Does Stripe Integrate With Quickbooks?

Stripe is a popular payment processor that many businesses use to accept online payments. QuickBooks is a popular accounting software that many businesses use to manage their finances. So, does Stripe integrate with Quickbooks?

The short answer is yes, Stripe integrates with Quickbooks. You can connect your Stripe account to Quickbooks and import your transaction data into the accounting software. This can save you a lot of time and effort when it comes to tracking your finances and preparing your taxes.

Stripe is a payment processing company that offers businesses a way to accept credit card payments online. QuickBooks is an accounting software program that helps businesses keep track of their finances. Both companies offer services that can be beneficial for businesses, but what about integration?

Does Stripe integrate with QuickBooks?

The short answer is yes, Stripe does integrate with QuickBooks. This means that businesses who use both Stripe and QuickBooks can have their credit card transactions automatically imported into their QuickBooks account, making it easier to keep track of finances and streamline the accounting process.

If you’re a business owner who uses both Stripe and QuickBooks, integrating the two can save you time and hassle. If you’re not sure how to get started, our team at ThePayrollDepartment.com can help. We’re experts in both Stripe and QuickBooks integration and can help your business set everything up so that your credit card transactions are automatically imported into QuickBooks.

Contact us today to learn more!

Let’s talk about Stripe Maybe? QuickBooks Online Integration from Synder! Save time and money!

Can You Import Stripe Transactions into Quickbooks?

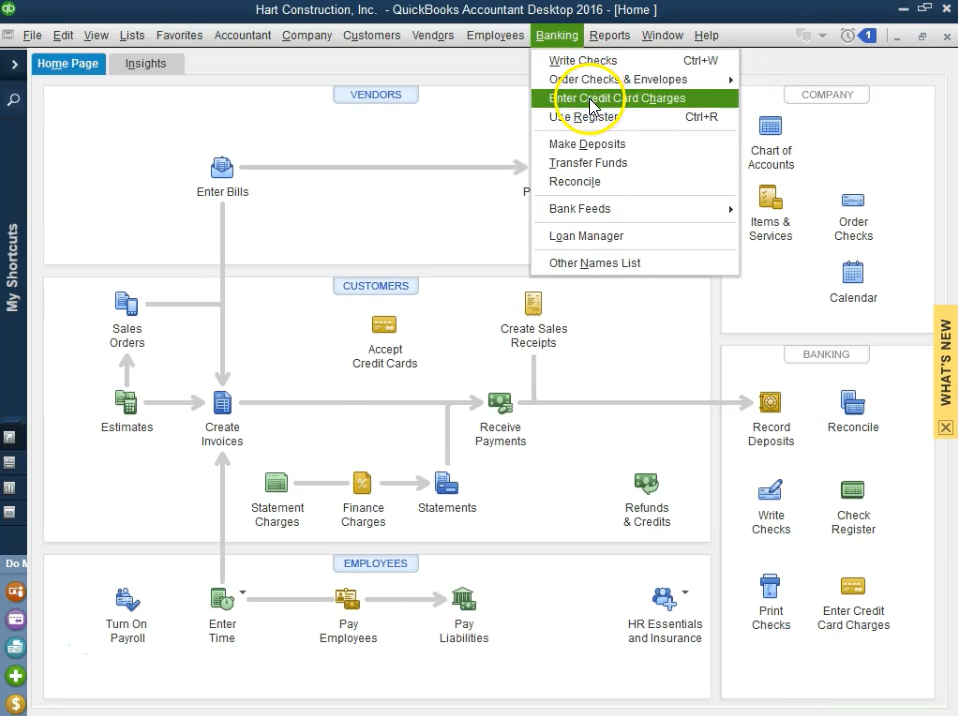

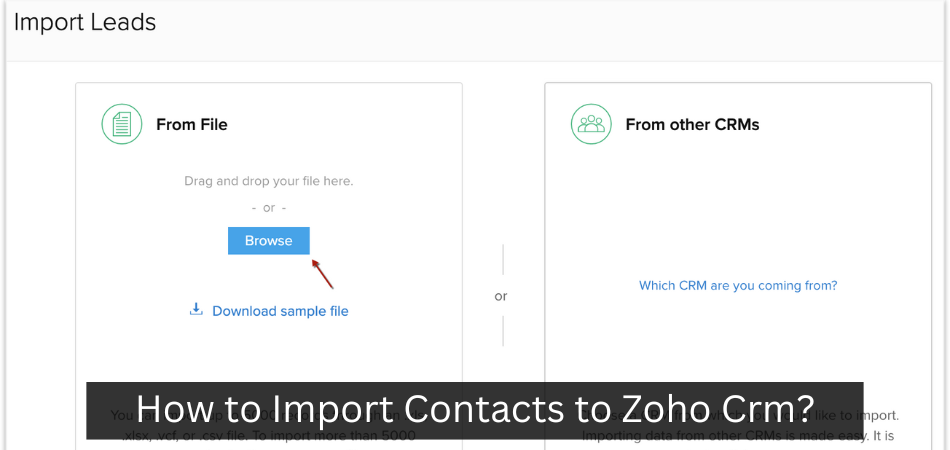

The answer is yes, you can import Stripe transactions into QuickBooks. This can be done by using a CSV file that contains your Stripe data. Once you have this file, you can follow these instructions to import it into QuickBooks:

1) Open QuickBooks and go to the File menu.

