Convenience checks: How to use them wisely and safely

Anúncios

Convenience checks may seem like an easy and accessible way to access funds, especially for individuals who need quick cash or want to transfer balances between credit cards.

These checks, provided by credit card issuers, allow cardholders to withdraw cash, make purchases, or pay bills.

Anúncios

However, while they offer flexibility, they come with significant risks and costs that should be carefully evaluated.

This article explores what they are, how they work, the potential risks associated with their use, and whether they are worth considering.

Anúncios

Additionally, we will examine how they impact your credit score and discuss viable alternatives to convenience checks that may better meet your financial needs.

What are convenience checks?

Convenience checks are issued by your credit card company, allowing you to borrow money directly from your credit card account.

These checks work like standard checks, but instead of withdrawing funds from a bank account, the amount is added to your credit card balance.

Those tools are often used for balance transfers, bill payments, or even making purchases at businesses that do not accept credit cards.

However, unlike standard credit transactions, it comes with higher fees and interest rates, making them a more expensive loan option.

How do convenience checks work?

Convenience checks operate similarly to personal checks but are linked to your credit card account instead of a bank account.

When you use convenience checks, the amount written on the check is treated as a cash advance and added to your credit card balance.

Most credit card issuers charge a fee for using convenience checks, usually ranging from 3% to 5% of the transaction amount.

Additionally, the interest rate applied to these transactions is often higher than the standard purchase APR. Interest begins accumulating immediately, as there is no grace period.

Borrowers should carefully read the terms associated with convenience checks before using them, as fees and charges can significantly increase the total cost.

Are there risks in using convenience checks?

While convenience checks can provide quick access to cash, they present several risks that borrowers should consider.

One of the main risks is the high cost associated with their use. In addition to transaction fees, higher interest rates on convenience checks can make them an expensive borrowing option.

Unlike regular credit card purchases, convenience checks typically do not have a grace period, meaning interest begins accumulating immediately.

Another risk involves fraud. Since convenience checks are linked to your credit card account, losing or misplacing one can result in unauthorized transactions.

Additionally, using convenience checks irresponsibly can lead to increased credit card debt, which may harm your financial stability.

How to obtain a convenience check

Obtaining a convenience check is relatively simple. Credit card issuers often send them directly to cardholders as part of promotional offers.

If you do not receive convenience checks automatically, you can contact your credit card company to request them.

Once you have the checks, it is essential to review the terms and fees associated with their use. Ensure you understand transaction fees, interest rates, and payment terms before deciding to use them.

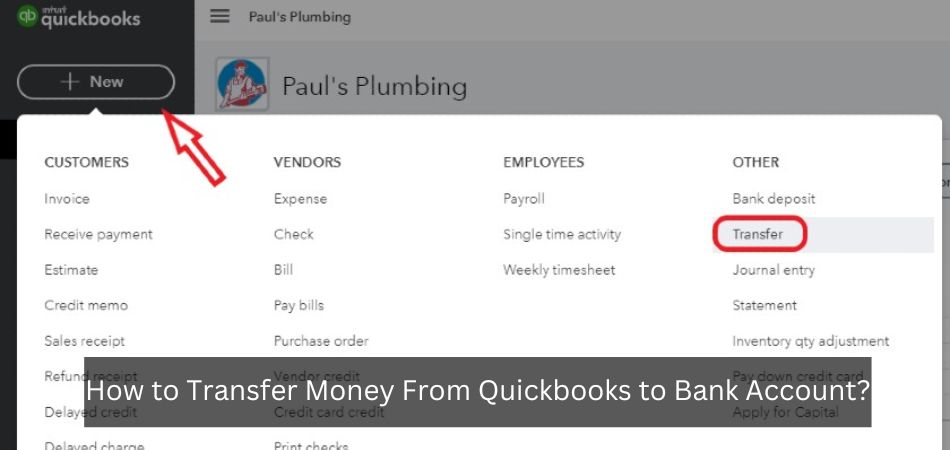

Using a convenience check involves filling it out like a standard check, including the recipient’s name and amount.

Once deposited or cashed, the transaction is processed, and the funds are added to your credit card balance. Depending on the bank or financial institution, it may take several business days for the check to clear.

How to use a convenience check

Using convenience checks is similar to writing a personal check. Here’s how to use one effectively:

- Write the check: Fill out the convenience check with the recipient’s name and the amount. Ensure the details are correct to avoid processing issues.

- Deposit or cash the check: The recipient can deposit the check into their bank account or cash it. You can also use it to pay bills or transfer balances.

- Wait for clearance: Depending on the bank, it may take a few business days for the check to clear. During this time, ensure your credit card account has sufficient credit available to cover the transaction.

Keep in mind that interest starts accumulating immediately, making it essential to have a repayment plan to minimize costs.

Are convenience checks worth it?

Convenience checks can be useful in certain situations, but they are not always the best financial tool. To determine whether they are worth it, let’s examine their advantages and disadvantages.

Advantages

- Provide flexibility to access cash, pay bills, or transfer balances quickly.

- Useful for paying merchants or covering services that do not accept credit cards.

- Some promotional checks offer lower introductory interest rates, making them ideal for consolidating debt at a reduced cost.

- Offer a quick and practical alternative for temporary financial constraints.

Disadvantages

- High fees and interest rates make these checks an expensive borrowing option, especially for cash advances.

- No grace period, meaning interest starts accumulating immediately after use.

- Irresponsible use can result in excessive debt, negatively impacting your credit score and financial health.

- May include strict terms and short deadlines, increasing financial risks for borrowers.

Does convenience checks hurt your credit score?

Convenience checks can indirectly impact your credit score depending on how they are used. When you use a convenience check, the amount is added to your credit card balance, increasing your credit utilization ratio.

A high utilization ratio can lower your credit score, as it indicates you are using a significant portion of your available credit.

Additionally, if you fail to make timely payments on the increased balance, it can lead to late fees and further damage your credit score.

To minimize the impact on your credit, try to pay off the balance as quickly as possible and keep your credit utilization below 30%.

Alternatives to convenience checks

If convenience checks do not meet your needs, consider these alternative financial tools:

- Personal loans: A personal loan may offer lower interest rates and fixed repayment terms, making it a more affordable borrowing option.

- Balance transfer credit cards: These cards allow you to transfer balances with low or 0% introductory interest rates, which can save money on interest.

- Home Equity Line of Credit (HELOC): A HELOC provides access to funds based on your home’s value, usually with lower interest rates than convenience checks.

- Cash advances: Although not ideal, credit card cash advances may have lower fees compared to convenience checks. Review the terms carefully before choosing this method.

Each of these options has its pros and cons, so evaluate them based on your financial situation and borrowing needs.

Convenience checks can be a useful financial tool in specific situations, such as paying bills or consolidating debt through balance transfers.

However, they come with significant risks, including high fees, immediate interest accumulation, and the potential for credit score damage.

Before using a convenience check, carefully review its terms, fees, and potential impact on your finances.

If possible, explore alternative options like personal loans or balance transfer credit cards, which may offer more favorable terms.

Stay informed and visit our website regularly for expert advice on managing your finances and choosing the right financial products for your needs.

Looking for a suggestion? Also, check out our content explaining how construction loans work!