Credit Monitoring Service: Understand If It’s Worth It

In today’s financial world, where information is essential and transactions happen at breakneck speed, maintaining accurate and up-to-date control of your credit history is more important than ever.

Credit monitoring service has emerged as a vital tool for consumers seeking to protect their financial identity and keep their financial health in good shape.

But the question persists: is it worth investing in a credit monitoring service? In this article, we’ll talk about what this credit monitoring service is and how it works. Keep reading to find out.

Anúncios

What is a Credit Monitoring Service?

A credit monitoring service is a tool offered by various companies to continuously track and analyze a consumer’s credit history.

It works by monitoring the credit-related activities of the user, such as credit inquiries, opening of new accounts, bill payments, among others, and provides alerts if there are any suspicious activities or significant changes in the credit profile.

Anúncios

These services typically provide access to the user’s credit scores, detailed credit reports, and analysis tools to help consumers better understand their financial health and make informed decisions.

Additionally, some services offer extra features such as identity theft insurance, social media monitoring for fraudulent activities, and assistance in case of identity theft.

Therefore, a credit monitoring service is designed to help consumers protect their financial identity, detect potential fraud, and take proactive measures to maintain their financial health.

Understanding How This Service Works

The operation of a credit monitoring service involves several steps and processes that are executed continuously to ensure effective surveillance of a consumer’s credit history.

The operation proceeds as follows:

- Information Collection: The credit monitoring service collects relevant information from the consumer, such as their name, address, Social Security number, and other personal information.

- Access to Credit Reports: The service gains access to the consumer’s credit reports from one or more credit bureaus, such as Equifax, Experian, and TransUnion. These reports provide a detailed record of the consumer’s financial activities.

- Analysis and Monitoring: The service uses algorithms and advanced technologies to analyze the data from the consumer’s credit report and identify any suspicious activities or significant changes.

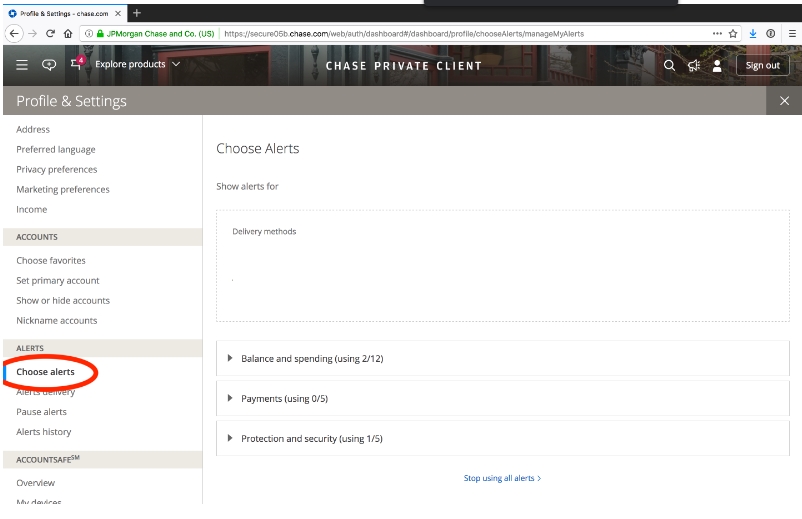

- Alerts and Notifications: If the service detects any suspicious activity or significant change in the consumer’s credit history, it sends immediate alerts and notifications to the user.

- Additional Resources: In addition to continuous monitoring of the credit history, many credit monitoring services offer additional features to prevent fraud.

The credit monitoring service functions as a vigilant guardian of the consumer’s credit history, detecting and alerting about suspicious activities to help protect against fraud and maintain financial health.

Who Needs This Type of Monitoring?

The credit monitoring service is useful for a variety of people in different financial and life situations.

Individuals concerned about the security of their financial information, including those who have been victims of identity theft in the past.

Or who wish to proactively protect themselves against potential fraud, can benefit from this type of monitoring.

Additionally, people with poor or limited credit history can use the service to ensure they are taking steps to improve their credit score and correct any errors or inaccuracies in their credit reports.

For those planning major purchases, such as buying a home or a car, credit monitoring can help ensure that their credit score is healthy. And that there are no suspicious activities that could negatively affect their ability to obtain financing.

Moreover, anyone who believes they may be a potential victim of fraud or identity theft can benefit from credit monitoring to quickly detect and respond to fraudulent activities.

Even for those without immediate concerns about financial security, credit monitoring can be a valuable tool for maintaining control over their financial health.

And of course, identifying areas for improvement, and ensuring they are on track to achieve their long-term financial goals.

Thus, credit monitoring is essential for anyone who values their financial security and wants to protect their identity and financial health from potential threats and fraud.

Benefits of Using the Credit Monitoring Service

The credit monitoring service offers a range of significant benefits to consumers, including:

Fraud Detection

One of the main advantages of the service is its ability to detect suspicious or unauthorized activities in your credit history.

This may include the opening of new accounts without your knowledge, unauthorized credit inquiries, and other activities that may indicate potential fraud or identity theft.

Real-Time Alerts

The service provides immediate and real-time alerts whenever it detects suspicious activities in your credit history.

These alerts allow you to respond quickly to any fraudulent activity and take necessary steps to protect your identity and financial resources.

Credit Score Protection

Maintaining a good credit history is essential to ensuring access to financing and favorable interest rates.

The credit monitoring service helps protect your credit score by alerting you to any activity that may negatively affect it, allowing you to take steps to correct issues quickly and maintain a healthy score.

Credit Report Monitoring

In addition to alerts of suspicious activities, the service offers continuous access to and monitoring of your credit report.

This allows you to closely track all information in your report, identify errors or inaccuracies. And take steps to correct them, ensuring the accuracy and integrity of your credit history.

How Much Does the Monitoring Service Cost?

The cost of the credit monitoring service varies depending on several factors.

Basic plans usually monitor only one of the three credit reports and offer basic fraud alerts. While more comprehensive plans monitor all three reports, provide detailed alerts, and include additional features such as identity restoration and identity theft insurance.

The three major US credit bureaus (Experian, Equifax, and TransUnion) offer their own credit monitoring services, in addition to private companies. Prices may vary between agencies and companies.

Some services include additional features such as dark web monitoring, password protection, and credit score simulators, which may increase the monthly cost.

To get an idea of average credit monitoring service costs, see the prices below:

- Basic plans: $10 to $15 per month

- Comprehensive plans: $20 to $35 per month

- Premium plans: $40 to $50 per month or more

Now that you understand the credit monitoring service, you can choose to subscribe to one and enjoy the benefits. And explore other tips to keep your money safe by browsing our website.