right one for your business.

Operating expenses can be a tough area to cut. They are often considered unavoidable but there are ways to reduce them with a little creativity. By implementing Profit First accounting, you will force your company to spend more disciplinedly than before. This will ensure that you build a sustainable business.

Profit First accounting is a system that helps small businesses become profitable faster. Developed by entrepreneur Mike Michalowicz in his book Profit First, it reverses the traditional order of funds allocation. Profit First teaches small business owners to pay employees first and then pay operating expenses with the rest.

A higher profit allocation percentage means a more efficient business. It will result in less operating expenses and more money for other parts of the business. It also means you’ll be able to save more money and take more time. It’s a good idea to keep the remaining fifty percent in the account as a reserve.

Operating income is the net profit you earn from your operations. Operating expenses include all the other expenses you incur for running your business. Operating income will show you whether your company is profitable or not. If your operating income is increasing, this is a good sign that you’re managing your costs well.