How Long Does Plooto Take to Deposit?

Plooto is an online platform that helps businesses manage their accounts payable and receivable. It’s a fast and efficient way to get your invoices paid, and you can get started with Plooto in just a few minutes. But how long does it take for Plooto to deposit the money into your account?

The answer depends on a few factors, including the type of account you have with Plooto and how quickly your bank processes payments. In most cases, Plooto will deposit the funds into your account within 1-2 business days. However, if you have a particularly large or complex payment, it may take longer for Plooto to process the payment and deposit the funds into your account.

If you’re like most people, you probably have a few questions about Plooto and how it works. In particular, you may be wondering how long it takes for Plooto to deposit your money into your bank account.

Here’s the short answer: Generally speaking, it takes 1-2 business days for Plooto to deposit your money into your bank account.

However, there are a few factors that can affect this timeline, such as the amount of money being deposited and the policies of your specific bank.

Now let’s take a closer look at each of these factors…

The Amount of Money Being Deposited

One factor that can affect how long it takes for Plooto to deposit your money is the amount of money being deposited. If you’re only depositing a small amount of money, it’s likely that the transaction will go through fairly quickly. However, if you’re depositing a large sum of money, it may take a bit longer for the funds to show up in your account.

This is because banks typically have different processes for handling large deposits.

The Policies of Your Specific Bank

Another factor that can affect how long it takes for Plooto to deposit your money is the policies of your specific bank.

Every bank has its own set of rules and regulations regarding deposits and other transactions. As such, some banks may take longer to process deposits than others. If you’re not sure about the policies of your bank, we recommend contacting them directly to get more information.

Credit: www.softwareadvice.com

Anúncios

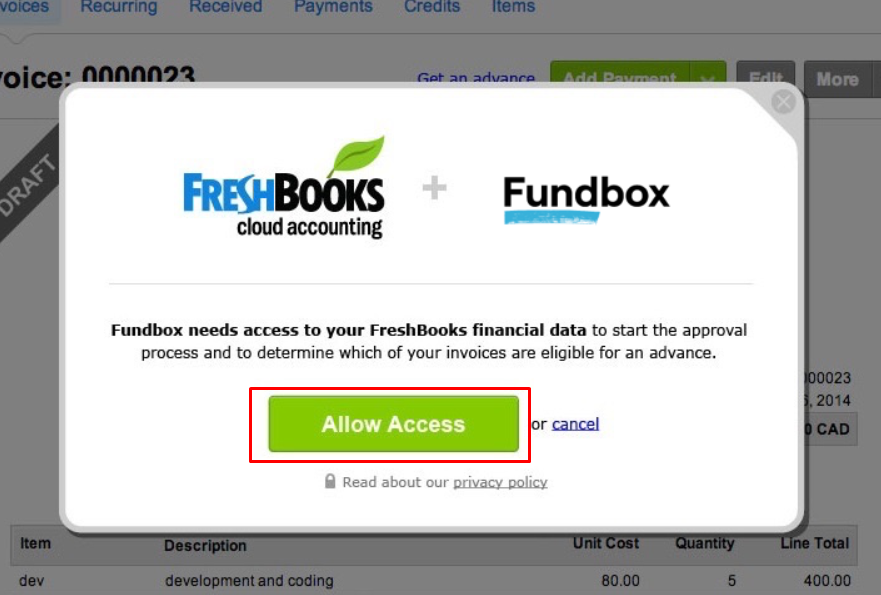

How Do I Receive Money from Plooto?

Assuming you are referring to how users can receive payments from Plooto, there are a few ways.

If you are a vendor/supplier, you can choose to be paid by cheque, EFT (Electronic Funds Transfer) or through PlootoPay. If you are set up for automatic payments, your payments will come through on the date specified in your agreement with the payer.

If not, you will be notified of the payment and can log in to retrieve it.

To receive your payment via cheque:

-Go to the “Receive” tab on the left-hand side of your screen

-Click “Receive by Cheque” at the top of the page

-Select which invoices you’d like to include in this batch of payments by clicking the checkbox next to each one

-Click “Submit for Payment” at the bottom right corner of the screen

– Your cheques will be mailed out within 5 business days

To receive your payment via EFT:

– Go to the “Receive” tab on the left-hand side of your screen

– Click “Receive by EFT” at the top ofthe page

– Select which invoices you’d liketo include in this batchof paymentsby clickingthe checkboxnext toeachone

– Click “Submit for Payment” atthe bottomrightcornerofthe screen

What is Plooto Instant?

