Do I Need Accounting Software Or a Spreadsheet?

If you are wondering whether you need accounting software or a spreadsheet to manage your finances, there are a few things to consider. First, think about how much money you have coming in and going out each month. If you only have a few transactions, a spreadsheet may be sufficient.

However, if you have many transactions or your financial situation is complex, accounting software can help you stay organized and make better financial decisions.

Another thing to consider is how often you need to access your financial information. If you only need to track your finances once in awhile, a spreadsheet may be all you need.

However, if you need to track your finances on a daily or weekly basis, accounting software can make the process easier and faster.

Finally, think about whether you want to share your financial information with others. If so, accounting software can make it easy to do so.

Spreadsheets can also be shared, but they may not provide as many features for collaboration as accounting software programs.

If you’re running a business, you need to keep track of your finances. But what’s the best way to do that? Should you use accounting software or a spreadsheet?

There are pros and cons to both methods. Accounting software is designed specifically for tracking finances, so it can be easier to use and more accurate than a spreadsheet. However, it can also be more expensive.

Spreadsheets are cheaper and can be just as effective as accounting software, if used correctly. But they require more time and effort to set up and maintain.

So, which is right for you?

It depends on your business needs and budget. If you have the money to invest in accounting software, it may be worth it. But if you’re on a tight budget, a spreadsheet will do the job just fine.

DO I NEED ACCOUNTING SOFTWARE FOR MY SMALL BUSINESS?

Is Spreadsheet an Accounting Software?

No, spreadsheet is not an accounting software. While you can use spreadsheet to track your finances and budget, it is not made specifically for accounting purposes. For this reason, most businesses and individuals opt to use accounting software instead of spreadsheets to manage their financial information.

Anúncios

Can You Use Excel As Accounting Software?

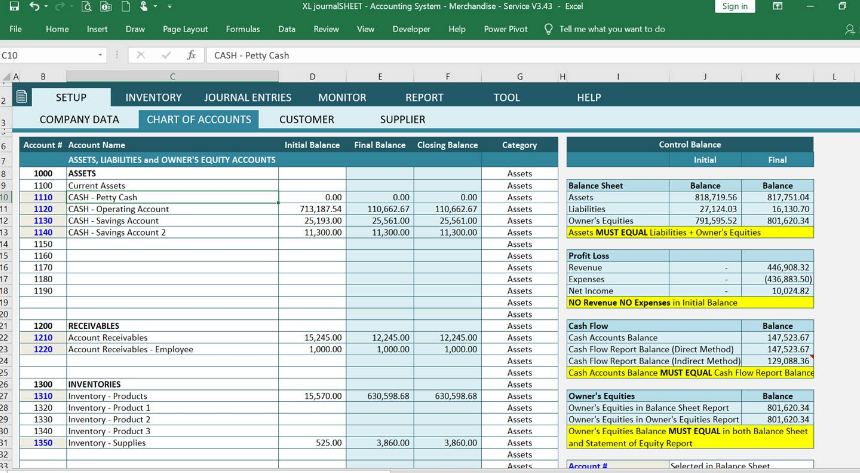

You can use Excel as accounting software by downloading a template or creating a spreadsheet from scratch. Many businesses use Excel for their accounting needs because it is a user-friendly program that allows you to track income and expenses, create invoices and reports, and manage your finances.

If you are starting a business or need to keep track of your personal finances, using Excel as your accounting software is a great option.

There are many templates available online that can help you get started, or you can create your own spreadsheet from scratch. Either way, Excel is a powerful tool that can help you manage your money and make informed decisions about your spending.

Is It Necessary to Have Accounting Software?

There is no one-size-fits-all answer to this question, as the necessity of accounting software depends on the specific needs of your business. However, in general, accounting software can save you time and money by automating tedious tasks, such as invoicing and tracking expenses. Additionally, it can help you ensure accuracy and compliance with financial regulations.

Therefore, if you are looking to streamline your accounting process and improve efficiency, investing in quality accounting software may be a wise decision for your business.

Anúncios

Is Excel Good Enough for Accounting?

If you’re running a small business, or even a medium-sized one, the answer is probably yes. Excel has all the features most businesses need for their accounting needs.

Larger businesses may find that they need something more robust, but for smaller businesses, Excel is usually good enough.

It can track income and expenses, prepare invoices and financial statements, and manage inventory.

Credit: blog.capterra.com

Is Excel an Accounting Software

Excel is a powerful spreadsheet application that can be used for a variety of purposes, including accounting. While Excel is not designed specifically as an accounting software program, it has many features that make it well suited for financial and accounting tasks. For example, Excel includes built-in formulas for common financial calculations, such as interest rate and mortgage payments.

In addition, Excel’s data visualization tools can be used to create financial statements and other reports.

If you are considering using Excel for your accounting needs, there are a few things to keep in mind. First, while Excel is capable of handling complex financial calculations, it is important to make sure that your formulas are entered correctly.

A small error in a formula can lead to incorrect results. Second, if you are sharing your Excel workbook with others (such as your accountant), it is important to save separate copies for each person. This will prevent accidental changes from being made to the original workbook.

Difference between Excel And Accounting Software

There are many differences between Excel and accounting software. The most obvious difference is that accounting software is designed specifically for managing finances, while Excel is a general purpose spreadsheet application. This means that accounting software includes features and tools that are specifically geared towards financial tasks, such as invoicing, tracking payments and creating financial reports.

Another key difference is that accounting software is typically much easier to use than Excel. This is because it includes an intuitive interface and straightforward controls that make it simple to enter and manage financial data. In contrast, Excel can be quite complex to use, particularly for those who are not familiar with its various formulas and functions.

Finally, another key advantage of accounting software over Excel is that it offers greater security. This is because most accounting software applications include robust security features, such as password protection and data encryption, which helps to protect your financial information from being accessed by unauthorized individuals.

Spreadsheet Accounting Software

Spreadsheet accounting software is one of the most popular types of accounting software on the market. This type of software allows users to create and manage their financial records using a spreadsheet program, such as Microsoft Excel. Spreadsheet accounting software is easy to use and can be customized to fit the needs of any business.

Additionally, many spreadsheet accounting programs offer features that allow businesses to track their spending, income, and profits over time.

Conclusion

If you’re wondering whether you need accounting software or a spreadsheet to keep track of your finances, the answer is: it depends. If you have a simple financial situation, a spreadsheet may be all you need. But if your finances are more complex, you’ll probably benefit from using accounting software.

Benefits of using accounting software include:

1. You can save time by automation many tasks, such as invoicing and tracking payments.

2. Accounting software can help you make better financial decisions by providing insights into your spending patterns and trends.

3. Using accounting software can help you become more organized and efficient in your bookkeeping.

4. Many accounting software programs offer features that spreadsheets don’t, such as inventory management and tax preparation tools.