Transfer Money From Wisely Card to Bank Account

You can transfer money from your Wisely card to your bank account using the Wisely Pay app. In the app, you can also cash a check. Offline and online credit card to bank transfers are available as well. To learn more about how to transfer money from your Wisely card to your bank account, read our article.

Visa’s Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions

Visa’s Zero Liability policy does not cover transactions made with certain commercial cards or anonymous prepaid cards. This means that you’ll need to take additional steps if an unauthorized transaction shows up on your card. Those steps include filing a fraud claim form and making a police report if the card was stolen. If you don’t take these steps, Visa will not compensate you for your losses.

Anúncios

Nevertheless, the Visa Zero Liability policy does protect you from the risk of being charged for unauthorized purchases. This policy will reimburse you for any losses caused by unauthorized charges as long as you’ve notified your financial institution of the incident within 60 days of the unauthorized transaction.

If you’re unsure whether your card has zero liability protection, read your agreement carefully. Many debit cards have similar protections. But if you fail to report unauthorized use, you may be held liable for $50. If you’re in a commercial card company, however, your liability protection will vary. For example, if you lose more than $50, you might have to pay for the entire transaction. This could lead to financial hardship.

Anúncios

It is also important to protect your credit card while you’re using it. You should avoid sharing your credit card number with anyone, including merchants, and not leave your card’s receipt or signature panel unattended. Moreover, you should never give out your PIN to unauthorized individuals.

In order to protect yourself from losses due to unauthorized use, you should always pay your balance on time. You can also opt for online banking and alerts. These services will also protect you against unauthorized or fraudulent use. But remember to always read the terms and conditions carefully before using your card.

You should also make sure you have the right type of card. A debit card can be used anywhere debit cards are accepted. It’s also useful for those times when you want to make a big purchase. The Alliant Visa Platinum credit card is a great option if you’re looking to expand your financial flexibility.

Checks can be cashed to your Wisely Pay card

If you want to use your Wisely Pay card for check cashing, you can do so through a number of options. There are two main methods: by phone or online. If you want to use the phone option, you need to contact your employer. They should provide you with the registration code.

You can also use a Wisely Pay by ADP card. It is issued by Fifth Third Bank, N.A., Member FDIC, and is accepted at merchants that accept debit Mastercard. The ADP logo is a registered trademark of ADP, LLC. Ingo Money, Papaya, SnapPays Mobile, and Western Union are trademarks and service marks of their respective owners.

Using the app to transfer money

If you use the app to transfer money from wisely card into bank account, you can save time by not having to wait for payment to post. Using the app will also allow you to see your spending patterns, find an ATM near you, and see your transaction history. It will also let you set up savings accounts.

To use the app, you must have a debit card and a bank account. You will need to enter your bank account username and password to proceed. Once you do that, you can start using your card. You can also add a prepaid card or a regular debit card. Just make sure you provide the correct information and that you have permission to use the card.

Once you have set up your account, you can use the app to transfer money from wisely card. The app works with your Wisely Direct debit card. The app also allows you to earn cashback rewards from participating stores. However, you must opt-in to receive cashback rewards. There are no monthly fees or hidden fees, and you can easily transfer money from wisely card to bank account.

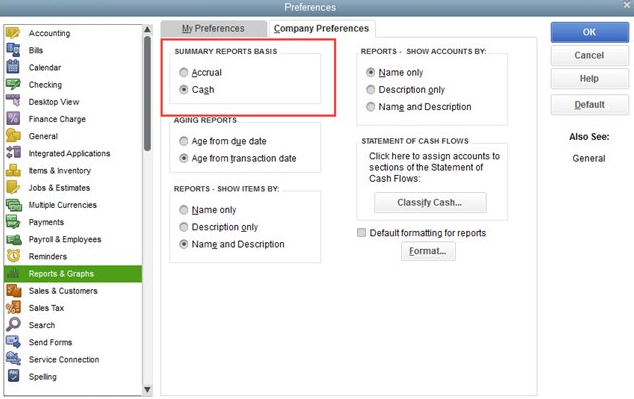

Offline and online credit card to bank transfer

Offline and online credit card to bank transfer services allow you to receive and send money between your cards. Online services are typically faster and easier, but offline credit card processing has some drawbacks. Offline processing is not always as secure as online, and it is often risky. If the internet connection is down for any reason, the transaction may not go through. Luckily, some ATMs have the ability to process payments offline.

The biggest difference between online and offline credit card to bank transfer is the method used. In an offline transaction, there is no immediate payment creation or transfer of funds. Instead, the customer enters the recipient bank account details and the purpose of the payment. The customer then performs the bank transfer by using the bank’s software or physical facilities. When the customer is finished with their payment, PXP Financial pulls the payment information from the company’s bank account and notifies the Merchant System. The Merchant System then marks the order paid and credits the amount to the user’s account.

In offline payment processing, merchants may have to wait for up to 72 hours to process the transaction. Because of this, the information on the card is erased after the transaction, preventing identity fraud and theft. Because of this, it’s important for businesses to limit the number of transactions per day and limit the total amount. In addition, merchants should also cross-check the customer’s ID to ensure that the card is valid.

An offline debit card is used when you can’t access online services. This card does not require a PIN, and the funds are transferred 24 to 72 hours later. Unlike online debit cards, offline debit cards can’t be used to deposit or withdraw money from an ATM. Offline debit cards are issued by card network providers, such as Visa and MasterCard.

Offline card processing can be safe as long as your payment terminals follow PCI compliance standards. The credit card terminals encrypt the data so that only the credit card processor has access to it. If you are unsure of the security of an offline card transaction, it’s always safer to use an online service.