Plooto is an online platform that helps businesses manage their accounts receivable and accounts payable. With Plooto, businesses can send invoices, track payments, and manage their cash flow all in one place. Plooto also offers a feature called “instant payouts” which allows businesses to get paid faster by issuing payments to their vendors through Plooto’s instant payment network.

Anúncios

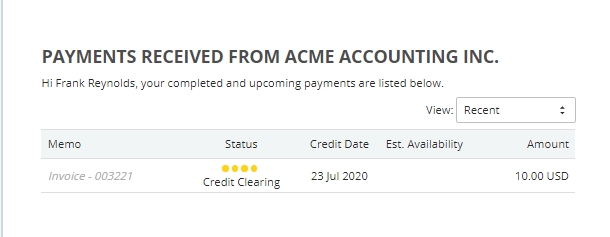

How Do I Pay Someone With Plooto?

In order to pay someone using Plooto, you’ll first need to set up an account and connect it to your bank account or credit card. Once you’ve done that, you can then create a new payment and select the person you’d like to pay from your contacts list. You’ll need to enter the amount you’re paying and select whether it’s for goods or services.

Finally, review the payment details and click ‘Submit Payment’ to complete the transaction.

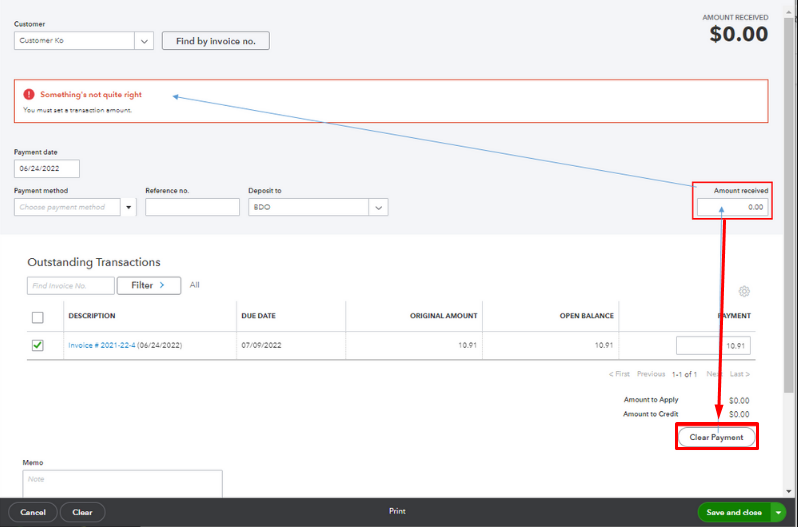

What is Plooto Clearing?

Assuming you are asking about the Canadian company Plooto Inc., they offer an accounts payable and receivable automation service. This means that they can help streamline your accounting processes by automating tasks like issuing payments, sending invoices and collecting payments.

Plooto clearing is the process of automatically issuing payments to your vendors and suppliers through Plooto’s platform.

This can save you time and money by eliminating manual payment processing. In addition, Plooto offers a number of other features that can help with your accounting, such as automated invoice management and online payment collection.

What is Plooto? Say good bye to mailing mailing cheques

Plooto Payment Methods

There are many different ways to pay with Plooto. You can use a credit or debit card, bank transfer, PayPal, or even cryptocurrency. All of these methods are safe and secure, so you can choose the one that best suits your needs.

Credit and debit cards are the most popular payment method on Plooto. They’re quick and easy to use, and you can pay for your purchases in just a few clicks. Plus, all major credit and debit cards are accepted, so you shouldn’t have any trouble finding a way to pay.

Bank transfers are also a popular payment method on Plooto. They’re simple and straightforward, and they allow you to move money directly from your bank account to Plooto. This is a great option if you don’t want to use a credit or debit card, or if you’re looking for a more secure way to pay.

PayPal is another popular payment method on Plooto. It’s fast, convenient, and it allows you to pay with just a few clicks. Plus, PayPal is accepted by millions of businesses around the world, so you should have no trouble finding a way to pay with this method either.

