How to Connect Freshbooks With Fundbox?

If you’re a small business owner, then you know how important it is to get paid on time. But sometimes, invoices can get lost in the shuffle. That’s where Fundbox comes in.

Fundbox is a financial technology company that offers businesses a way to get paid faster by advancing payments on their invoices. And the best part is that it’s easy to connect Freshbooks with Fundbox.

FUNDBOX’S MASSIVE BUSINESS LOAN. $150K. Low FICO OK. No PG. No Fees. 2-Day Funding 🔶 CREDIT S2•E296

- Go to the Freshbooks website and create an account

- Once you have created an account, log in and go to the “Settings” tab

- Under the settings tab, select “Funding Options

- From there, you will be able to connect your Freshbooks account with Fundbox

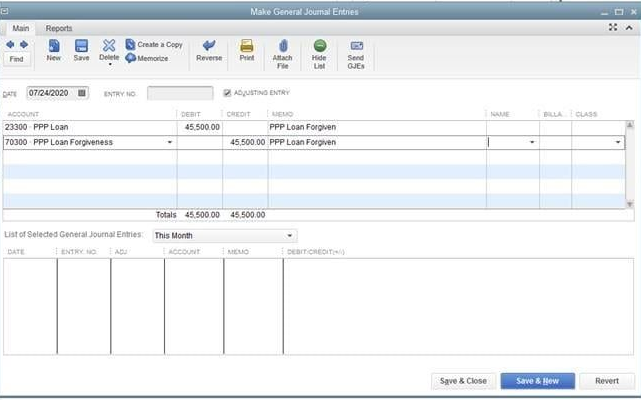

Fundbox Ppp Login

If you’re a small business owner who has been impacted by the COVID-19 pandemic, you may be wondering if there are any programs out there that can help you get back on your feet. One such program is the Paycheck Protection Program (PPP) from the Small Business Administration (SBA). The PPP is a loan program that provides low-interest loans to small businesses that have been impacted by the pandemic.

To apply for a PPP loan, you’ll need to fill out an application and submit it to your lender. Once your application is approved, you’ll receive the loan funds in two installments: one at closing and one six months later. You’ll also be required to make monthly payments on the loan, which will be deferred for the first six months.

If you’re looking for more information on the PPP or how to apply, Fundbox has put together a helpful guide that covers everything you need to know. You can check it out here: https://fundbox.com/ppp-loan/.

Fundbox Phone Number

If you’re a small business owner in need of working capital, you may be wondering if Fundbox is the right fit for you. After all, they boast an 80% approval rate and funding as soon as the next day. But with any financial decision, it’s important to do your research before moving forward.

In this blog post, we’ll provide a comprehensive overview of what Fundbox is, how it works, and whether or not it’s the right fit for your small business.

What is Fundbox?

Fundbox is a financial technology company that offers lines of credit to small businesses.

They are based in San Francisco, CA and were founded in 2013. Their mission is to “empower businesses with data-driven financing solutions.”

How Does Fundbox Work?

There are two primary products that Fundbox offers: lines of credit and invoicing factoring. Lines of credit are essentially loans that can be used at any time (up to the maximum amount borrowed) and repaid over time with interest. This product is best suited for businesses who have predictable income streams and can repay the loan within 12 weeks.

Invoice factoring works by selling your unpaid invoices (also known as receivables) to Fundbox at a discount in exchange for immediate payment – typically within 24 hours. This product is best suited for businesses who have customers who take longer than 30 days to pay their invoices.

To qualify for either product, you must have been in business for at least 3 months and have a minimum monthly revenue of $5000.

You will also need to provide some basic information about your business and connect your accounting software so that Fundbox can assess your risk profile. If approved, you will be able to choose which invoices you’d like to factor or how much money you’d like to borrow against your line of credit..

There are no fees associated with applying or being approved; however, if you do use either product there will be fees charged on the amount borrowed/invoiced (more on this below).

should You Use Fundbox?

