Learn all about Capital One Platinum and discover reasons to have yours!

Anúncios

A credit card is one of the main tools in the market for those who want more shopping benefits and to make the most out of having credit. Knowing this, Capital One offers a great card to the market.

With Capital One Platinum Credit Card, you can build your credit and enjoy even more when it comes to shopping. You have the security of the company, and you know your card will be protected at all times.

Anúncios

Follow this article to learn more about the card and how to get yours.

Anúncios

Reasons to apply for Capital One Platinum

There are several reasons why you should have your Capital One Platinum card. It is a card full of benefits that, in addition to helping build credit, has a Platinum brand, which allows for better discounts and purchases.

See what you will get with this credit card:

Capital One’s CreditWise

CreditWise is an innovative service from Capital One that puts the power of credit monitoring in your hands, offering free and regular access to crucial information related to your credit score.

Using data from TransUnion, this platform provides an accurate estimate of your credit score, as well as comprehensive details about your credit history, debts, and previous scores.

This service goes beyond simply displaying numbers, as CreditWise offers a detailed view of your financial profile, allowing you to better understand the factors that impact your credit score.

By providing regular updates, you stay informed about significant changes, ensuring that there are no unpleasant surprises along the way.

CreditWise is not just a passive monitoring tool; it empowers you to proactively manage your credit.

Through alerts about changes to your credit report, you are immediately notified of any suspicious activity in your account, allowing you to take prompt action to correct inaccurate information or identify potential threats to your score.

Additionally, CreditWise offers valuable personalized recommendations to enhance your credit score.

Whether through debt reduction strategies or suggestions to strengthen specific aspects of your credit history, the available tools help create an effective action plan.

Fraud Coverage

When it comes to financial security, Capital One goes above and beyond by offering robust fraud coverage that can reach up to $100,000 per account.

This means that if your card statement shows unrecognized purchases, Capital One is ready to act and help you resolve the situation effectively.

In addition to fraud coverage, Capital One reinforces its commitment to customer protection by offering comprehensive theft and loss insurance.

This service covers the cost of goods and services purchased with the card that are stolen or lost, providing additional peace of mind to cardholders.

This benefit is included in the Capital One Platinum Credit Card package.

24-Hour Support

To ensure convenience and continuous assistance to its customers, Capital One provides 24-hour customer support, seven days a week. Regardless of when you need support, the customer support team is ready to help.

Access to assistance is flexible and comprehensive, allowing customers to choose the communication channel that best suits their needs.

Whether by phone, email, or live chat, Capital One’s dedicated team is available to answer questions, provide guidance, or resolve issues, delivering high-quality service even in critical moments.

Security Alerts

Prioritizing the security of its customers, Capital One provides security alerts that play a crucial role in protecting your credit card against fraudulent activities.

These alerts are customized to notify you immediately of any suspicious activity on your account.

Flexibility is a priority, and you can choose to receive these alerts via email, SMS, or push notification, according to your preference.

Thus, every time you use your Capital One Platinum credit card, you are alerted to account activity.

Apps and Features

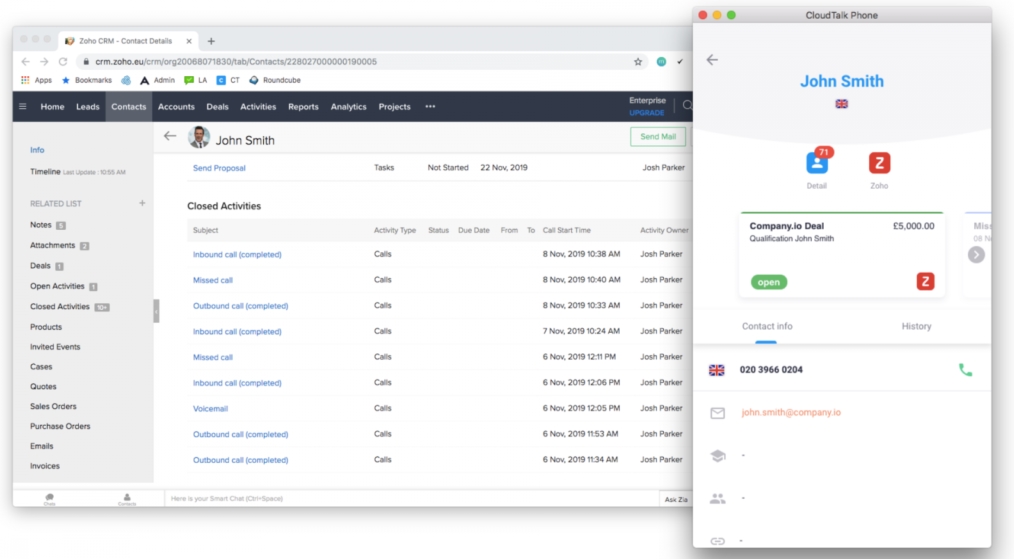

Simplifying account management, Capital One offers an intuitive mobile app and a user-friendly website.

These platforms were developed to provide a convenient experience, allowing you to manage your account effectively and without complications.

Through the app or website, you have access to a variety of practical features. You can check your balance in real-time, make payments quickly and securely, track your purchases, and much more.

The user-friendly interface and simple navigation options ensure that you can efficiently perform all these tasks without unnecessary effort.

Travel and Retail Benefits

While Capital One Platinum does not offer rewards programs like cashback or airline miles, it provides significant benefits for travel and retail. These benefits include:

- No International Transaction Fee: When using Capital One Platinum credit card for purchases outside the United States, you won’t be charged additional fees. This advantage provides savings and convenience when conducting transactions in foreign currencies.

- Emergency Card Replacement: In situations where your card is lost or stolen, Capital One Platinum offers the convenience of requesting an emergency replacement card. This ensures that you can continue your financial transactions without significant interruptions, providing peace of mind during travel or daily life.

- ATM Locator Services: Receive assistance in finding the nearest ATM while traveling.

- Contactless Payment (Tap to Pay): Just like in your mobile wallet, you can now make contactless payments with your card. It’s a fast and secure way to make payments. Simply hold or tap your card on a contactless card reader, and you’re all set.

- 50% Off Craft Beverages: Capital One cardholders enjoy a 50% discount on all craft beverages every day at any Capital One Café nationwide.

How to apply for Capital One Platinum?

To apply for Capital One Platinum, you can do so online, by phone, or at a Capital One branch.

First, to apply for Capital One Platinum online, follow these steps:

- Visit the Capital One website.

- Click on “Credit Cards.”

- Select Capital One Platinum.

- Click “Apply Now.”

- Fill out the application form.

- Submit the application form.

To apply for Capital One Platinum by phone, follow these steps:

- Call 1-800-955-7228.

- Speak with a Capital One representative.

- Provide the necessary information for the application.

- Wait for approval.

So, to apply for Capital One Platinum at a branch, follow these steps:

- Visit the Capital One website to find a branch near you.

- Visit the branch with the required documents for the application.

- Speak with a Capital One representative.

- Wait for approval.

Now, just enjoy all the benefits that Capital One Platinum has to offer.

Also, check out more credit card tips on our website.

Useful information

This content was produced in January 2024. In case of updates or changes to services and conditions, please contact the responsible bank.

Call Capital One at 1-877-383-4802