How to Qualify for a Real Estate Line of Credit?

Qualifying for a real estate line of credit (LOC) is a strategic process that involves several key steps.

Firstly, it’s essential to understand that a real estate LOC is a flexible financing option that taps into a property’s equity, akin to a business credit card. To be eligible for a real estate LOC, a high credit score is crucial.

Want to understand more about the subject? Check out the complete content we produced below. Good reading!

Anúncios

What is a Real Estate Line of Credit?

A real estate line of credit (LOC) serves as a dynamic financial tool for real estate investors, offering quick access to funds based on the property’s equity.

Unlike traditional loans, a LOC operates similarly to a revolving credit line, allowing borrowers to draw funds as needed and repay them, providing a continuous source of capital.

Anúncios

This flexibility distinguishes a LOC from conventional financing options.

The key advantage of a real estate LOC lies in its adaptable nature. Investors can draw funds multiple times during the draw period, paying interest solely on the utilized amount.

This contrasts with traditional loans, where borrowers pay interest on the entire loan amount.

Additionally, the interest rates for LOCs are often lower than those associated with hard money lenders, making it an attractive option for real estate investors.

The extended repayment term, tax benefits on interest paid, and the absence of prepayment or early exit fees contribute to the appeal of real estate LOCs.

In summary, a real estate LOC empowers investors with a versatile financial instrument, offering quick access to capital, lower interest rates, and a repayment structure aligned with the specific needs of real estate ventures.

Understanding the intricacies of a real estate LOC positions investors to make informed financial decisions and optimize their investment strategies.

How to Apply for an Investment Property Line of Credit?

When looking for a line of credit, it is essential to take some care and follow certain steps.

Below we explain certain points. Follow us!

Choose the Right LOC

Selecting the appropriate type of Investment Property Line of Credit (LOC) is a pivotal first step in the application process.

The variety of LOCs available caters to different business needs and goals.

Consider factors such as the number of investment properties you own, the scale of your real estate portfolio, and the specific requirements of your projects.

Options include a Single Investment Property LOC, Portfolio LOC, Commercial Equity LOC, and Acquisition LOC.

Each type has its unique features and advantages, so aligning your choice with your investment strategy is essential.

Careful consideration at this stage ensures that the selected LOC aligns seamlessly with your business objectives, providing the flexibility and financial support required for your real estate ventures.

Gather Documentation

Once you’ve identified the right type of LOC for your needs, the next crucial step is to gather the necessary documentation.

This involves collecting current property-related documents, pay stubs, bank statements, and the last two years of tax information.

Additionally, be prepared to provide records of previous investment property projects, showcasing your experience and success as a real estate investor.

Having these documents organized, scanned, and digitized streamlines the application process.

Lenders often require a comprehensive overview of your financial standing and the details of your real estate portfolio, so meticulous preparation at this stage ensures a smooth and efficient application process.

Complete Your LOC Application

The completion of the LOC application is a pivotal stage that demands attention to detail and accuracy.

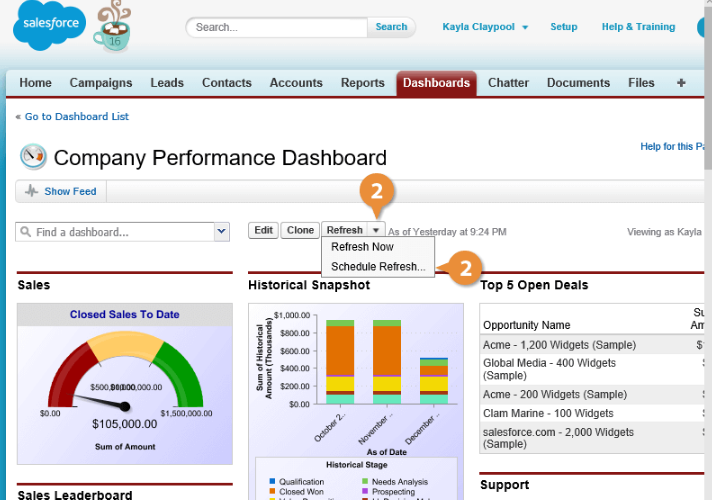

Most lenders facilitate an online application process, providing flexibility and convenience for applicants.

During this phase, input all required information accurately and ensure that the documentation you submit aligns with the lender’s specifications.

Double-checking your application before submission is crucial to avoid delays or complications in the review process.

Utilize any online tools or guidance provided by the lender to enhance the accuracy and completeness of your application. A well-prepared and comprehensive application increases the likelihood of a favorable response from the lender.