Now that we’ve covered the basics of what Fund box is and how it works, let’s dive into whether or not it’s right for your small business needs.. As we mentioned earlier , one key consideration when deciding whether or not to use any type of loan or financing option is whether or not you’ll be able manage repayment .

Anúncios

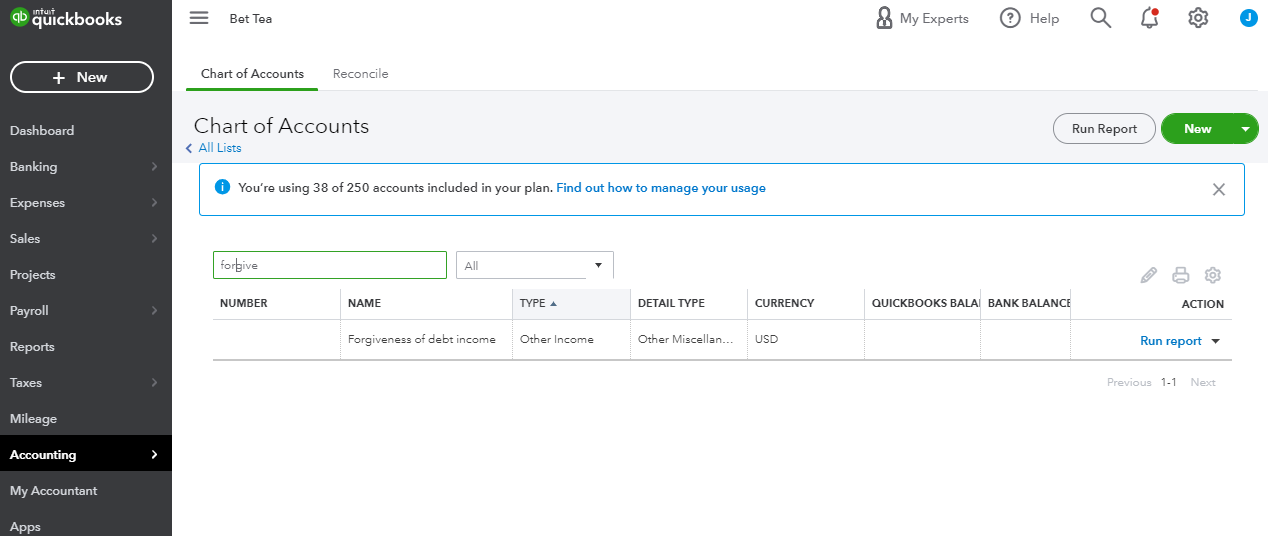

Freshbooks Pos

If you’re a small business owner, you know how important it is to keep track of your finances. That’s where FreshBooks comes in. FreshBooks is a cloud-based accounting software that makes it easy to track your income and expenses, create invoices, and manage your bookkeeping.

But what is FreshBooks POS, and how can it help your business? FreshBooks POS is a point-of-sale system that integrates with the FreshBooks accounting software. This means that you can useFreshBooks to track your inventory, customers, and sales data in one place.

This can save you time and money by eliminating the need for separate systems for each function.

In addition, Freshbooks POS offers several features that can help streamline your sales process. For example, you can set up tax rates for different items or services, apply discounts or coupons at the point of sale, and accept credit card payments directly through the system.

If you’re looking for an all-in-one solution for tracking your finances and managing your sales process, then Freshbooks POS is worth considering.

Fundbox Reviews

Fundbox is a financial technology company that provides working capital to small businesses. The company was founded in 2013 by Eyal Shinar, Tomer Shoval, and Gilad Cohen.[1][2]

According to Crunchbase, Fundbox has raised $176.5 million in six rounds of funding from eight investors.[3]

In June 2018, Forbes reported that Fundbox had reached a valuation of $1 billion after its Series C funding round.

