Personal Loan Requirements: What You Need to Know Before Applying

If you’re considering applying for a personal loan, it’s essential to be well-prepared and understand the requirements to increase your chances of approval.

This educational guide will cover the key aspects you need to know when applying.

So, let’s dive into the world of personal loan requirements and empower you with the knowledge you need to secure the financing you require.

Anúncios

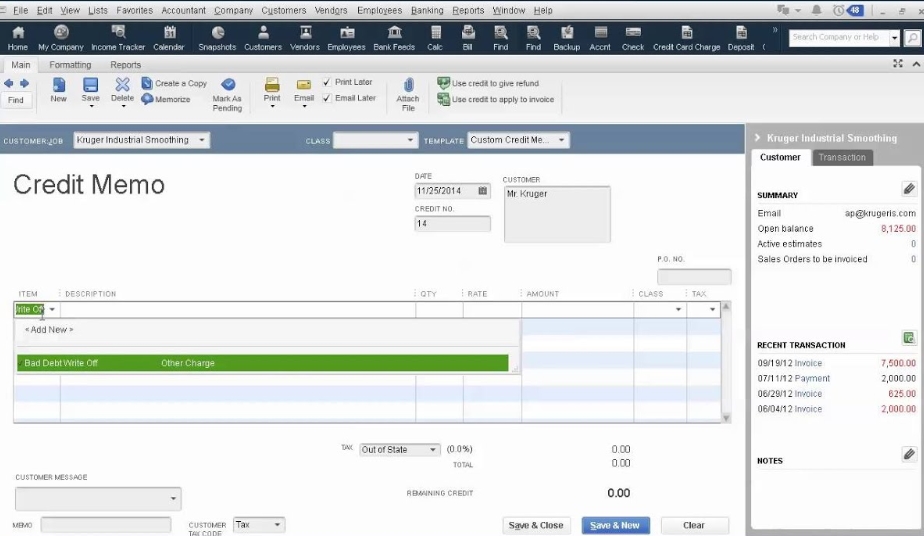

Personal loan documents usually require:

Personal loans are versatile financial tools that can help you achieve various goals, from consolidating debt to covering unexpected expenses.

However, securing a personal loan is not a guaranteed process; it involves meeting specific criteria set by lenders.

Anúncios

By familiarizing yourself with the essential requirements and steps outlined in this guide, you can navigate the personal loan application process with confidence.

Proof of Identity

The first step in applying for a personal loan is to prove your identity. Lenders need to ensure that you are who you claim to be.

To do this, you will generally need to provide one or more of the following documents:

- Driver’s License: A driver’s license is a commonly accepted form of identification that contains your name, photograph, and address. It is crucial for confirming your identity.

- Passport: A passport is another widely accepted document that verifies your identity. It can serve as proof, especially if you don’t have a driver’s license.

- ID Card: Some lenders may accept a state-issued identification card as proof of identity.

- Military ID: If you are in the military, your military identification card can also be used for identity verification.

- Government-Issued Photo ID: Any government-issued photo identification, such as a municipal ID card, can be presented.

- Social Security Number (SSN): Your SSN is a vital piece of identification, often required for financial transactions.

- Individual Taxpayer Identification Number (ITIN): If you don’t have an SSN but have an ITIN, some lenders may accept it as an alternative form of identification.

Loan Application

Most lenders require applicants to complete a loan application. This application contains personal information, the desired loan amount, and the loan’s purpose.

Make sure to fill it out accurately and clearly, as this will affect the approval decision.

The application serves as a roadmap for your loan journey, providing lenders with essential details about your financial needs and intentions.

Proof of Address

After verifying your identity, lenders want to confirm your current residential address. This is crucial for them to contact you and comply with applicable state laws.

You can use the following documents to verify your home address:

- Utility Bill: A recent utility bill in your name at your current address can serve as proof.

- Lease or Rental Agreement: If you’re renting, providing a lease or rental agreement with your address is acceptable.

- Voter Registration Card: Some lenders may accept a voter registration card as proof of address.

- Proof of Insurance: Documentation of home, rental, or car insurance that lists your address can also be used.

Employer Verification

If you are an employee, many lenders will require information about your current employer. This includes your employer’s name and contact information.

In some cases, they may contact your employer to verify your employment status.

Employer verification is a standard practice to ensure your ability to repay the loan, especially if you rely on employment income.

Proof of Income and Expenses

Lenders need to ensure that you have sufficient income to repay the loan. You will need to provide evidence of your income, which may vary depending on your employment status:

If employed by someone else:

- Pay Stubs: Your pay stubs provide a snapshot of your income and deductions, offering lenders insight into your financial stability.

- W-2 Tax Forms: These forms summarize your annual income and tax withholdings, aiding lenders in assessing your financial capacity.

- Bank Statements: Bank statements showing regular income deposits can be used to confirm your financial stability.

- Income Tax Returns: Providing your income tax returns offers a comprehensive view of your financial history.

If self-employed:

- 1099 Tax Forms: Self-employed individuals can present 1099 tax forms as proof of income.

- Income Tax Returns: Similar to those employed by others, self-employed individuals should provide income tax returns to document their financial situation.

- Bank Statements: Bank statements with income deposits serve as a reliable indicator of your income flow.

- Documentation of Extra Income: If you have additional sources of income, be sure to include documentation to demonstrate your full financial capacity.

How to Qualify for a Personal Loan

Now that you know the required documents, it’s equally important to understand how to qualify for a personal loan.

Lenders consider various factors to determine your eligibility, including your credit score, credit history, income, and debt-to-income ratio (DTI).

Here are some tips to improve your chances of approval:

Maintaining a credit score of at least 670 will increase your qualification chances. For the most favorable terms, a minimum score of 720 is recommended.

Your credit score is a crucial indicator of your creditworthiness and ability to manage debt responsibly.

While minimum income requirements vary among lenders, having a consistent monthly income is crucial to demonstrate your ability to make monthly loan payments.

A steady income reassures lenders that you can meet your financial obligations.

A debt-to-income ratio below 36% is ideal, although some lenders may approve highly qualified applicants with a ratio of up to 50%.

Aim for a lower DTI to enhance your qualification prospects. Your DTI ratio reflects your financial stability and capacity to manage additional debt responsibly.

Remember that each lender has its own minimum requirements and lending criteria. Therefore, it’s advisable to pre-qualify and confirm with the lender which specific criteria you need to meet.

This will ensure that you apply only for loans that align with your financial situation, increasing your likelihood of approval.

In summary, applying for a personal loan requires the submission of documents that prove your identity, address, income and expenses.

Additionally, meeting credit score and DTI criteria is essential to improve your approval chances.

Preparing these documents in advance can expedite the application process and help you obtain the loan you need to achieve your financial goals.