Does Quickbooks Report to Irs?

No, QuickBooks does not report to the IRS. You are responsible for ensuring that your records comply with IRS regulations.

Intuit, the company that makes QuickBooks, reports to the IRS. They are required to do so by law. However, they do not share information about individual taxpayers with the IRS.

DO NOT DO THIS in QuickBooks (When Adding Bank Transactions)

Does Quickbooks Self-Employed Report to Irs?

Yes, QuickBooks Self-Employed reports to the IRS. When you file your taxes, QuickBooks Self-Employed will provide you with a report that includes your income, expenses and other important information related to your self-employment taxes. This report can be used to help you complete your tax return and make sure that you are paying the correct amount of taxes.

Anúncios

Does Quickbooks Track Taxes?

Yes, QuickBooks can track your taxes. To do this, you’ll need to set up a few things in QuickBooks first.

To get started, go to the Taxes menu and select Payroll Taxes.

Then, click on the Set Up Payroll Taxes button. This will open the Set Up Payroll Taxes window.

In this window, you’ll need to enter your company’s information, including your EIN (Employer Identification Number) and tax filing status.

You’ll also need to select which payroll taxes you want to track in QuickBooks. These include federal taxes (such as income tax and Social Security), state taxes (such as sales tax), and local taxes (such as city or county taxes).

Once you’ve entered all of this information, click on the Save button.

This will save your settings and allow you to start tracking your payroll taxes in QuickBooks.

Can the Irs Access Your Quickbooks?

The IRS can absolutely access your QuickBooks data if they so choose. If you’re being audited, the first thing they’ll request is a copy of your QuickBooks file. They can also request QuickBooks data through other means, such as a summons.

While the IRS doesn’t have direct access to QuickBooks Online (QBO), they can still get their hands on your data if they need to. QBO stores data in the cloud, so the IRS could potentially subpoena Amazon (AWS), which hosts QBO data, for records.

If you use QuickBooks Desktop (QBDT), the IRS has even easier access to your financial information.

QBDT stores data locally on your computer, so the IRS could simply seize your computer during an audit and copy all of yourQuickBooks files.

Bottom line: The IRS can definitely access your Quickbooks data if they want to, so it’s important to make sure everything is accurate and up-to-date before an audit.

Anúncios

Does Quickbooks Send W2 to Irs?

While QuickBooks can help you fill out and print your W-2 forms, it cannot send them electronically to the IRS. You’ll need to mail your completed W-2s to the IRS yourself.