2) Select Import from the File menu.

3) Choose the CSV file that contains your Stripe data.

4) Follow the prompts in QuickBooks to complete the importing process.

Anúncios

How Do I Connect Stripe Payments to Quickbooks?

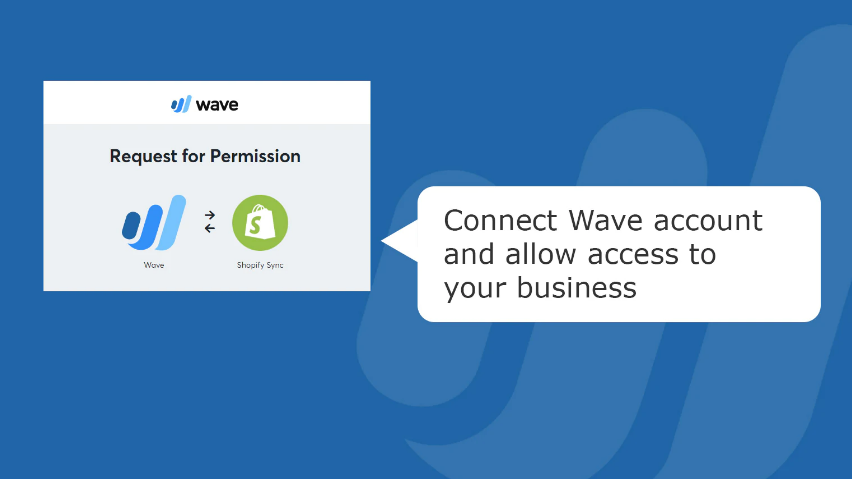

If you’re using Stripe to process payments for your business, you can connect your Stripe account to QuickBooks Online and automatically sync your payment data. This way, you can save time on data entry and make sure that your books are always up-to-date.

To connect Stripe to QuickBooks, you’ll need to create a webhook in your Stripe account.

A webhook is basically a URL that Stripe will send information to whenever a payment is processed. To create the webhook, log into your Stripe account and go to the API section. Then, click on the “Webhooks” tab and enter the following URL into the “Endpoint URL” field:

https://quickbooks.intuit.com/stripe/webhook

Now, every time a payment is processed through Stripe, the information will be sent over to QuickBooks Online and recorded accordingly.

What is the Difference between Stripe And Quickbooks?

There are many differences between Stripe and QuickBooks. For one, Stripe is a payment processor while QuickBooks is an accounting software. This means that with Stripe, you can accept payments online and QuickBooks will help you manage your finances and keep track of your spending.

Another difference is that with QuickBooks, you have to pay for a subscription in order to use it while Stripe has no monthly fees. There are also different features offered by each company. For example, QuickBooks offers invoicing and tracking of inventory while Stripe does not.

When it comes to which one is better, it really depends on what your needs are. If you just need a simple way to process payments online, then Stripe would be a good choice. However, if you need more advanced features like invoicing and inventory tracking, then QuickBooks would be a better option.

Anúncios

How Do I Record Stripe in Quickbooks?

If you’re using Stripe to process payments, you can use our integration to record those payments in QuickBooks. You’ll first need to connect your Stripe account to QuickBooks. Once that’s done, any payments processed through Stripe will be automatically recorded in QuickBooks.

To get started, open up the QuickBooks integrations page and click on the “Connect” button for Stripe. You’ll then be prompted to log in to your Stripe account. After logging in, you’ll need to grant permissions for QuickBooks to access your Stripe account.

Once you’ve done that, your accounts will be connected and any future payments processed through Stripe will be automatically recorded in QuickBooks!

