Impulse buying: How to resist the urge for excessive spending

Anúncios

Impulse buying is a common habit that often leads to financial stress and regret.

Whether it’s adding an extra item to your cart or succumbing to an online sale, impulsive spending can disrupt your budget and hinder your financial goals.

Anúncios

However, with awareness and the right strategies, it’s possible to break free from this behavior.

In this article, we explore what constitutes impulse buying, why we make these purchases, and practical steps to avoid them.

Anúncios

Let’s take a closer look at how to develop better spending habits and regain control over your finances. Keep reading!

What is considered impulse buying?

Impulse buying refers to any unplanned purchase made without prior intention or need. These purchases are often driven by emotions or convenience rather than practical necessities.

For example, grabbing a candy bar at the checkout or splurging on an item during a sale, even though it wasn’t on your shopping list, qualifies as impulse buying.

Impulse spending typically lacks careful consideration, meaning buyers don’t assess whether the purchase aligns with their financial plans.

While occasional indulgences may seem harmless, repeated impulse purchases can accumulate over time, reducing savings, increasing debt, and causing financial stress.

Identifying these patterns is the first step to effectively managing them.

Why do we make impulse purchases?

Impulse buying occurs due to a mix of emotional, psychological, and external factors.

A significant motivator is instant gratification — the pleasure derived from acquiring something new activates the brain’s reward system, releasing dopamine.

This fleeting sense of happiness often overshadows rational decision-making, leading to regret later.

Retailers capitalize on this behavior through strategic marketing tactics, including limited-time offers, visually appealing store layouts, and targeted online ads.

Social and emotional triggers, such as stress, boredom, or peer influence, also encourage irrational spending.

Understanding these triggers helps build self-awareness and implement measures to combat impulse buying.

Key tips to avoid impulse buying

Avoiding impulse purchases requires a proactive approach and conscious spending habits. Here are some effective strategies to help you take control of your finances.

Stick to a budget

A budget serves as a financial blueprint, guiding your spending decisions and ensuring your money aligns with your priorities.

When you allocate specific amounts for necessities, savings, and discretionary spending, it becomes easier to resist unplanned purchases.

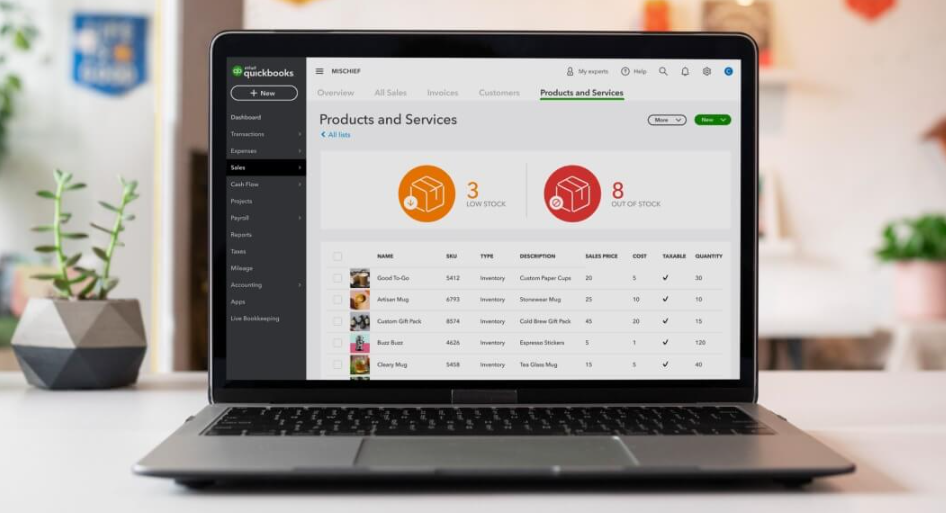

Budgeting apps and spreadsheets can help you monitor your spending in real time, reinforcing your commitment to reduce impulse spending.

Track your expenses

Keeping track of your expenses is a powerful tool to curb irrational spending. By regularly reviewing your purchases, you can identify patterns and triggers that lead to unnecessary expenses.

Use apps or journals to record daily expenses, no matter how small. Over time, this practice builds awareness and accountability, helping you make more deliberate financial decisions.

Make a shopping list

Before heading out to shop, whether in person or online, always create a detailed list of the items you need.

A shopping list acts as a roadmap, keeping you focused and reducing the likelihood of buying additional, unnecessary items.

Stick to the list, even when tempted by sales or promotional offers. This simple habit is particularly effective for avoiding overspending on groceries and household essentials.

Limit online shopping convenience

Online shopping, with its one-click purchases and constant promotions, is a significant driver of impulse buying.

To minimize temptations, disable saved payment methods, unsubscribe from marketing emails, and delete shopping apps from your devices.

Consider adding items to your cart and waiting at least 24 hours before completing the purchase. This delay gives you time to evaluate whether the purchase is truly necessary.

Wait 24 hours before buying

The 24-hour rule is a simple yet effective way to combat impulse purchases. When you feel the urge to buy something, pause and give yourself a day or more to think about it.

This waiting period allows emotions to settle, making it easier to determine whether the item aligns with your needs and financial goals.

Often, you’ll find the desire fades, saving you from unnecessary spending.

Be mindful of social media influence

Social media platforms are designed to promote consumerism, with ads, influencers, and curated posts constantly encouraging purchases.

To reduce impulse buying, unfollow accounts that trigger unnecessary spending or promote excessive consumption.

Instead, focus on content that aligns with your financial goals, such as budgeting tips or minimalist lifestyles.

Replace emotional spending with healthy activities

Impulse buying is often linked to emotional triggers, such as stress, boredom, or the need for validation.

Instead of shopping as a coping mechanism, explore alternative activities like exercising, meditating, journaling, or spending time with loved ones.

Engaging in these activities not only reduces emotional spending but also promotes long-term well-being.

Impulse buying is a common challenge, but it can be managed with the right strategies and mindset.

By understanding why you make unplanned purchases and adopting habits like budgeting, making shopping lists, and implementing the 24-hour rule, you can regain control over your finances.

For more tips on managing your money, avoiding irrational spending, and building better financial habits, explore our articles.

Start taking small steps today to transform your spending behavior and secure your financial future. Take control — your wallet will thank you!

Don’t forget to check out this post explaining how mortgage refinancing works.