Do I Need Accounting Software to Be an Independent Contractor?

Are you an independent contractor thinking about starting your own business? Or, are you already running your own show but wondering if you need accounting software to do your taxes? The answer is…it depends.

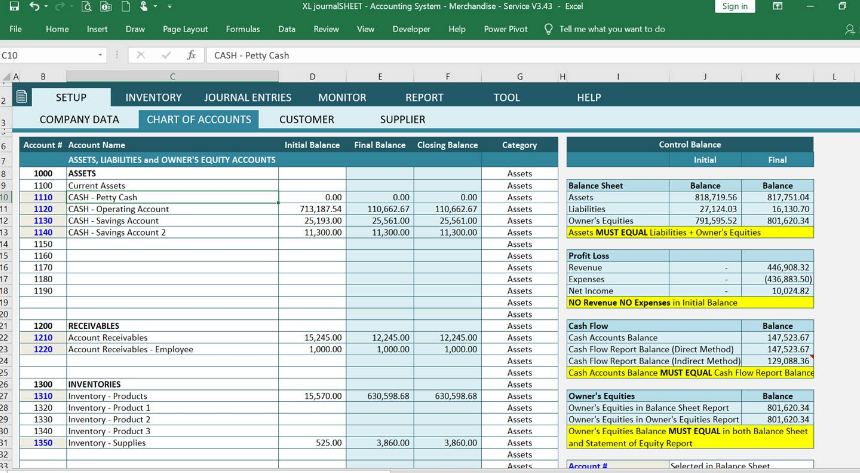

If you have a simple business with just a few clients and expenses, you can probably get by without any special accounting software. But, as your business grows, you may find that tracking everything in a spreadsheet becomes too time-consuming and difficult to manage. That’s when it might be worth investing in some accounting software.

As an independent contractor, you are in charge of your own finances. This means that you need to be organized and have a system in place to track your income and expenses. While you can certainly do this on your own, using accounting software can make the task much easier.

There are a number of different accounting software programs available, so it is important to choose one that meets your specific needs. If you are just starting out as an independent contractor, you may want to opt for a program that is simple to use and doesn’t require a lot of financial knowledge. As your business grows, you can upgrade to a more robust program if needed.

Some of the features that you may want to look for in accounting software include the ability to track invoices, payments, and expenses; generate reports; and connect with other financial applications such as QuickBooks or FreshBooks. In addition, many accounting software programs offer mobile apps so you can access your financial information on the go.

Using accounting software can save you time and help you stay organized as an independent contractor.

It can also give you peace of mind knowing that your finances are being tracked accurately.

Best Way To DIY Your Accounting Records [Quickbooks vs. Alternatives vs. Xero vs. Excel]

How Do Independent Contractors Keep Track of Finances?

Independent contractors usually have to keep track of their finances pretty carefully since they’re not working for a company that will do it for them. They need to make sure they keep track of all their income and expenses so they can pay taxes correctly and also so they can see how much profit they’re making.

There are a few different ways to keep track of your finances as an independent contractor.

You can use a simple spreadsheet, or there are also some software programs specifically designed for tracking business finances. Whichever method you choose, just be sure to be consistent in recording all your income and expenses.

One thing to keep in mind is that as an independent contractor, you may be able to deduct certain business expenses from your taxes.

So it’s always a good idea to save receipts for anything you spend on your business, like office supplies or travel expenses. This way you’ll be able to maximize your tax deductions come tax time.

Anúncios

How Do Independent Contractors Keep Track of Income And Expenses?

If you’re an independent contractor, you are responsible for tracking your own income and expenses. This can be done in a number of ways, but the most important thing is to be accurate and consistent.

One way to keep track of your income and expenses is to use accounting software.

This can help you stay organized and on top of your finances. You can also use a spreadsheet or simply keep track of everything manually in a notebook.

Whichever method you choose, be sure to track all income and expense items carefully.

This will ensure that you have a good record of everything come tax time. It will also help you keep tabs on your spending so that you can budget appropriately.

Do I Need Quickbooks As a Freelancer?

As a freelancer, you are always looking for ways to save time and money. QuickBooks is one of the most popular accounting software programs available and it can save you both time and money. QuickBooks can help you keep track of your income and expenses, create invoices and track payments, manage your customers and vendors, and run reports.