Credit: www.askforaccounting.com

How to Import Stripe Transactions into Quickbooks Online

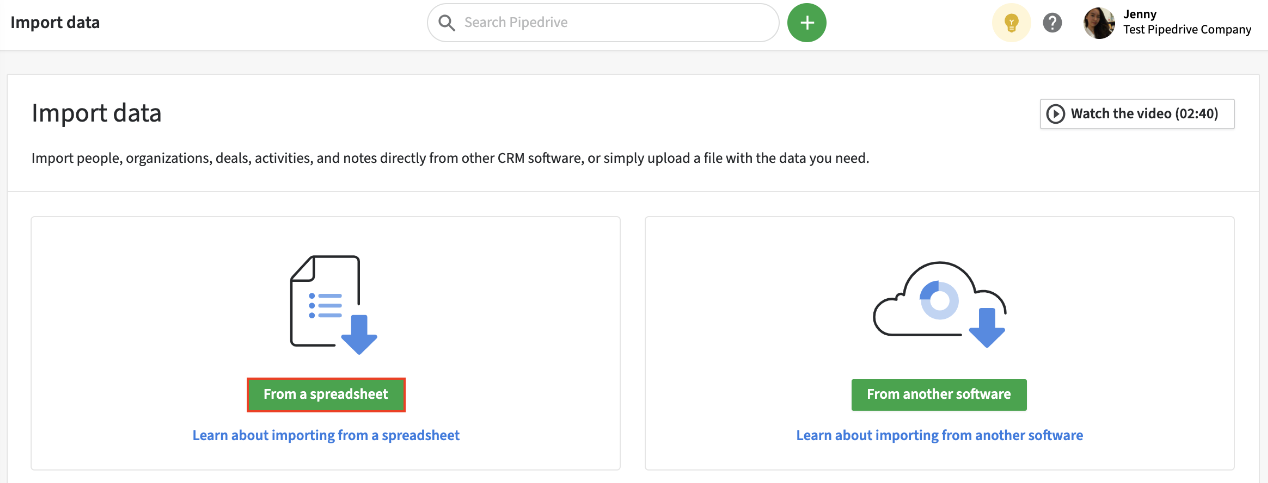

If you’re using Stripe to process payments, you may want to import your Stripe transactions into QuickBooks Online (QBO) for accounting purposes. Fortunately, this is a relatively easy process. Here’s how to do it:

1. Log into your Stripe account and go to the “Reports” tab.

2. Under “Export Data,” select “Download CSV.” This will download a file containing all of your recent Stripe transactions.

3. Log into your QBO account and go to the “Banking” tab.

4. Click on “Upload Transactions” and select the CSV file you just downloaded from Stripe.

5. QBO will automatically categorize each transaction based on its type (e.g., credit card payment, bank transfer, etc.).

You can review these categories and make changes if necessary before importing the transactions into your QBO account.

Stripe Quickbooks Invoice

If you’re running a business, chances are you’re using QuickBooks to track your finances. And if you’re using QuickBooks, you probably know that Stripe is one of the best ways to accept payments online. But did you know that you can now use Stripe to pay your invoices in QuickBooks?

That’s right – with the new Stripe integration for QuickBooks, you can now pay your invoices directly through Stripe. This means no more manually entering payments into QuickBooks, and no more missed payments or late fees!

To get started, all you need is a Stripe account and a QuickBooks Online account.

Then, just connect the two accounts and start paying your invoices via Stripe. It’s that easy!

If you’re not already using Stripe to accept payments online, now is the perfect time to start.

And if you are using Stripe, this new integration makes it even easier to manage your finances and stay on top of your invoices. So why wait? Get started today!

Zapier Stripe Quickbooks

If you’re like most business owners, you want to find ways to automate your accounting and bookkeeping processes. That’s where Zapier comes in. With Zapier’s Stripe QuickBooks integration, you can automatically send data from Stripe (your payment processor) to QuickBooks (your accounting software).

This means that all of your transactions will be logged in QuickBooks without you having to lift a finger!

What’s even better is that Zapier can also help you keep track of important information like customers’ contact information and invoices. So not only will your books be up-to-date, but you’ll also have all the information you need at your fingertips should anything come up.

Ready to get started? Here’s how to set up the Zap:

1. Go to Zapier and sign up for an account (if you don’t already have one).

2. Once you’re logged in, click on the “Make a New Zap” button on the left-hand side of the screen.

3. For the “Trigger App”, select “Stripe”. Then choose which trigger event you want: either “New Charge” or “New Customer”.

If you’re not sure, go with “New Charge”.

4. Now it’s time to connect your Stripe account with Zapier. To do this, click on the “Connect a New Account” button and enter your Stripe API keys (which can be found in your Stripe dashboard under Account Settings > API Keys).

5. Once your Stripe account is connected, test the connection by clicking on the “Test Trigger” button. This will pull in a recent transaction from Stripe so that Zapier can make sure everything is working properly.

6. Now it’s time to set up the action for this zap – meaning, what should happen when a new charge is processed in Stripe?

For this part, we’ll select QuickBooks as our action app and then choose which action event we want: either “Create Invoice” or “Create Customer”. Again, if you’re not sure which one to pick, go with “Create Invoice”.

7a . If you chose “Create Invoice”, fill out the template with information about how you want the invoice to look in QuickBooks .

Conclusion

Yes, Stripe integrates with QuickBooks! You can connect your Stripe and QuickBooks accounts to automatically sync your data. This will allow you to save time by not having to manually enter data into both systems.