Do I Need Accounting Software for Dropshipping?

There are a lot of different options when it comes to accounting software, and it can be difficult to decide which one is right for your business. If you’re in the dropshipping business, you might be wondering if you need accounting software at all. The answer is that it depends on the size and complexity of your business.

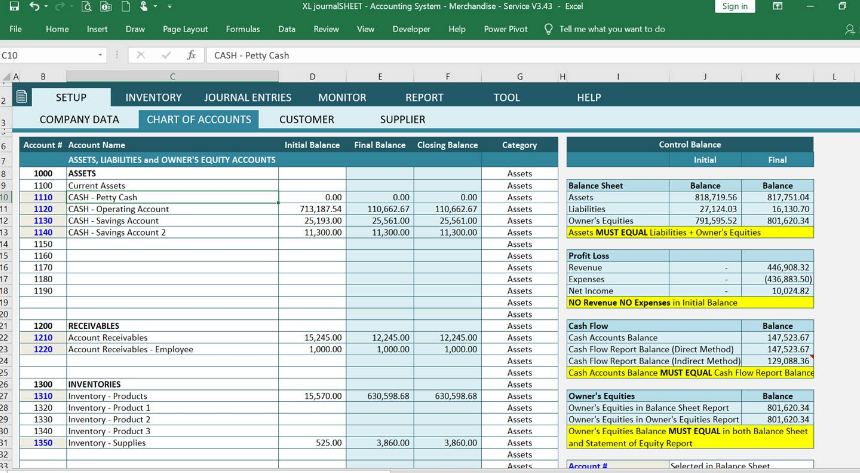

If you’re just starting out, you might be able to get by with a simple spreadsheet. But as your business grows, you’ll likely need something more robust.

If you’re running a dropshipping business, you might be wondering if you need accounting software. The short answer is that it depends on the size and complexity of your business. If you have a simple business with just a few products and orders, you can probably get by with a basic accounting system.

However, if your business is growing and you’re starting to deal with more complex financial issues, then you’ll need something more robust.

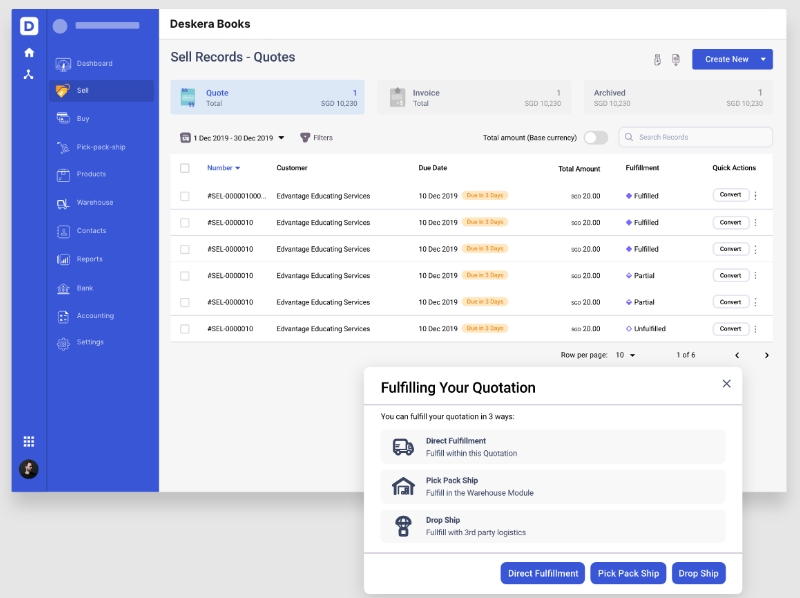

There are a number of different accounting software packages available, so it’s important to choose one that will meet your specific needs. Dropshipping businesses have unique requirements when it comes to tracking inventory, managing orders, and dealing with customer refunds and returns.

Make sure to select an accounting package that includes features specifically designed for dropshippers.

In general, we recommend using accounting software if your dropshipping business is growing and becoming more complex. It will save you time and help you keep track of your finances in one place.

Dropshipping Accounting: Easy Way to Understand It

Do I Need for an Accounting for Dropshipping?

Dropshipping is a business model in which ecommerce entrepreneurs sell products without having to carry any inventory. When a store owner receives an order from a customer, they simply contact the supplier, who will then ship the products directly to the customer’s doorsteps. Dropshipping apps like Oberlo let you add products from various suppliers into your shop to fuel your product offering.

The main benefit of dropshipping is that it’s possible to launch an online store without any upfront investment. You don’t need to worry about carrying inventory or managing stock. Plus, there are no large financial risks involved in starting a dropshipping business.

However, even though starting a dropshipping business requires little capital, that doesn’t mean that it’s free to run one. In fact, there are several costs associated with running a successful dropshipping business – such as marketing expenses, website hosting fees, and paying for apps & plugins (like Oberlo).

When it comes to accounting for your dropshipping business, you first need to track all of your income and expenses in order to file your taxes at the end of the year.

This can be done using accounting software like QuickBooks or Xero – which will make tax time much easier for you and your accountant.

You also need to keep track of your inventory levels and supplier information. This is important so that you know what needs to be ordered from your suppliers and when new stock needs to be added to your store.

The best way to do this is by using an app like OberloSuppliers .

Anúncios

Can I Use Shopify for Accounting?

Yes, you can use Shopify for accounting. You can track your sales and inventory, as well as create invoices and manage your finances. There are a few different accounting apps that integrate with Shopify, so you can choose the one that best suits your needs.

What Platform Should I Use for Dropshipping?