Finally, cryptocurrency is also an option for paying on Plooto. This is a relatively new payment method, but it’s becoming increasingly popular due to its security and anonymity features.

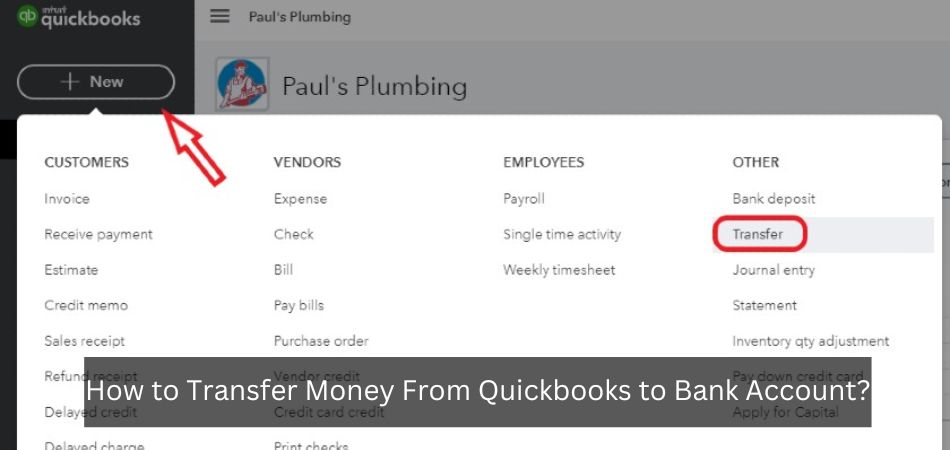

Plooto Money Transfer

If you’re looking for a fast, easy and secure way to send money, Plooto is the perfect solution. With Plooto, you can send money to anyone in the world with just a few clicks. Plus, there are no fees or exchange rates to worry about.

Plooto is a great option for sending money to friends and family overseas. All you need is the recipient’s email address and you can send them money in seconds. The funds will be deposited directly into their bank account, so they can access the money right away.

Plus, if you’re ever worried about security, Plooto uses state-of-the-art security measures to keep your information safe. So you can rest assured that your money is always safe when you use Plooto.

Plooto Receive Payments

If you’re a small business owner, you know how important it is to get paid promptly. But sometimes, customers don’t always pay on time. This can put a real strain on your business cash flow.

That’s where Plooto comes in. Plooto is a Canadian company that specializes in helping small businesses receive payments quickly and efficiently.

Here’s how it works: when you sign up for an account with Plooto, you’ll be able to send invoices to your customers electronically.

They can then pay those invoices online, using their credit card or bank account. And once the payment is processed, the funds will be transferred directly into your own account – typically within one or two days.

There are no monthly fees associated with using Plooto, and you only pay a transaction fee of 2% when customers make a payment (with a minimum fee of $1 per transaction).

This makes Plooto an affordable option for small businesses who need help getting paid on time.

If you’re ready to streamline your accounts receivable process and get paid faster, sign up for an account with Plooto today!

Plooto Payment Limit

If you’re a small business owner who relies on Plooto to manage your finances, you may be wondering what the payment limit is. Here’s what you need to know.

The Plooto payment limit is $10,000 per transaction.

This means that if you’re sending a payment to someone via Plooto, the maximum amount you can send is $10,000.

There are no limits on the number of transactions you can make or the total amount of money you can send through Plooto. However, keep in mind that each transaction will incur a fee (which we’ll discuss below).

So, why is there a limit? The answer has to do with security and fraud prevention. By limiting the amount of money that can be sent in each transaction, Plooto reduces its exposure to fraudulent activity.

Of course, if you need to send more than $10,000 in a single transaction, you can always make multiple payments. Just remember that each payment will incur its own fee.

Now let’s talk about fees.

When you make a payment through Plooto, there is a 2% fee charged by Plooto on top of any fees charged by your bank or credit card company (if applicable). So, if you’re sending a $10,000 payment, the total cost would be $10,200 ($10,000 + $200).

Conclusion

In general, Plooto will take 1-2 business days to deposit your funds. However, this may vary depending on your bank’s policies and procedures. If you have any questions about how long it will take for your funds to be deposited, we recommend contacting your bank directly.