How to Delete an Albert Account

Sometimes, you might wish to delete your Albert account. Perhaps you have been getting spam emails and no longer want to receive them. Or you may simply want to delete your account for privacy reasons. Either way, there are several ways to delete your account. This article will cover a few of them.

Cancel subscription

If you have a subscription with Albert, you can cancel it by following the steps below. Once you have signed into your account, go to the Albert app dashboard and tap on the “Subscriptions” tab. From here, you can select ‘Cancel Genius’. Or you can contact customer support by phone at 639-37 to cancel your membership.

Anúncios

You will be asked to enter your mobile number and e-mail address. This is to ensure that your account is registered with the correct e-mail address. Remember to enter the correct mobile number and e-mail address so that your subscription is not renewed. You can also change your password using the link provided in your recovery e-mail.

Albert offers many financial services under one roof. It also has a feature called “Albert Genius” that allows you to manage your finances with a single account. If you don’t like the features or don’t want to pay the monthly fee, you can cancel your subscription after 30 days.

Anúncios

Albert offers a range of wealth building products, such as stocks and ETFs. While it doesn’t offer many other assets, its stock market offerings are very attractive. The subscription comes with a bonus of 0.10% per year, and you can increase this bonus if you enable Genius. Using Genius also gives you the option to share your subscription with friends.

Unsubscribe from newsletters

Delete your Albert account if you are tired of receiving email spam messages. You can do this by writing an email to Albert. It is simple and quick. Once you have completed the steps below, you should be able to unsubscribe from newsletters and remove your account.

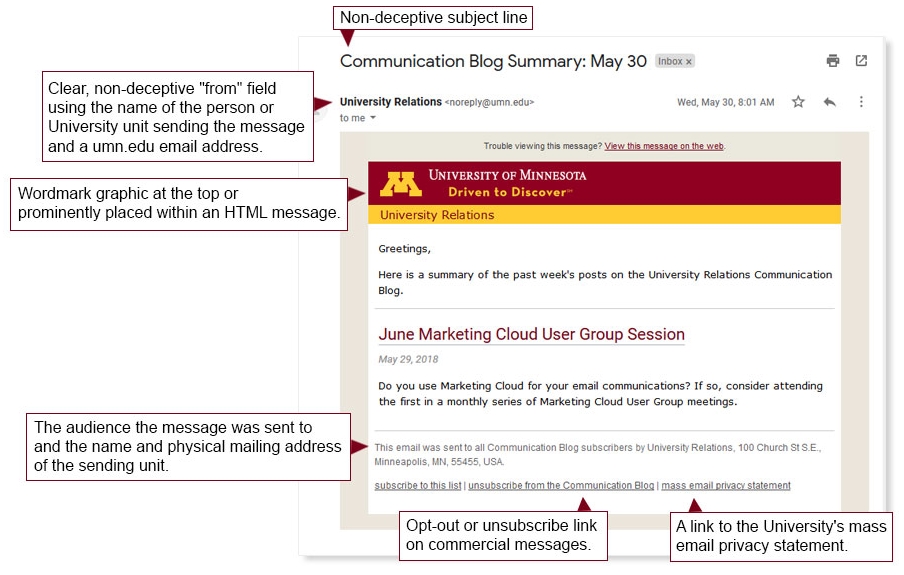

To unsubscribe from newsletters, go to the bottom of the email and select the unsubscribe button. If you do not want to receive their newsletters anymore, mark them as spam. This will ensure that you don’t receive them again. Once you’ve unsubscribed, they’ll stop sending you emails.

Albert uses bank-level security to protect your account. Users can link their accounts to the app with Plaid, a secure bank connection tool used by major banks. Moreover, your funds are safely stored in FDIC-insured savings accounts. Some users complain about poor customer service, but it’s worth noting that Albert has many positive reviews.

Changes to your account

If you have recently purchased a stock or bond, you may have noticed that there are some changes to your account. In most cases, you can change your investment or cash allocation dates. After you’ve made changes, you will receive an email notification when these documents become available. You can also visit your account to review documents that confirm your recent trades.

Albert uses bank level security to safeguard your account. It connects with your bank via Plaid, an industry-standard tool for secure bank connections. Your account is stored in an FDIC-insured savings account. Albert is one of several fintech applications that help you manage your money and save money.

The app will also organize your finances and analyze each transaction for potential savings. It helps you keep track of your recent bills and spending habits, and will also help you identify hidden fees that can eat into your finances. It will also send you useful alerts when you incur overdraft fees or see a large swing in your bills.

Albert also offers a savings account, cash account, and auto-investing tools. The basic Albert account is free. It also offers a cash bonus program if you save money. You can withdraw your savings whenever you like. You can also invest with Albert’s investment tool, Genius, which offers themed ETFs. You can start investing with as little as $1 and invest according to your financial goals. Albert accounts are FDIC-insured.

You can also change the Albert Genius app if you wish to stop receiving texts from Albert. You can do this by sending a text message to 63937, but you’ll need to wait for a confirmation from the company. The app can access your financial information if you want to share it with it. The app uses bank-grade security to protect your information.

Changing your bank connection

To change your bank connection, you should visit the settings section of the app, and then tap on ‘Bank Connection’. From here, you can choose to remove or link your account with another bank. You must be signed in to your Albert account before you can update your bank connection. Otherwise, you will be prompted to enter your login details.

Albert is a leading fintech app, with over six million users. It offers a range of financial services to help consumers improve their financial lives. This includes savings, investing, and budgeting. The app works with the Genius team of financial experts to provide guidance and assistance. It was launched in 2016 and has raised more than $175 million from investors. It offers banking services through Sutton Bank and a Mastercard debit card issued by Mastercard International.

While Albert is not a bank, its banking services are provided through a partnership with Sutton Bank, which is a member of the FDIC. Thus, your savings account funds are protected up to $250,000 in the case of non-payment. If you’re not comfortable with the relationship between Albert and your bank, you can look for a more appropriate banking application.

Changing your email address

Albert’s system uses a bank-level security system. Users can link their accounts to their banks through a secure tool called Plaid, which ensures that all savings are placed in FDIC-insured savings accounts. Albert isn’t the only fintech app that uses this type of security. Personal Capital, Digit, and Dobot are also fintech apps.