Are Cash Flow Statements Available in All Accounting Software?

No, cash flow statements are not available in all accounting software. While most accounting software programs do include this feature, there are a few that do not. This is usually because the program is geared towards small businesses or those who are just starting out and may not need this level of detail.

Most accounting software programs will have some form of cash flow statement available. However, the features and functionality of these statements can vary greatly from one program to another. Some software may only offer a basic cash flow statement, while others may provide more comprehensive tools for tracking and managing your company’s cash flow.

Cash Flow Statement Basics Explained

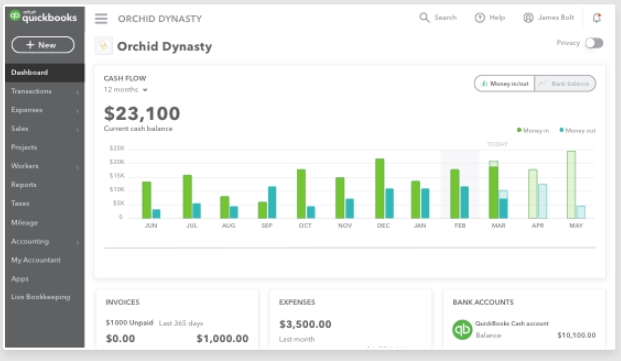

Does Quickbooks Have a Cash Flow Statement?

Yes, QuickBooks has a cash flow statement. You can find it under the Reports menu. It shows you a summary of your company’s inflows and outflows of cash for a specified period of time.

Anúncios

Which Accounting Standard is Application for Cash Flow Statement?

There are two types of accounting standards that can be applied to the preparation of a cash flow statement: the direct method and the indirect method.

The direct method involves starting with net income and then making adjustments for items that either increase or decrease cash flow. This approach is thought to provide more useful information to users of financial statements because it provides a clearer picture of how cash was generated during the period.

The indirect method, on the other hand, begins with accrual basis net income and then makes adjustments to arrive at cash from operating activities. This approach is required by U.S. GAAP and is more commonly used in practice.

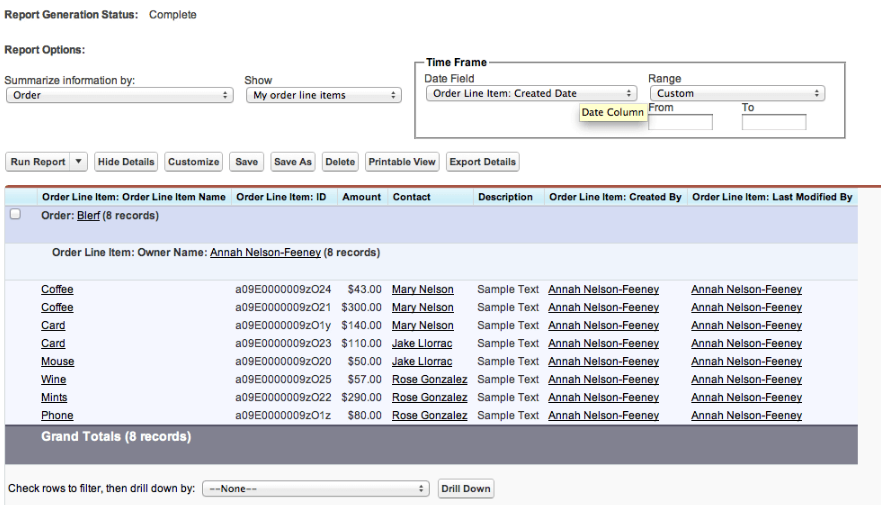

How Do I Pull a Cash Flow Statement in Quickbooks?

In order to pull a cash flow statement in QuickBooks, you will first need to ensure that you have set up your chart of accounts correctly. Once you have done this, you will be able to select the ‘Reports’ tab and then ‘Cash Flow Statement’ from the drop-down menu. If you have not set up your chart of accounts correctly, QuickBooks will not be able to generate a cash flow statement.

Anúncios

Where is Cash Flow Found?

Cash flow is the movement of money in and out of a business. It is the lifeblood of any business, large or small. Without cash flow, a business cannot pay its bills, make payroll or buy inventory.

In short, cash flow is essential to the survival of any business.

There are two types of cash flow: operating and investing. Operating cash flow is the money that comes into a business from its normal operations, such as sales of products or services.

Investing cash flow is money that moves in and out of a business as a result of its investments, such as buying new equipment or selling shares of stock.

Cash flow can be positive or negative. Positive cash flow means that more money is coming into the business than going out; negative cash flow means the opposite.

A company with positive cash flow is said to be “cash positive,” while one with negative cash flow is “cash negative.”

Most businesses strive for positive operating cashflow because it allows them to grow and expand their operations. However, even companies with negative operating cashflow can survive if they have positive investing cashflow (for example, if they are able to sell assets for more than they paid for them).

Ultimately, what matters most is not whether a company’s overall cashflow is positive or negative, but whether it has enough cash on hand to meet its obligations when they come due.

Credit: www.uschamber.com

Cash Flow Statement Questions And Answers Pdf

When it comes to preparing a cash flow statement, there are a few key questions that always seem to come up. To help you get a better understanding of this important financial document, we’ve put together a list of cash flow statement FAQs and answers.

What is a cash flow statement?