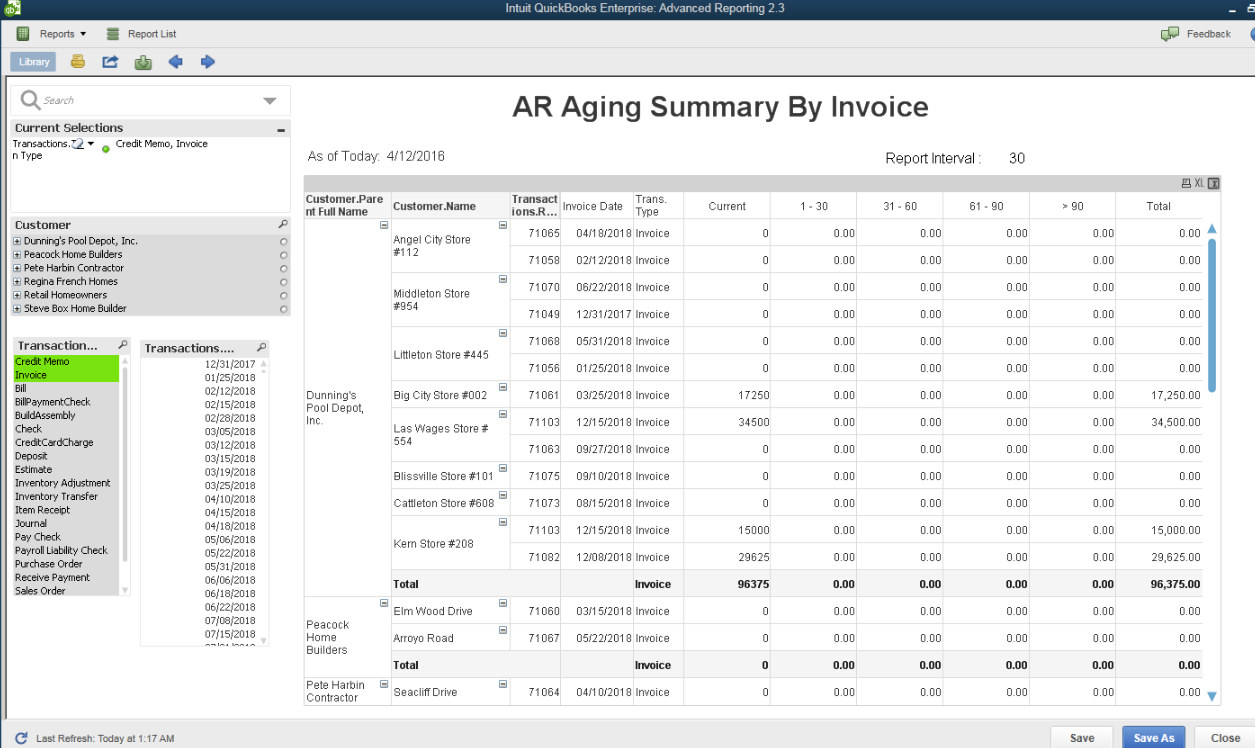

Credit: www.amazon.com

How Do I Get My 1099 from Intuit

If you’re a contractor or self-employed, you probably get a lot of 1099 forms at the end of the year. Intuit is one of the companies that may send you a 1099. So how do you get your 1099 from Intuit?

First, go to the Intuit website and log in to your account. Once you’re logged in, click on the “My Account” tab and then select “View My Forms.” From there, you should be able to view and print any 1099 forms that have been issued to you by Intuit.

If you can’t find your forms or if you have any other questions about getting your 1099 from Intuit, give their customer service team a call at 1-800-4INTUIT (1-800-446-8848). They’ll be happy to help!

Quickbooks 1099 Credit Card Payments

If you receive payments for goods or services through a credit card, you may need to file a 1099-C form with the IRS. Here’s what you need to know about QuickBooks and 1099-C credit card payments.

What is a 1099-C?

A 1099-C form is used to report cancelation of debt. When a debt is canceled, it’s considered income and must be reported on your taxes. If you receive payments through a credit card, those payments may be considered cancelation of debt and must be reported on a 1099-C.

How do I know if I need to file a 1099-C?

If you’re not sure whether or not you need to file a 1099-C, you can check with the IRS website or speak to your accountant. In general, though, if you’ve received credit card payments for goods or services that were canceled, you’ll need to file a 1099-C.

How do I enter 1099-C information into QuickBooks?

1. Go to the Vendors menu and select Enter Credit Card Charges.

2. Select the vendor that issued the credit card payment from the dropdown menu.

3. Enter the amount of the payment in the Amount field.

4. In the Payment Method dropdown menu, select Check/Card/1099Misc Payment (the bottom option).

Which Statement Describes the Gaap Consistency Principle?

The GAAP consistency principle requires that companies use the same accounting methods from one period to the next. This principle is important because it allows investors and other users of financial statements to compare a company’s financial results from one period to another.

Using different accounting methods from one period to the next would make financial statements much more difficult to compare, and would make it difficult to assess a company’s financial performance over time.

For this reason, companies must be consistent in their application of GAAP when preparing financial statements.

Conclusion

According to the author of this blog post, the answer to the question “Does Quickbooks Report to Irs?” is a resounding yes! Quickbooks is a software program that helps businesses keep track of their finances, and it reports to the IRS on a regular basis. The author goes on to say that Quickbooks is a valuable tool for small businesses, and that it can help them save time and money.