What is the Best Accounting Software for Sole Proprietor?

There are many accounting software programs on the market, but not all are created equal. When you’re a sole proprietor, you need to choose an accounting program that fits your specific business needs. To help you make the best decision for your business, we’ve compiled a list of the top five accounting software programs for sole proprietors.

There is a lot of accounting software out there and it can be tough to decide which one is best for your business. If you are a sole proprietor, you might be wondering what the best accounting software options are for you.

One option that you might want to consider is QuickBooks Self-Employed.

This software is designed specifically for sole proprietors and it offers a number of features that can help you manage your finances. For example, QuickBooks Self-Employed can help you track your expenses, invoices, and mileage. It also has a built-in tax calculator so you can estimate your taxes owed at the end of the year.

Another option to consider is Wave Accounting. This software is free to use and it offers many features that can benefit sole proprietors. Wave Accounting can help you track your income and expenses, create invoices, and even manage payroll if you have employees.

Plus, Wave Accounting integrates with a number of other business apps so you can manage all aspects of your business from one platform.

No matter which accounting software you choose, make sure it offers the features and functionality that you need to run your business effectively.

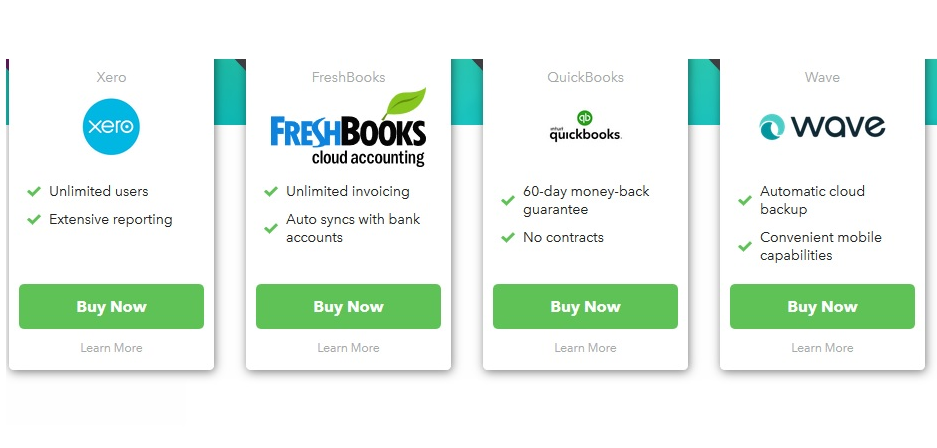

TOP 5 Accounting Software For Small Businesses 2022 – Quickbooks vs xero vs freshbooks vs wave

What is the Best Accounting Software for Sole Traders?

There is a lot of accounting software on the market, and it can be difficult to decide which one is best for your business. If you are a sole trader, there are a few things you should look for in accounting software.

First, the software should be easy to use.

You don’t want to spend hours trying to figure out how to input your data or generate reports. Second, it should have all the features you need. This includes basic features like invoicing and tracking expenses, as well as more advanced features like inventory management and project tracking.

Third, it should be affordable. You don’t want to break the bank just to get your accounting done.

Fortunately, there are many great accounting software options available for sole traders.

Some of our favorites include FreshBooks, Wave Accounting, and ZipBooks. All of these options are easy to use, offer a wide range of features, and are very affordable.

Anúncios

How Much is Quickbooks for Sole Proprietor?

There is no one-size-fits-all answer to this question, as the cost of QuickBooks will vary depending on the specific needs of your business. However, we can give you some general guidelines to help you determine how much QuickBooks will cost for your sole proprietorship.

First, you’ll need to decide which version of QuickBooks is right for your business.

QuickBooks offers three different versions – Basic, Pro and Premier – each with different features and price points. If you’re not sure which version is right for you, we recommend taking the QuickBooks Self-Employed tour to get a better idea of what each version has to offer.

Once you’ve decided on a QuickBooks version, the next step is to determine how many users you’ll need.

QuickBooks allows up to three users on its Basic and Pro plans, while its Premier plan supports up to five users. If you have more than three employees or contractors who need access to QuickBooks, you’ll need to upgrade to the Premier plan. Pricing for additional users starts at $10/month (billed annually).

