Is online bill payment a good idea? Learn about this option

Anúncios

Online bill payment has gained a lot of popularity in recent years, and for a good reason.

With the increasing digitization of financial services, people are looking for easier, faster, and safer ways to manage their bills.

Anúncios

If you want to know whether paying bills online is a good idea, keep reading to find out more details about this topic!

What is online bill payment?

Online bill payment is a service offered by banks, credit card companies, and other financial providers that allows consumers to pay their bills electronically.

Anúncios

Instead of using checks or physical cash, the payment is made directly from your bank account through online platforms or mobile apps.

This method can be used to pay a variety of bills, such as water, electricity, internet, and even credit cards.

Additionally, it eliminates the need to send checks by mail or visit bank branches and commercial establishments. All you need is an internet connection and access to your online bank account.

How does online bill payment work?

The process of online bill payment is very simple. First, you need to access your bank account through your bank’s website or mobile app.

There, you will find the bill payment option and select the service or company you wish to pay. There are two main ways to make online payments:

- Scheduled payments: In this option, you choose the date on which you want the payment to be processed, allowing you more control over when the money will leave your account.

- Automatic payments: This is an ideal option for those seeking more convenience. By setting up automatic payment, the bank or service provider makes the payments periodically, on the specified amount and date, ensuring you never miss a due date.

In both cases, the money is transferred directly from your bank account to the company, and you can track the status of the transaction in real-time.

Is online bill payment worth it?

Opting for online bill payment offers many advantages compared to traditional methods.

But it’s important to assess all aspects to know if this is the best option for your financial needs. Below, we highlight the main pros and cons of this payment method.

Pros

- Convenience and ease: One of the biggest advantages of online bill payment is convenience. You can make payments at any time of the day, from anywhere, without needing to go to a bank branch or service station. This is especially useful for those with a busy schedule who don’t want to spend much time on administrative tasks.

- Time savings: With online bill payment, you no longer need to wait in line or worry about filling out checks. In just a few clicks, you can pay all your bills, which saves a lot of time in your daily life.

- Scheduling and automation: The ability to schedule payments and set up automatic transactions ensures that you don’t forget to pay a bill or miss a due date. This helps avoid late fees and interest, contributing to keeping your finances in check.

- Financial organization: By paying bills online, you have access to a digital history of all your transactions. This makes organizing and monitoring your expenses easier since you can quickly and conveniently review your spending without rummaging through paper receipts.

- Security: Despite concerns about digital security, most banks and online payment platforms invest heavily in advanced encryption and two-factor authentication technologies, making online transactions as safe, or even safer, than sending checks through the mail or making physical payments.

Cons

- Possible service fees: Some banks and service providers charge fees for using the online payment service. Although many banks offer this feature for free, check if there are any costs involved before signing up.

- Human error: If you do not set up payments correctly, you may pay the wrong amount or send it to the wrong recipient. While errors can be corrected, this can cause delays and inconveniences.

- Dependence on connectivity: Since online bill payment depends on an internet connection, network outages or system failures may prevent you from making payments at critical moments. Therefore, it’s important to ensure that you have reliable internet access.

Can I trust online bill payment?

Yes, online bill payment is safe, as long as you use reliable platforms and follow some recommended security practices.

Most banks and financial institutions use state-of-the-art encryption systems to protect your financial information.

Many systems require two-factor authentication, which adds an extra layer of protection.

As with any online activity, it’s crucial to take precautions. Use strong passwords, never share your banking details, and avoid making transactions on public or unsecured Wi-Fi networks.

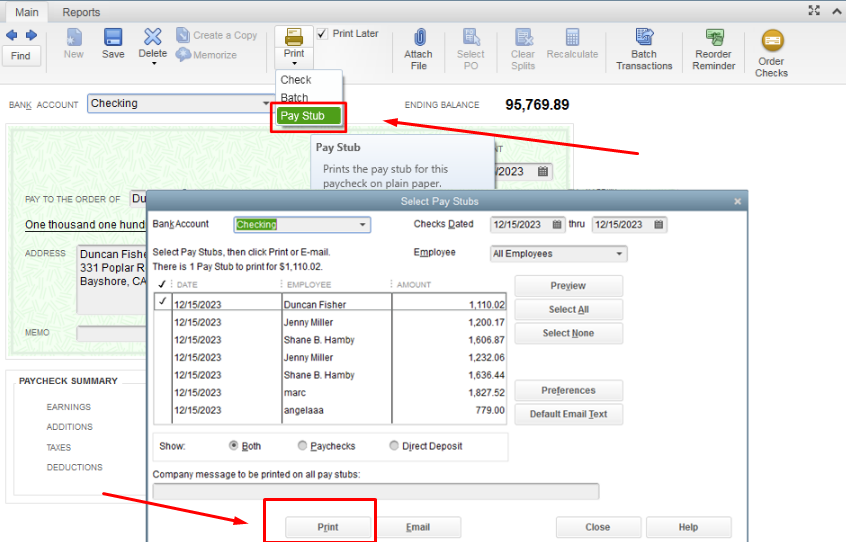

How to set up online bill payment for your accounts

The process is very simple. Check it out:

- Access your online account: Log into your bank’s website or app and locate the Payments or Bills section.

- Add the payee: Provide the details of the company or service you want to pay, such as the account number or billing code.

- Choose the payment method: Decide if you want to make a one-time payment or set up automatic payments.

- Confirm the details: Check all the information, including the amount and payment date, to avoid errors.

- Track transactions: After making the payment, ensure the amount was correctly debited and keep records of your transactions.

What is the processing time for online payments?

The processing time may vary depending on the bank and type of payment. Payments made to registered companies are processed within 24 hours.

However, transfers to accounts not in your bank’s system may take 2 to 5 business days.

It’s always advisable to schedule your payments a few days in advance to ensure they are processed on time, avoiding the risk of delays and penalties.

Did you understand how online bill payment works and whether it’s a good idea to use it? Take advantage of our site’s tips to make significant improvements in your financial life.

Want a suggestion? Also, read our content explaining how to get a secured credit card!