Anúncios

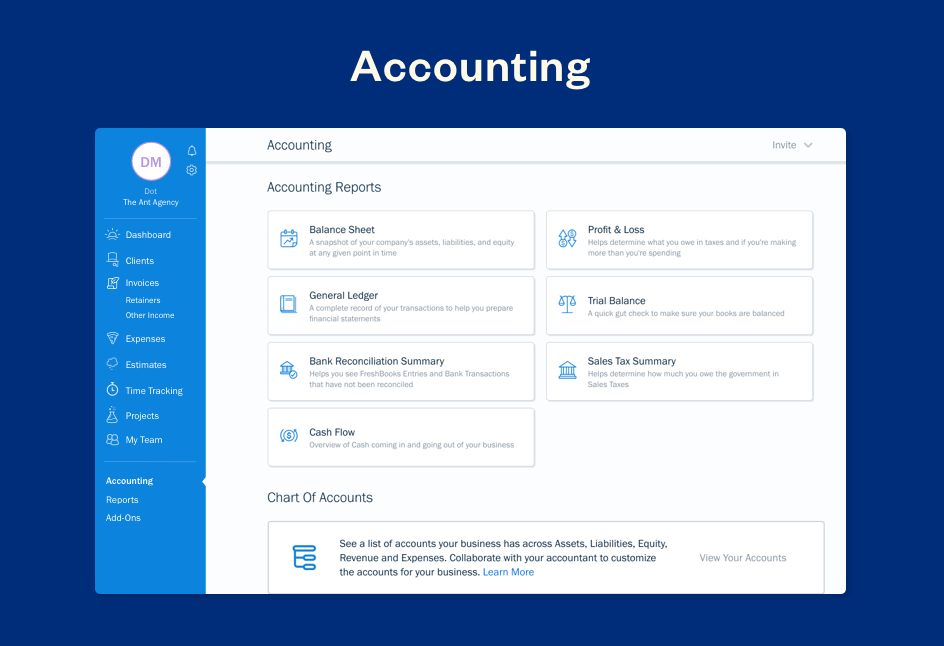

Freshbooks Payment Integrations

If you’re a small business owner, then you know how important it is to get paid on time. That’s why FreshBooks offers payment integrations with some of the most popular payment processors out there. This way, you can automatically send invoices and receive payments without having to worry about it.

Some of the payment processors that FreshBooks integrates with include PayPal, Stripe, and Authorize.net. All of these options are secure and easy to use, so you can rest assured that your money is safe. Plus, they all have different features that may be beneficial for your business.

For example, PayPal offers buyer protection in case something goes wrong with an order.

To learn more about FreshBooks payment integrations and which one might be right for your business, head over to their website today.

Credit: smarthustle.com

How Do You Draw Funds from Fundbox?

Assuming you are referring to the financial company, Fundbox, here is how you can draw funds from them:

1. Log in to your account on their website.

2. Click on the “Draw Funds” tab.

3. Select how much money you would like to draw, up to your available credit limit.

4. Fill out your bank information and click “Submit.”

5. Your funds will be deposited into your account within one business day!

How Do You Bill Clients in Freshbooks?

If you’re a freelancer, chances are you’ve looked into FreshBooks as a way to manage your invoicing and client billing. And if you’re looking into using FreshBooks, you probably want to know how their billing system works. Here’s a detailed look at how you can bill your clients through FreshBooks.

When you create an account with FreshBooks, you’ll be able to add your clients’ information into the system. This includes their contact information, payment terms, and any other relevant details. Once your clients are set up in the system, creating invoices is simple.

You can either create them manually or have FreshBooks generate them automatically based on the project details and time tracking data that you enter into the system.

Once an invoice is created, it will appear in your client’sFreshBooks account portal. From there, they can view the invoice and make a payment online.

They can also choose to receive automatic reminders about upcoming payments so that they never miss one. When a client makes a payment, you’ll be notified by email and the funds will be deposited directly into your bank account (minus any applicable fees).