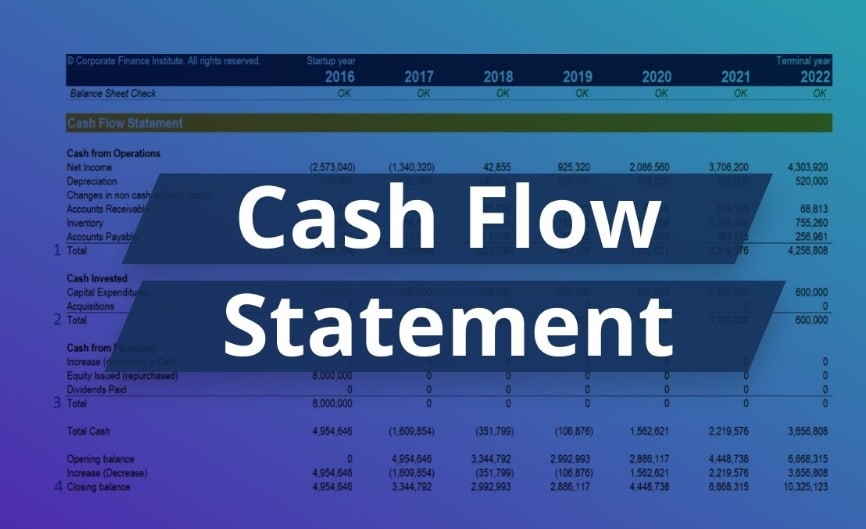

A cash flow statement is a financial document that details the inflows and outflows of cash for a specific period of time. This information can be used to assess the liquidity and solvency of a business.

What are the three main sections of a cash flow statement?

The three main sections of a cash flow statement are operating activities, investing activities, and financing activities. Operating activities include all the transactions that generate revenue for the company, while investing activities involve any expenditures on long-term assets. Financing activities encompass all the transactions that involve borrowing or lending money.

How do I calculate net cash flows from operating activities?

Net cash flows from operating activities can be calculated by adding up all the inflows and subtracting all the outflows. Inflows would include things like receipts from customers, while outflows would include things like payments to suppliers.

Cash Flow Statement Analysis

A cash flow statement is one of the most important financial statements for a business. It shows how much cash a business has on hand, as well as how much it is bringing in and spending each month.

By understanding the ins and outs of a cash flow statement, you can get a better handle on your business’s financial health.

This guide will explain everything you need to know about cash flow statement analysis.

What is a Cash Flow Statement?

A cash flow statement (also known as a “statement of cash flows”) is a financial report that shows how much cash came into your business during a certain period, and where that money went.

The report covers three main areas: operating activities, investing activities, and financing activities. Each section includes information about thecash inflows and outflows for that particular category.

Why is Cash Flow Statement Analysis Important?

As we mentioned before, the cash flow statement is an important tool for measuring your business’s financial health. By analyzing your company’s cash flow, you can make informed decisions about where to allocate your resources.

You can also use cash flow analysis to spot potential problems early on, such as if your company is consistently spending more money than it’s bringing in each month.

This type of information can help you make changes to improve your bottom line.

Tips for Analyzing Your Cash Flow Statement

Now that we’ve covered the basics, let’s take a look at some tips for effectively analyzing your company’scash flow statement: Compare Against Previous Periods: One of the best ways to gauge whether or not your business is improving its financial health is by comparing its currentcash flow against past periods.

If you see positive growth year-over-year, then you know you’re heading in the right direction! Pay attention to Seasonality: Many businesses experience fluctuations in their revenue due to seasonality factors (think holiday shopping sprees). When reviewing yourcash flow statement, be sure to take this into account so you don’t misinterpret any spikes or dips in activity.

Look at Net Income: Another key metric to keep an eye on when analyzing yourcashflowisnet income(or net loss). This figure represents the total amount of money earned (or lost) during a period after all expenses have been paid out . If net income is negative, it meansyourbusinessis operating at a loss; conversely , if net income is positive , thenyou’re making money!

Cash Flow from Operating Activities

Assuming a company has no debt and its only source of financing is equity, cash flow from operating activities can be calculated using the direct or indirect method. The direct method adjusts net income for the changes in accounts receivable, inventory, and accounts payable. The indirect method begins with net income and then makes adjustments for items that do not affect cash (depreciation and amortization) as well as changes in working capital items (accounts receivable, inventory, accounts payable).

Operating activities are a company’s primary revenue-generating activities. Cash flow from operating activities measures the cash that a company generates (or consumes) from these activities. A company’s ability to generate cash from its operating activities is important because it indicates whether the company is able to pay its bills and fund its other obligations without having to rely on external sources of financing.

The two methods used to calculate cash flow from operating activities are the direct method and the indirect method. The direct method adjusts net income for the changes in accounts receivable, inventory, and accounts payable. The indirect method begins with net income and then makes adjustments for items that do not affect cash (depreciation and amortization) as well as changes in working capital items (accounts receivable, inventory, accounts payable).

The main difference between the two methods is that the direct method provides a more detailed picture of a company’s cash inflows and outflows from its operating activities while the indirect method is simpler to calculate but less informative.

Conclusion

Most accounting software programs will have a cash flow statement feature available. This is because the cash flow statement is one of the most important financial statements for any business. The cash flow statement shows a company’s inflows and outflows of cash, which can be used to assess its overall financial health.