What Accounting Software Does the Federal Government Use?

The United States federal government uses a variety of accounting software to manage its finances. The primary software used is the Standard Financial System (SFS), which is maintained by the Department of the Treasury. The SFS is a centralized system that tracks all federal spending and revenue.

In addition to the SFS, each federal agency has its own accounting system to track specific expenditures.

The Federal government uses a variety of accounting software to manage its finances. The most common software used by the government is QuickBooks, which is used by small businesses and individuals to track their income and expenses. The government also uses Microsoft Excel to manage its budget and track spending.

accounting software in a central government system

What is the Government Accounting Software?

Most businesses in the United States use some form of accounting software to track their finances. The government is no different. The government accounting software is a tool used by federal, state, and local governments to manage their finances.

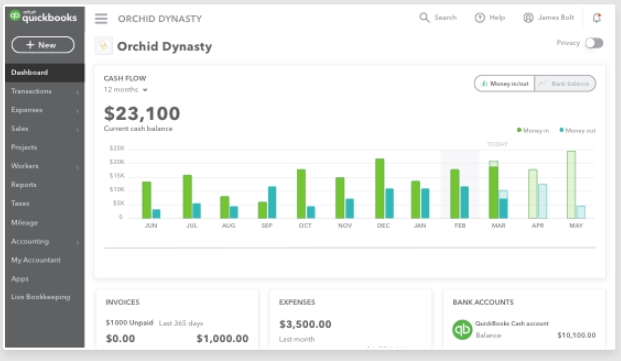

This software can track revenue, expenditures, assets, liabilities, and other financial data. It can also generate reports that help government officials make informed decisions about where to allocate resources. Government accounting software is typically more robust than commercial accounting software because it must meet the specific needs of the public sector.

Anúncios

What Type of Accounting Does the Federal Government Use?

The federal government uses a system of accounting known as accrual basis accounting. This means that transactions are recorded when they occur, regardless of when the money is actually exchanged. So, for example, if the government were to purchase a new fleet of vehicles, the cost would be recorded as soon as the contract was signed, even though the vehicles might not be delivered and paid for several months later.

This system provides a more accurate picture of the government’s financial position than cash basis accounting, which only records transactions when cash changes hands. However, it can be more complicated to track and report on accrual basis transactions.

What is the Most Used Accounting Software in Usa?