Finally, if you plan on using any of QuickBook’s add-on services – such as payroll or merchant services – there will be additional fees associated with these features. Overall, the cost of QuickBooks for a sole proprietor will depend on the specific needs of their business but should fall somewhere in the range of $20-$60/month when all factors are considered.

What is the Easiest Bookkeeping Software?

There is no single answer to this question as the best bookkeeping software for your business depends on a number of factors, including the size and complexity of your business, your industry, and your personal preferences. However, there are a few bookkeeping software programs that are generally considered to be easier to use than others.

One popular option is Xero, which is designed to be simple and user-friendly.

Xero offers a range of features that can make bookkeeping quick and easy, including automated bank feeds, invoicing tools, and reporting tools. Another option is QuickBooks Online, which also offers a range of features and tools to help streamline bookkeeping.

Whichever software program you choose, be sure to take some time to learn how it works before getting started.

There may be a bit of a learning curve at first but once you get the hang of it you should find it relatively easy to use. And if you ever have any questions or run into any problems, don’t hesitate to reach out to customer support for assistance.

Anúncios

Do I Need an Accountant If I am Self-Employed?

If you are self-employed, you may need an accountant to help you with your taxes. An accountant can help you figure out how much tax you owe and can also help you file your tax return.

Credit: www.adamenfroy.com

Free Accounting Software for Sole Proprietor

As a sole proprietor, you have the option of using free accounting software to manage your finances. This can be a great way to save money and keep track of your business expenses. There are a few different options available, so be sure to do some research to find the one that best suits your needs.

One popular option is Wave Accounting. This software is designed specifically for small businesses and offers a variety of features, including invoicing, expense tracking, and financial reporting. Wave Accounting is free to use and there are no monthly fees or hidden costs.

Another option is QuickBooks Online Self-Employed. This software includes many of the same features as Wave Accounting but also offers tax preparation and filing services. QuickBooks Online Self-Employed is $5 per month after a free 30-day trial period.

Be sure to compare the features of each program before making a decision. Choose the software that offers the most benefit for your business at the best price point. Free accounting software can be a great way to save money and stay organized as you run your sole proprietorship!

Accounting Software for Self-Employed

There are a number of accounting software programs available for self-employed individuals. Some of the more popular ones include QuickBooks, FreshBooks and Xero.

Each program has its own set of features and benefits, so it’s important to choose one that will suit your specific needs.

For example, if you’re looking for something that’s easy to use and can help you keep track of your income and expenses, then QuickBooks might be a good option.

On the other hand, if you need something with more advanced features, such as invoicing and reporting capabilities, then FreshBooks or Xero might be better choices.

No matter which program you choose, make sure to do some research and read reviews before making your final decision.

Top 10 Accounting Software

There are a lot of options when it comes to accounting software. It can be hard to decide which one is right for your business. To help you make a decision, here are the top 10 accounting software programs:

1. QuickBooks

QuickBooks is one of the most popular accounting software programs. It’s easy to use and has a lot of features that businesses need, such as invoicing, tracking expenses, and managing inventory.

QuickBooks also offers online banking and payment processing.

2. Xero

Xero is another popular accounting program that’s known for its ease of use.

It has all the basic features that businesses need, plus some advanced features like project management and time tracking. Xero also integrates with a lot of other business apps, making it even more versatile.

3. FreshBooks

FreshBooks is another great option for small businesses. It’s easy to use and has all the essential features, plus some extras like client portals and proposals & estimates. FreshBooks also integrates with PayPal so you can easily accept payments from your clients.

Conclusion

There are a number of accounting software programs on the market, but which is the best for a sole proprietor? This blog post takes a look at three of the most popular accounting software programs and compares their features to help you decide which one is right for you.

QuickBooks Online is a popular choice for small businesses, including sole proprietorships.

It offers a variety of features, including invoicing, tracking expenses, and creating financial reports. QuickBooks Online also has a mobile app so you can access your account from anywhere.

FreshBooks is another popular accounting software program that offers many of the same features as QuickBooks Online.

FreshBooks also has a simple interface that makes it easy to use, even for those who are not familiar with accounting software.

Xero is another option to consider if you are looking for accounting software for your sole proprietorship. Xero offers all of the standard features you would expect from an accounting program, such as invoicing and expense tracking.

However, Xero also includes some unique features such as the ability to track inventory and project profitability.