Review the Application

After submitting your LOC application, a critical phase follows where a representative from the lending institution reviews your application.

This step involves a thorough examination of the provided documents and may include requests for additional information deemed necessary for a comprehensive assessment.

It’s essential to be readily available during this phase to address any queries promptly. The lender may inquire about the specifics of your investment property projects, the terms of lease agreements, and details about your business structure.

Active engagement and cooperation during the application review stage contribute to a smoother process and potentially faster approval.

Be prepared for discussions about your financial standing, credit history, and the overall viability of your real estate investment plans.

There Are Alternatives to a Home Equity Line of Credit?

While a home equity line of credit (HELOC) is a popular financing option for real estate investors, it’s essential to explore alternative avenues that may better suit specific circumstances.

One such alternative is a business line of credit, leveraging a company’s credit history for financing.

This option is particularly beneficial for established businesses with a robust credit profile. Business credit cards present another alternative, offering a short-term line of credit with the added advantage of easy expense tracking.

Despite higher interest rates, business credit cards provide flexibility, especially for renovation expenses.

It’s crucial to choose cards that do not heavily impact personal credit scores, maintaining a separation between business and personal finances.

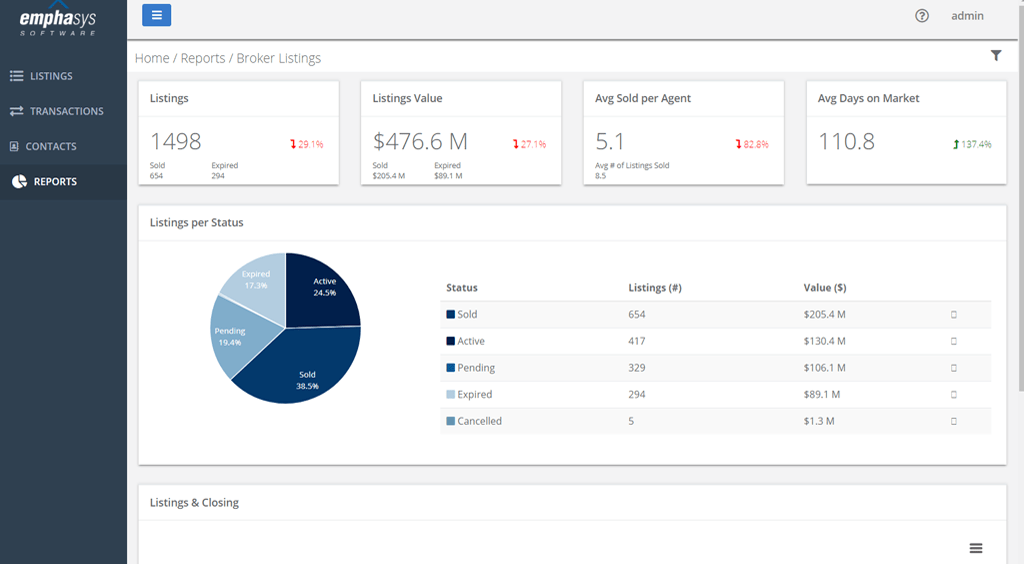

For those with multiple investment properties, a portfolio line of credit allows access to equity from an entire property portfolio.

This option is suitable for high-net-worth investors with a substantial property portfolio. Additionally, real estate investors can explore cash-out refinancing, where existing equity in a property is refinanced to provide a lump sum for future investments.

Understanding these alternatives empowers real estate investors to diversify their financing strategies, selecting options that align with their business structure, credit profile, and investment objectives.

While a HELOC remains a viable choice, exploring alternatives ensures a comprehensive approach to real estate financing.

Conclusion

In conclusion, a real estate line of credit can be a valuable financial tool for anyone looking to leverage the equity in their property for various purposes, such as home improvements, debt consolidation, or investment opportunities.

As we’ve discussed, it offers flexibility, lower interest rates, and the potential for tax benefits.

Applying for a line of credit, while it may seem daunting, is a straightforward process that begins with evaluating your needs, understanding your financial situation, and finding a lender you can trust.

Remember, a line of credit is not just a loan; it’s a financial resource that can be there when you need it most.

By maintaining good financial discipline and using it wisely, you can tap into your home’s equity and achieve your financial goals.

So, whether you’re considering a home renovation, planning for education expenses, or addressing unexpected financial challenges, a real estate line of credit can be a valuable ally in achieving your financial aspirations.

Be sure to consult with financial experts and lenders to explore your options and make informed decisions.