How Do Credit Cards Work in Ynab?

Credit cards can be a great tool for managing your finances, but they can also be a major source of stress and anxiety. If you’re not careful, it’s easy to get into debt with credit cards. This is where Ynab comes in.

Ynab is a budgeting app that can help you stay on top of your finances and avoid getting into debt.

Credit cards can be a great tool for managing your finances, but they can also be a little confusing. If you’re using YNAB (You Need A Budget), here’s how credit cards work.

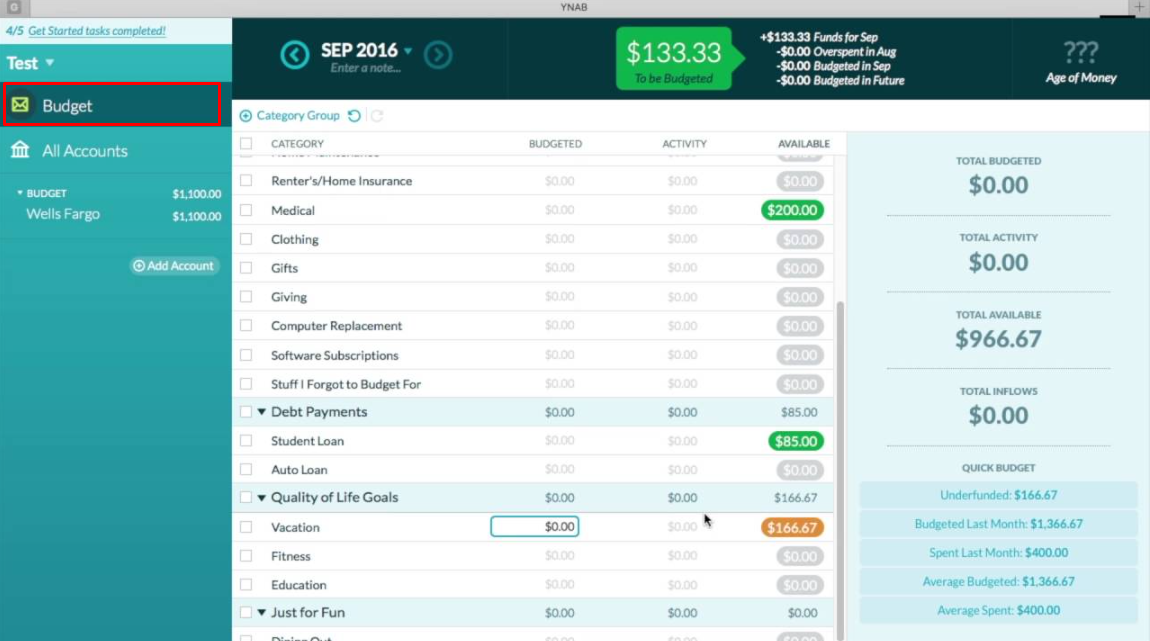

When you add a credit card to YNAB, you’ll need to enter the account information and your current balance.

You’ll also need to choose whether you want to pay the minimum payment or the full balance each month.

YNAB will then create a budget category for your credit card payments and track your spending in that category. When it’s time to make a payment, you can use the funds in your budget to pay off your credit card bill in full or make the minimum payment.

If you carry a balance on your credit card from month to month, YNAB will track that as well. You can see how much interest you’re paying and how quickly you’re paying off the debt. This information can help you make informed decisions about whether to keep using your credit card or find another way to pay down the debt.

Credit: www.sixfiguresunder.com

Anúncios

Does Ynab Automatically Categorize Credit Card Transactions?

No, YNAB does not automatically categorize credit card transactions. You will need to manually categorize each transaction when it is entered into the system.

How Do I Pay a Credit Card in Ynab?

Assuming you would like a blog post discussing how to pay off credit card debt using the YNAB method:

Paying off credit card debt can feel like an uphill battle, but with the right budgeting method, it can be manageable. One such budgeting method is YNAB, or You Need A Budget.

With YNAB, you give every dollar a job and work to achieve specific financial goals. This system can be helpful when applied to paying off credit card debt.

To start, create a new goal in your YNAB account specifically for paying off your credit card debt.

Then, break down that goal into smaller milestones that you can realistically achieve. For example, if your goal is to pay off $5,000 of credit card debt in one year, your milestone could be $416 per month (assuming a 5% interest rate).

Once you have created your goal and milestones within YNAB, it’s time to start allocating funds towards payment.

Begin by taking a look at your monthly income and then designating money from each paycheck towards the credit card payment goal. It may also be helpful to transfer money from other categories in your budget (such as dining out) in order to put more towards the debt payoff goal. The key is to make sure that all of your spending aligns with your overall budget so that you don’t find yourself falling behind later on.

As you make progress and pay down your credit card debt, be sure to adjust your YNAB goals accordingly. This will help keep you on track and motivated as you continue working towards becoming debt-free!

Anúncios

Can You Connect Ynab to a Credit Card?

Yes, You Need a Budget (YNAB) can connect to your credit card. This connection allows you to automatically import your credit card transactions into YNAB and categorize them according to your budget.

The benefit of connecting your credit card to YNAB is that it helps you stay on top of your spending.

By automatically importing your transactions, you can easily see where you are spending money and whether or not you are staying within your budget.

To connect your credit card to YNAB, simply go to the Accounts tab and click on the “Add Account” button. Then select “Credit Card” from the list of account types.

Enter your credit card information and click “Connect”.