QuickBooks is a great tool for any freelancer who wants to save time and money on their accounting.

Anúncios

Does an Independent Contractor Provide Their Own Tools?

An independent contractor is an individual who provides services to another company or person under terms specified in a contract. The key characteristic that sets apart an independent contractor from an employee is that the former is not under the direct control of the party for whom they are performing work. This means that, unlike employees, independent contractors are free to work when and how they choose as long as they meet their contractual obligations.

In some cases, an independent contractor may be required to provide their own tools and equipment in order to complete the work they have been contracted to do. This will be specified in the contract between the parties involved. In other cases, the company or person hiring the independent contractor may provide all necessary tools and equipment.

It is important to carefully review any contract before beginning work to ensure that you understand all of your rights and responsibilities.

Credit: www.adp.com

Free Accounting Software for Independent Contractors

As an independent contractor, you have a lot of responsibility when it comes to your finances. Not only do you have to keep track of your income and expenses, but you also have to pay taxes on your earnings. This can all be a bit overwhelming, especially if you’re not used to managing your own money.

Luckily, there are some great accounting software programs out there that can make the task much easier. And the best part is that many of them are available for free!

Here are four great options for free accounting software:

1. Wave Accounting: Wave offers free invoicing, accounting, and receipt scanning features for independent contractors. It’s simple to use and perfect for those who don’t need all the bells and whistles of more complex software programs.

2. FreshBooks: FreshBooks is another option that offers robust invoicing and accounting features at no cost.

It’s user-friendly interface makes it a good choice for those who want something straightforward and easy-to-use.

3. ZipBooks: ZipBooks is a newer entrant into the world of free accounting software but it’s already making waves with its feature-rich platform. In addition to traditional invoicing and accounting features, ZipBooks also offers project management tools, which can be helpful for larger projects or teams.

4. Nutcache: Nutcache rounds out our list with its robust suite of invoicing, time tracking, expense management, and project management features (among others). What sets Nutcache apart from other options is its focus on teamwork – making it a great choice for those who work with others on projects or in freelancer teams.

Best Accounting Software for Independent Contractors

As an independent contractor, you have a lot of responsibility when it comes to your finances. Not only do you need to keep track of your income and expenses, but you also need to make sure that you are paying your taxes on time. The good news is that there are some great accounting software programs out there that can help make this process a lot easier.

Here are some of the best options:

1. QuickBooks Self-Employed: QuickBooks is one of the most popular accounting software programs available and their Self-Employed version is specifically designed for those who work independently. It tracks both your income and expenses, as well as provides quarterly tax estimates so that you can stay on top of your obligations.

There is also a handy mileage tracker built in, which can be extremely helpful come tax time.

2. FreshBooks: FreshBooks is another excellent option for independent contractors. It has many of the same features as QuickBooks, including income and expense tracking, tax estimates, and mileage tracking.

One thing that sets it apart from other accounting software programs is its ease of use – it has a very user-friendly interface that makes managing your finances simpler than ever before.

3.. Wave Accounting: Wave Accounting is a great free option for independent contractors (though they do offer paid plans with additional features).

It includes all of the basics like income and expense tracking, as well as invoicing and accepting payments from clients – all from within the program itself.

What to Keep Track of As an Independent Contractor

As an independent contractor, it is important to keep track of your income and expenses. This will help you determine how much money you need to set aside for taxes and also help you keep track of your business expenses.

There are a few things you will need to keep track of:

1. Your income – This can be from invoices, client payments, or other sources. Be sure to keep track of the date, amount, and purpose of each payment.

2. Your business expenses – These can include office supplies, travel expenses, marketing costs, etc.

Keeping track of these expenses will help you deduct them on your taxes and also give you a clear picture of where your money is going.

3. Your time – If you are billing by the hour, it is important to keep track of the time you spend working on each project. This will ensure that you are getting paid for all the work you do and help you budget your time appropriately.

4 .Your tax information – Be sure to keep records of any taxes you pay as an independent contractor.

Conclusion

As an independent contractor, you are not legally required to have accounting software. However, there are many benefits to using accounting software, such as being able to track your income and expenses, creating invoices, and managing your taxes. If you decide not to use accounting software, be sure to keep good records of your income and expenses so that you can stay organized and on top of your finances.