Can Crypto Accounting Software Be Deducted?

The short answer is yes, you can deduct your cryptocurrency accounting software. The IRS has been clear that Bitcoin and other virtual currencies are to be treated as property for tax purposes. This means that any expenses related to your cryptocurrency business, including accounting software, can be deducted just like any other business expense.

As a business owner, you’re always looking for ways to save on taxes. So, can crypto accounting software be deducted?

The answer is maybe.

If you use the software for business purposes, then it may be considered a business expense and therefore deductible. However, if you use it for personal purposes, it’s not likely to be deductible.

To deduct crypto accounting software as a business expense, it must be necessary and helpful in running your business.

For example, if you use the software to track your inventory or customers’ orders, then it would likely be considered a business expense. On the other hand, if you only use the software to check prices or manage your personal finances, then it’s not likely to be deductible.

If you’re not sure whether your crypto accounting software is deductible, talk to your accountant or tax advisor.

They can help you determine if the software qualifies as a business expense and advise you on how to claim the deduction correctly on your taxes.

How To File Your Crypto Taxes – Best Crypto Accounting Software

Is Crypto Tax Software Deductible?

No, crypto tax software is not deductible. The Internal Revenue Service (IRS) has not ruled on the deductibility of crypto tax software specifically, but they have ruled that expenses related to the acquisition and disposition of cryptocurrency are not deductible. This would include any fees paid for using a service like CryptoTax Software.

Anúncios

Can You Write off Crypto As a Business Expense?

Yes, you can write off crypto as a business expense. The IRS has issued guidance stating that cryptocurrency is property and not currency, so it can be used as a deduction just like any other business expense. When writing off crypto as a business expense, you’ll need to keep track of the fair market value of the currency at the time of purchase or sale.

Can You Write off Crypto Mining Equipment?

There are a few things to consider when it comes to writing off crypto mining equipment. The first is that the IRS has not yet released any guidance on how to treat cryptocurrency mining income or expenses. This means that there is some ambiguity about how to properly report it come tax time.

The second thing to consider is that, even if the IRS were to release guidance on how to treat cryptocurrency mining, it’s unlikely that they would allow you to write off the full cost of your equipment. The reason for this is that crypto mining is considered a hobby activity, and as such, you can only deduct expenses up to the amount of income you generated from your hobby activity.

So, in short, while you may be able to write off some of the costs associated with your crypto mining equipment, it’s unlikely that you’ll be able to deduct the full cost.

Anúncios

Credit: masterthecrypto.com

Are Crypto Transaction Fees Tax Deductible

Are you one of the many people who have started investing in cryptocurrency? If so, you may be wondering if crypto transaction fees are tax deductible.

The answer to this question depends on a few factors, such as whether or not you are using cryptocurrency for personal or business purposes.

However, in general, most crypto transaction fees are considered to be taxable expenses.

This means that if you are using cryptocurrency for personal purposes, any losses that you incur from paying transaction fees can be used to offset any gains that you make. For example, if you bought $1,000 worth of Bitcoin and then sold it later for $2,000, your capital gain would be $1,000.

However, if you paid $100 in transaction fees when buying and selling your Bitcoin, your net capital gain would only be $900 ($2,000-$1,000-$100).

If you are using cryptocurrency for business purposes, then your situation may be different. For example, if you are a merchant who accepts cryptocurrency as payment for goods or services, the transaction fee that you pay is generally not tax deductible.

This is because the fee is considered to be part of the cost of goods sold (COGS). However, there may be some exceptions depending on your specific circumstances.

Overall, whether or not crypto transaction fees are tax deductible depends on a variety of factors.

However, in most cases they will either be considered taxable expenses or part of the COGS for businesses.

Crypto Transfer Fees And Taxes

Crypto Transfer Fees And Taxes

Are you looking to send cryptocurrency to another person? Perhaps you’re looking to receive cryptocurrency from someone else.

In either case, you’ll need to know about cryptocurrency transfer fees and taxes.

When it comes to sending cryptocurrency, there are two types of fees that may be incurred: transaction fees and network fees. Transaction fees are paid to the blockchain that processes the transaction.

Network fees are paid to miners who confirm transactions on the blockchain. The amount of each type of fee will vary depending on the cryptocurrency being sent and the size of the transaction. For example, at the time of writing this blog post, the average Ethereum transaction fee was around $0.10 USD.

As for taxes, things get a bit more complicated. Cryptocurrency is taxed as property in most jurisdictions, which means that capital gains tax may apply when it is sold or exchanged for other assets (including fiat currency). However, because crypto-to-crypto transactions are not yet considered taxable events in most countries, no tax is currently owed on transfers between different cryptocurrencies.

This could change in the future, so it’s always best to check with a tax professional before making any large crypto transfers.

In summary, if you’re planning on sending or receiving cryptocurrency, be sure to factor in both transaction fees and potential taxes before doing so. By doing so, you can avoid any unwanted surprises down the road.

Koinly

io

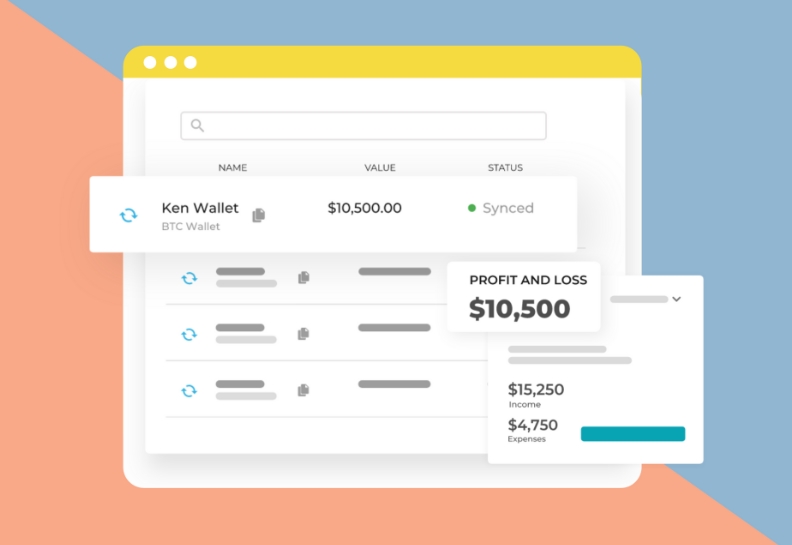

Koinly is a crypto tax software that helps you calculate your capital gains and losses for your cryptocurrency investments. It connects to all major exchanges and wallets, and allows you to import your transaction history from these platforms.

Koinly then calculates the cost basis of your assets, taking into account factors such as fees, discounts, and rebates. Finally, it generates a report detailing your realized and unrealized gains/losses in USD or any other fiat currency.

Conclusion

Crypto accounting software can be a great way to keep track of your crypto investments and transactions. However, you may be wondering if you can deduct the cost of this software on your taxes. The answer is yes!

You can deduct the cost of crypto accounting software as a business expense. This deduction will help you save money on your taxes and keep better track of your crypto investments.