Is a Career in Commercial Banks a Good Career Path?

Yes, a career in commercial banking is a good path. A commercial banker’s salary ranges from $70,000 to $92,000 a year, depending on the specific job duties you’re assigned. If you’re considering a career in banking, you have many options. You can start as an entry-level credit analyst, loan officer, or even a commercial real estate broker. You can work your way up to a higher-paying position if you want to, and the bank industry is continually expanding.

Entry-level jobs in Commercial Banks

Commercial banks offer a variety of entry-level positions and can be a great place to start a career. You don’t need to have a bachelor’s degree to get started; some banks offer internships. There are also graduate programs, which are ideal for those who want to move up in their career. These programs are often offered online and do not require a bachelor’s degree.

Anúncios

Many large banks offer a variety of different positions. Entry-level positions are not required, but some larger banks require that you have a four-year college degree. In addition to entry-level positions, you can also get a job as a trainee in a regulated bank. Most larger banks also provide scholarships for further study or student loans.

Many banks also employ office and support staff to keep their operations running smoothly. The majority of these positions don’t require a bachelor’s and can be as low as minimum wage. If you have an advanced degree, you can work your way up to senior positions that pay up to $100k per year.

Anúncios

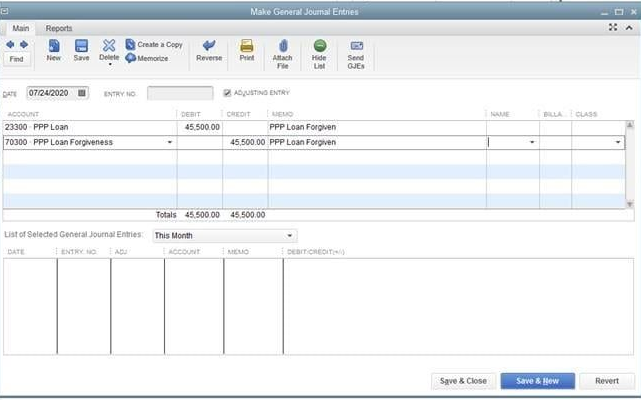

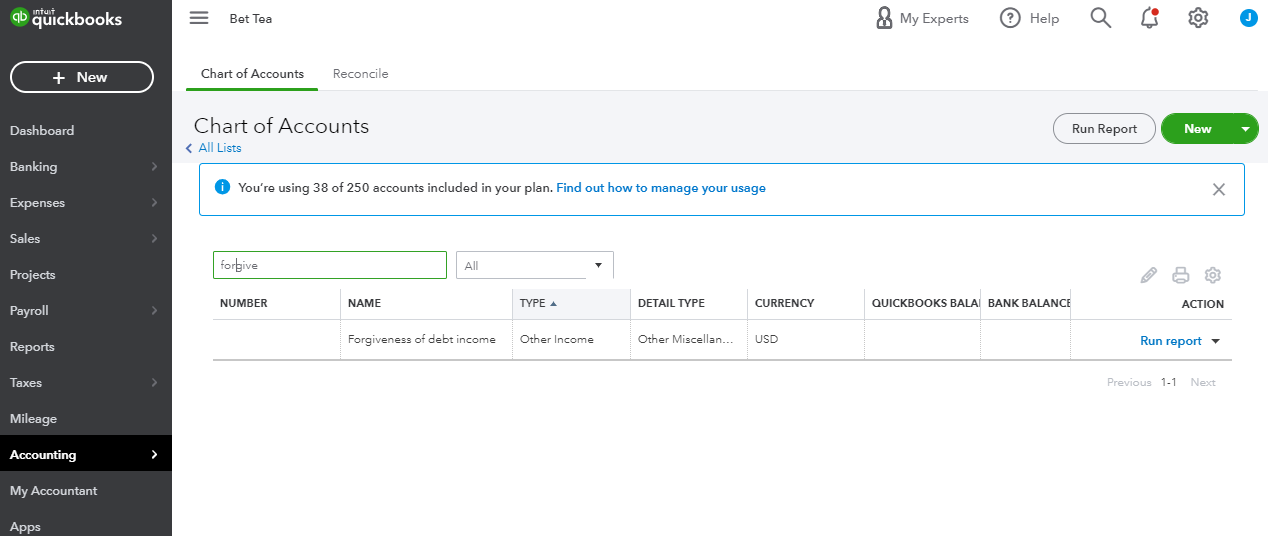

The banking industry is highly computerized and relies heavily on the internet for many transactions. Therefore, you need to be knowledgeable and proficient with accounting software and procedures. You don’t need a bachelor’s degree to become a bank employee, but you should be willing to develop your skills and learn the requirements for these positions.

You can become a branch manager or work in administrative support within a bank. Most national banks have branches in many states and larger cities. The jobs in commercial banks are varied and can include everything from bank teller to bank manager to fraud prevention specialist. In addition, there are many opportunities for advancement within the banks and within the regulatory agencies. The banking industry is not expected to go away in the near future.

Another good thing about commercial banks is that entry-level jobs usually don’t require a bachelor’s or advanced degree. You can apply for positions as a bank teller, branch manager, loan officer, and other managerial roles. Unlike a mortgage bank, a commercial bank uses its own funds to loan money to its customers.

Average annual salary of $92,000

If you’re interested in working in the financial sector, commercial banking may be the right career choice for you. As a commercial banker, you’ll work in partnership with commercial bankers and portfolio managers, gathering information, researching loan requests, problem-solving, and closing complex commercial loans. A commercial banker’s salary ranges from $70,000 to $92,000 a year, depending on the specific job duties you’re assigned.