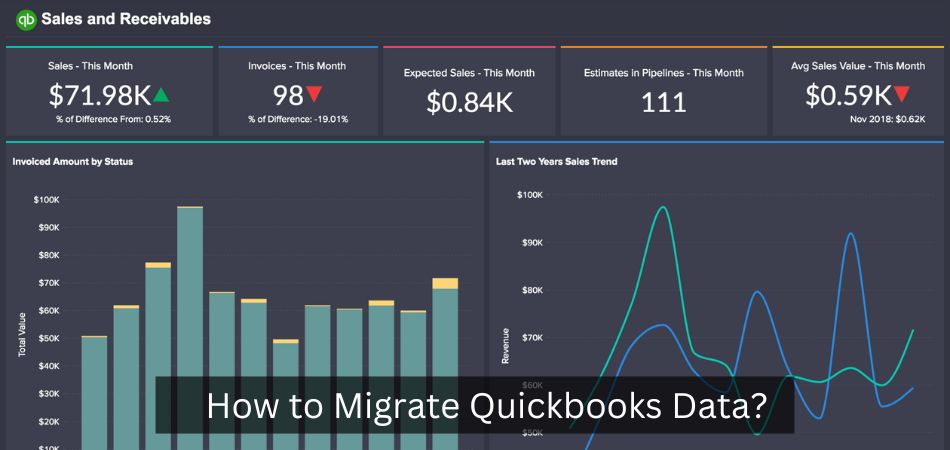

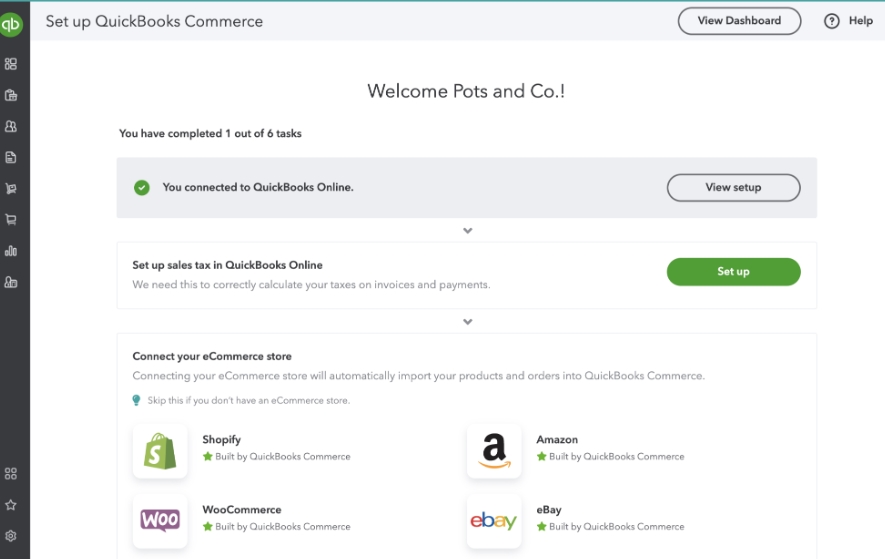

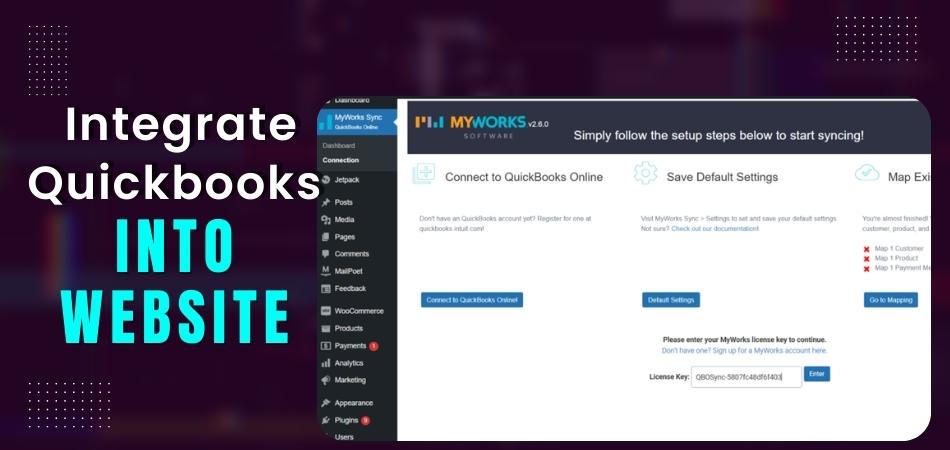

The most used accounting software in USA is QuickBooks. It is a cloud-based accounting software that helps small businesses manage their finances. QuickBooks offers many features such as invoicing, tracking expenses, and creating financial reports.

Anúncios

Do Governments Use Gaap?

There is no one answer to this question as different governments have different accounting standards. However, many governments do use Generally Accepted Accounting Principles (GAAP) as their basis for financial reporting. GAAP is a set of guidelines and principles that companies use to prepare their financial statements.

These statements provide information about a company’s financial health and performance. Many investors and analysts use GAAP reports to make decisions about investing in a company.

Credit: onlinedegrees.und.edu

Government Software

Government software is a broad term that can refer to any type of software used by a government entity. This could include everything from accounting software to help manage finances, to human resources software to help track employee information. In recent years, there has been an increasing focus on developing custom software solutions for governments, as opposed to using commercial off-the-shelf (COTS) products.

This is due in part to the unique needs of government organizations, and also because COTS products may not always meet security and compliance requirements.

There are a number of benefits to using custom government software solutions. Perhaps the most obvious is that these solutions can be tailored specifically to the needs of the organization, rather than being a one-size-fits-all product.

Additionally, custom solutions often have better security and compliance features built in, since they are designed with those requirements in mind from the start. And finally, working with a team of developers on a custom solution gives government organizations more control over the final product and its evolution over time.

Of course, there are also some challenges associated with custom government software development.

The biggest challenge is probably cost – developing a bespoke solution will usually be more expensive than purchasing an off-the-shelf product. There is also the risk that the project could end up being delayed or even cancelled if it runs into difficulties during development. However, when done right, custom government software can be a valuable tool for improving efficiency and meeting specific organizational needs.

Municipal Government Software

Municipal Government Software

The software that is used by municipal governments can vary depending on the size and needs of the municipality. There are many different types of software available to municipalities, and choosing the right one can be a challenge.

Here is some information about municipal government software to help you make a decision for your municipality.

There are several things to consider when choosing municipal government software. The first is what type of software you need.

There are many different types of municipal government software, each with its own purpose. For example, there is accounting software to manage finances, human resources software to manage employee information, and asset management software to track city property. You will need to decide which type or types ofsoftware best fit the needs of your municipality.

Another thing to consider is how user-friendly the software is. It is important that all employees who will be using the software are able to use it easily and efficiently. The last thing you want is for your employees to waste time trying to figure out how to use the software instead of actually using it to do their job.

Make sure you test out any potentialsoftware before making a purchase so that you know it will work well for your team.

Cost is also an important factor when choosing municipal government software . Some companies charge based on the number of users while others have a flat rate fee regardless of how many people will be using the system .

Be sure to get quotes from multiple vendors so that you can compare costs . Also , keep in mind that sometimes paying more upfront can save money in the long run if it means avoiding expensive monthly fees .

Overall , there are many things to consider when purchasing municipal government software .

But if you take your time and do your research , you should be ableto find a system that meets all of your needs and fits within your budget .

Government Accounting System

The government accounting system is a process that the government uses to keep track of its finances. This system is designed to provide accurate and timely information about the government’s financial position. The system is also used to produce financial statements and reports.

Conclusion

The federal government uses a variety of accounting software to manage its finances. The most common software used by the government is QuickBooks, which is used by small businesses and individuals to track their income and expenses. The government also uses Microsoft Excel to manage its budget and financial reports.