Can Salesforce Replace Quickbooks?

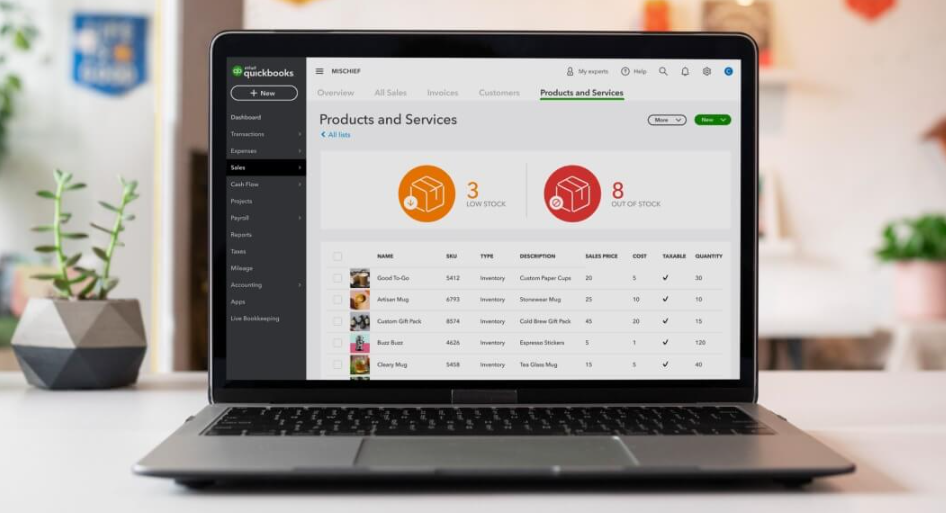

Salesforce is a cloud-based CRM software that offers a comprehensive suite of tools for managing customer data, sales, and marketing. Quickbooks is a desktop-based accounting software used to manage finances, track inventory, and generate invoices. While both Salesforce and Quickbooks offer similar features, Salesforce is more robust and customizable.

For small businesses looking to replace Quickbooks, Salesforce provides a cost-effective solution with more features and flexibility.

Salesforce is a powerful CRM tool that can do a lot of things, but can it replace Quickbooks? Let’s take a look.

Quickbooks is a great accounting tool that has been around for years.

It is simple to use and has a lot of features that businesses need. However, Salesforce does have some features that could replace Quickbooks.

Salesforce has an invoicing feature that allows businesses to create and send invoices directly from the platform.

This could be a great replacement for Quickbooks if your business uses Salesforce for other tasks as well.

Another feature that Salesforce has that Quickbooks doesn’t is the ability to track payments. With Salesforce, you can see when payments are made and received, which can help with cash flow management.

Overall, Salesforce is a great CRM tool with some powerful features. While it may not be able to completely replace Quickbooks, it could be a great complement to it.

Credit: www.sageintacct.com

Anúncios

Is Quickbooks Desktop Being Phased Out 2022?

No, QuickBooks Desktop is not being phased out in 2022. In fact, it’s still the most popular accounting software among small businesses. That said, Intuit (the company that makes QuickBooks) is putting more resources into its newer cloud-based product, QuickBooks Online.

So eventually, QuickBooks Desktop may become less popular than the online version.

Can Salesforce Be Used for Accounting?

Salesforce is a cloud-based customer relations management (CRM) software that can be used for managing sales, marketing and customer service. It is also possible to use Salesforce for accounting purposes.

There are many reasons why you would want to use Salesforce for accounting.

One reason is that it can save you time by automating tasks such as invoicing and tracking payments. Additionally, using Salesforce can help you get a better picture of your finances by providing real-time insights into your data. Finally, Salesforce integrates with other popular business applications, making it easy to add accounting functionality to your existing workflow.

If you are considering using Salesforce for accounting, there are a few things to keep in mind. First, make sure that you have the right edition of Salesforce for your needs. The Enterprise Edition includes features like FinancialForce Accounting, which is designed specifically for accounting purposes.