Once your credit card is connected, you will need to set up a rule for each type of transaction that you want imported into YNAB. For example, if you have a monthly subscription charge that appears on your credit card statement, you will need to create a rule in YNAB that says “import all charges from X vendor totaling $XX or more”.

You can also choose to manually import transactions from your credit card if you prefer not to have all of them imported automatically. To do this, go to the Accounts tab and click on the name of your credit card account. Then click on the “Import Transactions” button and select the transactions that you want to import into YNAB.

How Do You Pay off Credit Card Debt in Ynab?

Assuming you are asking about the YNAB method for getting out of credit card debt, here is how it works:

First, you need to give every dollar a job in your budget. This means that you will need to find room in your budget for your minimum monthly payments on all of your debts.

Once you have done this, any extra money that you have left over can be put towards paying down your debts.

The next step is to work on paying off your smallest debt first. Once that debt is paid off, you can then move on to working on the next smallest debt and so forth until all of your debts are paid off.

One thing to keep in mind is that as you are working on paying off your debts, you should still be putting money into savings each month. This way, if anything unexpected comes up, you will have the funds available to cover it without having to put it on a credit card and go back into debt again.

Using Credit Cards with YNAB: The Complete Guide

Ynab Credit Cards Confusing

If you’re like most people, the idea of using a credit card to manage your finances can be confusing. After all, aren’t credit cards supposed to be used for borrowing money?

The truth is, credit cards can be a great tool for managing your finances if used correctly.

In fact, many financial experts recommend using a credit card for all of your expenses, including bills and groceries.

Why? Because it’s easier to track your spending when everything is on one statement.

Plus, you can avoid costly interest charges by paying off your balance in full each month.

If you’re not sure how to get started with using a credit card for your finances, don’t worry. We’ve got you covered with this comprehensive guide to YNAB and credit cards.

Ynab Credit Card Starting Balance

If you’re new to YNAB, you may be wondering how to best enter your credit card starting balance. Here’s a quick guide!

First, open up your YNAB software and go to the Accounts tab.

Then, click on the “+Add Account” button in the top right corner.

In the “Add New Account” window, select “Credit Card” from the drop-down menu. Then, enter the name of your credit card issuer, your account number, and your current balance.

Be sure to also check the box that says “This is a credit card.”

Once you’ve entered all of that information, click on the “Create Account” button and you’re all set! Your credit card starting balance will now be reflected in your YNAB budget.

Ynab Credit Card Debt

Carrying credit card debt can feel like a never-ending cycle. You make your minimum payment each month, but your balance never seems to go down. And the interest you’re paying is adding up, making it even harder to get ahead.

If you’re struggling with credit card debt, you’re not alone. In fact, according to a recent report from the Federal Reserve, the average American household has nearly $7,000 in credit card debt.

But there is hope.

By following a few simple steps, you can get out of credit card debt and start fresh with a clean slate.

Here’s what you need to do:

1. Stop using your credit cards.

This may seem obvious, but it’s important to cut up your cards or at least put them away so you’re not tempted to use them. If you have trouble doing this on your own, consider asking a friend or family member to hold onto your cards for safekeeping.

2. Make a budget and stick to it .

A budget will help you see where all of your money is going and where you can cut back in order to free up some cash to put towards your credit card debt. Be sure to include all of your essential expenses like rent or mortgage payments, food, transportation costs, and healthcare in your budget so that you don’t end up short on cash each month. Once you’ve created a budget , commit to sticking to it as closely as possible .

This may mean saying no to nights out or impulse purchases , but it will be worth it in the long run when you’re out of debt .

Ynab Credit Card Interest

If you’re like most people, you probably have a credit card or two that you use for everyday expenses. And if you’re like most people, you probably don’t think much about the interest rate on your credit cards. But if you carry a balance on your credit cards, the interest rate can make a big difference in how quickly you pay off your debt.

The average credit card interest rate is around 15%, but rates can vary widely depending on the type of card and the issuer. If you have good credit, you may be able to get a lower rate. But if you have bad credit, you could be paying 30% or more in interest.

Interest charges are calculated based on your average daily balance. So if your average daily balance is $1,000 and your interest rate is 15%, you’ll be charged $15 in interest every month.

Paying just the minimum payment each month will not help reduce your debt very quickly because most of your payment will go towards paying off the interest charges rather than the actual balance.

In fact, it could take years to pay off your debt if you only make minimum payments.

Making regular, larger payments will help reduce your debt more quickly because more of your payment will go towards reducing the actual balance owed. For example, let’s say you have a $1,000 balance with a 15% interest rate and make a monthly payment of $50.

It would take 20 months to pay off the debt if all payments went towards interests charges. However, making a monthly payment of $100 would allow you to pay off the debt in 10 months because $50 would go towards reducing the principal balance each month instead of just paying interests charges .

If possible, try to avoid carrying a balance on your credit cards from month-to-month so that you don’t accrue anyinterest charges .

Ifyou do carry abalance , try tomake aslargerpayment aspossible eachmonthtopay downyourdebtquicklyandavoid highinterestcharges .

Conclusion

Assuming you are referring to the blog post titled “How do credit cards work in YNAB?” found here: https://medium.com/@ynab/how-do-credit-cards-work-in-ynab-ecd98f79a02b

In short, when you use a credit card in YNAB, you are essentially giving yourself a loan that you will need to pay back with interest. To budget for this, you’ll want to create a category for your credit card payments and make sure to include the interest rate in your budget.

Then, when you get your statement each month, you can update your budget accordingly. This will help you stay on top of your payments and avoid any late fees or other penalties.