A typical commercial banker in the U.S. made $88,506 per year in July 2022, according to Comparably. In addition to the average salary, the top earners in commercial banks could earn up to $541,000 annually. However, some jobs in commercial banking don’t pay as well. For example, the median salary for a bank teller in May 2021 was $36,310, compared to $45,760 for all occupations in the U.S.

Some commercial banking positions are stressful, and dealing with money, customers, and technology can be difficult. A few positions also rely heavily on commissions, which can make the compensation for these positions a bit shaky. A banker may also have to complete a master’s degree or get professional certification to get the job.

Competitiveness of the industry

If you’re looking for a career that pays well and offers a variety of job opportunities, a career in commercial banking might be perfect for you. This field is highly competitive, with many banks offering lucrative positions in senior positions to highly skilled individuals. However, you must be aware that the financial industry is becoming increasingly automated and computerized, which means that fewer jobs may be available in a few years. Banks are expanding all over the world, and competition is high for customers and business.

Although some younger generations still prefer to bank at their local community bank, many older generations are turning away from the local branch and are instead using online and telephone banking. Likewise, online services have made many local bank loan products obsolete. While large banks employ credit analysts, they also employ loan packaging services to ensure that their customers get the best interest rates.

While most banks operate in large cities, many smaller banks exist in smaller towns. Small banks are generally owned and operated by local communities. Small banks are often more stable and provide long-term career stability. Small banks are often local, which means they have a large following of customers. Likewise, they tend to be locally owned, meaning that customers are loyal to the owners and managers.

Whether you’re looking to work in a corporate banking environment or work in a small community bank, there are many ways to advance your career. You may begin as a teller or move up through the ranks. Or you can work as a loan officer or an investment salesperson. There are many levels of management within each of these departments.

Reasonable work hours

If you love working with money and numbers, then commercial banking is the perfect career path for you. You can find many positions in this field that require both interpersonal and technical skills. While most people in the banking industry work directly with customers, many of them are also surrounded by numbers and information.

Most retail banks have regular shifts. This allows them to give their employees some flexibility. They are also usually open on weekends, some evenings, and holidays. In addition to this, banking professionals can choose a schedule that fits their personal needs and preferences. Working in a bank is also an excellent way to gain experience and make contacts in the industry.