Dropshipping is a business model in which ecommerce entrepreneurs sell products without having to carry any inventory. When a store owner receives an order from a customer, they simply contact the supplier, who will then ship the products directly to the customer’s doorsteps. Dropshipping apps like Oberlo let you add products from various suppliers into your shop to fuel your product offering.

The beauty of dropshipping is that it’s easy to get started and it doesn’t require a large up-front investment. You can launch your own dropshipping business in just a few clicks. Plus, there are several platforms that you can use to create and run your store.

In this article, we’ll compare the most popular ecommerce platforms for dropshipping so that you can decide which one is right for you.

Shopify: Shopify is one of the most popular ecommerce platforms on the market and it’s perfect for dropshippers. It’s user-friendly, has tons of built-in features, and offers 24/7 support should you need any help along the way.

Plus, Shopify integrates with multiple dropshipping apps (including Oberlo), so it’s easy to add products to your store.”

Anúncios

What Do I Need Legally to Start a Dropshipping Business?

Dropshipping is a type of ecommerce business model in which the online store owner does not keep any inventory. Instead, when a store owner receives an order from a customer, they simply contact the supplier, who will then ship the products directly to the customer on the store owner’s behalf. Dropshipping is a popular business model for many reasons, including its low barrier to entry and flexibility.

To start a dropshipping business, you will need to register your business and obtain any relevant licenses and permits. You will also need to set up a payment gateway so that you can accept payments from customers. Once you have these things in place, you can start sourcing suppliers and building your online store.

Credit: www.esellerhub.com

How to Do Accounting for Dropshipping

If you’re looking to get into drop shipping, or even if you’re already running a drop shipping business, one of the most important things you’ll need to do is keep accurate records for your accounting. This can be a daunting task, but with careful planning and attention to detail it can be easily managed. In this article we’ll go over some tips on how to do accounting for dropshipping.

The first thing you need to do is set up a system for tracking your inventory. This can be as simple as using a spreadsheet to track what products you have in stock, how many of each item you have available, and what your cost is for each item. Alternatively, there are many software programs available that can help you manage your inventory more effectively.

Whichever method you choose, make sure that it’s something that you’re comfortable using and that will provide accurate information.

Once you have a system in place for tracking your inventory, the next step is to determine how you’re going to record sales and expenses. Again, there are various methods available depending on your preferences and needs.

You may opt to use QuickBooks or another accounting software program, or you may prefer to simply keep track of everything in a spreadsheet. Whatever method you choose, just make sure that it’s one that will work well for keeping accurate records of both your income and expenses.

When it comes time to file your taxes, there are a few things you need to keep in mind when doing your accounting for dropshipping businesses.

First of all, since dropshipping businesses are considered retailers by the IRS, they are subject to different tax rules than other types of businesses. Be sure to consult with an accountant or tax professional before filing your taxes so that you know exactly what forms and schedules need to be filed in order for everything to be done correctly.

Another important thing to remember when doing your accounting for dropshipping is that since inventory isn’t purchased until it’s sold, there may be times when items show up on your books as being “sold” but haven’t actually been shipped out yet.

How to Do Accounting for E-Commerce Business

When it comes to accounting for e-commerce businesses, there are a few key things you need to keep in mind. First and foremost, you need to make sure that all of your sales and expenses are properly tracked. This means having a good system in place for recording transactions and keeping track of inventory.

Another important thing to keep in mind is that you need to account for taxes on all of your sales. This can be a bit complicated, so it’s important to work with an accountant or tax professional to make sure you’re doing everything correctly. Lastly, you’ll also need to keep records of any refunds or chargebacks that occur as part of your business.

By following these tips, you can ensure that your e-commerce business is properly accounted for from a financial standpoint. This will give you peace of mind knowing that your finances are in order and will help you avoid any potential problems down the road.

Dropship Revenue Recognition

Dropship revenue recognition is the process of identifying when revenue from a dropship sale should be recognized. This can be tricky because there are often multiple parties involved in a dropship sale, including the supplier, the retailer, and the customer. In addition, Dropship sales often involve goods that are shipped directly from the supplier to the customer, which can complicate matters further.

There are two main methods for recognizing revenue from dropship sales: The first is to recognize revenue when the sale is made to the retailer; the second is to recognize revenue when the goods are shipped from the supplier to the customer. There are pros and cons to each method, and it’s important to carefully consider which method is best for your business before making a decision.

The main advantage of recognizing revenue when the sale is made to the retailer is that it provides more visibility into your business’s cash flow.

This method also allows you to track inventory levels more accurately, since you’ll know exactly how much inventory was sold at any given time. However, this method can create problems if retailers cancel orders or return merchandise, since you may have already recognized revenue that you won’t ultimately receive.

The main advantage of recognizing revenue when goods are shipped from the supplier to the customer is that it more closely aligns with when customers actually receive their merchandise.

This method can also help prevent issues with returns and cancellations, since you won’t have recognized revenue until after shipment has been made. However, this method can make it more difficult to track inventory levels accurately since shipments may be delayed or held up for various reasons beyond your control.

Conclusion

There are a lot of factors to consider when you’re trying to decide whether or not you need accounting software for dropshipping. The most important factor is probably the size of your business. If you’re just starting out, it’s likely that you can get by without accounting software.

However, if you’re doing a lot of business, it’s essential to have some sort of system in place to keep track of your finances.

Another important factor is the complexity of your dropshipping business. If you only have a few products and a few suppliers, it’s probably not necessary to invest in accounting software.

However, if you have a large number of products and suppliers, or if you offer customizations or other services, it’s definitely worth considering investing in some kind of accounting solution.

Finally, it’s also worth considering the cost of accounting software. There are some great free options available, but if you need more features or want something more robust, there are also paid options out there.

It really depends on your needs and budget as to which option is best for you.