Next, be aware that some setup and configuration is required in order to use Salesforce for accounting. You will need to create custom fields and objects, as well as set up financial processes like invoicing and payment tracking. Finally, consider connecting Salesforce to an external accounting system like QuickBooks or Xero in order to take full advantage of its capabilities.

Anúncios

Can Salesforce Work With Quickbooks?

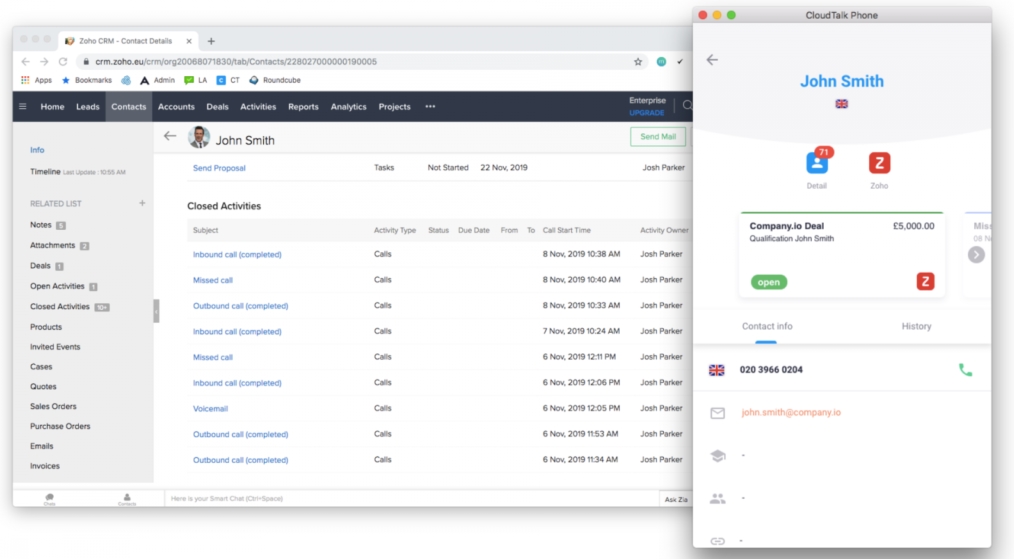

Salesforce is a cloud-based customer relationship management (CRM) software that enables sales teams to better track and manage their customer interactions. QuickBooks is an accounting software that helps businesses manage their finances. While the two software platforms are not directly compatible, there are third-party integrations available that enable them to work together.

This can be beneficial for businesses that use both Salesforce and QuickBooks as it allows for a more seamless workflow between the two platforms.

Is Quickbooks Desktop Being Phased Out 2021?

As of right now, it does not appear that QuickBooks Desktop is being phased out in 2021. In fact, it seems that Intuit (the company that owns QuickBooks) is still actively developing and releasing new versions of QuickBooks Desktop. For example, the latest version is QuickBooks Desktop 2021.

However, this doesn’t mean that QuickBooks Desktop won’t be phased out at some point in the future. It’s possible that Intuit could eventually decide to stop supporting QuickBooks Desktop and transition all users to the cloud-based QuickBooks Online.

Only time will tell what will happen with QuickBooks Desktop, but for now, it doesn’t appear that it’s going anywhere.

Simple Salesforce ➡️ QuickBooks Online Integration in 83 Minutes

Salesforce Quickbooks Desktop Integration

Salesforce Quickbooks Desktop Integration

Are you looking for a way to streamline your accounting process? If so, then you should consider integrating Salesforce with QuickBooks Desktop.

Doing so can save you time and money by eliminating the need to manually enter data into both systems.

Not sure how to get started? Don’t worry, we’ve got you covered.

In this blog post, we will provide detailed instructions on how to set up the integration between Salesforce and QuickBooks Desktop. We will also discuss some of the benefits of doing so.