Overall, billing through FreshBooks is simple and straightforward – perfect for busy freelancers who need to get paid quickly and efficiently!

How Do I Add a Payment Method to Freshbooks?

If you’re like most business owners, you want to get paid as quickly and easily as possible. That’s why we’ve made it simple to add a payment method to your FreshBooks account. Here’s how:

1. Log in to your FreshBooks account and click on the ‘My Account’ tab at the top of the page.

2. Under the ‘Billing’ section, click on the ‘Payment Methods’ link.

3. On the next page, click on the ‘Add Payment Method’ button.

4. Enter your payment information and then click on the ‘Save Payment Method’ button.

That’s it! You’ve now added a payment method to your FreshBooks account and can start processing payments from your clients right away!

How Long Does Fundbox Take to Deposit?

Fundbox is a financial technology company that offers business owners access to working capital. They are based in San Francisco, CA and were founded in 2013. Fundbox has a simple application process and they deposit funds as soon as the next business day.

The first step is to sign up for an account on their website. This will require some basic information about your business, such as your legal name, address, and tax ID number. Once you have completed the sign-up process, you will be able to log into your account and begin the funding application.

The funding application will ask for additional information about your business, such as annual revenue and average monthly credit card sales. You will also need to provide a link to your online accounting software so that Fundbox can review your financial history. Once you have submitted the application, Fundbox will make a decision within 24 hours.

If you are approved for funding, Fundbox will deposit the funds into your account as soon as the next business day. You can then use those funds to pay off outstanding invoices or other expenses related to your business. Repaying the loan is simple – you can choose to make weekly or monthly payments over a period of 12 or 24 weeks.

Conclusion

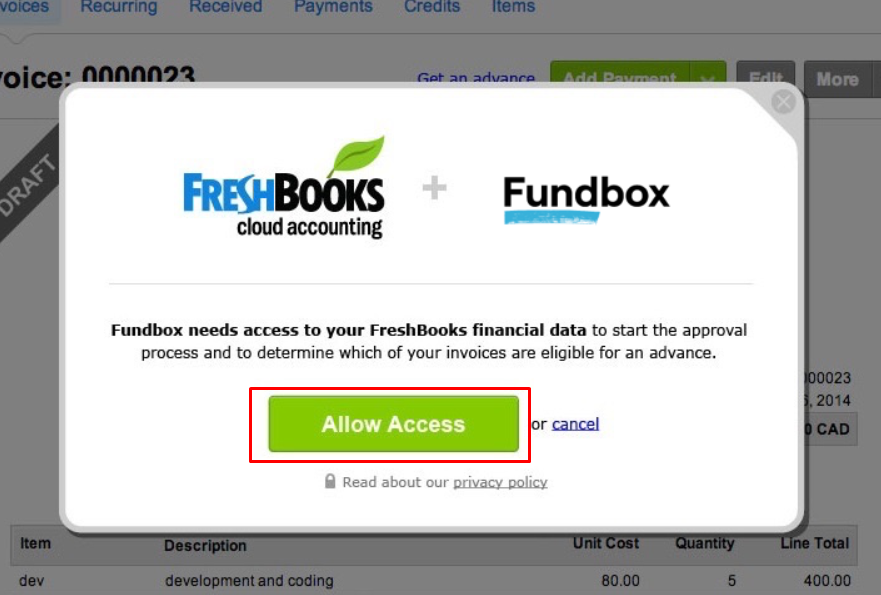

If you use Freshbooks to manage your business finances, you can now connect it with Fundbox and get access to quick and easy funding. This will allow you to free up cash flow and keep your business running smoothly. All you need to do is follow these simple steps:

1) Log into your Freshbooks account and go to the ‘Settings’ tab.

2) Click on the ‘Connections’ option and then select ‘Fundbox’.

3) Enter your Fundbox login credentials and click ‘Allow Access’.

4) That’s it! You’re now connected and can start using Fundbox to fund your invoices.