So let’s get started!

Quickbooks Vs Salesforce

There are many CRM software options on the market today. Two of the most popular are QuickBooks and Salesforce. So, which one is right for your business?

To help you decide, let’s take a closer look at each option.

QuickBooks is a popular accounting software that offers a CRM system. It’s designed specifically for small businesses and includes features such as contact management, sales tracking, and invoicing.

QuickBooks integrates with other software programs, making it a good choice for businesses that use multiple systems.

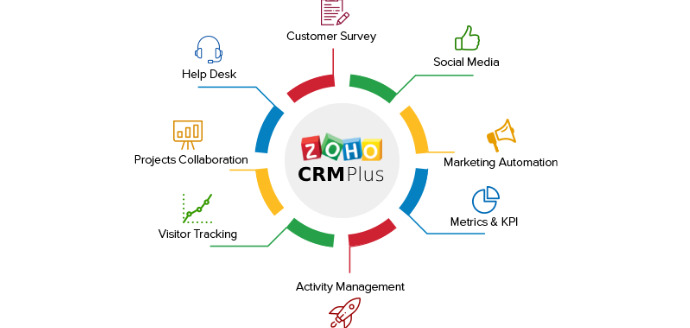

Salesforce is a cloud-based CRM system with features such as customer relationship management (CRM), sales force automation (SFA), and marketing automation. It also offers integration with other business applications.

Salesforce is suitable for businesses of all sizes but is especially popular with large enterprises.

Quickbooks Salesforce Appexchange

Salesforce and QuickBooks are two of the most popular business applications on the market. They both offer a lot of features and benefits to users, but they can also be difficult to use if you’re not familiar with them. That’s where the QuickBooks Salesforce Appexchange comes in.

The QuickBooks Salesforce Appexchange is a tool that allows you to connect your QuickBooks account to your Salesforce account. This way, you can view your QuickBooks data directly in Salesforce, and vice versa. You can also synchronize data between the two applications, so that changes made in one are reflected in the other.

The Appexchange is a great tool for small businesses or startups that use both QuickBooks and Salesforce. It can save you a lot of time and hassle by keeping your data synchronized between the two applications. And best of all, it’s free!

Quickbooks And Salesforce Integration Using Apex

QuickBooks and Salesforce Integration

Are you looking for a way to integrate your QuickBooks data with your Salesforce CRM? Look no further than Apex!

Our experts have put together a guide on how to do just that.

In order to connect QuickBooks with Salesforce, you will need to use the Apex Data Loader. This is a free tool that can be downloaded from the AppExchange.

Once you have installed the Data Loader, you will need to follow these steps:

1) Export your QuickBooks data as a CSV file.

2) Import the CSV file into Salesforce using the Data Loader.

3) Map the fields from QuickBooks to the corresponding fields in Salesforce.

4) Set up your sync schedule and start syncing!

Now that you know how to connect QuickBooks and Salesforce, here are some tips on how to get the most out of this integration:

– Use Apex triggers to automate tasks such as creating invoices in QuickBooks when an opportunity is closed in Salesforce.

– Use VisualForce pages to display financial data from QuickBooks in your Salesforce dashboard.

– Use custom reports and dashboards to track key metrics such as AR aging or number of invoices per month.

– Create workflows and approval processes that route invoices through different users depending on their value or other criteria.

– Leverage Apex web services to programmatically create or update records in both systems (such as creating a new customer in Quickbooks when a new lead is created in Salesforce).

Conclusion

Salesforce is a popular CRM tool, but can it replace Quickbooks as your go-to accounting software? Let’s take a look at the pros and cons.

Salesforce:

Pros:

1. Easy to use interface

2. Automates many tasks

3. integrates with other software systems easily

4. Excellent customer support

5. Scalable for businesses of all sizes

6. Affordable monthly subscription price